CashUSA Review

Summary

- Loans between $500 – $10,000

- Up to 72 months to repay

- Interest rates 5.99 – 35.99%

- Funds direct deposited into a designated account

- Accessible 24/7

- All credit types considered

What is CashUSA?

CashUSA is an online loan broker that connects borrowers with suitable lenders.

Through its network of lenders, CashUSA offers borrowers loans between $500 and $10,000. The maximum loan amount available to a borrower will depend on their creditworthiness.

However, according to CashUSA’s website, consumers with low credit scores will unlikely receive a loan greater than $1,000.

Borrowers can repay their loans in 90 days or stretch the payment terms to up to 72 months on approved credit.

Read more Cash USA reviews below or submit your own.

- Quick, user-friendly online application

- Customer support via email and phone

- Lender network includes both state and Tribal lenders

- All credit types considered

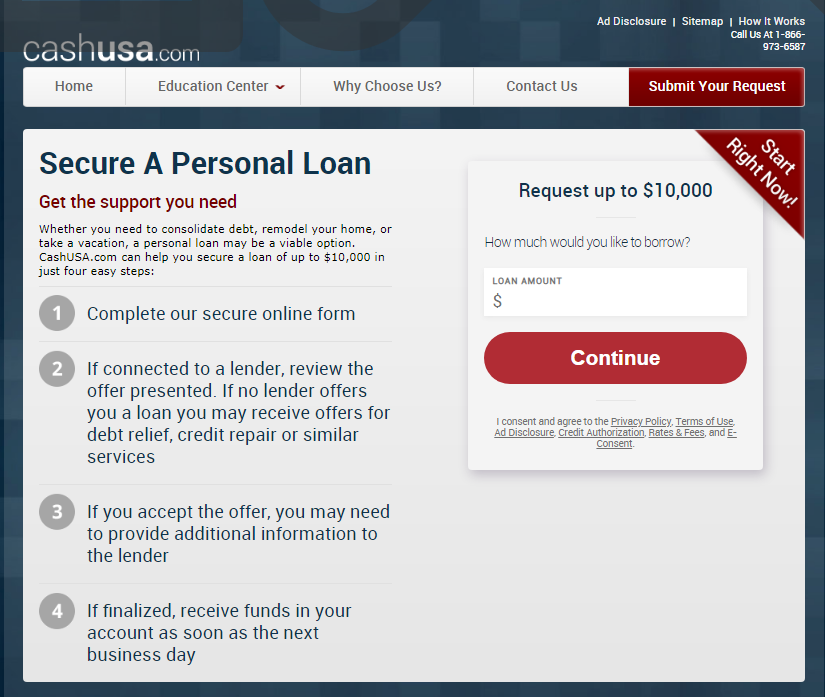

How CashUSA Works

With more than a million users every month, CashUSA offers a simple and straightforward online loan platform.

Borrowers simply need to enter their details online and they will receive offers from reputable lenders. CashUSA sends your submitted form to multiple lenders at the same time, so that you can compare multiple offers.

You can also read more CashUSA.com reviews at the bottom of this page.

Loan Requirements

Here are the loan requirements when applying for a CashUSA loan:

- Be at least 18 years of age (older dependant of state)

- U.S Citizen or permanent resident

- Have a minimum post-tax income of $1000 per month

- Provide a current email and phone number

- Have an active checking account

Applications usually take only a few minutes and once you receive your offers, you can review and accept the loan terms immediately.

Rates & Fees

CashUSA loans come with APR rates of between 5.99% and 35.99%.

Example: A loan of $5,000 over 36 months with an APR of 18% will equal monthly payments of $179.35 with a total loan amount of $6,456.68.

Payment Terms

Repayment terms on a CashUSA loan are from 3 months to 72 months.

Loan offers from Cash USA may come with an origination fee, depending on the lender. Different offers may also have unique interest rates and payment terms.

How To Apply for a CashUSA Loan

Apply Online

Visit CashUSA.com and submit your loan request. This will require some basic information like the loan amount, what you need it for, your date of birth, and zip code. This will also trigger a soft credit inquiry.Receive Loan Offers

Once you’ve submitted your details you’ll be presented with suitable loan offers. Review the offers to see if one suits you needs, before you proceed to apply. Once you do, it will trigger a full credit check.Loan Approval

Once your application has been submitted and reviewed, you’ll be notified of the outcome. Since the terms differ from one lender to the next, you may receive your loan as soon as the next day.Requesting a personal loan from CashUSA.com only takes a few minutes. This will result in a soft credit pull that does not impact your credit score.

You’ll get the process started by sending the network your initial online loan request. Your zip code, birth year, and the last four digits of your Social Security number are needed for this.

Your full name, address, whether you are an active duty military member, the amount of the loan, and your credit score range will all be requested on the page that follows. This can range from subpar (a score of 579 or lower) to outstanding (at or above 740).

As this is a personal loan, there are no restrictions on how you can use the money. You can use it for debt consolidation, emergency expenses, car repairs, home improvements, and more.

CashUSA.com Alternatives

Some alternatives to CashUSA.com include:

| Lender | Loan Amount | Terms | Apply > |

|---|---|---|---|

| PersonalLoans.com | $500 – $35,000 | Up to 72 months | Apply |

| BadCreditLoans | $500 – $10,000 | Up to 36 months | Apply |

| 5KFunds | $100 – $35,000 | Up to 72 months | Apply |

| LoansUnder36 | $500 – $35,000 | Up to 72 months | Apply |

👉 View a complete list of online lenders here.

Our CashUSA Review

Fast loan application process

Cash deposits directly into your account

All credit types accepted

Available online 24/7

Secure site

CashUSA Pros

Small loan amounts up to $10,000

High APRs possible

Not a direct lender

CashUSA Cons

CashUSA has a simple and straightforward online loan application process and can connect you with many well-known U.S. lenders in just a few minutes.

CashUSA loans are a good option if you are looking for a bad credit loan or have a credit history that needs some work.

At Financer.com we always recommend that you shop around to find a lender that suits your personal needs.

Customer Service

CashUSA.com offers support via email, phone, and online. There is no CashUSA login available but you can apply for a loan online in minutes.

Want to leave feedback? Add your CashUSA.com review below.