Figure Review (2023)

Figure is a fintech company co-founded in 2018 by Alana Ackerson, Cynthia Chen, June Ou, Michael Cagney, and Sara Priola.

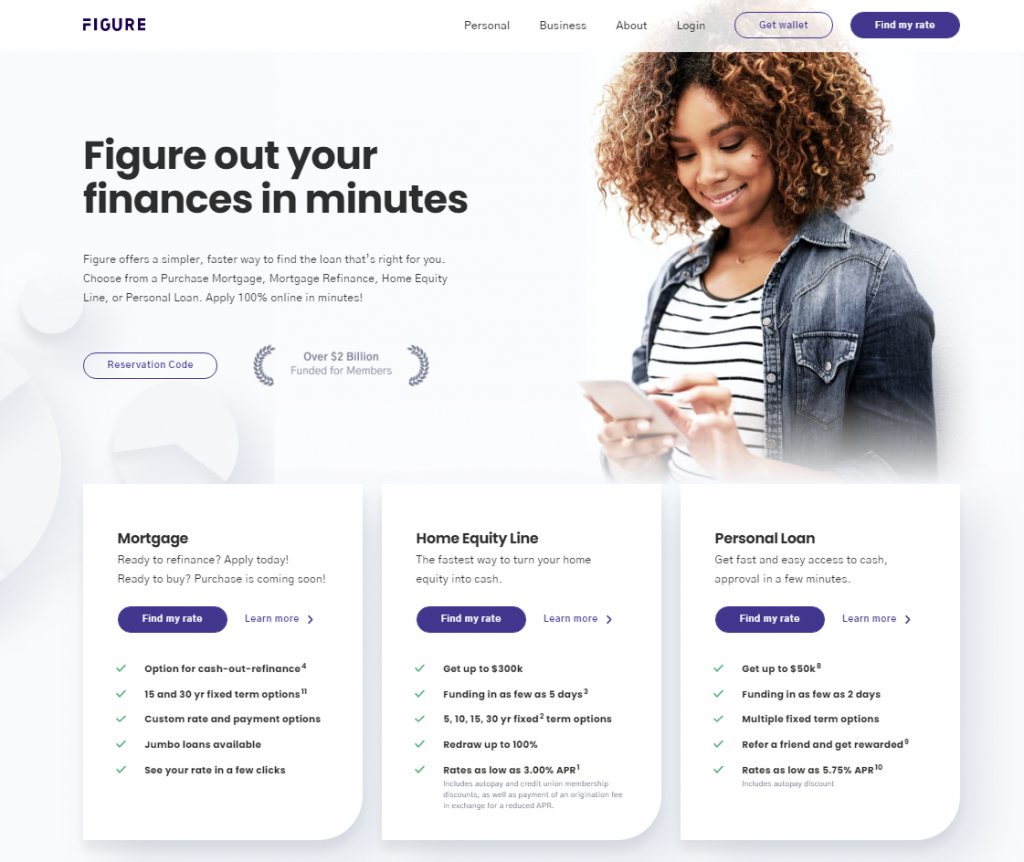

With over $2 billion funded for their members, Figure leverages blockchain, AI, and advanced analytics to unlock new access points for consumer credit products that can transform their customers’ financial lives.

Figure offers HELOCs with repayments of up to 30 years, with funds available in five minutes. They also have a very easy online application process.

How We Rate Figure

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate Figure:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐⭐ |

Do We Recommend Figure?

Yes, we recommend Figure as a trustworthy online lender. Skip to our full review below and see how we rate Figure.Here’s what we’ll cover in this review:

Want to skip the details? Jump to our final verdict here.

What Is Figure?

Figure specializes in providing home equity release solutions, including home equity lines of credit (HELOCs), home improvement loans, and home buy-lease-back offerings for retirement and personal loans.

They offer innovative financial solutions to homeowners, giving their members a more straightforward way to optimize their lending opportunities.

Here’s a quick summary of Fortuna Credit:

| Overview | Features |

|---|---|

| Loan type: | Lines of credit (HELOCs) |

| Loan amount: | $15,000 – $400,000 |

| Loan term: | 3 to 30 months |

| Fees: | From 3.99% |

| Min. credit score: | 640 |

| Monthly fees: | None |

| Payout time: | 5 minutes |

- Get fast access to your home equity

- Apply in five minutes and get funding in 5 days

- Origination fee of 0-4.99%

- HELOC up to $400,000

As a private financial technology company, Figure.com is relatively new to the consumer home finance industry.

Products Offered

Figure offers the following:

- Home equity lines of credit (HELOC)

- Mortgages

- Personal loans

- Crypto-backed loans

Figure.com offers HELOCs of up to $400,000 with repayment terms of up to 30 years. Personal loans are available up to $50,000 as well as mortgage refinance with the option to cash out.

Once approved, funds will be paid to your account in as little as five days.

Unlike other HELOC lenders, Figure works on a fixed-rate model and this means that with every draw, the interest rate is fixed based on the prime rate at the time.

Depending on your repayment term length, you can make additional draws for a period of up to five years after your original HELOC was granted.

Figure mortgages also come with a 100% online application process with multiple term options ranging from 15 to 30 years.

Crypto-Backed Loans

With a crypto-backed loan from Figure.com, you can borrow up to $20M against your crypto. No credit check is required.

Rates are set at 5.99% and 7.99% APR and you don’t have to sell your crypto, so there are no taxable gains or losses.

This is a great way to fund large purchases or home improvements, or even invest in more crypto.

To borrow against your crypto, simply choose your loan amount, term, rate, and crypto type. Provide personal details for your account, including your bank account to receive your funds.

Review and sign the lending agreement and provide your wallet address to imitate funding.

How Figure Works

Figure off a 100% online application process. It’s easy to understand and use their website, and the application process for Figure loans is very smooth.

It takes less than 10 minutes to fill out the application and they do a great job of highlighting all the products and services they offer members.

Here at Financer.com, we think there’s something to be said for simplicity, both in user experience and in site design.

The Figure site delivers on both of these while staying true to its stated mission: “Rewire the American banking system so that we can positively change the financial path for every hard-working American.”

Rates & Fees

Figure charges an origination fee on HELOCs of between 3% and 4.99% of the initial amount, depending on your location.

If you sign up for autopay you’ll get a 0.25% discount on your monthly payment. Get an additional 0.25% discount if you opt into their Credit Union Membership.

Repayment Terms

A Figure HELOC comes with repayment terms of 5, 10, 15, and 30 years and there is no early prepayment penalty.

There is no fee involved in the appraisal of your home as Figure uses an automated valuation process.

Figure Pros and Cons

Here are some of the pros and cons of Figure as a lender:

Pros

- Access to your money faster with blockchain technology.

- Figure offers full transparency.

- Figure provides flexible loan terms.

- Very fast funding process.

- Easy online application.

- Customer support lines are available 6 days per week.

- 15 and 30-year fixed-term mortgage options.

- Crypto-backed loans available.

With Figure, you get access to your money faster. Their industry-first blockchain technology simplifies the application process so you can get funded faster.

There are no hidden fees or extra charges—ever. They believe in always being upfront about rates and fees so you can have complete control of your assets.

Figure provides flexible options with multiple ways to borrow and invest, so you can save and grow your money the way you want to.

Figure offers very fast funding, with approval times taking five minutes.

Their customer support is also available seven days a week via phone and email.

You have to draw the entire amount.

The loan maximum is $400,000.

Certain properties are not eligible.

Cons

With the Figure, you have to withdraw the entire loan amount. As you pay back the initial amount, you can make additional withdrawals.

Compared to other HELOC lenders, the loan maximum of $400,000 may be low for some lenders.

Certain properties are not eligible for a Figure HELOC, including multifamily real estate, co-ops, and manufactured housing, among others.

Who is Figure For?

Figure is ideal for homeowners with good credit scores who need to access equity in their homes. The larger your credit score, the better your terms.

Credit scores of 640 to 659 can give you up to 75% of your home equity. With a credit score of up to 699, you can access up to 85% of your equity, and a credit score of up to 850 would give you up to 90% of your equity.

Loan Requirements

To qualify for a Figure HELOC, you need:

- A minimum credit score of 640

- Be a U.S. citizen

- Have a valid checking account

Who Figure Is For

Figure is a good option for borrowers who:

- Need access to the equity in their home

- Have good credit scores

- Don’t need a large loan amount

Who Figure Is Not For:

Figure is not a good option for if you:

- Have a bad credit history

- Need a loan of more than $400,000

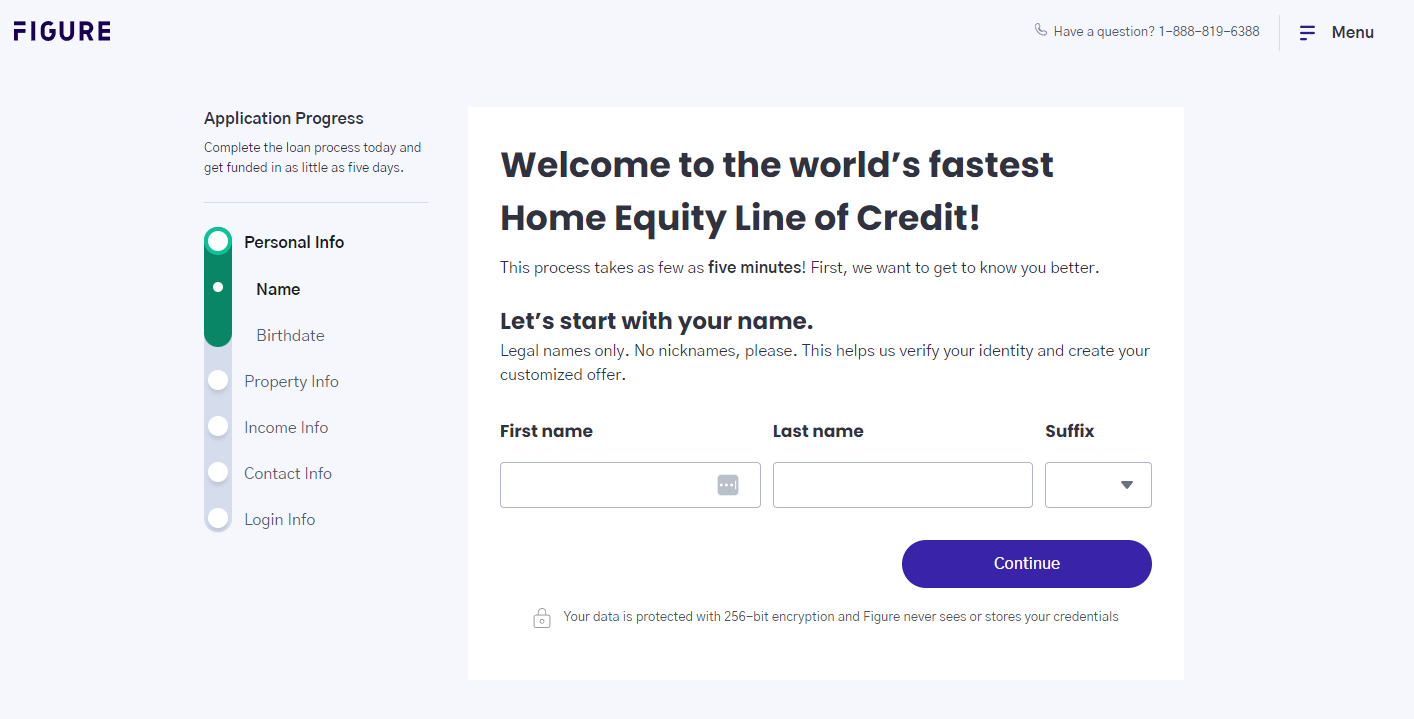

How To Apply for a Figure HELOC

Complete an online application

This typically takes only a few minutes. Navigate to the Figure website and click on ‘Find my rate.” You’ll need to provide basic information such as your name, income details, date of birth, property type, and reason for borrowing.Verify your details

From here a hard inquiry will be done on your credit report and you’ll need to connect at least one checking account so that your income can be verified and the loan disbursement set up.Loan approval

Once your Figure loan is approved you’ll have a video session with a notary to confirm your identity and review and sign your loan documents. In some states, you may need to work with a notary in person. Once done, the funds will be made available within five days.How Financer.com Rates Figure

Is Figure legit? Yes, at Financer.com we recommend Figure as a lender.

At Financer.com, all lenders go through a thorough research and review process. We don’t make recommendations lightly.

With low APRs and streamlined systems, we recommend considering Figure when you are looking for your next loan.

It is one of the most popular home equity lenders we have reviewed. They have earned their reputation by creating a site that is streamlined and simple to use.

Application Process

The application process with Figure is very quick and easy. It takes only a few minutes to complete the steps and funds are available in five business days.

Figure uses an Automated Valuation Model (AVM) to assess the value of your property, taking into account things like public records, historical data, and recent sales of similar properties in the area.

Fees

The origination fee of up to 4.99% is standard and in line with other lenders. There are no early repayment penalties either, making Figure a good option.

Another benefit is that draws are available for up to five years from your origination date.

Payments

Payments on a Figure loan are done by Automatic Clearing House (ACH). You can set up Autopay or submit one-time payments.

Customers can also log into their account dashboard or mobile app to make payments and review their loan details.

Customer Service

Figure only offers customer support only via phone and live chat, however, they are available seven days a week.

Want to leave feedback? Write your Figure review below.

Figure FAQs

Can I apply for multiple loans with Figure?

What if I choose to back out of the loan?

Where are Figure loans available?

What type of properties are eligible?

What type of home owners are eligible?

Do I need insurance?

What can I do with my home equity line of credit?

Where do I find my Figure login?

Figure Loans Alternatives

Here’s a list of alternatives to Figure and how they compare:

| Lender | Reviews | Loan Amount | Fees | Max. Loan Term |

|---|---|---|---|---|

| Figure | View | $15,000 – $400,000 | 0 to 4.99% | 30 years |

| PenFed Credit Union | View | $25,000 – $500,000 | Avg. of 1% | 30 years |

| SunTrust | View | $15,000 – $500,000 | $50 annual fee | 30 years |

| US Bank | View | $15,000 – $750,000 | $90 annual fee | 30 years |