Tally Review

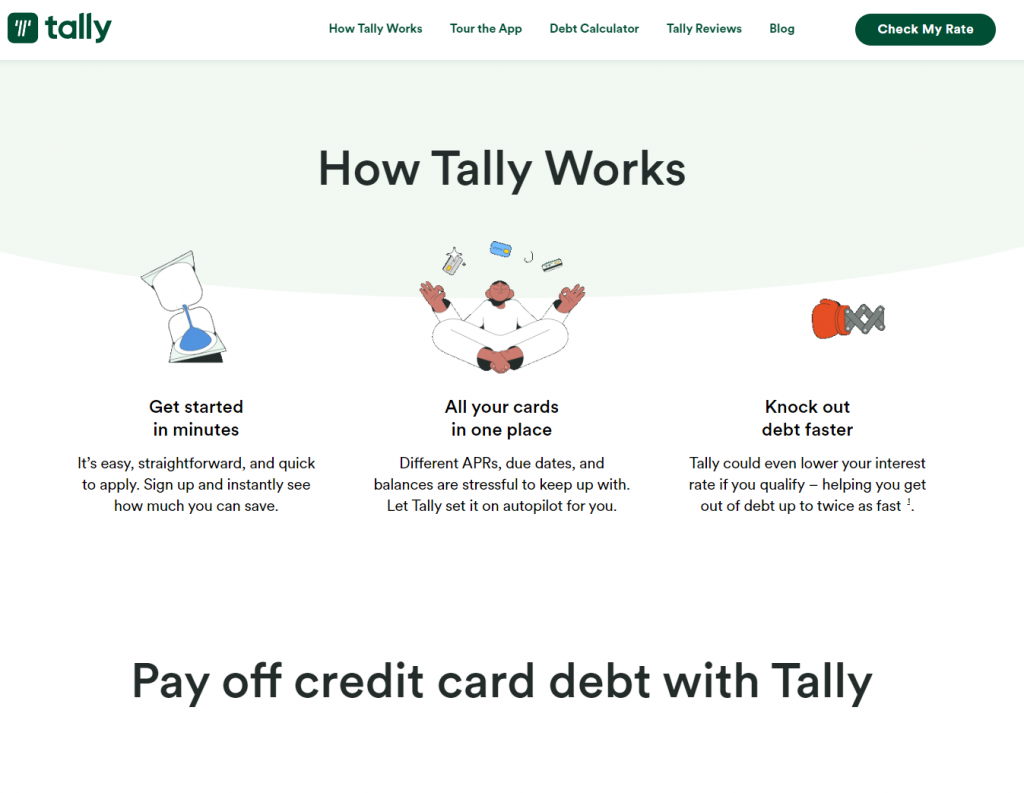

Tally is a credit card payoff app that helps you consolidate your credit card debts into one low-interest line of credit.

Tally has helped thousands of people consolidate their high-interest credit card payments into one lower-interest monthly payment.

Tally offers different membership levels with no upfront payments. Read our Tally reviews below and learn how Tally works.

In an emergency, credit cards can be a helpful tool for making purchases, but if you frequently carry a balance, you might be paying hundreds or even thousands of dollars in interest.

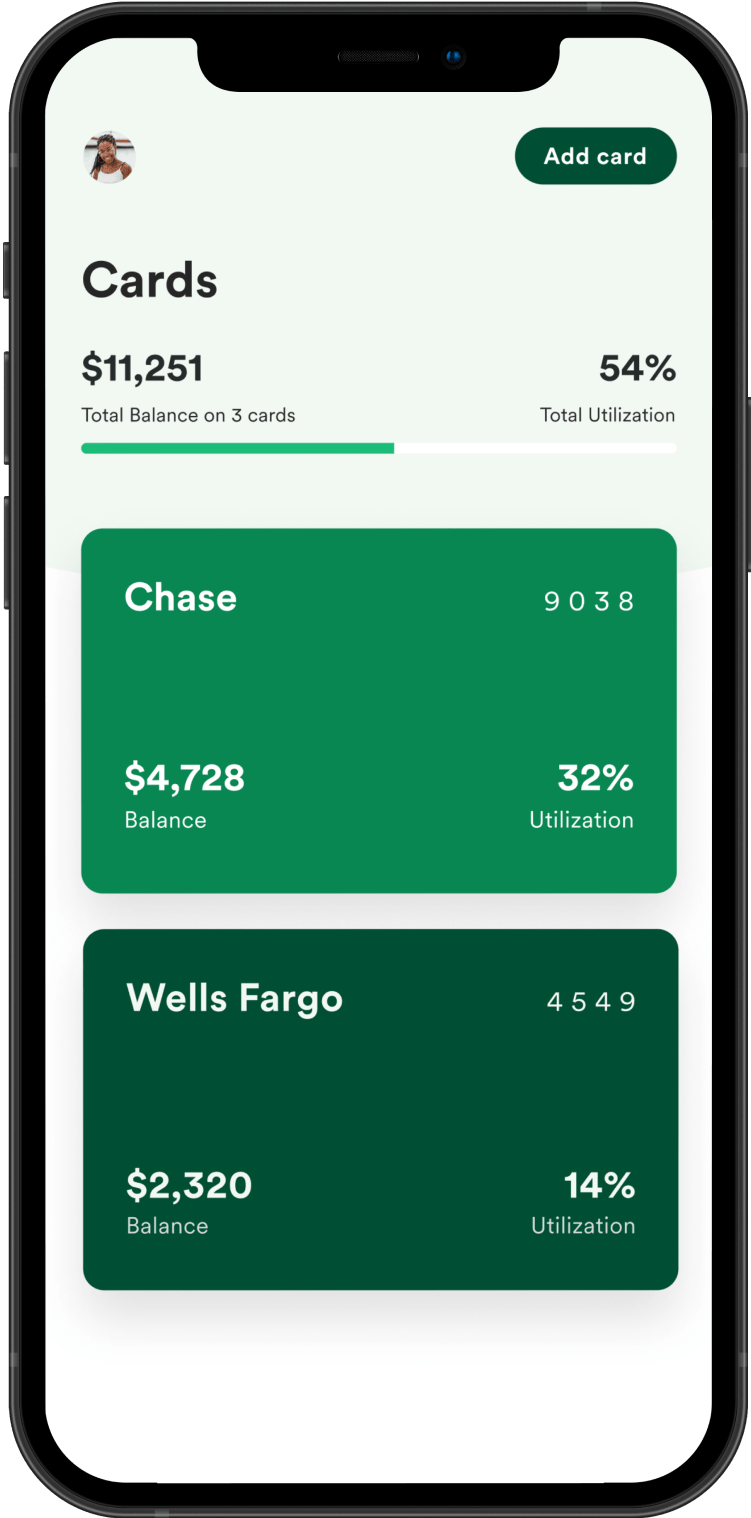

According to Experian, the average American has four credit cards. But this can make it confusing to keep up with credit card due dates, and varying APRs.

This is where the Tally app comes in.

Note: Tally is not available in Nevada, Vermont, or West Virginia.

How We Rate Tally

At Financer.com, all apps go through a thorough research and review process. Here’s how we rate Tally:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend Tally?

Yes, we recommend 5KFunds as a reliable lender marketplace. Skip to our full review below and see how we rate Tally.Here’s what we’ll cover in this review:

Want to skip the details? Jump to our final verdict here.

Tally Overview

Tally gives individuals a loan, and then it settles their credit card debt. After that, users are then responsible for repaying their Tally loan.

Similar to a credit card, a Tally loan is an open line of revolving credit.

Here’s a quick summary of Tally:

| Overview | Features |

|---|---|

| Loan type: | Line of credit |

| Loan amount: | $2,000 – $25,000 |

| APR: | 7.90% – 29.99% |

| Min. credit score: | 580 |

| Monthly fees: | None |

| Payout time: | Immediately |

| Weekend payout: | No |

| Requirements: | At least 18 years old U.S. citizen Active bank account Regular income Valid phone number and email |

You can download the Tally app to add your credit cards and see if you qualify for a low-interest line of credit.

Tally has different membership levels with no upfront fees. It’s a credit card payoff app that offers you a smart credit card manager, late fee protection, and a customized payoff plan specifically for you.

Tally functions as a debt consolidation service even if it does not regard itself as being one. With Tally, users can link all of their credit cards, and Tally will then pay off more than the minimum amount due on each of the cards each month.

Your monthly payments will increase from the minimum on your credit cards if the value of your Tally revolving line of credit is greater than your debt.

Tally will pay off the whole balance on all of your credit cards if you are approved for a line of credit that is greater than the total of all of your credit card debt.

You are then in charge of paying Tally’s monthly cost, which consists of Tally fees, interest on your Tally line of credit, and 1% of your Tally principal balance.

Tally debits the associated bank account to pay off your balance.

Tally Pros and Cons

Pros

- Fast funding

- Automatically pays high-interest cards first

- Option to change your payment date

- No hard credit pull

Tally allows for fast approvals and funding and is ideal for borrowers who want to focus on paying off high-interest cards first.

Tally offers immediate payouts and you can change your payment dates. There is no hard pull on your credit profile and adding your cards to the Tally app is easy to do, by simply adding or scanning their details.

May report payments to none or one of the three major credit bureaus.

May charge a membership fee.

Cons

Tally is free to use but Tally+ has a membership fee of $25 a month or $300 a year. Payments may not always be recorded by all three credit bureaus.

Tally’s Membership Levels

Tally has three different memberships: Tally, Tally Basic, and Tally+.

These options all have benefits to offer and you can choose what membership plan you want to have.

Tally

Your Tally membership gives you access to pay off your debt and use the app’s planning features. You can link all your credit cards and Tally will help you pay them off in the best way.

Tally will set up automatic payments for you and also add payment reminders to help you reach your debt-free goals.

Tally Basic

If you qualify for a Tally credit line, you’ll have the Tally Basic membership. You’ll get all the benefits of the Tally app, and access to a low-interest credit line to pay off your credit card debt.

Tally Basic members can choose which cards they want to link to their credit line.

Tally+

The Tally+ membership gives you even better discounts and a higher credit line. Every month you pay your minimum amount on time, you get money back.

This effectively lowers your interest rate by an average of 4%.

My Payoff Feature

Additionally, Tally offers consumers the ability to make additional payments toward their credit card debt through its “My Payoff” function.

According to the payback plan you select, Tally will automatically allocate money to a number of credit cards when you use the “My Payoff” feature.

You can choose between the avalanche, snowball, or credit score factors payoff techniques.

The debt with the highest interest rate gets paid off first using the avalanche approach. Your cards are paid off using the snowball approach in order of the amount of their balances, beginning with the one with the smallest balance.

Last but not least, the credit score factors approach prioritizes paying off debts that have the highest effects on your credit score first.

What Tally Costs

The Tally app is free to download and has no upfront costs.

Depending on your credit score, your APR will be around 7.9% – 29.9% a year.

The Tally+ membership has an annual fee, which comes directly from your credit line, leaving you with no out-of-pocket expenses.

The annual fee for Tally+ is $300 or about $25 per month.

Users of Tally+ have a higher credit limit and a lower APR than those of Tally Basic. Users’ credit limits may be set anywhere between $2,000 and $25,000.

Users often have a maximum credit limit of between $8,000 and $10,000, so if you have a significant debt load that you want to pay off with Tally, you might have to choose Tally+.

How to Get Tally

When you apply for Tally, it conducts a soft credit check, which has no effect on your credit score, to determine your eligibility.

A FICO score of 580 or higher is typically required. Tally examines your credit history and the APRs on all of your credit cards to establish the APR on your Tally line of revolving credit.

The annual percentage rate (APR) for a Tally revolving line of credit can range from 7.9%, which is much lower than the average credit card APR, to 29.9%, which is greater than the highest APRs on many credit cards.

How to Sign Up for Tally

Get started in minutes

Access your low-interest line of credit

Tally pays off your cards, right away

If you accept the offer, Tally will immediately pay off your credit cards with your Tally line of credit, saving you money right away.

If you accept the offer, Tally will immediately pay off your credit cards with your Tally line of credit, saving you money right away.Pay Tally back in one simple monthly bill

Tally uses your credit line to consolidate all your card payments into one monthly bill. No more different due dates, balances, and APRs.Note: You can use your credit again and again. As you pay back Tally, you’ll have more space on your line of credit to add more cards.Get rewarded

If you keep up with minimum payments on time every month, you’ll get access to Tally’s member discount.How Financer.com Rates Tally

Tally is a credit payoff app that works. It offers good APRs and has helped thousands of users reduce their credit card debt effectively.

The app is free to download and they clearly explain the rates and costs on their website. The memberships are very reasonably priced and offer you great rewards for paying on time.

You can easily check your rate online and see if you qualify for a line of credit. On average, Tally+ members can save $4,185 in five years3.

The Tally website has plenty of information for new users and their customer support is available via email at support@meettally.com and phone by calling the customer service team at (866) 508-2559.

Tally App FAQs

How much does Tally cost?

Will signing up with Tally impact my credit score?

What is the Tally+ membership?

Tally Technologies, Inc. (NMLS # 1492782 NMLS Consumer Access). Lines of credit issued by Cross River Bank, Member FDIC, or Tally Technologies, Inc. (“Tally”), as noted in your line of credit agreement. Lines of credit not available in all states.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. Based on your credit history, the APR (which is the same as your interest rate) will be between 7.90% – 29.99% per year. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.

1Late Fee Protection – With a Tally line of credit, late fee protection is available on linked credits cards for users who are current on their account, in good standing, and have provided accurate credit card and bank account information.

2Tally+ Member Discount – With Tally+ you get discount credits applied to your Tally principal balance each month effectively lowering your annual interest. Tally+ members who pay at least the Tally minimum on time each month receive the discount.

3Can save $4,185 in 5 years with Tally+ – We calculated the savings estimates in March, 2021 based on Tally’s records for borrowers who enrolled in Tally from November 2018 through October 2020. We calculated the interest users would pay if they had received and accepted a Tally+ line of credit and compared that to the interest they would pay without Tally until their credit card balances are fully repaid. For each borrower we used: (a) their average APR weighted by their initial credit card balances and APRs; (b) an average monthly payment of 3% of their credit card balance(s); (c) average monthly credit card transactions of 0.8% of their credit card balance(s). We assumed the borrower received Tally+ discount credit every month and we deducted annual fees from any potential savings. Actual savings will vary based on factors such as each user’s credit card APRs, the total payments made, and additional credit card charges.

Tally Alternatives

Here’s a list of alternatives to Tally and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| PersonalLoans.com | View | $500 – $35,000 | 5.99-35.99% | Up to 6 years | Yes |

| BadCreditLoans | View | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | View | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

More Tally App Reviews

What Users On the Web Are Saying

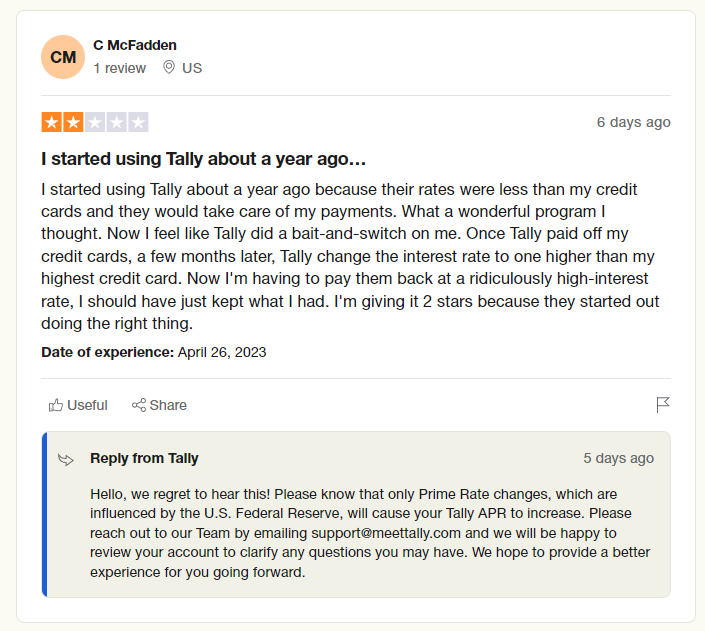

Tally gets 4.3 out of 5 stars on Trustpilot, with some users being disappointed with the interest rates charged:

Tally does reply to reviews and explains the possible reasons for interest rate changes, to clear up the issues.

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used Tally before? Leave your review now.