Polkadot Price Data

The live Polkadot price today is $6.770000 with a 24-hour trading volume of $295,642,380.

We update our DOT to USD price in real-time. The price of Polkadot has changed 2.18% in the last 24 hours.

Currently, Polkadot is the #17 largest cryptocurrency by market cap, with a live market cap of $9,176,570,831.00. It has a circulating supply of 1,354,250,365 DOT coins but the maximum supply is not available.

See where to buy Polkadot or use our Polkadot Profit Calculator to calculate and track the performance of your investment.

Polkadot at a glance

Polkadot is a multi-chain network designed to make blockchains interoperable. It does this by connecting parachains (special-purpose blockchains built for specific tasks) in a network that allows them to communicate with each other.

What Determines the Price of Polkadot?

Specific determinants of Polkadot’s price include market demand, trading volume, investor sentiment, and general conditions in the crypto market. Learn more here.

A Beginner’s Guide to Polkadot

What is Polkadot?

At its core, Polkadot is a multi-chain network that enables the seamless transfer of data and assets across multiple blockchains.

It serves as a bridge between different blockchains, allowing them to interoperate and share information securely. This unique architecture has earned Polkadot the reputation of being the “Internet of Blockchains.”

Launched in 2020, Polkadot is designed to address some of the fundamental limitations of earlier blockchain networks, making it an exciting project in the world of decentralized technologies.

The idea behind the Polkadot protocol is to let blockchains communicate with each other for seamless data flow without the need for any intermediate entities.

DOT is the native cryptocurrency of the Polkadot network.

What Determines the Price of Polkadot (DOT)?

The price of Polkadot (DOT) is influenced by a combination of factors that are common to most cryptocurrencies. Here are specific factors that impact the price of Polkadot:

- Adoption and Use Cases: The more projects and applications that are built on Polkadot, the higher its demand. A robust ecosystem with multiple use cases can drive up demand for DOT tokens.

- Technology and Development: Polkadot’s ongoing development, upgrades, and security measures can impact investor confidence. Strong development progress can result in a positive outlook for DOT.

- Market Speculation: As with many cryptocurrencies, speculation can play a significant role in price fluctuations. Traders and investors may buy and sell DOT tokens based on short-term price movements.

- Regulatory Changes: Regulatory developments and government policies regarding cryptocurrencies can have a substantial impact on the price and adoption of Polkadot.

Polkadot Price Prediction

With Bitcoin’s next halving scheduled for early 2024 and a market rally anticipated as a result of the event, Polkadot is likely to benefit from the rally.

While the opinions of analysts are varied on the probable future course of Polkadot, one thing they agree on is a positive outlook for DOT.

That said, note that it is difficult to forecast the future course of volatile assets. While a broad outlook can be forecasted (positive or negative), it is hard to make specific predictions.

Polkadot Price History

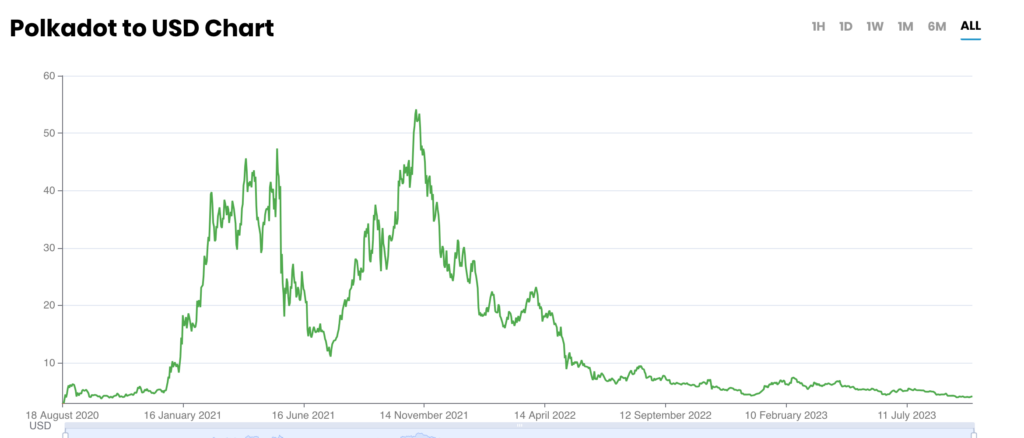

Since its launch, Polkadot has experienced significant price volatility, as is common in the cryptocurrency market. The price of DOT tokens has seen notable fluctuations, driven by market forces and developments within the Polkadot ecosystem.

Polkadot (DOT) has witnessed a rollercoaster journey since its inception. Launched in May 2020, the cryptocurrency quickly gained attention for its unique approach to interoperability and scalability in the blockchain space.

Here’s an overview of its price history:

- Early Days (2020): Polkadot made its debut in 2020 with a relatively modest price, trading at around $2 to $3 in the months following its launch.

The early days were marked by enthusiasm in the crypto community, as Polkadot aimed to address fundamental challenges in the blockchain ecosystem.

- Bullish Momentum (Late 2020 – Early 2021): As interest in decentralized finance (DeFi) projects surged, Polkadot’s value started to climb.

By the end of 2020 and into early 2021, DOT experienced a significant price surge, reaching $30 per token.

This uptrend was partly driven by the anticipation of the Polkadot mainnet launch and the growing demand for blockchain interoperability solutions.

- Mainnet Launch and Market Volatility (2021): The official launch of Polkadot’s mainnet parachain auctions in 2021 brought further attention to the project.

Like most cryptocurrencies, DOT was hit by the market crash of 2021 (that stretched into 2022) causing it to lose significant chunks of its value.

- Stabilization and Growth (2022 – Present): DOT has since stabilized and demonstrated steady growth throughout 2022 and beyond.

As more parachains and decentralized applications (dApps) join the Polkadot ecosystem, the network’s utility and value proposition will continue to expand.

- Future Prospects: While it’s impossible to predict the future with certainty, Polkadot’s technical capabilities and unique position in the blockchain landscape make it an intriguing project to watch.

It’s important to note that the cryptocurrency market is highly dynamic, and influenced by myriad factors, including market sentiment, technological advancements, and regulatory changes. Hence, you can’t depend solely on the past to predict the future.

How Polkadot Works

Polkadot’s innovative design revolves around its parachain and relay chain architecture. Here’s a simplified explanation of how it works:

- Relay Chain: The core of Polkadot is the relay chain, which coordinates and secures the entire network. It validates transactions and ensures the overall integrity of the system.

- Parachains: These are individual blockchains that connect to the relay chain. Each parachain can have its own unique characteristics, consensus mechanisms, and applications. Parachains can interact with each other through the relay chain, creating a network of interoperable blockchains.

- Bridges: Polkadot can also connect to external blockchains or networks through bridge mechanisms, expanding its connectivity and functionality.

- DOT Tokens: The native cryptocurrency of Polkadot, DOT tokens, are used for various purposes within the network, including staking, governance, and bonding to secure parachain slots.

What is Polkadot Used For?

Polkadot has a wide range of use cases, thanks to its interoperable and scalable nature. Some common applications and use cases of Polkadot include:

- Decentralized Finance (DeFi): Polkadot hosts numerous DeFi projects that leverage its multi-chain structure for improved scalability and efficiency.

- NFTs (Non-Fungible Tokens): The platform is used to create and trade NFTs, enabling artists and content creators to tokenize their digital assets.

- Supply Chain Management: Polkadot’s transparency and security features make it suitable for supply chain tracking and verification.

- IoT (Internet of Things): Polkadot’s capacity for handling data from various sources makes it a viable choice for IoT applications.

- Cross-Chain Communication: Its main use case is facilitating communication and data transfer between different blockchains and networks.

Who are the Founders of Polkadot?

Polkadot was co-founded by Gavin Wood, one of the co-founders of Ethereum, and Robert Habermeier, a blockchain researcher with a strong background in computer science.

The project’s founding team comprises notable figures in the cryptocurrency and blockchain space. Let’s take a closer look at the key founders of Polkadot:

Dr. Gavin Wood: Dr. Gavin Wood is one of the most prominent figures in the blockchain space and serves as the co-founder and lead architect of Polkadot.

Prior to his involvement with Polkadot, Dr. Wood was a co-founder and the Chief Technology Officer (CTO) of Ethereum, where he played a central role in designing and developing the Ethereum Virtual Machine (EVM) and Solidity programming language.

His deep understanding of blockchain technology and smart contract development paved the way for the creation of Polkadot, a project aimed at addressing the scalability, interoperability, and governance challenges faced by blockchains.

Robert Habermeier: Robert Habermeier is another key co-founder of Polkadot and has played an instrumental role in the project’s technical development.

Before co-founding Polkadot, he was involved in various blockchain research initiatives and contributed to the development of Ethereum.

Robert’s expertise in consensus mechanisms and blockchain interoperability has been integral to the success of Polkadot.

Peter Czaban: Peter Czaban is a co-founder of Polkadot and has a background in mathematics and computer science.

He has been actively involved in the development and governance of Polkadot, helping shape its innovative approach to parachains and cross-chain communication.

What Makes Polkadot Unique?

Polkadot’s uniqueness lies in its ability to solve several critical challenges facing the blockchain industry:

- Interoperability: Polkadot enables different blockchains to communicate and share data seamlessly, fostering collaboration and innovation.

- Scalability: Its multi-chain architecture allows for the parallel processing of transactions, increasing the network’s throughput.

- Governance: Polkadot’s governance model empowers token holders to make decisions and upgrades through a decentralized process.

- Security: The platform utilizes a robust consensus mechanism and bonding system to ensure the security of its parachains.

How is Polkadot Secured?

Polkadot employs a security model based on a shared relay chain and the Proof-of-Stake (PoS) consensus mechanism. Here’s how Polkadot ensures security:

- Nominated Proof-of-Stake (NPoS): Validators are selected through a Nominated Proof-of-Stake mechanism, with token holders nominating trustworthy validators to secure the network.

- Slashing: Validators are economically incentivized to act honestly through a slashing mechanism that penalizes malicious behavior.

- Collators: Collators collect and validate transactions for parachains, adding another layer of security.

- Governance: Polkadot’s on-chain governance allows token holders to participate in decision-making and security-related matters.

This multi-layered security approach makes Polkadot resilient against various types of attacks and ensures the integrity of its network.