The State of Finance: Global Financial Trends For 2021

- 5 January, 2024

- 30 min read

-

2521 reads

We can all agree that 2020 was a year to be remembered.

Whether or not you’re one of the many individuals around the globe whose personal finances were affected by the events of 2020, you’re probably wondering what to expect from 2021 and beyond.

We’ve taken a deep dive into the past year and looked at what the top financial experts and organizations predict for the year ahead.

Keep reading for a global look at the current state of finance and the top financial predictions for 2021.

Table of contents

The pessimistic vs. the optimistic outlook

There are two very different potential economic outlooks for 2021. We have presented each of them below, including the chain of events that may lead us to a prolonged recession or a much-awaited path to recovery.

| Pessimistic Outlook | Optimistic Outlook |

| 1. Coronavirus uncontained 2. Prolonged lockdowns 3. Unemployment rises 4. Global trade struggles 5. Stock market crash 6. Ineffective stimulus plans 7. Global stagflation 8. Commodity prices soar 9. Long recession | 1. Coronavirus contained 2. Economies fully operational 3. Unemployment falls 4. Global trade recovery 5. Stock market grows steadily 6. Stimulus plans halt 7. Global inflation rates below 2% 8. Commodity prices stabilize 9. Economic recovery |

The economy’s fate in 2021 will also determine the long-term economic outlook. We will now argue that the optimistic scenario seems more likely, but a negative reversal is also in play.

Will Europe’s Next Generation EU and Biden’s economic policies stabilize the global economy and set the world on track for a brighter and more sustainable future?

Will Asian economies gain ground in trade and technological innovation and set the foundations to become the dominant forces in the global scene?

Read below to find out what the experts have to say.

A New Normal

To analyze the trends of 2021, we need to look back at 2020 and where we are starting from. Black swan events, such as the Coronavirus pandemic, affected every country. However, that doesn’t mean we’re all starting the new financial year in the same boat.

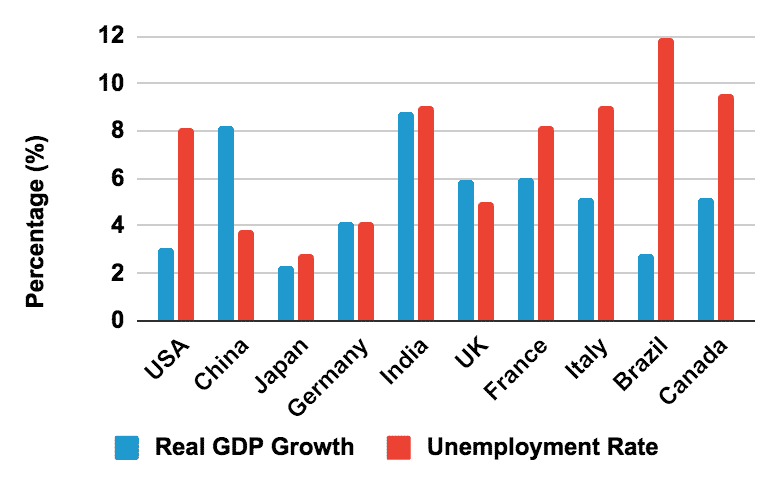

In the following graph, you can see the GDP growth and unemployment rates of the top 10 GDP countries in the world.

GDP growth and the unemployment rate

2020

The top 10 GDP countries had higher unemployment rates and decreasing GDP growth in 2020.

The United States had a GDP growth of just 3.1%, smaller than Canada and all their European counterparts, and an unemployment rate of 8.1%, more than double the rate recorded in February.

China has the best GDP growth/unemployment ratio, while Japan has the lowest unemployment rate, just above 2%.

Since GDP growth and unemployment rates are strongly inversely correlated, we expect a reversal of the 2021 unemployment trends to be drastic as soon as global lockdowns and travel restrictions end.

The financial implications of COVID-19

The year 2020 will forever be defined by the worldwide Coronavirus (COVID-19) outbreak.

At the time of writing, there have been over 114 million cases and over 2.5 million lives claimed, and devastatingly, those numbers continue to grow daily.

This highly contagious virus has not just impacted those infected in specific countries or sectors. However, the whole world has felt the impact of COVID-19, and for many, that impact was financial.

Less than a flying start for the travel industry

Unsurprisingly, the aviation industry has been one of the most brutal hits throughout the pandemic, and IATA described the severity of the situation in their December 2020 Air Passenger Market Analysis.

“The year 2020 brought an unprecedented challenge to the airline industry through closed borders, strict travel controls, and depressed travel confidence – all effects of the pandemic.

RPKs plunged by a dramatic 66% compared with 2019 – eight times faster than during the 12 months following the 9/11 attacks – considered the most severe aviation crisis before 2020.”

With many countries still in lockdown worldwide and borders closed, we don’t expect the aviation industry to pick up for some time.

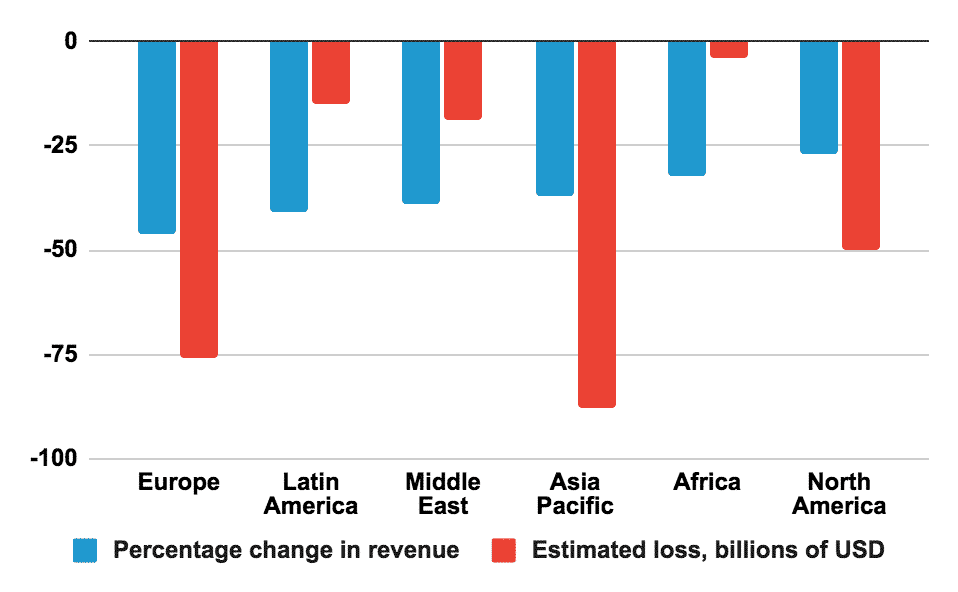

Change in revenue and estimated loss within the aviation industry

2019-2020

According to this data from IATA, Asia Pacific took the most significant financial loss during the peak of the crisis in April 2020, followed closely by Europe.

All continents had a minimum percentage change in revenue from the previous year of 27%, with Europe and Latin America over 40%.

Losses in the hospitality industry

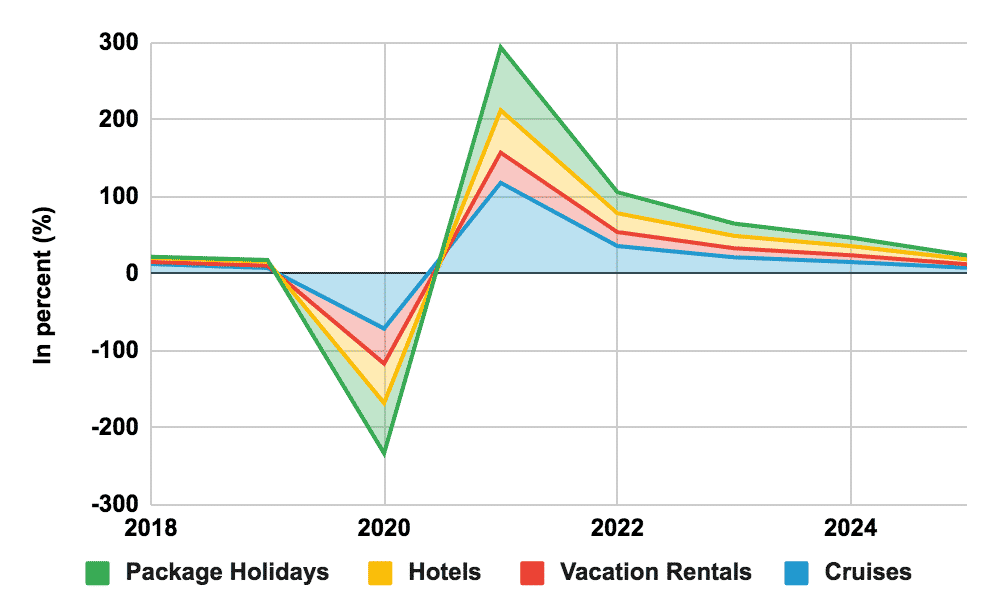

The hospitality industry also saw a significant drop in 2020. The graph below reveals the revenue growth in percentage from 2018 to the estimated numbers of 2024 in the United States, as predicted by Statista.

Unsurprisingly, all sectors, from cruises to package holidays, suffered losses in growth from 45-70% in 2020. However, Statista expects growth to rise steadily over the coming years and, by 2023, be at the same level of year-on-year growth experienced from 2018-2019.

Estimated percent change in revenue in the travel and tourism market in the United States

2018-2024

The future of travel is hard to imagine, but based on the previous summer, we can predict countries that could cope better with the pandemic to be the most popular.

Writing for Foreign Policy, Elizabeth Becker believes some countries might not want to return to pre-pandemic tourism levels. “Overnight, much of the world went from over-tourism to no tourism. Since then, locals have seen how their lives have improved without those insane crowds: clear skies with vistas stretching for miles, a drastic reduction of litter and waste, clean shorelines and canals, and a return of wildlife.”, which she says could make travel to such places more expensive than we have become accustomed to.

Estimating this approach will sharply contrast with other governments who “will compete for the shrinking tourist dollar by racing to the bottom, allowing the travel industry to regulate itself, using deep discounts to fill hotels and airplanes and revive over-tourism.”

“Other governments will compete for the shrinking tourist dollar by racing to the bottom, allowing the travel industry to regulate itself, using deep discounts to fill hotels and airplanes and revive over-tourism.”

Elizabeth Becker

We predict that trends such as local ‘staycations,’ road trips, and camping will also likely grow in popularity in 2021 as travel lovers find a new appreciation for their local gems and avoid the cancellations and uncertainty which plagued holidaymakers in 2020.

Will vaccinations save the day?

As many industries remain at a standstill and businesses become desperate to reopen, the recent vaccination measures could not have come soon enough.

Countries with a highly vaccinated population could experience the following benefits:

- Less strain on the healthcare system

- Economies reopen and recover

- National and international travel between vaccinated countries

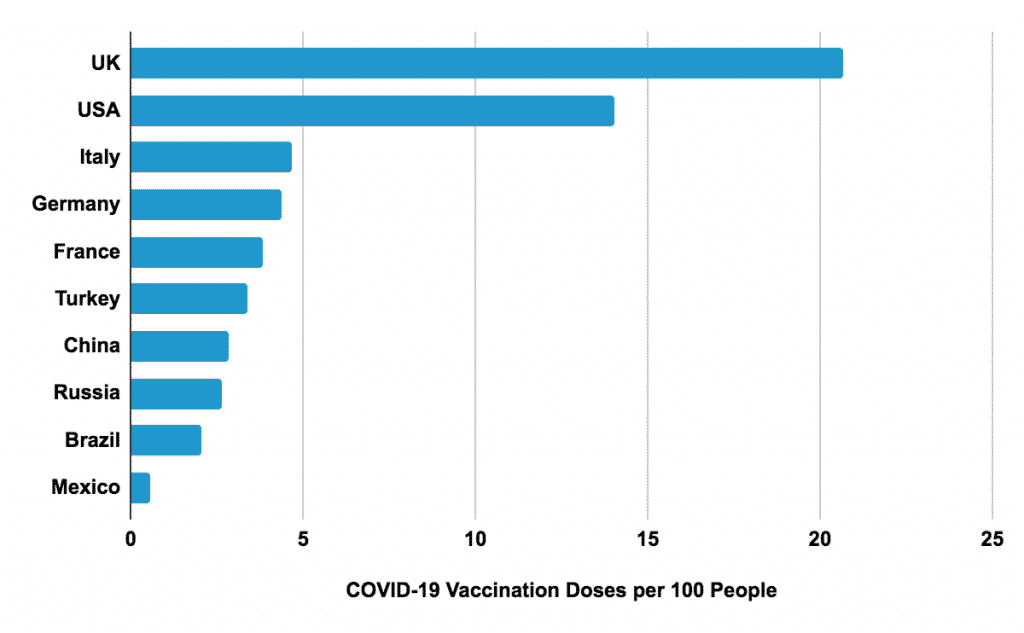

The graph below shows the cumulative COVID-19 vaccination doses administered per 100 people as of February 11th, 2021.

The United Kingdom is leading, with 20.67 per 100 people vaccinated. They have been praised for their strong vaccination effort, starting with care-home patients, key workers, and vulnerable people who have been the worst affected during the pandemic.

Cumulative COVID-19 vaccination doses administered per 100 people

As of: 11.2.21

On the 16th of February, the Centers for Disease Control and Prevention reported that providers were administering about 1.72 million doses per day on average in the United States.

EU countries, on the other hand, have taken a slower approach to the vaccine rollout. Supply chain issues and a slow response from the EU to sign for the vaccine have meant that in the first quarter of 2021, they may receive only 40% of the amount they requested last August.

How Asia responded to the COVID-19 crisis

The World Health Organisation (WHO) first reported a cluster of infectious pneumonia cases, later found to be COVID-19, on the 31st of December 2019, in Wuhan City, Hubei Province, China.

In the following months, the rest of the world caught up and announced many COVID-19 cases and deaths. But China, where the virus is predicted to have originated, seemed to get the pandemic under control much more quickly than other countries due to a fast response, strict nationwide lockdown, and screening measures.

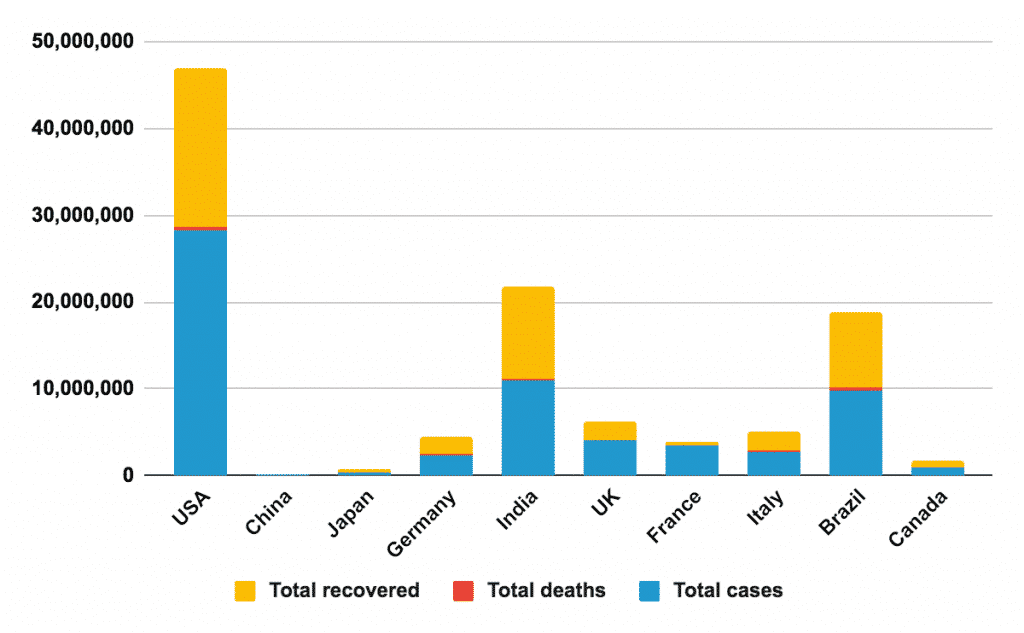

Total COVID-19 cases, deaths, and recoveries in the top 10 GDP countries

total cases as of: 11.2.21

The graph above compares the number of COVID-19 cases, deaths, and recovered patients in the top 10 GDP countries worldwide as of the 15th of February, 2021.

At the time of writing, the USA has had more than 29 Million cases and half a million deaths, which is more than 100 times higher than the death figure reported by China,

India, which took over the UK’s spot as the 5th largest economy in the world in 2019, is another country that has been badly affected by the pandemic. With 10,919,616 cases and 155,789 deaths, their economy has taken a hit and slipped behind, and they are now not due to take back their place until 2024.

Generally, East and South East Asia have been praised for their approach to handling the pandemic and getting it under control more successfully than the rest of the world.

Many people compared this to their previous experience with the SARS outbreak between 2002 and 2004. However, consistent advice, swift action, and stricter government intervention also played a role.

Whatever the reason, experts predict that the many Asian countries that could return to normal more quickly will have a financial advantage over the parts of the world that were not.

How Europe responded to COVID-19

All European countries took unique approaches in responding to the crisis. Some were quicker than others to react to the first wave, and there were varying levels of the strictness of national and regional laws.

As of the 11th of February 2021, the EU has adopted the Recovery and Resilience Facility (RRF), which includes a €672.5 billion recovery fund. By the 30th of April 2021, all EU members must submit their national recovery and resilience plans, including their reform and investment agendas up until 2026.

The solidarity between European nations has been commended worldwide, with countries sharing hospital beds, supplies, and doctors with their neighbors when needed.

The Financial Trends of 2021

Most of us entered 2020 with a tiny idea of our year ahead. With the insights from past events, though, we’re now in a better position to predict the financial trends of 2021.

The following sections will cover the financial trends within the following areas; ‘The rise of China and Asia,’ ‘The Biden administration,’ ‘European affairs,’ ‘The Stock markets and currencies’ and ‘The growing global debt.’

The rise of China and Asia

Since 1979, China has been one of the world’s fastest-growing economies, and this trend has only accelerated over the last year, and Asia, in general, seems to be on the rise.

The Chinese economy is predicted to overtake the US.

As a result of China’s successful response to the pandemic and the comparatively little damage to their economy, many predict they will soon overtake the US, including The Centre for Economics and Business Research (CEBR) annual report.

The report claimed that due to the “skillful management of the pandemic and the hits to long-term growth in the West […], the Chinese economy in dollar terms will overtake the US economy in 2028, 5 years earlier than we thought last year.”

Going on to predict “the trend rate of growth for China to be 5.7% annually from 2021-25 and 4.5% annually from 2026-30 and 3.9% annually from 2031-35.”

CEBR says things don’t look so favorable for the United States. Despite currently being the largest economy and one of the wealthiest countries in the world, they suggest “the trend rate of growth of the States to be 1.9% annually from 2022-24 and 1.6% annually for the rest of the forecast horizon,” which is 2.6% and 2.3% lower than China’s projected growth.

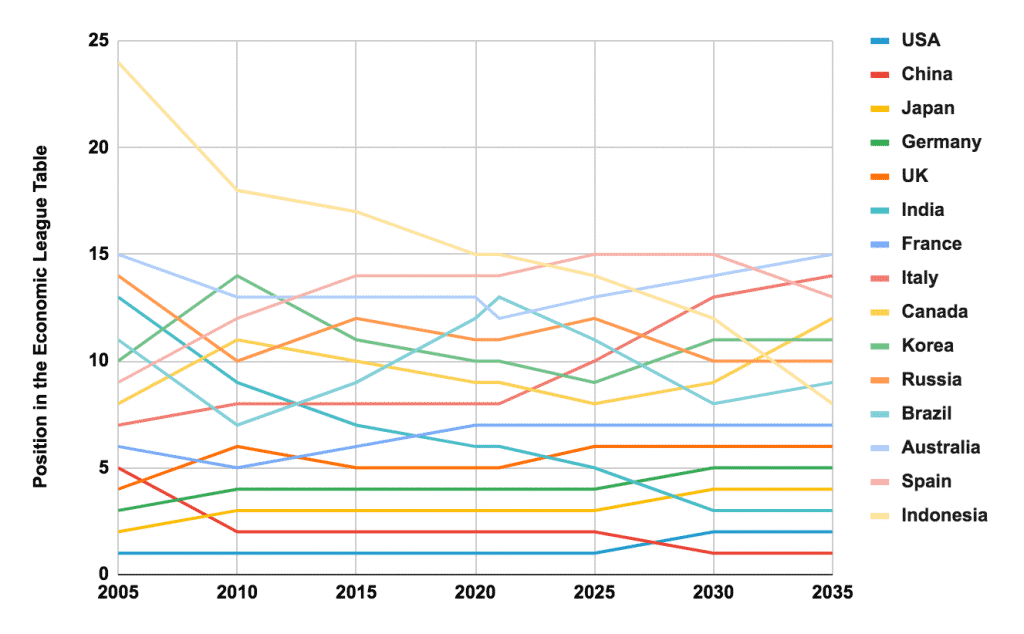

World economic league table predictions

2005-2035

Preview in a new tab (opens in a new tab)

India, steadily climbing up from just 13 in 2005, is expected to be the third-largest economy by 2030. Currently sitting at 15, Indonesia is predicted to be the 8th largest economy by 2035.

Furthermore, Italy, Australia, and Korea are all predicted to slip down the table in the next 15 years.

The RCEP forms the world’s largest trading bloc.

November 15th of 2020, marked the end of eight years of negotiations and confirmed the formation of the Regional Comprehensive Economic Partnership (RCEP).

Otherwise known as the world’s most significant free trade agreement, which will cover 30% of global trade.

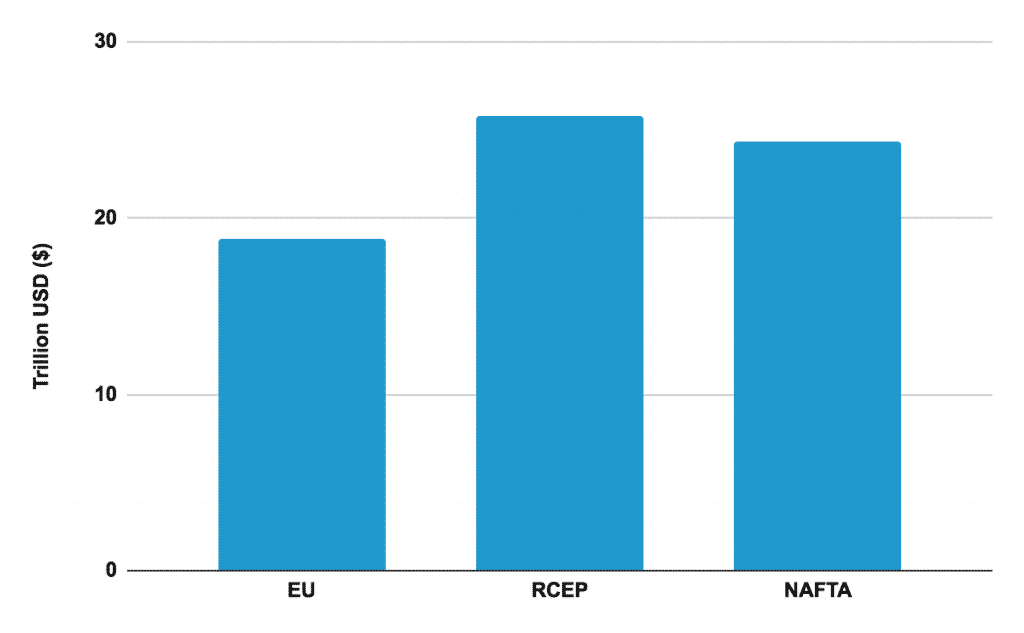

The chart below shows the total GDP of member countries of the EU, RCEP, and NAFTA.

Real GDP of member countries of selected regional free trade agreements

2019

What countries are part of the RCEP?

Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam, Australia, Japan, New Zealand, South Korea and China.

The Biden administration

As the largest economy in the world, what happens in the United States fundamentally impacts the global economy. The 2020 election brought the end of the uncertainty of the Trump era, which we predict will help to stabilize markets.

The ING Group is skeptical and thinks that cross-country relationships may remain tainted by the former presidency, saying: “Despite the election of a new president, U.S. – China trade relations are unlikely to experience much of an improvement after a tumultuous few years of tit-for-tat tariff hikes.”

Biden’s plans for a greener America

Joe Biden is pushing for what he has described as a “clean energy revolution.” One of his first acts as president was to rejoin the Paris Agreement that former president Donald Trump withdrew from in 2017, which included pledging to reduce emission levels between 26-28% by 2025.

The president says, “If we can harness all of our energy and talents, and unmatchable American innovation, we can turn this threat into an opportunity to revitalize the U.S. energy sector and boost growth economy-wide.”

Claiming that the Biden administration’s response to climate change can create more than 10 million well-paying jobs in the United States “if executed strategically.”

What’s included in Biden’s plan to tackle climate change?

- USD 1.7 trillion investment in clean energy

- Promise to reach 100% clean energy by 2050 with net-zero emissions

- Record-breaking investment in zero-carbon technologies

- 10 million well-paying jobs across America

How America dealt with Coronavirus

Writing for Forbes in October 2020, Mike Patton said, “Before the pandemic, the U.S. economy was doing very well. Unemployment was at a 50-year low, and inflation was below the Fed’s target of 2.0%.

However, because we closed a significant portion of the U.S. economy, ‘real’ GDP growth (i.e., the % increase/decrease in economic growth compared to one year prior, ‘net’ of inflation) fell during the second quarter by an astounding 31.40%. These are numbers not seen since the Great Depression of the 1930s.

Unemployment spiked to its highest rate in the post-WWII era, hitting 14.7% earlier this year.”

However, unemployment rates have steadily decreased since their peak in April 2020.

Stimulus plans

The US House just passed a $1.9 trillion stimulus plan that will relieve American businesses and individuals enormously.

The plan will provide up to $1,400 in stimulus checks available for mixed citizenship families and adult dependents, who were left out of the previous two stimulus plans under the previous government.

The plan also aims to assist the unemployed, food stamp recipients, low-income households, small business owners, and struggling homeowners in paying their rent or taxes.

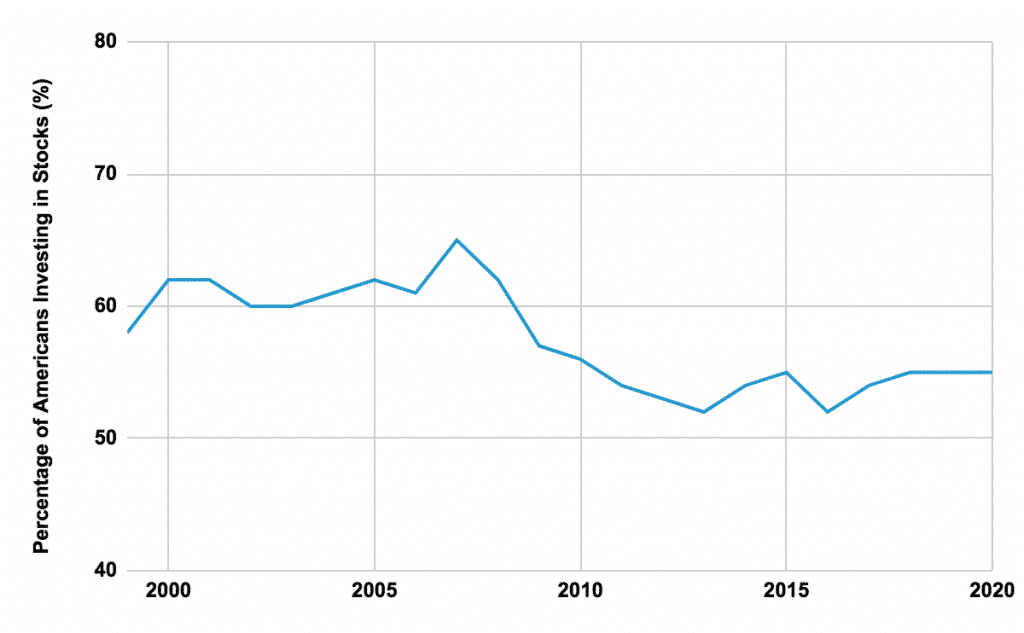

America’s attitude toward the financial markets

Despite the turbulent year, America’s attitude toward the financial markets has remained steady. As the graph below shows, 55% of adults in the United States invested in the stock market using stock trading apps or other platforms in 2020.

Although lower than the percentage of investors during the Great Recession, it is in line with the two years previous and has risen since 2016. With the vaccine and new stimulus checks being rolled out, we don’t expect this to decrease in the coming year.

Share of adults in America investing in stocks

1999-2020

Europe‘s path to recovery

Europe went into 2020 expecting the ongoing Brexit saga to dominate the headlines. However, the pandemic unsurprisingly took center stage instead. We’ve examined how Europe is financially doing after such an unprecedented year.

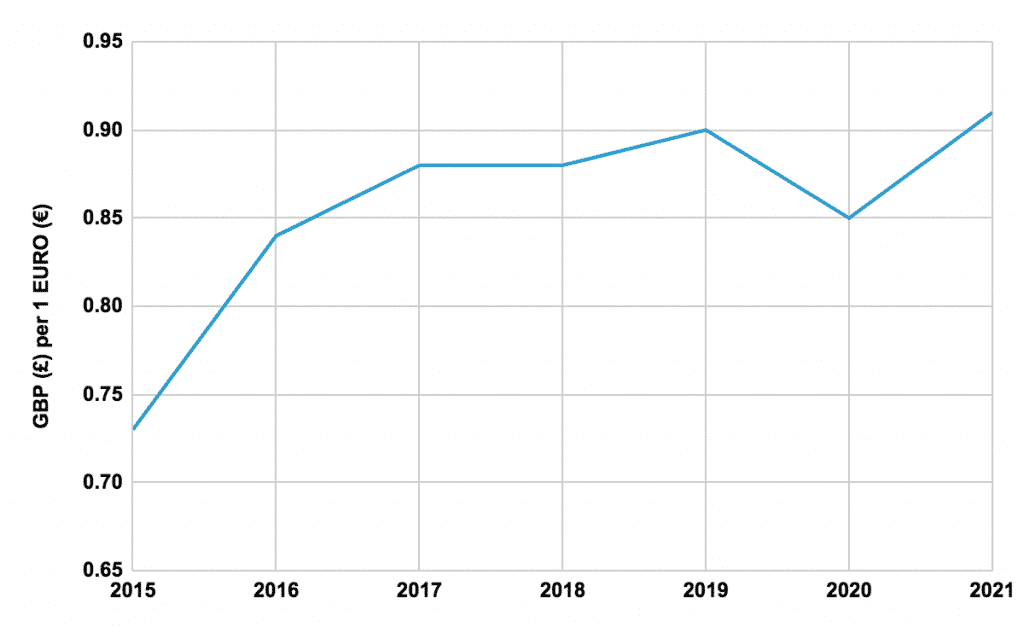

A post-Brexit Europe

Although overshadowed in 2020 by COVID-19, Brexit will significantly impact both the UK and EU in 2021. Already we can see the British pound (GBP) has devalued considerably against the Euro since the referendum result in 2016.

In January 2015, the GBP was 0.73 against 1 Euro, which is 0.18 lower than 0.91 in December 2020. However, there may be light at the end of the tunnel for the GBP.

After the vaccine announcement, the GBP saw a slight comeback after a peak of 0.94, which made them nearly 1-1. We’re now seeing numbers back down to 0.89 as confidence grows in the UK economy due to the strong vaccine measures.

FX strategist Petr Krpata suggests the conclusion of Brexit has also made an impact.

“With the risk of a ‘no deal’ Brexit no longer hanging over markets, the persistent pound undervaluation of recent years should begin to dissipate”.

Petr Krpata

GBP per 1 Euro

2015: Q4 – 2020: Q4

Migration between the UK and Europe is also expected to slow down now that a decision has been finalized. However, with COVID-19 reducing travel to such a great extent, it might be some time until we find out how much.

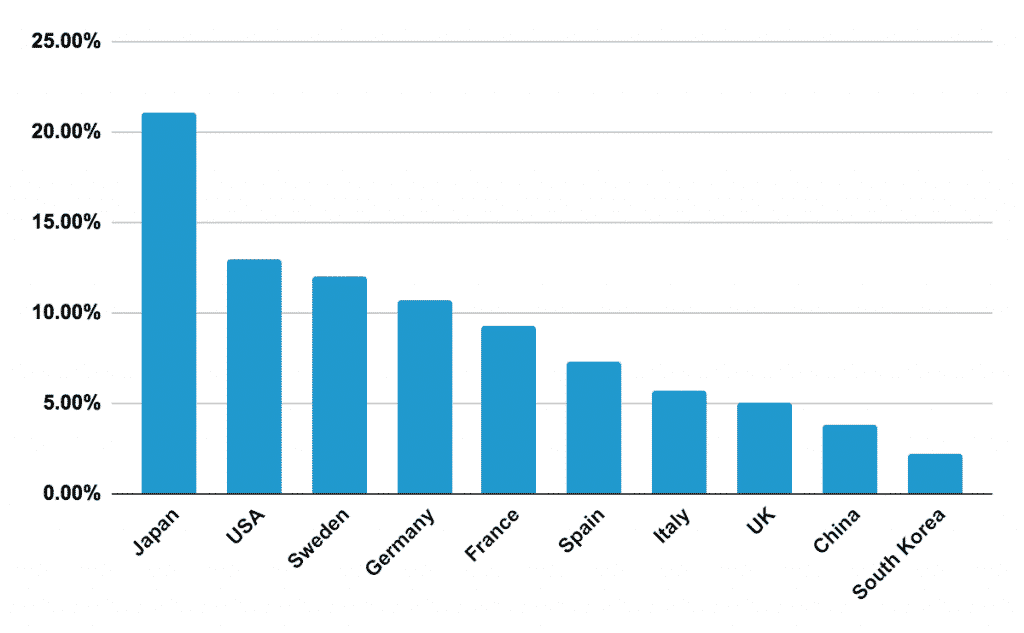

Next Generation EU

The graph below outlines the financial response to the pandemic as a share of GDP. Japan is taking a solid lead at 21.1%, much higher than the European numbers between 12% and 5%.

Coronavirus stimulus packages compared

As of: 10.5.2020

However, there have still been generous stimulus packages all over Europe. The European commission’s long-term budget and the NextGenerationEU were confirmed on the 17th of December 2020.

Ursula von der Leyen announced a total of 1.8 trillion euros which will be used to rebuild Europe post-COVID-19. They will “use the bulk of this money to help member states recover from the crisis and build their long-term resilience capacity.”

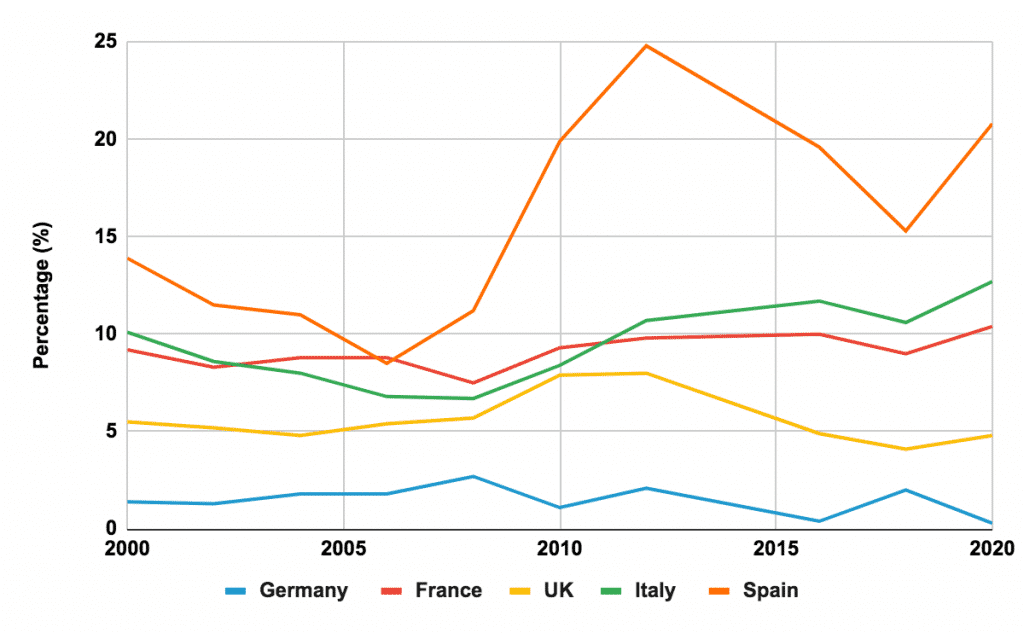

Growing unemployment in Europe

Due to this government-provided relief, unemployment rates didn’t skyrocket as much as many expected in 2020.

Of Europe’s five largest economies, France, the UK, Italy, and Spain experienced an increase in unemployment, with Spain at the most worrying level of 20.8%. However, Germany continues to keep the lowest unemployment rate out of the five and saw a drop in 2020 to just 0.3%.

The unemployment rate of the largest economies in Europe

2000 -2020

Although this seems relatively positive, analysts suggest everything is being temporarily propped up by furlough and other government support schemes and that we will see the actual results in late 2021 and beyond.

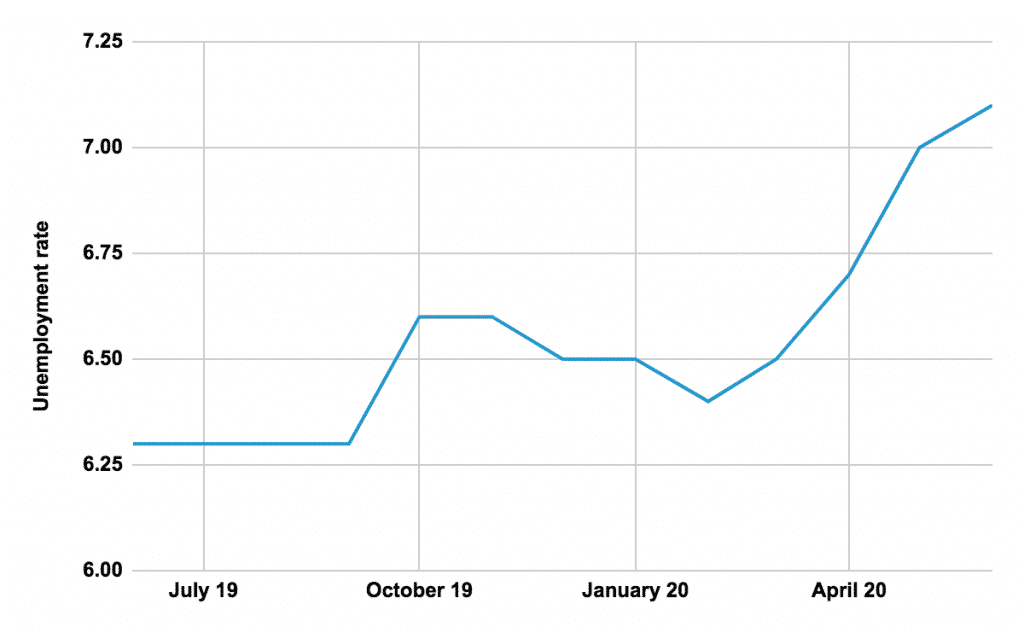

This prediction aligns with the graph below, showing how unemployment rose in the EU when lockdowns began in February 2020.

The unemployment rate in the EU

2000 -2020

Stock markets and currencies

The Federal Reserve assured markets that interest rates would remain unchanged, and S&P 500 and Dow are at their highest since the lows of March 2020, making things look remarkably positive.

But what can we expect from the rest of 2021 in a world still vastly locked down?

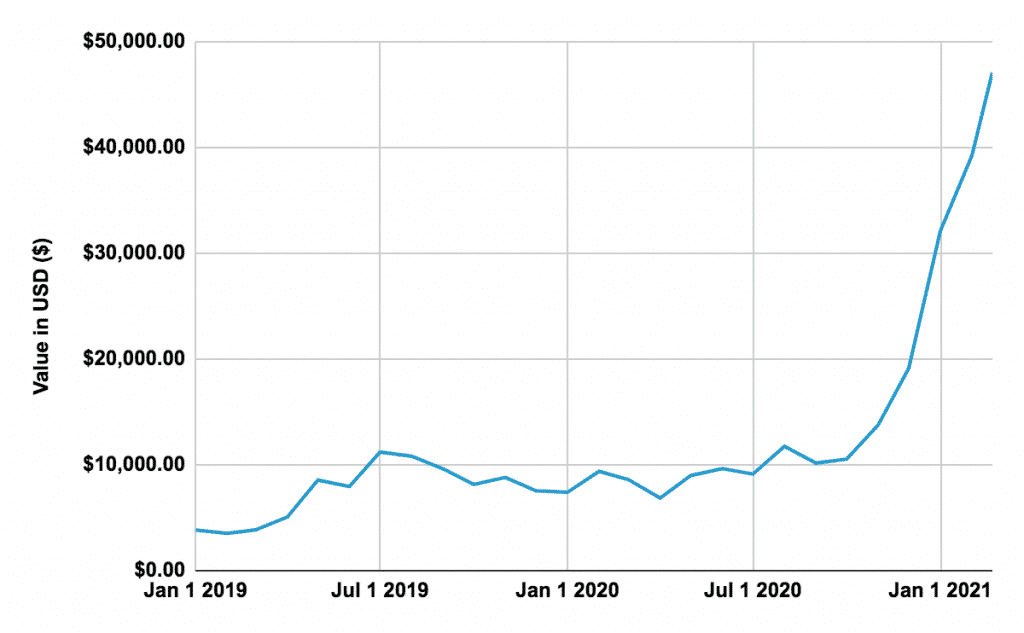

Digital currencies explode

The dollar’s value has decreased against the Euro and GBP since April 2020, yet digital currencies continue to grow.

When Tesla brought $1.5 billion in Bitcoin in February, they contributed to exponential growth, taking us to an unprecedented value of $50,000.00 per Bitcoin today. The company even claimed they “expect to begin accepting bitcoin as a form of payment for our products shortly.”

We expect more S&P 500 companies to follow suit and for the value of Bitcoin to continue to rise in 2021.

Value of Bitcoin

1.1.19 – 1.1.21

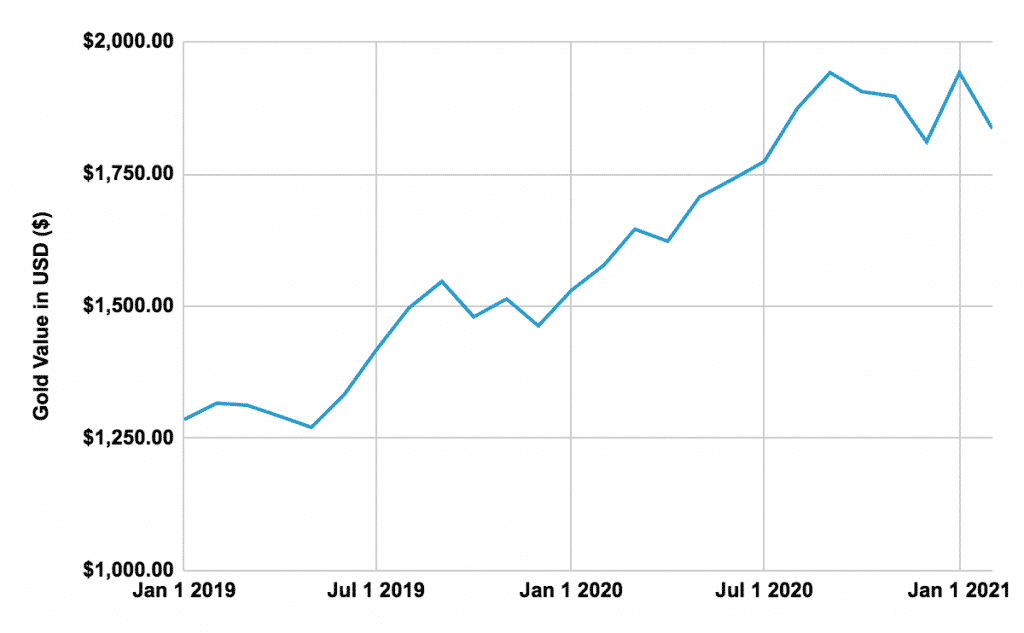

Gold, often known as a ‘safe bet’ for investors, has also risen in value since last February’s first wave of lockdowns.

In January 2021, the value of gold rose by $656 from the previous year, which is still showing no signs of stopping.

Value of Gold

1.1.19 – 1.1.21

“The dollar will likely weaken modestly as the global recovery proceeds. Investors should keep an eye on currency exposures and consider beneficiaries of a weakening dollar, such as emerging markets.”

JP Morgan Private Bank

A looming debt crisis

After a global pandemic, it’s not surprising that government debt is growing globally. So, what can we expect from the year ahead?

In an interview by Jeffrey Caso from McKinsey, Professor Edward I. Altman said: “For companies that cannot buy back debt because they don’t have the cash, or those unable to issue new equity at attractive prices because their performance has been poor—these are the companies that I believe are going to default in increasing numbers in 2021”.

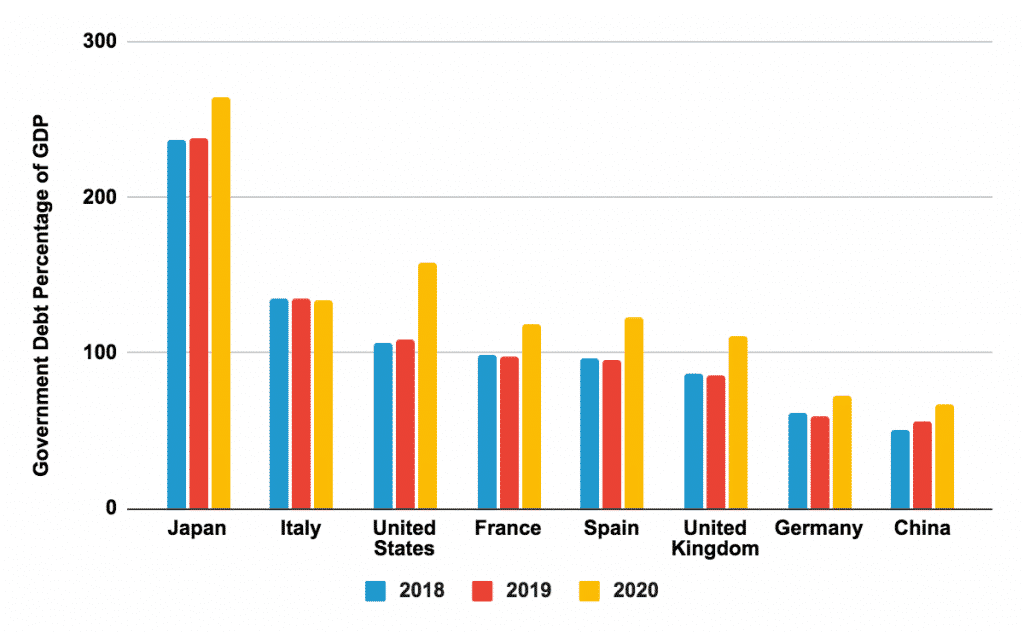

Government debt continues to grow.

The pandemic has accelerated the general government debt levels that many countries faced even pre-2020. The graph below compares the debt levels of selected countries from 2018-2020 as a percentage of GDP.

Levels in certain countries, such as Japan and Italy, were already high before the pandemic hit and have continued to grow. Other countries, such as the United States, saw a sharp increase in 2020.

General government debt percent of GDP

2018-2020

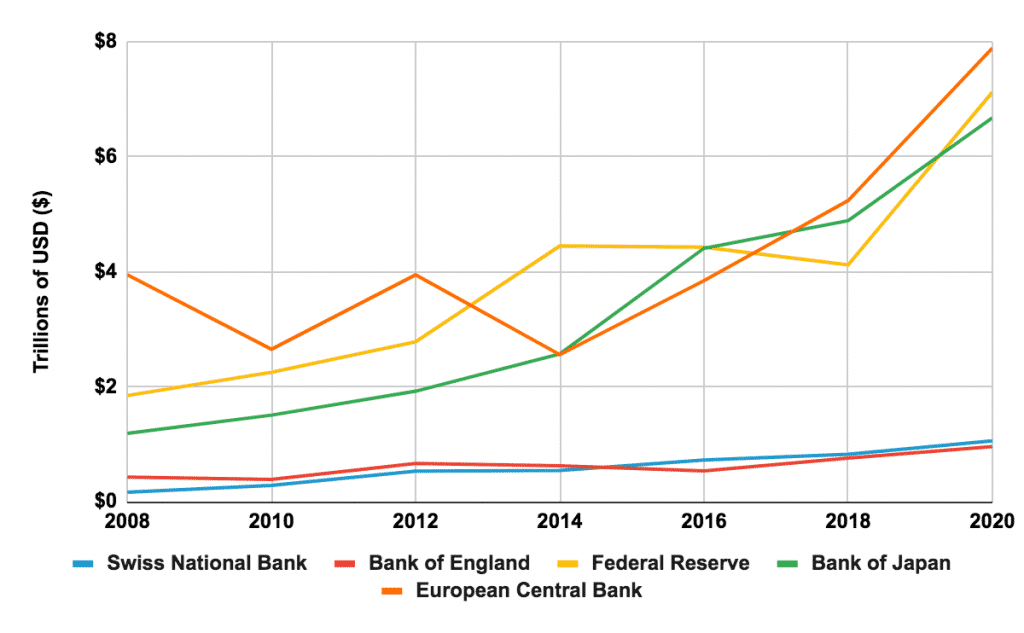

Money printing

To keep up with these worrying levels of debt, some of the world’s central banks have been printing money at a potentially alarming rate.

The Federal Reserve and the European Central Bank printed around three trillion dollars between 2018-2020, showing a significant rise for each of the five banks.

Global central bank balance sheets

2008-2020

Three Scenario Predictions for 2021

We’ve looked at what the experts think and put together three possible scenarios for the remainder of 2021.

📈 1st Scenario: The revival of the roaring 20s

Our most optimistic prediction is that 2021 will revive the roaring ’20s. After a year of unexpected hardship, the increased vaccine roll-out will kickstart economies and zero COVID-19 will be achieved.

“Looking ahead to next year, respondents’ economic expectations are increasingly positive: 63 percent say their countries’ economies will be better six months from now.” Says McKinsey.

People will quickly spend the money saved from being stuck in the house over the last year, injecting a mini boost into the travel, retail, and hospitality industries.

The financial markets will keep setting new all-time highs, and personal and government debt will slowly pay off with interest rates staying down.

Federal Reserve Chairman Jerome Powell said he wouldn’t raise rates for the foreseeable future. “We were in a good place in February of 2020, and we think we can get back there, I would say, much sooner than we had feared.”

“We were in a good place in February of 2020, and we think we can get back there, I would say, much sooner than we had feared.”

Jerome Powell

This scenario may be the most possible, assuming that the economic recovery plans and the coronavirus containment and vaccination plans go according to schedule.

📊 2nd Scenario: Cautious and steady post-vaccine recovery

Our second prediction for 2021 is more neutral. Supply issues could delay the vaccine rollout until the end of the year, keeping borders closed in high-risk areas throughout the summer.

Yet, with the absence of new major COVID-19 strains, local economies could slowly begin to rebuild with social distancing measures in place.

The financial markets may begin to slow down, but this won’t undo the gains of recent months, and there will be no significant losses. Inflation will stay within expected levels, and money printing will slow down with the hope of COVID-zero on the horizon.

With companies and schools adapting more to the work-from-home culture, employment will steadily rise.

Acting Vice President of the World Bank, Ayhan Kose, says, “Growth was coming back in 2021. At the global level, we are expecting growth to be around 4%. If you look at advanced economies, they will deliver growth at about 3.3%. And if you look at emerging global economies, we expect them to grow at around 5%.

Not so good news is that it is still a subdued recovery, and it will take time to recover from this devastating year 2020.”

📉 3rd Scenario: The Great Depression 2.0

Our final prediction is our ‘worst-case scenario.’

New COVID-19 strains will wreak havoc, and vaccines won’t be effective against all new strains sending us straight back to February 2020.

Lockdowns continue across the globe until further notice, causing borders to close and economies to crash. Unemployment will rise, causing industry breakdowns, a loss in consumer demand, and a steady decrease in global trade.

This chain of events may trigger a sudden global stock market crash surpassing the one experienced in March 2020.

Policymakers will try to push urgent stimulus plans into the economy. Still, the decreasing confidence in the general economy and global currencies will deem the stimulus plans ineffective in reviving the markets.

Global economies will enter a period of prolonged stagflation, with soaring inflation rates, while the actual economic output will keep shrinking.

Stores of value, such as gold and real estate, will start soaring, while hyperinflation will further damage global consumer purchase power, especially for the lower-income class.

Global income and living standards inequality will rise to profound levels, which will cause extreme social and political unrest. The world, at this point, may enter a prolonged depression reminiscent of the Great Depression in the 30s.

Final thoughts

Thank you for reading our State of Finance and Global Predictions for 2021. The 2023 State of Financer report will be published in the second half of 2023.

Let us know in the comments below what you believe is in store for the year ahead and which trends you are hopeful for.