Ethereum Price Data

The live Ethereum price today is $3,062.77 with a 24-hour trading volume of $23,821,327,444.

We update our ETH to USD price in real-time. The price of Ethereum has changed -3.9% in the last 24 hours.

Currently, Ethereum is the #2 largest cryptocurrency by market cap, with a live market cap of $367,901,554,486.00. It has a circulating supply of 120,070,408 ETH coins but the maximum supply is not available.

See where to buy Ethereum or use our Ethereum Profit Calculator to calculate and track the performance of your investment.

What determines Ethereum price

The price of Ethereum is determined by Its utility, demand, and supply dynamics in the crypto market and trends on social media. Learn more here.

In this article, we explore more details related to the price of Ethereum (ETH) and help you make the right decision.

Ethereum at a glance

- Ethereum is a public blockchain that enables developers to build and deploy decentralized applications. A key part of the Ethereum platform is its smart-contract functionality which enables the creation of self-executable agreements. These contracts are written in code and are triggered when specific conditions are met.

- The advent of Ethereum has inspired the development of novel financial and economic paradigms such as decentralized finance (DeFi), decentralized autonomous organizations (DAOs), and non-fungible tokens (NFTs).

- While Ethereum was inspired by Bitcoin, the two platforms are fundamentally different. Bitcoin is a breakthrough in digital currency, whereas Ethereum revolutionizes decentralized computing.

The Ultimate Beginner’s Guide to Ethereum

- 1.What is Ethereum?

- 2.Ethereum versus Ethereum Classic

- 3.What Determines Ethereum Price?

- 4.Ethereum Price History

- 5.How Ethereum works – Unpacking Ethereum

- 5.1.Smart Contracts

- 5.2.Decentralized applications (dApps)

- 5.3.Ethereum Mining

- 5.4.The Ethereum Virtual Machine (EVM)

- 5.5.The Ethereum Stack

- 5.6.Ethereum as a currency

- 5.7.Ethereum Wallets

- 5.8.Types of Ethereum accounts

- 5.9.Ethereum token standards

- 5.10.Ethereum Layer 2s

- 6.“Ethereum Killers”

- 7.What is Ethereum used for?

- 8.Who are the Founders of Ethereum?

- 9.What makes Ethereum unique?

- 10.How is Ethereum secured?

What is Ethereum?

Ethereum is a blockchain with smart contract capabilities. A smart contract is a self-executable code that is activated when certain conditions are met.

The Ethereum network consists of independent computers working together to power decentralized applications.

While Bitcoin is a breakthrough in digital currency, Ethereum revolutionizes decentralized computing.

Introducing Ethereum in 2014, Vitalik Buterin described it as a “next-generation smart contract and decentralized application platform.”

Inspired by Bitcoin

In 2009, Satoshi Nakamoto launched Bitcoin: the first digital currency that ran independently of a central authority. The advent of Bitcoin was a breakthrough in digital money.

But behind Bitcoin was something even more revolutionary: a decentralized record of transactions that was tamper-proof and could not be altered.

While studying the work of Satoshi Nakamoto, Vitalik Buterin – a Russian-Canadian computer scientist intuited that the blockchain could be more than just the backbone for a decentralized currency: it could be a tool of distributed consensus.

Ethereum takes Bitcoin’s vision further: from a decentralized currency to a decentralized blockchain system that allows for so much more than currency transactions.

Features of Ethereum

- A peer-to-peer network: As a peer-to-peer network Ethereum facilitates the transfer of value in a trustless environment. It also allows people to collaborate and transact without using third parties or centralized structures.

- Secure and censorship-resistant: The Ethereum blockchain is powered by a decentralized network of independent nodes and is secured by cryptography. Since no central authority controls the network, it cannot be censored.

- Smart contract functionality: Ethereum allows anyone to write self-executable codes called smart contracts. Smart contracts are triggered when certain conditions are met.

- A platform for hosting decentralized applications: The Ethereum platform also enables developers to build and deploy applications that run in a decentralized manner. dApps have no single point of failure and are not controlled by anyone (not even the developer that built it).

- A native cryptocurrency: Ethereum’s native cryptocurrency – Ether (ETH) – is used to process transactions on the network and activate smart contracts.

Ethereum: Two key innovations

In a 2014 whitepaper introducing Ethereum, Vitalik Buterin pointed out two key innovations:

- Self-executing agreements a.k.a Smart contracts and

- Decentralized applications

Smart contracts are self-executing codes written into the blockchain. “Self-executing” meaning they are triggered when certain conditions are met. Put simply, a smart contract is an agreement written in code that is subject to certain conditions.

Decentralized applications or dApps for short are applications that are built and deployed on the blockchain.

This means that dApps aren’t controlled by a single entity and don’t have a central point of trust. Think of Gmail or Facebook that runs on the blockchain which means nobody controls it.

A Snapshot of Ethereum

- Ethereum was launched in 2015 as a public blockchain that allowed developers to build and deploy decentralized applications.

- The idea for Ethereum was first proposed by Russian-Canadian programmer Vitalik Buterin in 2013.

- Ethereum has been instrumental in the emergence of new financial and economic paradigms like decentralized finance (DeFi), and decentralized autonomous organizations (DAOs).

- Ethereum is anchored on two key innovations: smart contracts and decentralized applications. Smart contracts are self-enforceable codes that run on the blockchain while decentralized applications are applications that run without a central point of trust.

- Ethereum takes Bitcoin’s vision further by allowing for the application of blockchain technology beyond cryptocurrency.

Ethereum versus Bitcoin

Although Bitcoin and Ethereum are both powered by blockchain technology, they were built for different purposes.

While Bitcoin was designed to be electronic money that ran independently of a central authority, Ethereum was designed to be a platform for building applications that run without a central point of trust (in other words, applications that run independently of a central authority).

With Bitcoin, people can send and receive money without using a payment processor like PayPal. With Ethereum, developers can build applications that are not controlled by anyone.

| Bitcoin | Ethereum | |

|---|---|---|

| Founder | Satoshi Nakamoto | Vitalik Buterin |

| Key innovation | First implementation of cryptocurrency and Blockchain technology | A programmable blockchain with smart-contract functionality that enables developers to build decentralized applications |

| Supply cap | 21 M | Unlimited (capped at 18M per year) |

| Time per transaction | 10 mins | 15 seconds to 5 mins |

| Application | Currency | Smart contracts Decentralized applications |

While Bitcoin solved the double-spend problem that made it possible to send and receive money without going through a third party, Ethereum modified that technology by building the full capabilities of a computer on top of it.

Another difference between the two lies in their native tokens. While Btc was created to compete against fiat currencies and gold, Eth was created to process transactions on the network and facilitate smart contracts.

Ethereum versus Ethereum Classic

Ethereum allows for collaboration in a trustless manner. This means people can come together and join resources towards a common end.

One of the projects that utilized the Ethereum platform for such purposes was The DAO. The DAO (short for Decentralized Autonomous Organization) was a group of crowdfunded investors that came together to invest for a common goal.

The DAO pulled roughly US$150 million from around 11,000 investors.

Along the way, the DAO got hacked. A malicious actor found a vulnerability in the code of the smart contract and stole US$50 million worth of Ethereum.

To remedy the situation, Vitalik proposed a radical solution: modify the blockchain. In specific terms: roll back the blockchain and reverse the hack like it never happened in the first place.

However, a section of the Ethereum community disagreed with Vitalik’s proposal. They believed that altering the blockchain was against the Ethos of the community such as decentralization and immutability.

This disagreement split the Ethereum community into two:

- Those that agreed to the modification of the blockchain and

- Those that thought the modification went against the ethos of the community

In the end, the modification was made and the Ethereum network split into two:

- The original Ethereum network

- The modified blockchain (where the funds were given back to The DAO)

So mainstream Ethereum is actually the modified version of the original chain. Ethereum Classic is the original chain.

While Ethereum switched from proof of work to proof of stake, Ethereum Classic continues to use the proof of work model.

Mainstream Ethereum is known by the ticker symbol “ETH” while Ethereum Classic is known by the ticker symbol “ETC”

What Determines Ethereum Price?

The price of Ethereum – like other cryptocurrencies – is determined by a number of factors:

- Utility: Ethereum is the biggest smart contract blockchain and the largest blockchain network after Bitcoin. Over the years, Ethereum has become a popular platform for building decentralized applications. Since smart contracts deployed on Ethereum need Eth to be triggered, the number of smart contracts and dApps deployed on Ethereum have an impact on the price of Ethereum. As more smart contracts and dApps are deployed on the platform, the price of Ethereum will rise.

- Demand and supply: Like Bitcoin, the joint forces of demand and supply also affect the price of Ethereum. As more smart contracts and decentralized applications are deployed on Ethereum, the price of Ethereum will spike. On the other hand, it is important to state that Ethereum doesn’t have a fixed cap at the moment. That said, the supply of Ethereum has been on a steady decline. If demand for Ethereum spikes and its supply continues to decline, this can lead to a spike in the price of Ethereum.

- Social media: Speculation plays a big role in the pricing of cryptocurrencies and it’s not just Ethereum. Bullish sentiments on social media can lead to a spike in the price of a cryptocurrency. On the other hand, bearish sentiments can lead to a fall in prices even when this has little to do with the utility or long-term prospects of the cryptocurrency. Positive news about Ethereum can lead to a rise in the price of Ethereum.

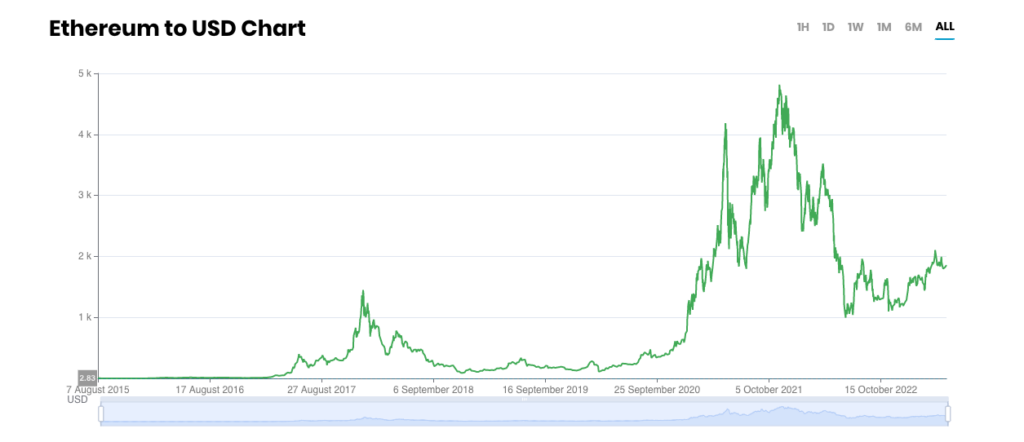

Ethereum Price History

Key events that have played shaped Ether’s price trajectory include

- Ethereum ICO in 2014: Ethereum launched in 2014 funded by a crowdfunding campaign (known as an Initial Coin Offering in the crypto world) that raised $18 million in only 42 days. At the time of the ICO, Ether was priced at $0.30.

- The bull run of 2017/2018: In 2018, the price of Ether reached a new all-time high due to the ICO boom that saw new projects deployed on the Ethereum platform. Since most of these projects used Ether to raise money, the price of Ether spiked reaching a peak of $1,432.88.

- The second run of 2020/21: In 2021, the crypto market experienced another rally triggered by the halving of Bitcoin. This led to a new all-time high of $4,362.35.

Another run in 2024/2025?

Traditionally, the halving of Bitcoin has led to a price rally that has benefited the wider crypto market. With another halving billed for early 2024, will ether experience another spike in price?

How Ethereum works – Unpacking Ethereum

Here are the integral pieces that makeup Ethereum’s decentralized computing platform:

Smart Contracts

What are smart contracts?

A smart contract is simply an agreement written in code that binds the parties to certain conditions. Smart contracts are activated when the conditions embedded in them are triggered.

Because they are autonomous and run in a trustless way, they can be used to build products that run without a central point of trust.

At a basic level, smart contracts are simply “if” and “then” statements.

Characteristics of smart contracts

- Autonomous: Smart contracts are autonomous. This means that they execute the terms of the contract without third-party intervention.

- Reduce the cost of operations: Smart contracts reduce the cost of operations since they don’t need a trusted thirty party to be activated

- Tamper-resistant: Smart contracts are tamper-resistant. This means the contract can’t be modified

- Transparency: Since both parties have the same information, there’s less room for manipulation.

Advantages of smart contracts

Some of the advantages of smart contracts include:

- Autonomous: One of the primary advantages of smart contracts is to eliminate the need for third parties. This makes it easy to enforce agreements.

- Building blocks for dApps: Because smart contracts eliminate the need for third parties, they are the basis on which decentralized applications are built.

- Lower transaction cost: By eliminating third parties, smart contracts lower the cost of transactions

Disadvantages of smart contracts

Although smart contracts are revolutionary, they are not without disadvantages:

- Smart contracts are not intelligent: Smart contracts execute the terms of the “agreement” to the letter without consideration for eventualities that may cause a breach of contract.

- Errors can lead to hacks: Since smart contracts are publicly available for everyone to see, malicious actors can explore them for vulnerabilities. This is what happened with The DAO event that saw the theft of over $50 million.

Decentralized applications (dApps)

What is a dApp?

A decentralized application – short for dApp – is an application built and deployed on a public blockchain. Because they are deployed on a blockchain, they have no single point of trust.

Hence, a dApp runs without a central authority. Because dApps are open source, anyone can verify the content of the software.

An integral part of what makes dApps possible are self-executable codes that are triggered when certain conditions are met (a.k.a smart contracts). Smart contracts allow dApps to operate in an autonomous and trustless manner.

The only difference between regular applications and decentralized applications is that the latter is deployed on the blockchain. Think of Facebook or Gmail not run by a single entity controlling operations.

The revolutionary nature of dApps has spun off new paradigms like decentralized finance: an ecosystem of financial products built and deployed on the blockchain.

Properties of decentralized applications (dApps)

- Blockchain Native: Decentralized applications can only be built and deployed on a blockchain network.

- Decentralized: A dApp is, by its very nature, decentralized. This means there’s no single point of trust.

- Secure: dApps use cryptographic protocols and consensus mechanisms to ensure the security and integrity of transactions.

- Open source: dApps are open-source and can be audited by anyone.

Advantages of dApps

Some of the advantages of dApps include:

- No central authority: Because dApps have no central authority, they have no single point of trust which also means they have no single point of failure. This makes them more reliable than traditional applications.

- Trustless interactions: At the heart of many dApps are self-enforceable codes known as smart contracts. Smart contracts allow dApps to operate in a trustless manner.

- Transparency: dApps built and deployed on public blockchains like Ethereum can be audited since all participants can view transactions and smart contracts.

- Open and permissionless: dApps are, by their very nature, open-source projects. This means that anyone can inspect the code and contribute to its development.

- Tokenization and incentive structures: dApps can use tokens to create an incentive system that enables innovation and promotes growth.

Disadvantages of dApps

dApps also come with some disadvantages:

- Slow processes: The lack of a central authority – a major pro for dApps – can cause it to run slower than a traditional app. Unlike traditional apps where a company can implement changes as they please, Dapps require majority consensus to implement updates.

- Scalability: dApps inherit some of the problems of that plague blockchain networks such as scalability issues. The decentralized structure of the blockchain means dApps take much longer to confirm and validate transactions compared to traditional applications.

- User Experience: Since dApps are still in their infancy, they provide a less intuitive user experience. Interacting with dApps requires a basic understanding of blockchain technology, wallet usage, and private key management.

Some popular dApps

Some popular dApps include:

- Aave: A peer-to-peer lending platform

- Uniswap: A decentralized exchange

- Chainlink: A decentralized oracle network

- Compound: A peer-to-peer lending platform

Ethereum Mining

The Ethereum blockchain consists of and is powered by a decentralized network of nodes. These nodes form the base layer of the blockchain.

Nodes in the network verify transactions and keep the network secure. To keep participants in the network incentivized, nodes are rewarded for validating transactions.

The process of validating transactions on a blockchain network is called mining. Prior to September 2022, Ethereum used a model called Proof-of-work – a model that requires nodes to perform complex math puzzles to verify transactions.

Because the Proof-of-Work model required high-end computers to qualify as nodes in the network, it required massive energy consumption.

This propelled the move to Proof-of-Stake: a system that required nodes to hold a certain amount of Eth to verify transactions.

The Ethereum network moved to the POS model in late 2022 in an event called the Merge.

The Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine is responsible for processing and verifying transactions and executing the code of smart contracts written in high-level languages like Solidity.

Think of the EVM as a state machine that processes transactions and maintains the state of the Ethereum network. It uses bytecode, a low-level language that computers can understand, to execute smart contracts and power decentralized applications (dApps) on the Ethereum network.

In essence, the Ethereum Virtual Machine is like a compiler that translates codes written in human languages (like solidity) into machine code that the network can run.

The Ethereum Stack

The Ethereum platform consists of three simple layers:

- Base layer: This is the backbone of the Ethereum network – it is the hardware layer of the network. This layer consists of the nodes (the computers) that form the network. The nodes that form the network are connected to the internet and run software that allows them to communicate with each other.

- Software layer: This is the layer that supports programming languages like Solidity, vyper, and bamboo. These programming languages allow developers to write smart contracts.

- Application layer: This is the layer where developers can build and deploy decentralized applications.

These three layers – hardware, software, and application – form the Ethereum network: a secure platform for executing smart contracts and deploying decentralized applications.

Ethereum as a currency

While the term Ethereum is used in mainstream media to refer to both the platform and the cryptocurrency, the two are actually different.

Ethereum refers to the platform as a whole while Ether is the native cryptocurrency of the platform. Ether is used to facilitate transactions on the platform and trigger smart contracts.

Ether was designed to be the fuel that powers the Ethereum platform, facilitating transactions and activating smart contracts.

Ether – powering the Ethereum Network

If Bitcoin can be likened to digital gold, then you can think of Ether as digital oil – the fuel that powers the Ethereum platform.

To deploy a smart contract or decentralized applications on the Ethereum network, you have to pay for the computing power and space required using Ether.

Ethereum has a unique pricing system that determines the amount of Ether required to deploy a smart contract or dApp on the platform.

This pricing system is known as gas. Gas is a metric for measuring the amount of computational power required to carry out a given operation on the Ethereum platform.

Ether Units

Ether units are denominations of the cryptocurrency. They are divided into one quintillion units (that’s a one with eighteen zeros after it). The smallest unit is called a Wei – named after computer engineer and cryptographer, Wei Dai.

| Unit | wei value | wei |

|---|---|---|

| wei | 1 wei | 1 |

| Kwei | 1e3 wei | 1000 |

| Mwei | 1e6 wei | 1,000,000 |

| Gwei | 1e9 wei | 1,000,000,000 |

| Microether | 1e12 wei | 1,000,000,000,000 |

| Milliether | 1e15 wei | 1,000,000,000,000,000 |

| Ether | 1e18 wei | 1,000,000,000,000,000,000 |

In most cases, you will see gas prices denoted in Gwei (short for Gigawei).

In Ethereum, miners are incentivized to keep the network running and process transactions.

Gas limits

The gas limit is the maximum amount of gas units you are willing to pay for a single transaction. Gas limits prevent situations where an error in the smart contract causes you to pay a high amount of gas.

You will get an insufficient funds notification or something similar if there isn’t enough gas to complete the transaction you desire.

Ethereum Wallets

An Ethereum wallet is a place where you can securely store your Ether. A wallet has the following features:

- A private key: a private key is like your secret password – it is the key to unlocking your account. It gives anyone in possession of it access to your coins. If you lose your private key, you lose access to your coins.

- A public key: A public key is like your bank account number. It is a public address that you can use to send and receive Ether.

Types of Ethereum accounts

Externally Owned Account (EOA): This is your regular wallet. An EOA has an address that is controlled by a private key. EOAs can send and receive Ether as well as trigger smart contracts.

Contract Account: As the name suggests, contract accounts are associated with smart contracts. Contract accounts have a unique Ethereum address.

Just like EOAs, contract accounts can send and receive Ether if triggered. Once written, smart contracts cannot be changed hence the author must be very thorough in drafting the conditions for each trigger.

They can send Ether to other EOAs or create new contract accounts.

However, unlike EOAs, they don’t have a private key. So how are they controlled? The contract is bound by a set of codes that defines predefined triggers.

Ethereum token standards

An Ethereum token standard is a predefined set of rules and guidelines that tokens issued on the network are required to conform with.

These standards ensure compatibility and interoperability between different tokens issued on the Ethereum platform and allow developers to create applications that interact with different tokens.

Examples of Ethereum token standards include ERC-20 (the rules that fungible tokens issued on the network are expected to conform to) and ERC-721 (the rules and guidelines for non-fungible tokens).

Ethereum Layer 2s

An Ethereum Layer 2 is a blockchain built on the main Ethereum network. Layer 2s are designed to address the scalability challenges of the main Ethereum chain.

Examples of Ethereum Layer 2s include Arbitrium, Optimism, and StarkNet.

“Ethereum Killers”

So-called Ethereum killers are blockchain platforms that aim to improve the limitations of Ethereum.

These platforms focus on offering lower fees, faster transaction processing and higher transaction throughput.

Popular “Ethereum Killers” include Polkadot, Binance Smart Chain, and Solana.

Ethereum killers are EVM-compatible blockchains which means dApps deployed on the Ethereum network can be redeployed on the blockchain.

What is Ethereum used for?

Ethereum’s smart-contract blockchain has a wide range of applications, such as

- Decentralized Crypto Exchanges (DEXs): A decentralized exchange is a crypto exchange platform that facilitates the exchange of crypto assets between two or more parties without a central intermediary coordinating affairs. DEXs employ smart contracts and decentralized protocols to enable peer-to-peer transactions. Popular DEXs include Uniswap and Pancakeswap.

- Decentralized Finance Applications: A DeFi dApp is simply a decentralized application that runs without a central authority. Popular finance dApps include lending protocols and yield farms like Aave, Compound, and Yearn.

- Non-Fungible Tokens (NFTs): Non-fungible tokens, also known as NFTs, are one-of-a-kind tokens issued on Ethereum. Because it is nonfungible, an NFT cannot be exchanged for another NFT. NFTs are used to represent one-of-a-kind items like property deeds and car titles on the blockchain. Popular NFTs include The First 5000 Days by Michael Winkelmann (a.k.a Beeple) and the CryptoPunk collection.

Who are the Founders of Ethereum?

Ethereum was first proposed by Russian-Canadian programmer Vitalik Buterin. Prior to the launch of Ethereum, Buterin had been active in the Bitcoin community, working as a writer for Bitcoin Weekly and co-founding Bitcoin magazine.

In 2013, Vitalik published a whitepaper introducing Ethereum: “A Next-Generation Smart Contract and Decentralized Application Platform.”

Between 2013 and 2015, Vitalik worked with other developers such as Gavid Wood and Joseph Lubin to build Ethereum.

The platform went live in 2015.

What makes Ethereum unique?

The utility of Ethereum boils down to the following key elements

- Self-enforcing agreements: Ethereum’s smart contract functionality means that two parties can enter an agreement without a third party ensuring that the terms of the contract are upheld.

- Applications that run without a central authority: By enabling developers to build decentralized applications, the Ethereum platform has become home to entirely new paradigms like decentralized finance and decentralized autonomous organizations. Popular dApps on Ethereum include UniSwap, Aave, and Compound.

- Organizations that operate with a central authority (DAO): Another new paradigm that owes its origins to Ethereum is an organization run by code: a decentralized autonomous organization. DAOs allow people to come together and collaborate without a central authority. Popular DAOs on Ethereum include MakerDAO and Curve DAO.

How is Ethereum secured?

The Ethereum network is secured through a combination of consensus algorithms, cryptographic techniques, and a decentralized network of nodes.

Here are some key aspects of Ethereum’s security:

- Blockchain technology: The Ethereum platform is based on blockchain technology – a decentralized and distributed ledger that is censorship-resistant and tamper-proof.

- Network Nodes: The Ethereum network consists of a large number of nodes distributed worldwide. Nodes maintain a copy of the blockchain, validate transactions, and ensure consensus across the network.

- Cryptographic Security: The Ethereum platform utilizes cryptographic algorithms to secure transactions and protect user data. Public key cryptography is used to generate unique keys. These keys can be used to sign transactions and provide secure access to funds. Cryptographic hash functions ensure the integrity of data stored in blocks, making it tamper-resistant.

- Proof-of-Stake (PoS) Consensus: Ethereum currently employs a consensus mechanism called Proof-of-Stake. A consensus mechanism is a way for the participants in a blockchain network to agree on the validity of transactions and reach a shared version of the truth without relying on a central authority.

FAQs

How much will 1 ethereum be worth in 2030?

According to Bitnation, Ethereum could reach a new all time high price of $18,324.21 by 2030.

What makes the Ethereum network unique?

There are two key innovations central to Ethereum: smart contracts and decentralized applications. While there are now other smart-contract blockchains, Ethereum was the first.

Is ETH worth buying now?

Yes, Ethereum is worth buying now. It has strong utility, expanding use cases, and a clear development roadmap.

What is the peak price of ethereum?

Ethereum’s all time high price is $4356.