LEO Token Price Data

The live LEO Token price today is $5.760000 with a 24-hour trading volume of $1,427,214.

We update our LEO to USD price in real-time. The price of LEO Token has changed 0.6% in the last 24 hours.

Currently, LEO Token is the #24 largest cryptocurrency by market cap, with a live market cap of $5,337,893,025.00. It has a circulating supply of 926,549,697 LEO coins but the maximum supply is not available.

See where to buy LEO Token or use our LEO Token Profit Calculator to calculate and track the performance of your investment.

LEO at a glance

The LEO token is a utility token that is used to redeem rewards and claim special offers in the Bitfinex ecosystem. Investors also get discounts on transaction fees as well as credit fees.

A Beginner’s Guide to LEO

What is LEO Token?

LEO Token, short for UNUS SED LEO, is a cryptocurrency that has gained prominence in the blockchain and cryptocurrency space.

LEO was created as part of the iFinex ecosystem. It serves various purposes within the ecosystem, including providing liquidity and offering incentives to traders and holders.

iFinex, considered one of the largest companies in the crypto industry, is known among other things as the owner of Bitfinex, one of the largest crypto exchanges by trading volume, and the founder of the world’s largest stablecoin Tether (USDT).

LEO was developed exclusively for Bitfinex, making its application limited to Bitfinex. Thus, LEO is similar to BNB – the in-house cryptocurrency of Binance.

“This token is a utility token that gives holders access to special rewards or promotions. First and foremost, it can benefit those who want to get the most out of the Bitfinex trading platform and thus actively participate in the events in the ecosystem at the same time.” – LEO founding team

What Determines the Price of LEO Token?

As with all other cryptocurrencies, the price of LEO is determined by supply and demand dynamics in the crypto market: The more capital flows into the coin, the higher its price.

However, what sets LEO apart from other cryptos, establishing it as a potentially attractive investment, is the fact that LEO is bought back from investors on a daily basis, driving up its value.

This process is called token burn. iFinex has committed to buy back and burn coins worth at least 27% of iFinex’s consolidated net revenue from the previous month each month. According to the consolidated reports, the company was able to raise more than $1 billion between 2017 and 2019.

LEO Price Prediction

The community behind LEO Token is strong and consequently believes strongly in the future of the project.

This is also evidenced by the fact that the token was still able to record price increases for several months after the onset of the bear market (towards the end of 2021) despite the falling prices of other cryptos.

According to Price Prediction, LEO expects a successful future with stable value growth, so it could even be a triple-digit value per coin in 2032.

Digital Coin Price, however, takes a slightly more conservative approach, estimating that UNUS SED LEO could trade for $73 per coin by 2032, making it an attractive long-time investment prospect.

Towards the end of 2021, iFinex entered into a partnership with the government of El Salvador, through which the crypto company committed to helping the Central American nation adopt Bitcoin.

The LEO Token holds significant potential, primarily due to its direct association with iFinex or Bitfinex. However, it’s hard to accurately predict the future prospects of LEO.

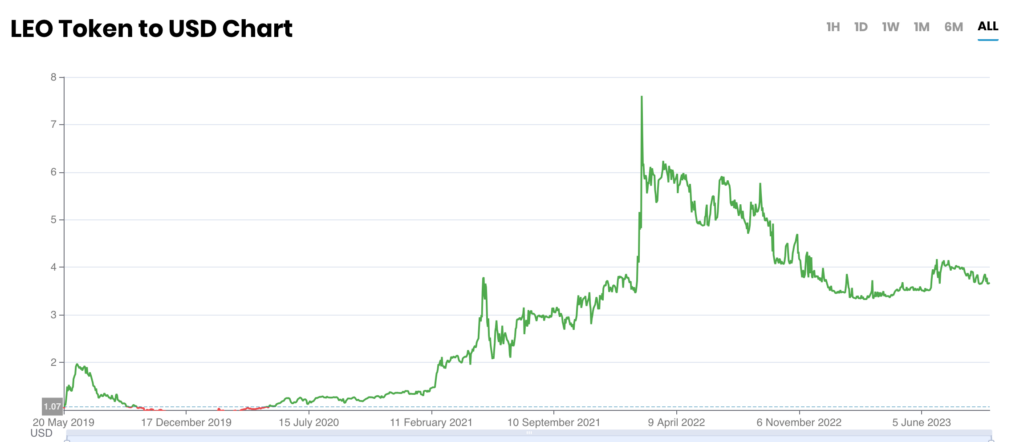

LEO Token Price History

LEO Token made waves in the crypto community shortly after its launch in May 2019, quickly raising over $1 billion in record time.

In mid-2022, amidst the unexpected downturn of LUNA and UST, UNUS SED LEO managed to leverage the situation to its advantage, registering notable price gains during this period.

Even in the face of declining Bitcoin prices, LEO demonstrated impressive price stability for an extended period.

How LEO Token Works

The LEO Token operates on the Ethereum blockchain as an ERC-20 token.

UNUS SED LEO was offered in an Initial Exchange Offering (IEO) in May 2019 and was able to secure $1 billion in additional investment for the company within the first week.

At the same time, the whitepaper was also published, detailing how LEO Token works and the benefits potential holders can enjoy.

How much owners get rewarded depends on how many tokens they possess. The rewards program is divided into 3 levels in terms of trading fees:

| LEVEL 1 | LEVEL 2 | LEVEL 3 | |

|---|---|---|---|

| REQUIREMENT | Token worth at least 1 USDT | Token worth at least 5,000 USDT | Token worth at least 10,000 USDT |

| FEE DISCOUNT | |||

| Crypto → Crypto | – 15 % (Taker Fee) | – 25% (Taker Fee) | – 25% (Taker Fee + up to 6 bps) |

| Crypto → Stablecoin | – 15 % (Taker Fee) | – 25% (Taker Fee) | – 25% (Taker Fee + up to 6 bps) |

| Crypto → Fiat | – | – 10 % (Taker Fee) | – 10% (Taker Fee + up to 6 bps) |

| Crypto → Derivative | – | – | Up to 0.5 bps /1.5 bps (Maker Fee + Taker Fee) |

What is LEO Token Used For?

LEO Token was created as a result of several security breaches and controversies the crypto exchange had suffered over the years.

In August 2016, Bitfinex experienced a significant security breach, marking the largest hacking incident in Bitfinex’s history. Although the stolen cryptocurrencies, (almost 120,000 BTC), have since been recovered, the identity of the individuals or groups responsible for the attack remains undisclosed.

In recent years, the relationship between Bitfinex and Tether has been increasingly questioned, resulting in a notable penalty of $18.5 million that iFinex had to pay in February 2021.

The Hong Kong-based parent company was accused of failing to hedge the stablecoin with bank reserves, as well as unlawful transactions between the two companies to cover the exchange’s losses in 2017 and 2018.

Specific Uses of LEO Token

The LEO Token can be used for the following:

- LEO Token allows holders to enjoy special discounts in the iFinex ecosystem and get the most out of the trading platform.

- The token is also used to optimize the trading processes on the Bitfinex trading platform. This means that additional rights and benefits will be attributed to all holders of the coin.

- The capital raised in the Initial Exchange Offering is used by iFinex to improve the user experience and the products on offer, as well as to pay off existing debts. This guarantees the holders that this is a long-term sustainable project.

Who are the Founders of LEO Token?

LEO Token was launched by iFinex, which was established in 2012. iFinex, in turn, was founded by 3 people in Hong Kong:

- Giancarlo Devasini (CFO) – University of Milan

- Jan Ludovicus van der Velde (CEO) – National University of Taiwan

- Phil Potter (CSO*) – Yale University

* Resigned from the position in 2017

What Makes LEO Token Unique?

LEO Token distinguishes itself from other cryptocurrencies through its close integration with Bitfinex, one of the leading cryptocurrency exchanges globally.

Its unique features include discounted trading fees, token burns, and access to exclusive offerings. These factors contribute to its appeal and utility within the Bitfinex ecosystem.

How is LEO Token Secured?

LEO Token, like other cryptocurrencies, relies on the security of blockchain technology. Transactions are recorded on the Ethereum blockchain, which is known for its robust security.

Additionally, Bitfinex implements stringent security measures to protect user accounts and assets, ensuring the safety of LEO Token holders.