Lorien Strydom Staff 11 reviews | November 8, 2021

General Review

(Edited)

Reply

Share

Helpful? (0) You found this review helpful

Post reply

Chosen 27 times

Tested Company

EquityMultiple is a real estate investment platform that connects accredited investors with commercial real estate investment opportunities.

As an online real estate company, EquityMultiple makes it easier for professional investors to invest in managed real estate. They stand out far above other investing platforms in terms of preferred equity and debt investments.

EquityMultiple is a registered broker-dealer with the U.S. Securities and Exchange Commission (SEC) and a member of FINRA.

At Financer.com, all brokers go through a thorough research and review process. Here’s how we rate EquityMultiple:

| Category | Rating |

|---|---|

| Investment options | ⭐⭐⭐⭐ |

| Ease of use | ⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Want to skip the details? Jump to our final verdict here.

EquityMultiple was founded in 2015 by Charles Clinton and Marious Sjulsen.

The company’s mission is to democratize access to commercial real estate investment opportunities by connecting investors with quality sponsors and investment properties.

EquityMultiple offers a variety of investment opportunities in commercial real estate, including equity investments, preferred equity, and mezzanine debt.

The company focuses on properties in top markets across the US, with an emphasis on asset quality and a sponsor track record.

The investment process is thorough and rigorous, with a focus on underwriting, due diligence, and risk management.

Here’s a quick summary of EquityMultiple:

| Overview | Features |

|---|---|

| Requirements: | Accredited investors only |

| Minimum investment: | $5,000 |

| Fees: | 0.5% to 1.5% |

| Investment options: | Preferred and common equity Savings alternatives Equity/SAFE Debt Funds 1031 exchanges |

| Ease of use: | Platform is user-friendly |

| Transparency: | Very good |

| Customer support: | Phone, email, and chat |

The EquityMultiple platform is user-friendly and easy to navigate.

Investors can view current investment opportunities, track their investments, and access relevant information and documents.

The investment process on the platform is straightforward and transparent.

Investors can browse current investment opportunities on the platform, view detailed information about each opportunity, and submit an investment request.

Once an investment is made, investors can track their investments, view regular updates and reports, and receive regular distributions.

EquityMultiple’s investment opportunities provide investors with access to high-quality commercial real estate investments that were previously only available to institutional investors.

The company’s focus on rigorous underwriting and risk management helps to minimize risk and increase the likelihood of strong returns.

Overall, EquityMultiple’s investment offerings provide accredited investors with a convenient and accessible way to diversify their portfolios and access quality commercial real estate investments.

For individuals, the two most common ways to qualify as accredited are:

For entities, including LLCs, the most common way to qualify is if all of the owners of the entity are accredited investors.

For financial professionals, the most common way to qualify is to hold in good standing the General Securities Representative license (Series 7), the Private Securities Offerings Representative license (Series 82), or the Uniform Investment Adviser Representative license (Series 65).

Here are some of the pros and cons of EquityMultiple as an investment platform:

EquityMultiple provides accredited investors with access to commercial real estate investments that were previously only available to institutional investors.

Their strengths include a strong track record of investment performance, a user-friendly platform, and a rigorous investment process.

EquityMultiple prioritizes thorough due diligence and risk management when selecting investment opportunities, helping to minimize risk and increase the likelihood of strong returns.

Only available for accredited investors

High minimum investment

Complex investment structure

Overall, EquityMultiple is a reputable real estate investment platform that offers quality investment opportunities to accredited investors.

The company has a strong track record of investment performance, a user-friendly platform, and a focus on rigorous underwriting and risk management.

However, investors should carefully evaluate each opportunity and consider their risk tolerance before investing.

EquityMultiple is best for:

EquityMultiple may not be a good option for you if:

Getting started with EquityMultiple is easy. Here are the steps:

EquityMultiple has a strong track record of investment performance, with historical returns averaging around 12%.

However, as with any investment, there is risk involved, and investors should carefully evaluate each opportunity and consider their risk tolerance.

EquityMultiple charges a fee based on the investment amount, with a range of fees depending on the investment type and size.

The fee structure is transparent and competitive compared to other real estate investment platforms.

EquityMultiple is a registered broker-dealer with the Securities and Exchange Commission (SEC), and as such, the company is subject to strict regulatory oversight.

The company is also a member of the Financial Industry Regulatory Authority (FINRA), which is a self-regulatory organization that oversees broker-dealers and protects investors.

EquityMultiple takes investor protection seriously and has implemented various measures to ensure that investors’ personal and financial information is secure.

The platform uses bank-level encryption to protect investors’ data, and the company has a dedicated security team that monitors the platform for any potential security breaches.

EquityMultiple also conducts thorough due diligence on each investment opportunity, including background checks on sponsors and property owners, as well as comprehensive underwriting and risk assessments.

The company is transparent in its communication with investors, providing detailed information about each investment opportunity, including risks and fees.

Investors can rest assured that EquityMultiple is committed to regulatory compliance and investor protection.

The company operates in accordance with all applicable laws and regulations, and its team of experienced professionals is dedicated to providing a safe and transparent investment platform for accredited investors.

Is EquityMultiple good? Yes, at Financer.com we recommend EquityMultiple.

At Financer.com, all brokers go through a thorough research and review process. We don’t make recommendations lightly.

Overall, EquityMultiple provides accredited investors with access to high-quality commercial real estate investments with a rigorous underwriting process and strong regulatory compliance.

However, the high minimum investment requirements and limited liquidity may be drawbacks for some investors, and there is always the potential for lower-than-expected returns or losses with any investment opportunity.

It’s important for investors to carefully evaluate each investment opportunity and consider their risk tolerance before investing.

We were able to sign up within a few minutes and have investment options presented to us. The process is extremely fast and easy. See above.

EquityMultiple’s annual management fees are typically around 1% which is somewhat higher than other similar investment brokers.

Since each investment is unique and has its own fee structure, some may include additional fees. However, origination fees are for the sponsor, not the investor.

The customer support team is responsive and helpful, and the communication is transparent and timely. However, support is only available on weekdays.

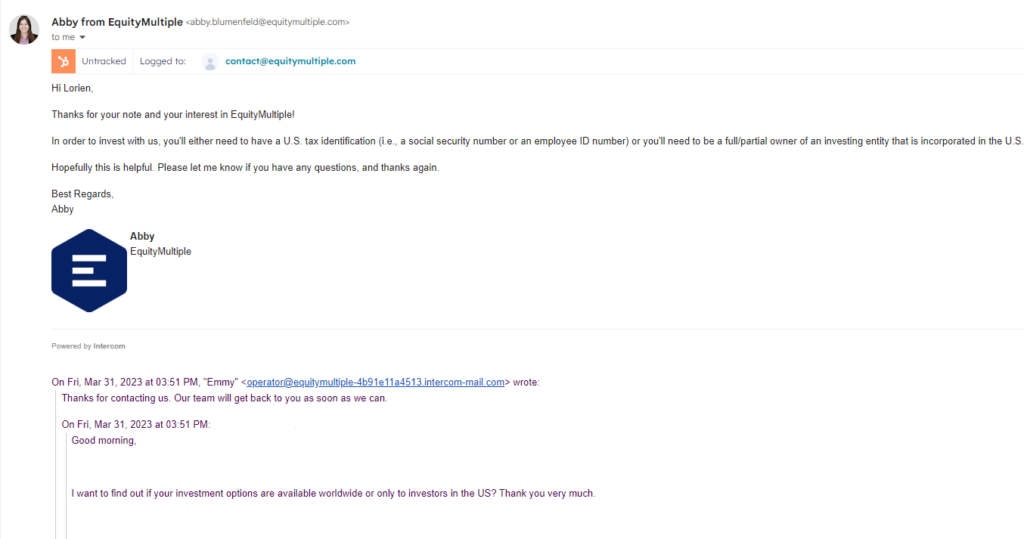

We’ve reached out to EquityMultiple via email and got a reply within 24 minutes:

Here’s a list of EquityMultiple alternatives and how it compares to other brokers:

| Lender | Reviews | Fees | Account Minimum |

|---|---|---|---|

| EquityMultiple | View | 0.5% – 1.5% | $5,000 |

| Fidelity Investments | View | $0 per trade | $0 |

| Empower | View | 0.49%-0.89% | $100,000 |

| Ameritrade | View | $0 per trade | $0 |

| Betterment | View | 0.25% – 0.40% | $0 |

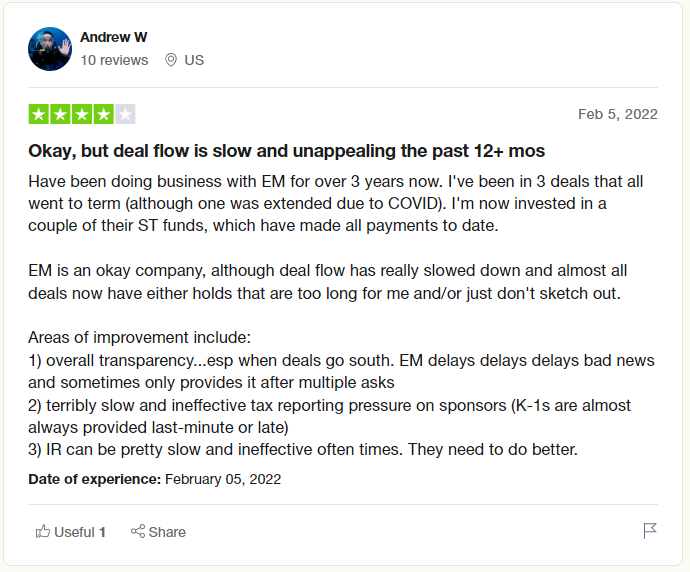

EquityMultiple gets 3.2 out of 5 stars on Trustpilot, with users showing mixed feelings:

Some users were unhappy about their personal information being shared, while others felt the service was fast and easy.

Read more reviews on Financer.com from verified users below.

Have you used EquityMultiple before? Leave your review now.

Rate & Review EquityMultiple

Your rate for this company. Edit Rate

Take a minute to write a review!

Share your experience and help others to choose the right company.

Pros

Cons

Visit their official website and learn more about EquityMultiple

Or sign in with email

The username or password is incorrect.

Authentication Code:

Thank you for choosing

Share your experience and help others to choose the right company.

This website uses cookies among other user tracking and analytics tools. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Cookies may also be used for other marketing and advertising purposes, or for other important business analytics and operations.

To use our website you need to agree to our Terms and Conditions and Privacy Policy. To find more about the legal terms that govern your use of our website, please read our Terms and Conditions here.To find more about your privacy when using our website, and to see a more detailed list for the purpose of our cookies, how we use them and how you may disable them, please read our Privacy Policy here.