Cardano Price Data

The live Cardano price today is $0.52096900 with a 24-hour trading volume of $402,330,928.

We update our ADA to USD price in real-time. The price of Cardano has changed 4.24% in the last 24 hours.

Currently, Cardano is the #11 largest cryptocurrency by market cap, with a live market cap of $18,375,634,529.00. It has a circulating supply of 35,310,891,231 ADA coins and a maximum supply of 45,000,000,000 coins.

See where to buy Cardano or use our Cardano Profit Calculator to calculate and track the performance of your investment.

Cardano at a glance

- Cardano is a third-generation blockchain platform that aims to build a blockchain system that is highly scalable and secure without sacrificing decentralization.

- It is powered by the Ouroboros protocol which enhances its efficiency and security by adapting to system conditions. Cardano finds practical applications in education, healthcare, and supply chain management.

A Beginner’s Guide to Cardano

What is Cardano?

Cardano is a proof-of-stake blockchain platform that was launched in 2017.

Cardano considers itself a third-generation blockchain system, the first and second generations being Bitcoin and Ethereum respectively.

Cardano aims to build a blockchain platform that is highly secure, scalable, and decentralized.

In general, blockchain systems can achieve one or two of these ideals at most, usually at the expense of the third.

Ethereum’s co-founder, Vitalik Buterin coined the term “blockchain trilemma” to describe the trade-off between decentralization, security, and scalability faced by developers of blockchain networks.

For example, Bitcoin’s highly decentralized and secure blockchain comes at the expense of scalability.

Cardano aims to solve the Blockchain trilemma.

The Cardano platform also aims to be the Internet of Blockchains – a blockchain system that can communicate with other blockchains.

Key Takeaways

- Cardano is a third-generation proof-of-stake decentralized blockchain platform that prioritizes decentralization, security, and scalability.

- Cardano’s real-world applications span education, healthcare, and supply chain management. Its partnership with the Ethiopian Ministry of Education showcases the platform’s potential to revolutionize record-keeping and verification processes.

- Cardano has gained significant traction in the cryptocurrency market. At the moment, it ranks 8th in terms of market capitalization.

What Determines the Price of Cardano?

Here are some key determinants of Cardano’s price:

- Market Demand and Investor Sentiment: Like any tradable asset, the price of Cardano is influenced by market demand and investor sentiment. Positive news, developments, and overall confidence in the project can attract more buyers, driving up the price. Conversely, negative news or market uncertainty can lead to selling pressure and a decline in price.

- Overall Market Conditions: The broader market conditions within the cryptocurrency industry can impact the price of Cardano. If there is a general uptrend in the market and increased interest in cryptocurrencies, it can have a positive impact on Cardano’s price. Conversely, a bearish market sentiment or regulatory concerns can exert downward pressure.

- Development and Upgrades: Cardano’s price can be influenced by the progress of its development and upgrades. Positive developments, such as the implementation of new features, technological advancements, or partnerships, can attract attention and investment, potentially driving the price higher. On the other hand, delays or negative developments may impact investor confidence and result in a price decline.

- Network Activity and Adoption: The level of network activity, including the number of transactions, active addresses, and overall adoption of Cardano, can impact its price. Higher adoption and usage generally indicate a growing ecosystem, which can be viewed positively by investors and potentially contribute to a price increase.

- Regulatory Environment: The regulatory landscape for cryptocurrencies can also play a role in Cardano’s price movement. Positive regulatory developments, such as clear regulations and institutional acceptance, can boost investor confidence and drive the price upward. Conversely, negative regulatory actions or uncertainties may lead to price volatility and investor caution.

Cardano Price Prediction

It’s important to note that cryptocurrencies are highly volatile and predicting their movements can be challenging. The following price estimates should be treated as informational rather than investment advice.

Based on information from reputable sources like CoinCodex, CryptoPredictions, TradingBeasts, and Changelly, the forecasted minimum and maximum prices for Cardano in 2023 and 2025 are as follows:

2023

| Platform | Minimum Price (USD) | Maximum Price (USD) |

|---|---|---|

| CoinCodex | 0.323 | 0.835 |

| CryptoPredictions | 0.369 | 0.676 |

| TradingBeasts | 0.397 | 0.662 |

| Changelly | 0.572 | 0.959 |

2025

| Platform | Minimum Price (USD) | Maximum Price (USD) |

|---|---|---|

| CoinCodex | 0.835 | 1.42 |

| CryptoPredictions | 0.503 | 0.918 |

| TradingBeasts | 0.522 | 0.949 |

| Changelly | 0.85 | 1.23 |

Cardano Price History

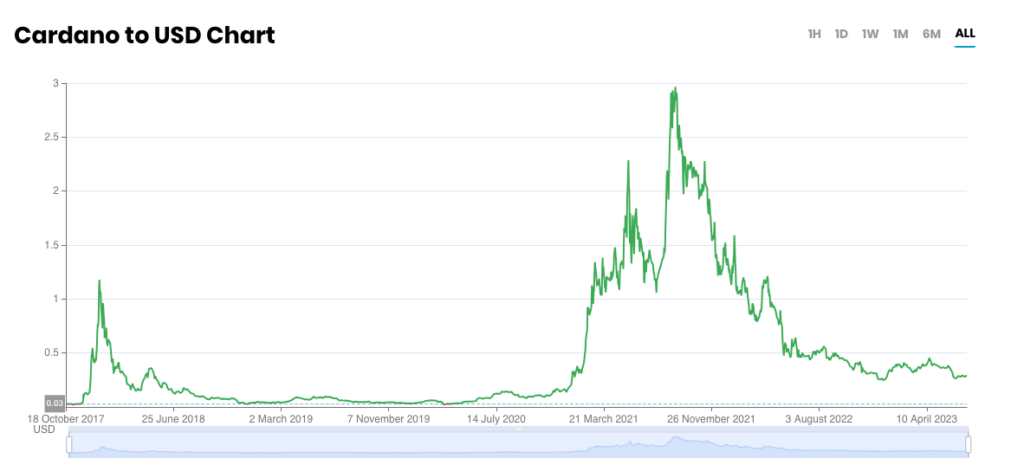

After its September 2017 launch, Cardano experienced a significant surge, rising from $0.02 in 2017 to over $1 in 2018.

In 2021, Cardano reached its all-time high price of $3.1.

The crash of the crypto market in 2021 (which stretched into 2022) saw Cardano shed over 90% of its value.

In 2022, the price of ADA ranged from $0.25 to $1.6. So far in 2023, ADA has traded in the $0.24 to $0.45 range.

These price variations were influenced by market dynamics, investor sentiment, platform developments, and overall market conditions.

How Does Cardano Work?

Cardano’s Layered Architecture

Cardano employs a unique layered architecture, separating its system into distinct components, each serving a specific purpose. The two main layers of Cardano are the Cardano Settlement Layer (CSL) and the Cardano Computation Layer (CCL).

- Cardano Settlement Layer (CSL): The CSL layer is responsible for handling transactions and the accounting of ADA, the native cryptocurrency of Cardano. It ensures secure and transparent transactions through the Ouroboros consensus protocol, which relies on a proof-of-stake (PoS) mechanism. The CSL layer provides the foundation for the transfer of value and maintains the security of the network.

- Cardano Computation Layer (CCL): The CCL layer focuses on the execution of smart contracts and the implementation of dApps. It enables developers to create and deploy custom applications on top of the Cardano blockchain. The CCL layer supports multiple programming languages and offers flexibility and interoperability, allowing for seamless integration with various systems.

Proof-of-Stake Consensus with Ouroboros

Cardano utilizes a proof-of-stake (PoS) consensus mechanism to secure its network and validate transactions. The PoS protocol employed by Cardano is known as Ouroboros, which ensures the decentralized operation of the blockchain.

Ouroboros divides time into epochs and slots. Each epoch consists of several slots, and within each slot, a slot leader is randomly chosen to create and validate a block.

Slot leaders are selected based on their stake (ownership) in ADA, with higher-staked participants having a greater probability of being chosen as slot leaders. This random selection process ensures fairness and prevents the concentration of power.

Continuous Improvement through Research and Peer Review

Cardano stands out for its scientific approach and commitment to peer-reviewed research. The platform’s development is driven by rigorous academic research and collaboration with experts in the field.

Cardano’s design and updates go through extensive scrutiny, ensuring robustness, security, and scalability.

To facilitate the peer review process, Cardano employs a formal specification language called Haskell, which helps in accurately describing the behavior of the blockchain protocol.

This approach enhances the reliability and verifiability of the system, making Cardano a pioneer in the field of blockchain technology.

Sustainability and Governance

Another key aspect of Cardano’s functioning is its focus on sustainability and governance. The platform incorporates a decentralized governance model, allowing ADA holders to participate in decision-making processes.

Through a voting system, ADA holders can propose and vote on protocol upgrades, funding projects, and implementing changes.

Cardano also embraces a treasury system, where a portion of transaction fees and newly minted ADA are allocated to a treasury pool.

These funds are then used to support the development of the ecosystem, including research, infrastructure, and community initiatives. This sustainable funding mechanism ensures the long-term viability and growth of Cardano.

Pros and Cons of Cardano

Pros

- Scalability and Sustainability: Cardano’s layered architecture and the implementation of the Ouroboros consensus protocol provide a scalable and sustainable infrastructure for decentralized applications. The platform aims to address the scalability issues faced by earlier blockchain networks, enabling high transaction throughput and efficient resource utilization.

- Peer-Reviewed Development: Cardano’s commitment to scientific research and peer-reviewed development sets it apart. By leveraging formal methods and extensive scrutiny, Cardano aims to ensure the highest standards of security, reliability, and verifiability. This approach enhances the robustness and credibility of the platform.

- Decentralized Governance: Cardano’s decentralized governance model empowers ADA holders to participate in decision-making processes. Through a voting system, stakeholders can propose and vote on protocol upgrades, funding initiatives, and overall network improvements. This inclusive governance structure promotes community involvement and consensus-driven decision-making.

- Sustainability and Treasury System: Cardano’s treasury system allocates funds from transaction fees and newly minted ADA tokens to support ongoing development, research, and community-driven projects. This sustainable funding mechanism fosters long-term growth and resilience within the Cardano ecosystem.

- Interoperability and Flexibility: The Cardano Computation Layer (CCL) offers interoperability and flexibility, allowing developers to create and deploy customized decentralized applications. Supporting multiple programming languages and integration with various systems, Cardano provides a versatile platform for building innovative blockchain solutions.

Development Complexity and Timeframe: Cardano’s rigorous scientific approach and emphasis on formal methods can result in longer development cycles compared to some other blockchain platforms. While this approach ensures robustness, it may lead to delayed feature rollouts or upgrades.

Early Stage of Implementation: Cardano is still in its early stages of implementation and adoption, with certain features and functionalities yet to be fully realized. As with any emerging technology, there may be uncertainties and potential risks associated with the platform’s development and future market adoption.

Competing Blockchain Platforms: Cardano operates in a competitive landscape, with various other blockchain platforms vying for market share and developer attention. Established platforms and emerging competitors present challenges to Cardano’s growth and adoption, requiring ongoing differentiation and innovation.

Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies and blockchain technology is evolving and can present uncertainties for Cardano. Changes in regulations or unfavorable regulatory actions may impact the platform’s operations and market perception.

Cons

What Is Cardano Used For?

Here are some key areas where Cardano is being utilized:

- Decentralized Finance (DeFi): Cardano’s robust infrastructure and smart contract capabilities make it well-suited for decentralized finance applications. Through the creation of dApps, developers can build decentralized exchanges, lending platforms, stablecoins, and other financial instruments on the Cardano network. These applications provide users with greater control over their financial assets, increased transparency, and reduced reliance on intermediaries.

- Supply Chain Management: The transparent and immutable nature of blockchain technology is advantageous for supply chain management. Cardano can be used to create decentralized supply chain solutions that enhance traceability, accountability, and efficiency. By recording and verifying transactions on the blockchain, stakeholders can ensure the authenticity and integrity of products, streamline processes, and reduce fraud or counterfeiting.

- Identity Management: Cardano’s focus on privacy and security makes it a suitable platform for identity management solutions. By leveraging blockchain technology, Cardano can enable secure and self-sovereign identity systems, where individuals have control over their personal information and can selectively share it with trusted parties. This can lead to improved privacy, reduced identity theft, and enhanced user control in digital interactions.

- Government Applications: The blockchain’s characteristics, such as transparency, immutability, and decentralized governance, make Cardano applicable to various government applications. It can be used for voting systems, land registries, public record-keeping, and other areas where trust, security, and accountability are essential. Cardano’s decentralized governance model also enables more inclusive and transparent decision-making processes within governmental organizations.

- Healthcare: The healthcare industry can benefit from Cardano’s capabilities, particularly in data management, patient privacy, and medical research. Cardano can facilitate the secure sharing of medical records between healthcare providers, enable consent-based access to patient data, and support the development of privacy-preserving health applications. Additionally, blockchain technology on Cardano can enhance the integrity and transparency of clinical trials and medical research data.

- Educational Initiatives: Cardano’s commitment to research and academic collaboration extends to educational initiatives. The platform can be used for issuing and verifying educational certificates, creating transparent and tamper-proof systems for academic credentials, and enabling secure collaboration and knowledge sharing within the educational community.

Who Is the Founder of Cardano?

Cardano was founded by Charles Hoskinson and Jeremy Wood, along with the team at Input Output Hong Kong (IOHK).

Charles Hoskinson, previously a co-founder of Ethereum, brought his expertise in mathematics and computer science to shape Cardano’s vision.

Jeremy Wood, with a background in cryptography and technology development, played a key role in architecting Cardano’s technical aspects.

IOHK, led by Hoskinson and Wood, continues to contribute to the design, development, and maintenance of Cardano.

Together, they have driven Cardano’s growth and established it as a leading blockchain platform.

What Makes Cardano Unique?

Cardano distinguishes itself from other cryptocurrencies through several unique features:

- Two-layer architecture: The separation of the value transfer and computation functions in Cardano’s two-layer architecture allows for greater flexibility, scalability, and the addition of new functionalities.

- Scientific and academic principles: Cardano’s development is based on a rigorous scientific and academic approach. Extensive research and analysis have been conducted by experts before each phase’s launch, ensuring a secure and transparent system.

- Smart contract implementation: Cardano was one of the first virtual currencies to implement smart contract technology. Smart contracts enable the execution of predefined conditions and automate various processes on the blockchain.

- Scalability: Cardano is highly scalable, and it aims to handle an impressive number of transactions. With the implementation of the third layer, Cardano is expected to process up to 1 million transactions per second.

- Proof of Ownership and Staking: Cardano’s core protection lies in its proof-of-stake consensus mechanism. To authorize transactions, validators are randomly selected from ADA coin holders in the network. Validators with a larger stake of ADA have a higher probability of being selected. This proof-of-stake approach ensures network security and reduces energy consumption compared to traditional proof-of-work systems.

How Is Cardano Secured?

Cardano utilizes various mechanisms to ensure the integrity and protection of its blockchain network. Here is an overview of how Cardano achieves security:

- Proof-of-Stake (PoS) Consensus: Cardano employs a unique Proof-of-Stake (PoS) consensus protocol called Ouroboros. Unlike traditional Proof-of-Work (PoW) protocols that rely on computational power, Ouroboros uses stake (ownership of ADA) to secure the network. The protocol randomly selects slot leaders, who are responsible for creating and validating new blocks. This decentralized approach to block production ensures network security and prevents the concentration of power.

- Stakepool Operators: Cardano allows ADA holders to delegate their stake to stakepool operators. Stakepool operators play a crucial role in the consensus protocol by validating transactions and participating in block creation. The delegation process adds an extra layer of security, as it prevents a single entity from gaining excessive control over the network.

- Continuous Network Monitoring: Cardano’s network is continuously monitored by both the platform’s development team and community participants. This active surveillance helps identify and mitigate potential security threats promptly. Regular updates and patches are released to address any identified vulnerabilities and ensure the network remains secure.

- Transparent and Peer-Reviewed Development: Cardano follows a transparent development process and actively engages in peer-reviewed research. The platform undergoes meticulous scrutiny from experts in academia and the blockchain community, ensuring that security vulnerabilities are thoroughly addressed and that the protocol’s design and implementation are robust.

- Treasury System and Governance: Cardano’s treasury system helps sustain the network’s security by allocating a portion of transaction fees and newly minted ADA tokens to fund ongoing development and security initiatives. Additionally, Cardano’s decentralized governance model allows stakeholders to participate in decision-making processes, promoting community involvement and fostering consensus-driven security practices.