CreditFresh Review

Founded in 2019, Creditfresh is a Delaware-based lender offering lines of credit to borrowers in 24 US states.

Creditfresh is in partnership with CBW Bank, and First Electronic Bank (Both FDIC Members) and offers lines of credit up to $5,000.

Note: Creditfresh lines of credit are available in 24 U.S. states: Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Hawaii, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Washington, and Wisconsin.

How We Rate Creditfresh

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate Creditfresh:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐ |

| Transparency | ⭐⭐⭐ |

| Customer support | ⭐⭐ |

| Overall | ⭐⭐⭐ |

Do We Recommend Creditfresh?

Yes, we recommend Creditfresh as a reliable lender. Skip to our full review below and see how we rate Creditfresh.Want to skip the details? Jump to our final verdict here.

CreditFresh Overview

CreditFresh partners with financial institutions to provide fully integrated technology and service solutions to expand their current product offerings and provide consumers with access to credit.

Here’s a quick summary of Creditfresh:

| Overview | Features |

|---|---|

| Loan type: | Line of credit |

| Loan amount: | $500 – $5,000 |

| APR: | From 65% |

| Min. credit score: | None |

| Monthly fees: | None |

| Payout time: | One business day |

| Weekend payout: | No |

| Requirements: | At least 18 years old U.S. citizen Active bank account Regular income Valid phone number and email |

Requests for credit submitted on this website may be originated by one of two Bank Lending Partners including CBW Bank, Member FDIC and First Electronic Bank, Member FDIC.

Requesting a Line of Credit through CreditFresh is done completely online. The process is simple, quick, and completely transparent, with clear repayment terms and no hidden charges.

Access to a Line of Credit through CreditFresh varies by state.

CreditFresh reviews as mostly positive and borrowers note that the website is easy to use with great customer support.

Products Offered

The Line of Credit through CreditFresh has a maximum credit limit of $5,000. A line of credit is an open-ended credit product that allows you to take draws, repay and redraw as needed.

A line of credit is a flexible way to have a safety net for any unexpected expenses.

Request a Line of Credit Now

Why Choose CreditFresh

Choosing a personal line of credit through CreditFresh has many benefits:

- Fast funding. If approved, any requested funds may be deposited into your bank account as early as the same business day*; timing of funding may vary. The date and time the funds are made available to you by your bank is subject to your bank’s policies.

- A transparent experience. Navigating credit products can be challenging and frustrating. A line of credit through CreditFresh offers a fully transparent experience.

- Part of your credit journey. As customers move through their credit journeys, they may become eligible for reduced billing cycle charges and/or increase credit limits based on a good payment history over time. Actual eligibility is based on individual circumstances.

Creditfresh Pros and Cons

Pros

- Access to cash for bad credit borrowers.

- On-time payments can help to boost credit scores with main credit reference agencies.

- Creditfresh is transparent with their billing cycle charges

Although Creditfresh doesn’t have extremely high APRs compared to other line of credit lenders, their APR starts at 65% which is still quite high.

Checking eligibility won’t affect your credit score and this is typically aimed at borrowers with bad credit who want to improve their score.

Billing Cycle Charges are costly and can be misunderstood by borrowers

Continued access to the line of credit can make unnecessary additional spending tempting for borrowers.

Cons

As mentioned, APRs can be very high and this is also one of the main concerns among past borrowers. It’s essential to understand the total cost of borrowing and reference the billing cycle charges.

They are very quick with approvals but it may not always be worthwhile for borrowers.

How CreditFresh Works

A line of credit through CreditFresh allows you to draw from your balance, repay, and redraw as needed. This is different from a traditional installment loan where you get a lump sum of money that you need to repay over a fixed loan term.

With a line of credit through CreditFresh, you only pay fees on the amount you borrow. You can withdraw money at any time, as long as you have available credit and an account that is in good standing.

An outstanding balance has to be paid with regular payments and your payment dates will typically align with your pay frequency.

The request process for a line of credit through CreditFresh is quick, simple, and transparent. The line of credit through CreditFresh is currently offered in:

- Alabama

- Alaska

- Arizona

- Arkansas

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Indiana

- Kansas

- Kentucky

- Louisiana

- Michigan

- Mississippi

- Missouri

- Nebraska

- North Carolina

- Ohio

- Oklahoma

- South Carolina

- Tennessee

- Texas

- Utah

- Washington

- Wisconsin

Creditfresh reports your account activity to TransUnion, so making regular payments and keeping your account up to date may help to improve your credit.

Line of Credit Requirements

Here are the requirements to request a line of credit through CreditFresh:

- Be of legal age to contract in your state.

- Be a U.S. citizen or permanent resident.

- Have an active bank account.

- Have a regular stream of income.

- Have a valid contact number and email address.

You may be required to provide additional information during your application, including the following:

- Proof of bank account (like a void check)

- Proof of identity (like your driver’s license)

- Proof of residence (like a utility bill)

- Proof of income (like a bank statement)

Rates & Fees

There is a billing cycle charge that ranges between $5 and $410 and is based on the amount of money outstanding throughout your billing cycle (not your credit limit).

If you have an amount outstanding on your principal balance, you’ll need to pay a mandatory principal contribution in addition to the billing cycle charge with every minimum payment you make. This will ensure part of every payment is applied toward your principal balance.

You will only start incurring charges once you’ve received your funds.

Creditfresh does not charge an origination fee.

Creditfresh also doesn’t charge a cash advance fee and there are no late fees.

Repayment Terms

You will receive a statement prior to your due date, detailing the activity on your account and the minimum payment due. The minimum payment includes the billing cycle charge and mandatory principal contribution. You can pay just the minimum balance, or pay more to reduce the total outstanding balance.

Reducing your principal balance will also increase the amount of credit available to you.

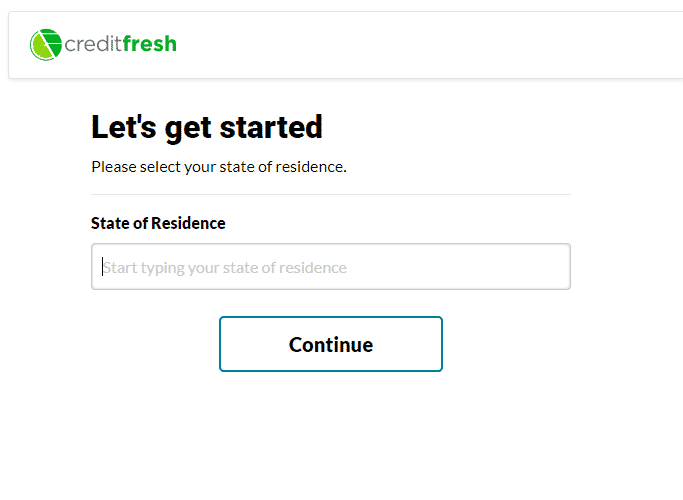

How to apply for a line of credit through CreditFresh

Visit the Website

Visit the CreditFresh website here.Submit Your Request

Submitting a request only takes a few minutes.Provide Your Details

Simply request a credit limit, securely verify your details, and review and sign your agreement.Get Approved

If approved, you can request a draw from your linke of credit and funds may be in your bank account as early as the same business day*.Uploading Documents

You can log into your secure CreditFresh account to upload your documents.

Navigate to your Profile, scroll down and click on Upload Document. Next, select the document type and description, then Choose File which will allow you to upload the required documentation.

You can upload most images and/or PDF files, up to 5MB in size. If you are required to provide multiple documents, you will need to upload each document individually.

Making a Withdrawal

You have immediate access to the money you require. To request a draw, just sign into your account and choose the amount you need.

You have the option of taking out the entire amount of credit at once or in installments. The funds may be deposited into your bank account as soon as the same day.

How Financer.com Rates Creditfresh

Our general opinion of the Line of Credit through CreditFresh is a positive one.

Whenever an issue was brought to their attention, it was addressed quickly and responded to with a proposed solution to the problem.

Support

Our experience with their customer service team was positive.

They can be reached via email, or on their toll-free helpline and are well-trained and friendly when assisting their customers.

No matter how you reach out to their team, they are quick to respond and eager to help answer questions and solve any issues.

Website

We love simplicity, both in functionality and design, and the CreditFresh site delivers on each of these fronts. It’s easy to understand their website, and the loan application was very smooth.

It took us less than 10 minutes to fill out the application from beginning to end. They do a particularly good job of making every step clear and straightforward.

The CreditFresh login is found on the front page of the website.

Does Financer.com Recommend CreditFresh?

Yes, we do. CreditFresh is a legitimate lending partner backed with FDIC Member banks. This is one of the more popular line of credit websites we have reviewed, and it’s easy to see why their following is growing.

Their site and application process are streamlined and simple, and they provide high-quality and reliable support.

A line of credit through CreditFresh is a good option when looking for quick access to cash, especially for borrowers with poor credit.

Why Customers Choose CreditFresh

The CreditFresh Line of Credit through CreditFresh offers flexible access to credit when you need it. Below we have listed just a few of the many advantages of choosing CreditFresh for your borrowing needs:

- A range to suit your needs: A personal line of credit between $500 – $5,000.

- Quick funding: Request a draw and the funds may be in your bank account as soon as the same business day*!

- Request is not detrimental to your credit: Submitting a request will not affect your credit score**.

- Flexible access: Once approved, access your available credit when you need it, so long as your account is in good standing.

- Transparent process: Easy to understand process.

*The date and time any requested funds are made available to you by your bank are subject to your bank’s policies. For specific funding cut-off times, visit the CreditFresh website.

**Submitting a request does not result in a hard inquiry to your credit report.

Learn more about their loan products here and read CreditFresh reviews below.

CreditFresh FAQs

Is CreditFresh reputable?

Where can I find the CreditFresh login?

How much can I borrow through CreditFresh?

How do I repay my line of credit through CreditFresh?

When will I receive funds?

How do I qualify for a line of credit through CreditFresh?

- Be of legal age to contract in your state.

- Be a U.S. citizen or permanent resident.

- Have an active bank account.

- Have a regular stream of income.

- Have a valid contact number and email address.

How much does a line of credit from Creditfresh cost?

How do I verify my banking information?

How does DecisionLogic work?

How do I cancel my account?

Creditfresh Alternatives

Here’s a list of alternatives to Creditfresh and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| PersonalLoans.com | View | $500 – $35,000 | 5.99-35.99% | Up to 6 years | Yes |

| BadCreditLoans | View | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | View | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

| Low Credit Finance | View | $100 – $5,000 | 5.99- 35.99% | Up to 7 Years | yes |

More Creditfresh Reviews

What Users On the Web Are Saying

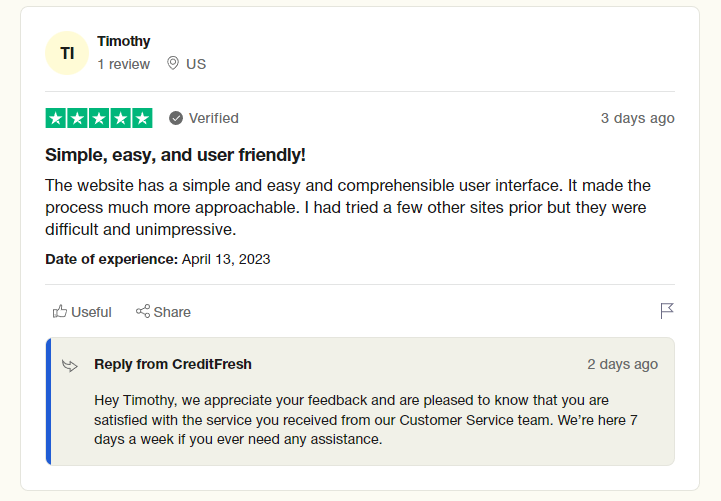

Creditfresh gets 4.6 out of 5 stars on TrustPilot, with most users reporting a positive experience:

One thing to note is that Creditfresh is always quick with replies to customers and addresses issues immediately.

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used Creditfresh before? Leave your review now.