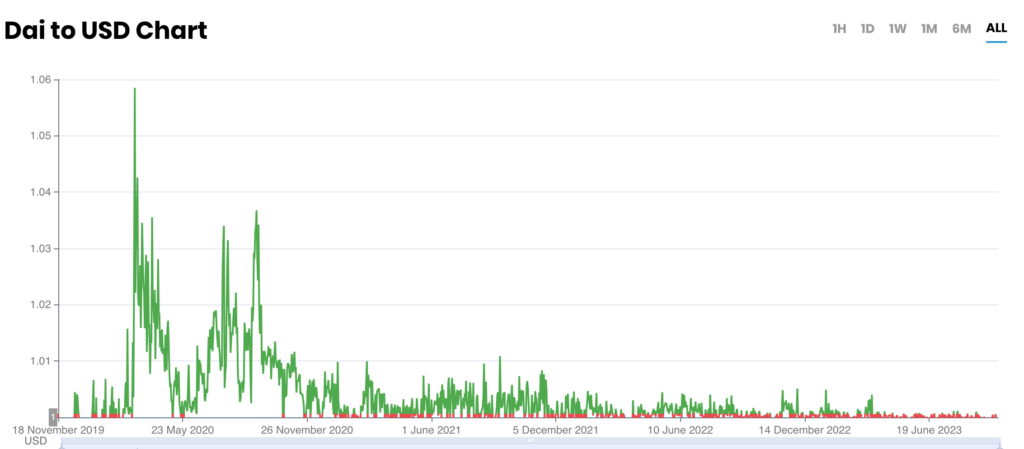

Dai Price Data

The live Dai price today is $0.99899700 with a 24-hour trading volume of $427,929,997.

We update our DAI to USD price in real-time. The price of Dai has changed -0.07% in the last 24 hours.

Currently, Dai is the #25 largest cryptocurrency by market cap, with a live market cap of $5,203,196,136.00. It has a circulating supply of 5,208,419,754 DAI coins but the maximum supply is not available.

See where to buy Dai or use our Dai Profit Calculator to calculate and track the performance of your investment.

Dai at a glance

Dai is a decentralized stablecoin operating on the Ethereum blockchain. It is designed to maintain a 1:1 peg with the US dollar through transparent smart contracts and collateralization, offering stability and autonomy in the volatile world of cryptocurrencies.

A Beginner’s Guide to Dai

What is Dai?

Dai is a decentralized stablecoin that is designed to maintain a stable value over time, by being pegged to a fiat currency.

What makes Dai unique is that it is not issued or controlled by a centralized authority like a government or a corporation. Instead, it operates on the Ethereum blockchain through a system of smart contracts.

Unlike traditional cryptocurrencies like Bitcoin and Ethereum, DAI is designed to maintain a stable value to the US dollar.

DAI is created through a complex system of smart contracts that allows it to maintain its peg to the US dollar through a mechanism of supply and demand.

Stablecoins can be compared to the “crypto versions” of traditional currencies such as EUR and USD.

There are several reasons why you should consider using these cryptocurrencies, the main one being that in many cases the value remains stable.

With DAI, you are insured against the typical price fluctuations that is common with other cryptocurrencies. Stablecoins like DAI therefore play an important role in the crypto market.

Stablecoins also act as a bridge between fiat currency and cryptocurrencies and are a key factor in perhaps seeing even less volatility in the future.

What determines the price of Dai?

The price of Dai is determined by market forces, primarily supply and demand dynamics within the cryptocurrency ecosystem.

Unlike other cryptocurrencies, which can experience extreme price volatility, Dai aims to maintain a 1:1 peg with the US dollar. This stability is achieved through a combination of decentralized mechanisms.

The DAI aims to maintain a stable 1:1 value against the US dollar.

Because DAI is pegged to the US dollar, the price of the DAI mirrors the performance of the US dollar.

Dai rises and falls in value in tune with the US dollar.

Dai price history

Here is a list of some of the most important price changes in the history of the DAI:

- 2017: DAI was launched at a price of around 1 USD

- December 2018: DAI’s price drops to around 0.80 USD, following the general decline of the whole market

- March 2019: DAI rises to over a 1 USD, as a result of the massive demand and increased interest in cryptocurrency

- March 2020: DAI rises again to above 1 USD due to increasing demand and uncertainty in traditional markets due to the COVID-19 pandemic

- August 2021: DAI rises again to a price of around 1.04 USD due to increased demand for stablecoins as a result of high uncertainty in traditional markets.

- December 2022: DAI closes 2022 with a price of 1,002 USD

It is important to keep in mind that past price changes for DAI are not indicative of future performance.

How Dai differs from other cryptocurrencies

DAI differs from other cryptocurrencies in several ways.

- DAI is a stablecoin. This means that it is designed to maintain a stable value against the US dollar.

- The DAI is set up through a decentralized network of smart contracts. This means that it is not controlled by any central authority. This is unlike other traditional fiat currencies that are issued and managed by central banks

- Dai is designed to be used in decentralized applications and ecosystems. This means it can be used for a wide range of purposes, from payment for goods and services to collateral for loans and investments

How does Dai maintain it’s stability?

DAI’s stability is maintained through a complex system of smart contracts and algorithms.

The MakerDAO system uses a number of mechanisms to ensure that the value of DAI remains stable against the US dollar.

When a user creates the DAI, they must lock a certain amount of Ethereum in a CDP.

What is a CDP?

A CDP (Collateralized Debt Position) is a smart contract used in the DAI ecosystem to lock a certain amount of cryptocurrencies as collateral to create and issue new DAI.

The amount of Ethereum to be unlocked is determined by the MakerDAO system, which takes into account the volatility of the asset and the amount of DAI created.

The locked amount of Ethereum acts as collateral for the DAI, meaning that if the value of Ethereum falls below a certain level, the CDP will automatically unwind.

A CDP helps to ensure that there is always enough security to back the DAI, which in turn helps to maintain stability.

In addition to the CDP system, MakerDAO also uses a number of other mechanisms to maintain the stability of the DAI.

These include the Dai Savings Rate (DSR), which allows users to earn interest on their DAI, as well as the (Stability Fee), which is a fee charged on CDPs to ensure that the system remains stable.

How Dai works

As mentioned earlier, DAI is created through a complex system of smart contracts operating on the Ethereum blockchain.

When a user wants to create DAI, they must deposit Ethereum (ETH) in a smart contract called a collateralized debt position (CDP).

ETH is held in the CDP as collateral and the user can then generate DAI.

The amount of DAI that can be generated against the value of Ethereum in CDP is determined by a predetermined security ratio.

This ratio is set by the DAI ecosystem and is currently set at 150%. This means that for every 1 dollar of DAI generated, there must be at least 1.50 USD worth of Ethereum held as collateral in CDP.

If the value of Ethereum falls below the predetermined ratios, the user must either deposit more Ethereum or repay some DAI to re-establish the ratio.

This helps to ensure the stability of the DAI ecosystem and maintain the peg to the US dollar.

What is Dai used for?

Dai can be used for the following:

- Use in DeFi Apps: DAI has a wide range of purposes in the Decentralized Finance (DeFi) ecosystem.

It can be used as a means of exchanging goods and services, as a store of value, and as collateral for loans and investments.

As DAI is considered stable and decentralized, it can be used in a variety of DeFi applications, including decentralized exchanges and lending platforms. - Crypto lending: DAI is also used for lending, allowing investors to generate a passive income in the form of interest payments.

Many investors lend their DAI and in return, they receive, for example, 2% per year in interest.

This service is available on several major platforms such as Coinbase and Binance. - International payments: Making international transfers to other countries through traditional methods such as banks, Western Union, etc. can be very expensive and time-consuming.

With Maker Protocol, which is based on blockchain technology, you can make transfers using DAI at a fraction of the cost and within seconds.

Dai has found practical use in the real world. Here are some of the ways Dai is used:

- A blockchain-based travel agency called Travala accepts payment in DAI for booking travel and experiences worldwide

- A nonprofit organization called GiveCrypto uses DAI as part of their emergency relief programs, giving cryptocurrencies to people in need around the world

- Decentraland, a virtual reality project, has created an economy based on DAI where users can buy, sell, and trade virtual goods and services

Who are the founders of Dai?

In 2014, Danish Rune Christensen launched an open source project called Marker DAO.

The following year, he gathered a group of skilled developers and formed the Marker DAO protocol.

In 2017, DAI was launched on Marker Protocol, as a smart contract on the Ethereum blockchain.

The purpose of DAI was to provide a decentralized cryptocurrency that was less volatile and could be used to take out loans with cryptocurrency as collateral.

Since then, Rune Christensen has given up ownership of Marker DAO to the Maker community, which has since helped move DAI to where it is today.

Marker DAO is a decentralized autonomous organization run by people around the world, all of whom own the Marker DAO cryptocurrency (MKR).

If you own Marker DAO cryptocurrency, you have voting rights and decide through a joint agreement what will happen in the future with Marker DAO’s smart contracts and thereby also DAI.

What makes Dai unique?

There are several things that make DAI unique.

- As a stablecoin, Dai is a valuable tool for both trading and investing, insuring crypto traders and investors against the volatility of the crypto market.

- Dai is a decentralized system based on blockchain technology. This means that it is not controlled by a central authority or institution and is therefore more resistant to corruption and censorship.

- Being decentralized, DAI is also more democratic and inclusive as it gives everyone equal access to the system, no matter where they are in the world

Dai is also one of the most widely used cryptocurrencies on the market. This is because it is designed to be used for a wide range of applications and ecosystems, from payment for goods and services and collateral for loans and investments.

This helps to provide flexibility and options for the user and may also help to increase the uptake of cryptocurrencies in the future.