samwilliamson654 13 reviews | May 24, 2023

General Review

(Edited)

Reply

Share

Helpful? (0) You found this review helpful

Post reply

Chosen 72 times

Chime Financial, Inc offers everyday banking services with a range of benefits. The fintech company provides a secured credit card and a bank account with no monthly fees. Complete with overdrafts up to $200.

Chime works with a network of more than 60,000 ATMs across the US.

At Financer.com, all apps go through a thorough research and review process. Here’s how we rate Chime:

| Category | Rating |

|---|---|

| Fees | ⭐⭐⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Security | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Want to skip the details? Jump to our final verdict here.

Chime is a financial app offering a range of banking products Stride Bank and Bancorp Bank with more than 14 million customers.

Here’s a quick summary of Chime:

| Overview | Features |

|---|---|

| Accounts: | Checking, credit builder, savings |

| Overdraft: | Up to $200 |

| APR: | 7.90% – 29.99% |

| Min. credit score: | 580 |

| Monthly fees: | None |

| Requirements for a credit builder card: | – Chime Checking Account – Direct deposits of $200 and more |

Chime allows you to receive your direct deposits up to two days early, build credit, send payments, and earn interest on savings.

Some of the best benefits of Chime is that it doesn’t charge monthly fees and offers free overdrafts of up to $200.

Chime offers three types of accounts: a checking account, a savings account, and a credit builder.

These options all have benefits to offer and you can choose what account you need based on your financial goals.

Chime’s checking account has no monthly fees and offers 24/7 mobile banking. It’s also easy to access cash anytime with 60,000+ ATMs worldwide.

With no overdraft fees you can get up to $200 fee-free with SpotMe, should you qualify. The negative balance is then added and applied to your next deposit.

Friends can also boost each other and this can increase your SpotMe limit. There are no fees to use SpotMe.

Another great feature of the Chime checking account is that you can get paid up to two days early. We’ll notify you as soon as the paycheck is available.

With access to your paycheck earlier, you can use it to pay bills or add it to your savings earlier. You’ll get an instant notification when you’re paycheck is ready.

With the credit builder account you pay no annual fee and there is no credit check needed. You also don’t need a security deposit to open an account.

This makes the Chime Credit Builder account a great way to build your credit. You get a secured Visa credit card to help you build your credit profile with everyday purchases.

Chime also reports your payment history to all three major credit bureaus and members see an average of a 30-point increase in their credit*.

Simply open a Chime Checking Account and make a direct deposit of $200 or more and you’ll be ready to apply.

With the Chime Savings Account, you can earn 2.00% APY on your funds and boost your earnings further with the Automatic Savings feature.

Chime’s high-yield savings account offers you up to nine times the national average and has no monthly fees.

Another benefit of Chime’s savings account is that you can use Round Ups to automatically round up and save the change of your purchases.

You can also use the Save When I Get Paid feature to automatically help you save by saving a percentage each time your paycheck gets deposited.

One of the biggest benefits of a Chime bank account is that there are no monthly fees payable. You can build credit easily and save with a high-yield savings account.

Once you have qualifying deposits, you can get your paycheck up to two days early and access thousands of ATMs with a free debit card.

No in-person branches

Check deposits are only available if your account gets direct deposits

One of the biggest drawbacks is that Chime doesn’t have in-person branches to assist customer services.

As mentioned there are no monthly fees and no minimum balance requirements. When using ATMs, there are no fees unless you use ATMs that are out of Chime’s network, in which case you’ll be charged $2.50 per withdrawal.

There are also no:

You can use the Chime app to deposit a check via mobile deposit.

Chime a digital bank that is ideal for those looking to build their credit without paying monthly bank fees.

With no fees and benefits like access to your paycheck faster, Chime is a great alternative to a traditional checking account.

We think the high-yield savings account is a great addition to your Chime account as it allow you to bank your change and get up to 2.00% APY on your savings.

Chime may not be the best option if you’re looking for a full-service banking suite though.

Chime is FDIC insured up to $250,000 per deposit and they implement multiple security features to safeguard information.

Customers get real-time notifications for transactions on their account.

Since there are no banking fees Chime is a competitive option for digital banks.

Customer is available via phone 24/7 and you can chat with an agent live via the Chime app.

Here’s a list of alternatives to Tally and how they compare:

| Lender | Reviews | Monthly Fees | Account Type | Debit Card |

|---|---|---|---|---|

| Ally Bank | View | None | Checking | Yes |

| Revolut | View | From $12.99 | Checking | Yes |

| SoFi | View | None | Checking | Yes |

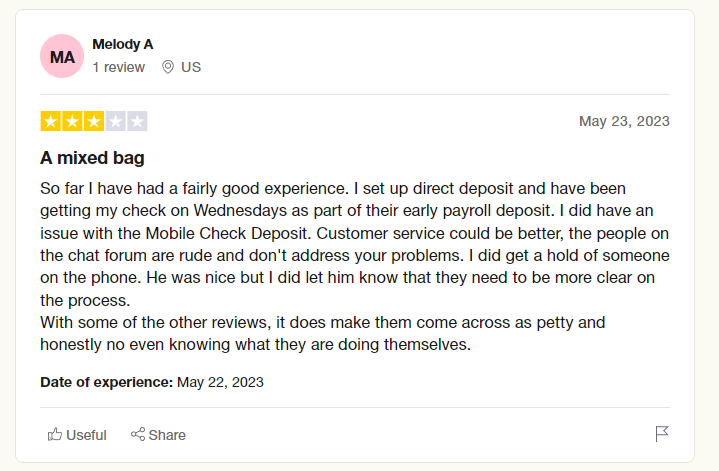

Tally gets 2.8 out of 5 stars on Trustpilot, with mixed reviews:

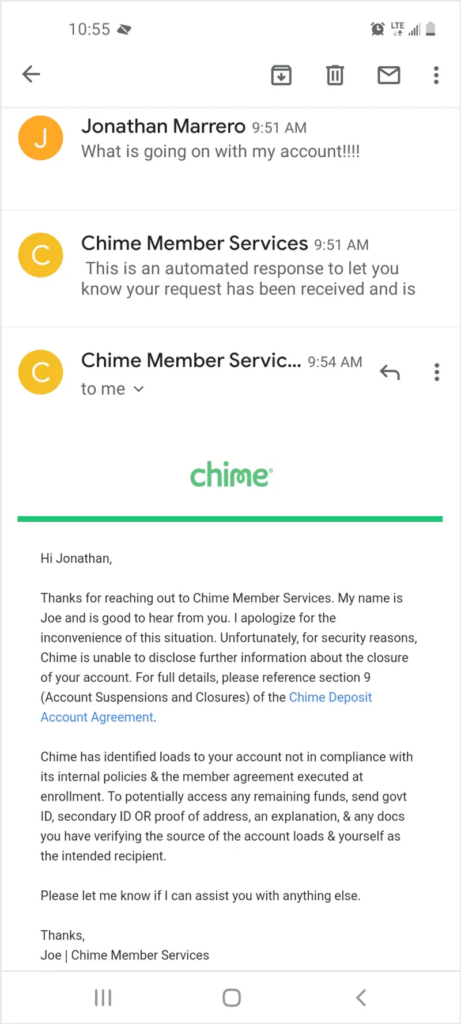

Unfortunately, Chime doesn’t respond to all the reviews.

Read more reviews on Financer.com from verified users below.

Have you used Chime before? Leave your review now.

* Based on a representative study conducted by Experian®, members who made their first purchase with Credit Builder between June 2020 and October 2020 observed an average FICO® Score 8 increase of 30 points after approximately 8 months. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

Rate & Review Chime

Your rate for this company. Edit Rate

Take a minute to write a review!

Share your experience and help others to choose the right company.

Pros

Cons

Visit their official website and learn more about Chime

Or sign in with email

The username or password is incorrect.

Authentication Code:

Thank you for choosing

Share your experience and help others to choose the right company.

This website uses cookies among other user tracking and analytics tools. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Cookies may also be used for other marketing and advertising purposes, or for other important business analytics and operations.

To use our website you need to agree to our Terms and Conditions and Privacy Policy. To find more about the legal terms that govern your use of our website, please read our Terms and Conditions here.To find more about your privacy when using our website, and to see a more detailed list for the purpose of our cookies, how we use them and how you may disable them, please read our Privacy Policy here.