BNB Price Data

The live BNB price today is $561.810 with a 24-hour trading volume of $1,246,003,040.

We update our BNB to USD price in real-time. The price of BNB has changed 3.37% in the last 24 hours.

Currently, BNB is the #4 largest cryptocurrency by market cap, with a live market cap of $86,377,375,609.00. It has a circulating supply of 153,856,150 BNB coins and a maximum supply of 200,000,000 coins.

See where to buy BNB or use our BNB Profit Calculator to calculate and track the performance of your investment.

BNB at a glance

BNB is the official cryptocurrency of Binance. Its value is directly tied to the success of Binance as well as market factors. Despite market volatility, BNB has demonstrated resilience and has displayed a positive price trend over time.

A Beginner’s Guide to BNB

What is BNB?

BNB is the native cryptocurrency of the Binance platform. It was launched in 2017, just before Binance commenced trading operations.

Initially perceived as a play on the words “Binance” and “Bitcoin”, the meaning of BNB has since evolved to “Build and Build.”

BNB serves as the native token of the BNB Chain, facilitating the creation of DeFi projects and other blockchain-based developments.

BNB has consistently maintained a spot in the top ten cryptocurrencies in terms of market capitalization. This consistent positioning reflects investor confidence in both BNB and the Binance ecosystem in general.

A snapshot of BNB

- BNB is the official cryptocurrency of Binance, the largest crypto exchange in the world in terms of trading volume.

- It was launched in 2017 and is used as the token for the BNB Chain, facilitating DeFi projects.

- BNB operates on the BNB Chain.

- BNB cannot be mined, and a scheduled burning reduces its circulating supply.

- BNB is distinct from BUSD, which is a stablecoin issued by Binance.

BNB versus BUSD

Binance Coin (BNB), is the native cryptocurrency of Binance and plays a central role in the Binance ecosystem. It is the fuel that powers the BNB chain.

Binance USD (BUSD), on the other hand, is a stablecoin pegged to the value of the US dollar (USD). As a fiat-backed digital asset, BUSD offers stability and serves as a reliable medium of exchange within the Binance ecosystem.

The table below shows the different use cases of BNB and BUSD that set them apart:

| BNB | BUSD |

|---|---|

| Token Launchpad: BNB is often used as the primary currency for token sales and Initial Coin Offerings (ICOs) on Binance Launchpad. It enables participants to purchase new tokens during the token sale phase, further enhancing its utility within the Binance ecosystem. DeFi Projects and Blockchain-Based Developments: BNB’s compatibility with different blockchain networks opens up opportunities for decentralized finance (DeFi) projects and other blockchain-based developments. Its integration with Binance Smart Chain facilitates the creation and execution of smart contracts, providing a robust infrastructure for developers. Trading and Transaction Fees: BNB provides users with a significant advantage on the Binance exchange by allowing them to pay for trading fees with BNB. By utilizing BNB, traders can enjoy reduced fees, adding value and cost-efficiency to their trading activities. | Trading Pair: BUSD serves as a base currency for trading pairs on the Binance exchange. It provides a stable reference point for traders looking to hedge against market volatility by converting their assets into a stablecoin. Cross-Border Transactions: BUSD simplifies cross-border transactions by enabling users to send and receive payments in a stable digital asset. Its compatibility with the Binance network ensures fast and low-cost transfers, making it an attractive option for international payments. Stability in DeFi: BUSD is widely adopted in decentralized finance (DeFi) applications as a stable asset for lending, borrowing, and yield farming. Its value stability makes it an ideal choice for users seeking to minimize exposure to the volatile nature of other cryptocurrencies. |

What Determines BNB Price?

Here are some of the factors that influence BNB’s price:

- Market Demand and Supply: Like any other tradable asset, the price of BNB is influenced by the fundamental principles of supply and demand. Since BNB is inextricably tied to the Binance ecosystem, its demand is based on the value and future prospects of the Binance ecosystem.

- Binance Ecosystem Growth: The expansion and development of the Binance ecosystem can have a significant impact on the price of BNB. As Binance continues to introduce new features, products, and partnerships, it creates a positive environment for BNB’s value to rise.

- Token Burn Mechanism: BNB operates on a token burn mechanism, whereby Binance periodically uses a portion of its profits to buy back and burn BNB tokens. This process reduces the circulating supply of BNB, which, in turn, can have a positive effect on its price. Token burns create a deflationary mechanism, increasing scarcity and potentially driving up the value of BNB over time.

- Overall Cryptocurrency Market Trends: As an integral part of the broader cryptocurrency market, BNB’s price can be influenced by general market trends and sentiment. Factors such as regulatory developments, macroeconomic conditions, institutional adoption, and the performance of other cryptocurrencies can impact the demand for BNB. During periods of positive market sentiment and increased interest in cryptocurrencies, BNB may experience upward price momentum.

- Investor and Trader Sentiment: The perception, confidence, and sentiment of investors and traders can play a significant role in determining the price of BNB. Positive news, successful project launches, and strong community engagement can generate enthusiasm and attract new participants to the BNB ecosystem. On the other hand, negative events, security concerns, or regulatory setbacks may have an adverse impact on BNB’s price as investor sentiment wanes.

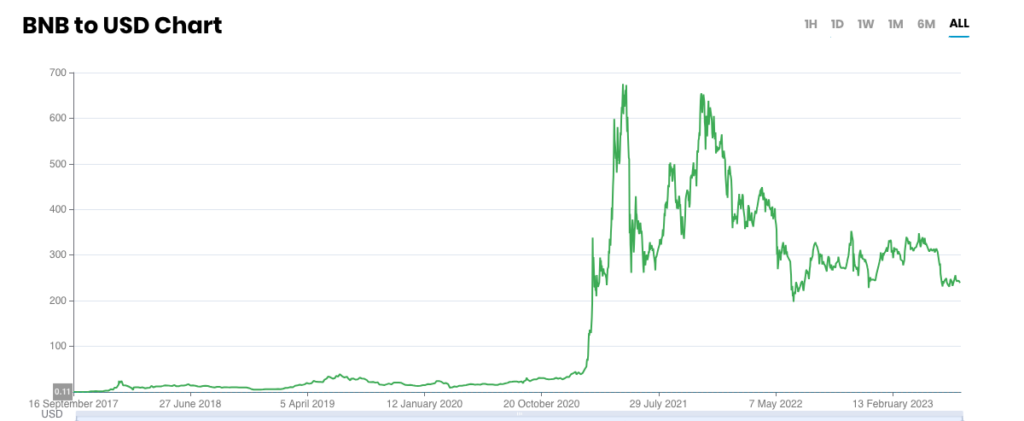

BNB Price History

Here are significant events that have shaped BNB’s price history:

- Initial Coin Offering: BNB was initially launched through an Initial Coin Offering (ICO) in July 2017, where it was offered at a price of $0.10 per token.

The ICO was successful, raising funds for Binance’s development and establishing the foundation for BNB’s future growth.

During its early days, the price of BNB remained relatively stable as it gained traction within the Binance ecosystem.

- Bull Run of 2017-2018: In line with the broader cryptocurrency market, BNB experienced a significant surge in value during the historic bull run of late 2017 and early 2018.

The price of BNB reached as high as $39.57 in January 2018, driven by increased demand, growing adoption, and market optimism.

- Market Correction and Recovery: The market peak in 2018 was followed by a severe correction, that led to a period of declining prices commonly referred to as “crypto winter.”

BNB was not immune to this downturn, and its price declined along with other cryptocurrencies.

However, Binance’s strong ecosystem, strategic initiatives, and continued development efforts helped BNB recover and regain momentum in subsequent years.

- BNB’s Resurgence and Binance Smart Chain: BNB’s price history took a significant turn with the introduction of Binance Smart Chain (BSC) in September 2020.

The Binance Smart Chain provided a scalable and cost-effective platform for decentralized applications (DApps) and DeFi projects, contributing to a surge in demand for BNB.

This period also coincided with a major rally in the broader crypto market which saw BNB rise to as high as $686. - Market Correction of 2021/2022: The market peak of 2021 was followed by a significant decline that has seen most cryptocurrencies lose a significant chunk of their value. BNB was not spared as it lost more than half of its value.

How does BNB work?

BNB is the native token of the BNB Chain serving as the fuel that powers the platform. It serves as the transactional currency for the creation and execution of smart contracts.

It also functions as a governance token and the preferred currency for staking in the Binance chain.

BNB plays a crucial role on Binance Launchpad, the platform for token sales and Initial Coin Offerings (ICOs). Participants can use BNB to purchase new tokens during the token sale phase, further enhancing its utility within the Binance ecosystem.

Binance periodically uses a portion of its profits to buy back BNB from the market and subsequently burn (destroy) the tokens. This token burn mechanism reduces the total supply of BNB, increasing its scarcity over time.

What is BNB used for?

Here are some ways BNB is used:

- Token Launchpad Participation: BNB holds great significance on Binance Launchpad, the platform for hosting token sales and Initial Coin Offerings (ICOs). It is often the designated currency for purchasing new tokens during the token sale phase.

- Staking and Passive Income: BNB holders can participate in staking programs offered by Binance, allowing them to earn passive income. By locking up their BNB tokens, users can contribute to network security or support specific blockchain initiatives and receive staking rewards in return. Staking BNB provides an avenue for individuals to earn additional tokens without actively trading or participating in other activities.

- DeFi Applications: BNB plays a key role in the BNB Chain ecosystem allowing for a wide range of DeFi applications. BNB can be used as collateral for lending and borrowing services, providing liquidity in decentralized exchanges (DEXs), and participating in yield farming and liquidity mining activities. BNB’s integration with the DeFi ecosystem on the BNB chain provides opportunities for BNB holders to engage in various financial activities and earn rewards.

- Payment Method and Merchant Services: BNB can be used as a payment method within the Binance ecosystem and is accepted by numerous merchants and service providers. Users can utilize BNB to make purchases, pay for services, and transact with Binance’s growing network of partners. This integration of BNB as a payment option expands its utility beyond the crypto space and enhances its real-world usability.

Who are the Founders of BNB?

BNB was created by the Binance team, with Changpeng Zhao at the helm as the CEO of Binance. Widely recognized as CZ, Changpeng Zhao is a Chinese-Canadian entrepreneur with a strong background in computer science and extensive experience in the world of asset trading.

Before establishing Binance, he worked at Bloomberg Tradebook and also founded Fusion Systems, a company providing traditional trading services to brokers.

What makes BNB unique?

- Native Utility within the Binance Ecosystem: One of the things that set BNB apart is its native utility within the Binance ecosystem. Unlike many other cryptocurrencies that rely solely on speculative trading, BNB offers tangible value and purpose within the Binance platform.

From trading fee discounts and participation in token sales to staking, DeFi applications, and payment methods, BNB provides users with a diverse range of functionalities within a thriving ecosystem. - Token Burn Mechanism and Deflationary Pressure: BNB operates on a unique token burn mechanism implemented by Binance. Binance periodically uses a portion of its profits to buy back and burn BNB tokens, reducing the total supply in circulation.

This deflationary process creates scarcity and contributes to the potential appreciation of BNB’s value over time. The token burn mechanism sets BNB apart from many other cryptocurrencies and adds an intriguing economic dynamic to its ecosystem.

How is BNB secured?

BNB is secured by the BNB chain. The BNB chain controls the issuance and security of BNB tokens. The blockchain itself relies on a number of mechanisms, chief of them the Proof of Staked Authority (PoA) consensus mechanism.

Further Reading:

The Ultimate Beginner’s Guide to Bitcoin

The Ultimate Beginner’s Guide to Ethereum

FAQs

Is it possible to mine BNB coin?

No, it is not possible to mine BNB coin. BNB cannot be obtained through mining. If you want to acquire BNB, you will need to purchase it from a cryptocurrency exchange or participate in Binance’s offerings.

Which is better: Bitcoin or BNB?

There is no definitive answer to this question as it depends on individual objectives and preferences. Bitcoin is the more established cryptocurrency and has experienced significant price appreciation over time, making it a popular investment choice.

On the other hand, BNB is closely tied to the projects developed within Binance, and its value and utility are associated with the success of the exchange and the BNB Chain.

Ultimately, whether one is better than the other depends on factors such as investment goals, risk tolerance, and one’s perception of the platforms and technologies behind these cryptocurrencies.

Is BNB the same as BUSD?

No, BNB (Binance Coin) and BUSD (Binance USD) are different cryptocurrencies, although both are created by Binance. BNB is the cryptocurrency that powers the BNB chain while BUSD is a stablecoin that helps traders de-risk from volatile assets.