Lendio Review (2023)

Lendio is an online broker that partners with more than 75 lenders to provide business loans for businesses in the U.S.

Startups and small businesses often have limited access to capital funding. With its network of lenders, Lendio helps businesses get the funding they need.

They have a quick and free online application process that only takes minutes. With Lendio you can get the capital you need within 24 hours.

How We Rate Lendio

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate Lendio:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend Lendio?

Yes, we recommend Lendio as a reliable lender marketplace. Skip to our full review below and see how we rate Lendio.Here’s what we’ll cover in this Lendio review:

- 1.Lendio Overview

- 2.Types of Business Loans

- 2.1.Business Term Loans

- 2.2.Business Line of Credit

- 2.3.Merchant Cash Advance

- 2.4.Equipment Financing

- 2.5.SBA Loans

- 2.6.Startup Business Loans

- 2.7.Accounts Receivable Financing

- 2.8.Business Acquisition Loans

- 3.Fees

- 4.Lendio Pros and Cons

- 5.How to Qualify for a Lendio Loan

- 6.How to Apply for a Lendio Loan

- 7.Who Is Lendio For?

- 8.How Financer.com Rates Lendio

- 8.1.Transparency

- 8.2.Customer Service

- 8.3.Is Lendio Legit?

- 9.Lendio Alternatives

- 10.More Lendio Personal Loan Reviews

Want to skip the details? Jump to our final verdict here.

Lendio Overview

Lendio is a platform that offers business loans by connecting business owners with a network of lenders.

Despite not actually offering loans itself, Lendio’s network of over 75 business lenders — which includes well-known companies like Kabbage, OnDeck, Amex, Fundbox, and many others — is meant to serve as a one-stop shop for funding.

Here’s a quick summary of Lendio:

| Overview | Features |

|---|---|

| Loan type: | Business loans |

| Loan amount: | Up to $5 million |

| Loan term: | Up to 30 years |

| APR: | From 6.00% |

| Min. credit score: | Varies by lender |

| Monthly fees: | None |

| Payout time: | One business day |

| Weekend payout: | No |

| Requirements: | Varies by lender |

Lendio has funded more than $12 billion in loans so far and facilitated more than 300,000 loans to date. With banks typically rejecting up to 80% of business loan applications, Lendio makes it possible for business owners to get the funding they need by comparing a variety of lenders.

Types of Business Loans

Lendio offers a variety of business loans and the platform is easy to use.

Business owners can apply for more than one type of loan and they’ll be connected with over 75 lenders to find the type of business funding they need.

Here’s a quick summary of the types of business loans Lendio offers:

| Loan Type | Terms |

|---|---|

| Business Term Loan | $5,000 to $2 million Starting from 6% APR Available in all states Repayments from 1 – 5 years |

| Startup Loan | $500 to $750,000 Starting from 0% to 17% APR Available in all states Repayments depend on the lender |

| SBA Loans | Up to $5 million APRs not disclosed Available in all states Repayments from 10 – 30 years |

| Business Line of Credit | $1,000 to $500,000 Starting from 8% to 24% Available in all states Repayments from 1 – 2 years |

| Equipment Financing | $5,000 to $5 million Starting from 7.5% APR Available in all states Repayments from 1 – 5 years |

| Merchant Cash Advance | $5,000 to $200,000 Starting from 18% APR Available in all states Repayments depend on the lender |

| AR Financing | Up to 90% of receivables Starting from 2% APR Available in all states Repayments depend on the lender |

| Business Acquisition Loan | $5,000 to $5 million Starting from 5.5% APR Available in all states Repayments depend on the lender |

Business Term Loans

With a business term loan from Lendio, you can borrow from $5,000 up to $2 million and get funding as soon as 24 hours.

Loan terms are from one year to 10 years with interest rates as low as 6%.

Short-term loans are typically less than 18 months and normal-term loans can be from two years up to 10 years or more.

Lendio’s business term loans are available in all states.

Business Line of Credit

A business line of credit can give you business funding from $1,000 up to $500,000 with interest rates starting at 8% APR.

A business line of credit is available from Lendio in all states and funding can be within two weeks. Repayment terms are from one to two years.

Merchant Cash Advance

Business owners can get a merchant cash advance from Lendio of between $5,000 and $200,000. Repayment terms for merchant cash advances are up to two years and interest rates start at 18% APR.

You can get funding within 24 hours and this is available in all states.

Equipment Financing

With equipment financing, you can borrow from $5,000 up to $5 million and get funding within 24 hours.

Loan terms are typically between one and five years, and interest rates can be as low as 7.5%. Equipment financing is a type of asset-based lending that helps business owners get funding to buy or lease the equipment they need.

Credit approval is a bit more flexible for these loans and the equipment is typically used as collateral for the loan.

SBA Loans

With Lendio you can apply for SBA loans of up to $5 million and terms between 10 years and 30 years. SBA loans are available in all U.S. states.

Startup Business Loans

For business owners who need a startup loan, Lendio can connect you with lenders that offer startup loans between $500 and $750,000.

Interest rates start at 0% or 17% with repayments up to 25 years.

Funding is typically between two weeks and four weeks.

Accounts Receivable Financing

With accounts receivable financing, businesses can get fast cash of up to 90% of their receivables. Funding happens within 24 hours and APRs start at only 3%. Repayment terms are up to a year.

Applying for financing online takes only 15 minutes.

Business Acquisition Loans

With a business acquisition loan from Lendio, you can borrow from $5,000 to $5 million and get funding within 30 days.

Loan terms are revolving, or up to 25 years and interest rates start as low as 5.5%.

You can use a business acquisition loan to buy a business, including an existing business or a franchise, even if you don’t have the capital ready.

Fees

Lendio doesn’t charge any fees as its revenue comes from its partners.

Depending on the loan offer you choose, the fees that the lender charge may include the following:

- Fixed fees: Some lenders charge a fixed fee rather than an interest rate, especially those lenders that offer short-term business loans.

- Interest rates: The cost of borrowing will vary between lenders.

- Origination fees: Some lenders may charge an origination fee or an administration fee.

- Prepayment penalties: Some lenders may penalize you when you repay your loan earlier as they may lose out on interest rate payments.

They represent the “cost” of processing and administering your loan and may or may not be added to your interest rate or a flat fee by the lender.

Asking your lender about these costs is important because they might not be mentioned upfront. These costs could be fixed or based on a percentage of your loan balance.

Some alternative lenders may charge a flat fee as opposed to an interest rate, particularly those who provide short-term loans and merchant cash advances.

A fixed charge is specified as a percentage of the loan amount or as a multiplier in decimal form. Therefore, if you borrowed $10,000 at a 20% fee (or a 1.2 rate), you would owe $12,000 in total.

Lendio Pros and Cons

Pros

- Available in all states

- Wide range of funding options

- Borrower qualifications are lower than banks

- Multiple types of financing available

- Long-term financing options available

- Positive ratings and reviews

- Application process is fast and easy

One of the best benefits of Lendio is that they offer access to loans in all states. There are many different types of loans available and requirements for borrowers are typically lower than those of major banks.

Long-term financing is also available, making it easier for businesses to borrow a larger sum over an extended time.

The application process is done online and it’s fast and easy.

Does not work with all lenders

Not much information available for each funding solution

Cons

Lendio doesn’t work with all lenders and they lack some transparency for all the business funding solutions they offer.

How to Qualify for a Lendio Loan

Different lenders have other own requirements. Note that Lendio is not a lender but rather a platform that connects you with business loan providers.

Here are some requirements you would have to meet, though, while looking at all of their lenders:

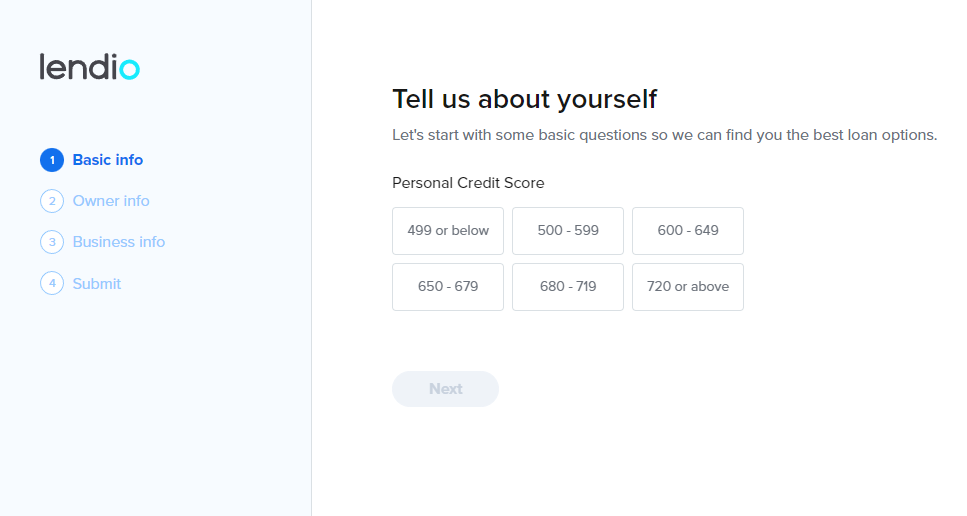

Personal Credit Score

Lendio does not determine the minimum personal credit score needed to be eligible for business financing; each individual lender does. Lendio only offers this data for a select few categories of financial products, such as:- Startup business loans: 680

- Business line of credit: 560

- Equipment financing: 650

Time in Business

Even for beginning loans, the majority of the lenders in Lendio’s network demand that you have been in operation for at least six months. Some loan kinds may have more stringent restrictions, such as those from the U.S. Small Business Administration (SBA) (at least two years) or loans for equipment (at least one year).Annual Revenue Requirements

Depending on the sort of finance you’re seeking and the exact lender Lendio matches you with, the revenue required to qualify for a loan will vary. Businesses typically need a minimum annual revenue of $50,000 to $250,000. Lendio, however, only offers examples for a few specific types of business finance, such as:- Business lines of credit. $50,000 (minimum)

- Equipment financing. $50,000 (minimum)

How to Apply for a Lendio Loan

the application process on Lendio’s website typically takes a few minutes.

Lendio will typically get in touch with you within a day or two to go through your alternatives and assist with the application process with a particular lender. Application requirements vary depending on the lender.

You can complete your application online within 15 minutes and apart from your personal and business details, you may need to upload additional documentation.

Lendio doesn’t charge any application fees and you can get access to your business capital as soon as 24 hours.

Who Is Lendio For?

Lendio is ideal for business owners who need flexible loan options without having to go to a traditional bank for a loan.

If you’re looking for the best loan rates available, you may want to consider a traditional business loan from a bank where you may get competitive rates.

Eligibility Requirements

Eligibility varies by lender, but to get the best deal you typically need:

- A good credit score

- To be in business for at least 6 years

- Annual business revenue of $50,000 to $250,000

Who Lendio Is For

Lendio is best for business owners who:

- Are thorough: Lendio has more than 75 lenders to save you a lot of time when it comes to comparing business loan lenders.

- Aren’t sure what type of loan to choose: Lending helps you choose the best business loan that may work for your business.

- Want to work with reputable lenders: Lendio has great reviews and is a popular resource in the online small business lending world.

Who Lendio Is Not For

Lendio may not be the best option for business owners who:

- Want to be private: Lendio may share your information with many lenders so you might receive follow-up calls or emails.

- Want to vet lenders thoroughly first: Lendio’s model works to connect you with specific lenders instead of you doing your own research and getting in contact with lenders on your own.

How Financer.com Rates Lendio

Lendio works with a network of over 75 other lenders to assist you in getting the finance your business needs.

With Lendio’s extensive network of lenders, this popular lending platform can be a solid choice for business owners who want to quickly compare lenders and get funding.

Prospective borrowers may submit applications for a range of loans, including initial business loans, short-term loans, and equipment finance, among others.

Transparency

Customer reviews do not detail instances where fees or other unexpected policies caught customers off guard.

The only catch is that until you are matched with a lender, you won’t know the precise terms of the loan. Lendio does make an effort to prepare potential borrowers about what they could expect, though.

To find all the information provided, you might need to go through a few pages because there are some minor distinctions between the various loan product kinds. Always use a loan calculator to get an idea of what to expect.

Customer Service

Lendio offers support via phone from Mondays to Fridays and you can also submit a request online. They also have a comprehensive FAQ and help section.

Is Lendio Legit?

Is Lendio legitimate? Yes. Lendio is a well-known loan broker that connects business owners with a network of 75 reputable lenders.

Are you a customer? See more Lendio reviews below or add your own.

Lendio FAQs

How much can I borrow?

Can I get a startup loan?

Does Lendio offer SBA loans?

How do I qualify for a Lendio loan?

Lendio Alternatives

Here’s a list of alternatives to Lendio and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| Loan Builder | View | $5,000 – $500,000 | 2.90-18.72% | Up to 6 years | Yes |

| Uplyft Capital | View | Up to $500, | From 9.99% | Up to 8 months | Yes |

More Lendio Personal Loan Reviews

What Users On the Web Are Saying

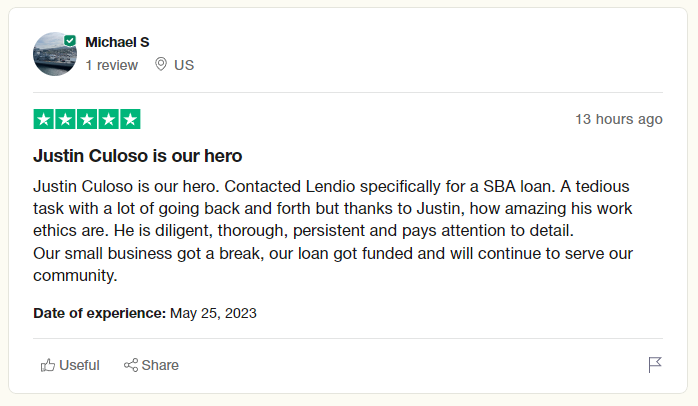

Lendio gets 4.8 out of 5 stars on Trustpilot, with users being happy with their service:

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used Lendio before? Leave your review now.