Solana Price Data

The live Solana price today is $134.140 with a 24-hour trading volume of $5,112,329,022.

We update our SOL to USD price in real-time. The price of Solana has changed -5.06% in the last 24 hours.

Currently, Solana is the #5 largest cryptocurrency by market cap, with a live market cap of $59,920,384,008.00. It has a circulating supply of 446,702,592 SOL coins but the maximum supply is not available.

See where to buy Solana or use our Solana Profit Calculator to calculate and track the performance of your investment.

Solana at a glance

Solana is a high-performance blockchain platform renowned for its lightning-fast transactions, low costs, and support for DeFi, NFTs, and Web3 applications. Solana is backed by a unique Proof-of-History mechanism.

What is Solana?

Solana is a blockchain network that has quickly risen to prominence as a robust platform supporting smart contracts and decentralized applications (dApps). What sets Solana apart is its lightning-fast transactions and low costs.

At the heart of Solana’s allure lies its fast transaction processing speed. With the capability of processing up to 65,000 transactions per second, Solana outpaces many of its contemporaries by a significant margin.

This exceptional speed is accompanied by low transaction costs, making Solana an attractive choice for both users and developers.

What Determines Solana (SOL) Price?

The price of Solana (SOL) is subject to a range of dynamic factors that collectively shape its market value. Here are some of the factors that influence Solana’s price:

- Supply and Demand Dynamics: Like any asset, the fundamental principle of supply and demand plays a pivotal role in determining Solana’s price. For example, if demand wanes or there’s an oversupply, the price may experience downward pressure.

- Market Sentiment: Cryptocurrency markets are inherently influenced by sentiment. Positive news, partnerships, technological advancements, and endorsements can propel SOL’s price upwards, while negative events or regulatory concerns can lead to price declines. Traders’ emotions and market perceptions significantly impact short-term price movements.

- Technological Developments: The progress of Solana’s technology and its ecosystem can significantly impact its price. Upgrades, enhancements, and successful implementation of new features can attract attention and investment, positively affecting SOL’s valuation.

- Network Activity: The level of activity on the Solana network, measured by the number of transactions and the usage of decentralized applications (dApps), can influence the price. High network activity may signify increased adoption and utilization, potentially leading to upward price movement.

- Overall Market Trends: The broader cryptocurrency market trends can impact Solana’s price. During bullish market phases, where most cryptocurrencies experience price appreciation, SOL might also see upward movement. Conversely, during bearish trends, SOL could face downward pressure.

- Regulatory Environment: Regulatory developments and announcements related to cryptocurrencies can significantly influence market sentiment and Solana’s price. Positive regulatory news can boost confidence, while adverse regulations can lead to price declines.

- Market Manipulation: Cryptocurrency markets can be susceptible to manipulation due to their relatively low liquidity compared to traditional financial markets. Manipulative trading practices, such as “pump and dump” schemes, can temporarily distort Solana’s price.

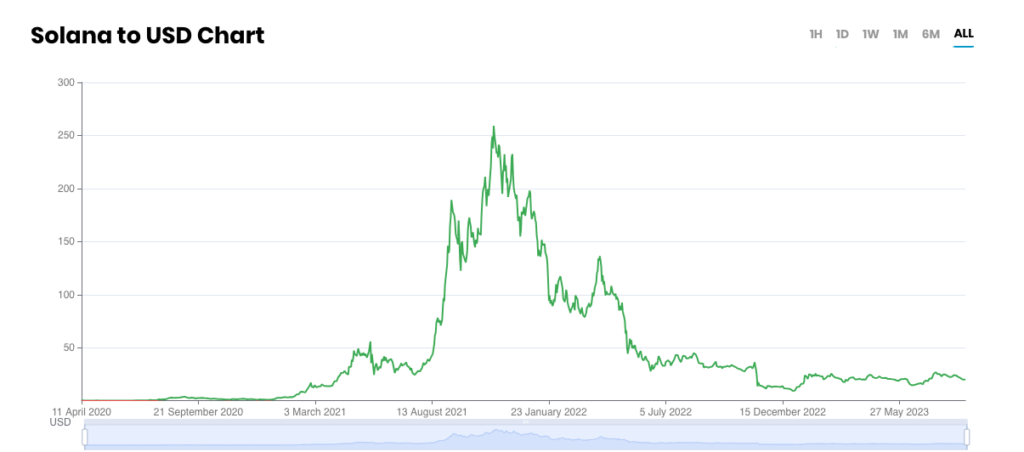

Solana Price History

As a relatively new cryptocurrency, Solana doesn’t boast an extensive historical record. However, its brief trajectory unveils intriguing patterns, strongly tied to the movements of cryptocurrency titans like Bitcoin and Ethereum.

Let’s take a closer look at some pivotal moments in Solana’s price history:

- April 2020 – A Humble Start: Public trading commences on the Solana blockchain, with SOL trading under one dollar.

- September 2020 – Early Surges: Solana reaches its initial peak within its first price rally, hitting $4.02.

- November 2021 – Historical Heights: Solana achieves an all-time high price of $224.42. This remarkable milestone catapults Solana into the spotlight and showcases its potential.

- April 20 2022 – Below the Century Mark: Solana’s price temporarily drops below the $100 mark.

- 2023 – Rebound and Consolidation: Over the course of 2023, SOL experienced a slight rebound in price, going from under $10 to over $20.

While the events in Solana’s price history offer insights into the interplay between market forces and its valuation, they’re not infallible indicators of future performance.

The cryptocurrency landscape is shaped by a multitude of factors, including technological developments, market sentiment, regulatory shifts, and broader economic trends.

How Solana works

Solana (SOL) operates as a dynamic blockchain that shares some similarities with Ethereum but distinguishes itself through its unique consensus mechanism, leading to exceptional transaction speed and cost efficiency.

At the core of Solana’s architecture is the ingenious Proof-of-History (PoH) mechanism, working in harmony with the underlying Proof-of-Stake (PoS) consensus.

This integration introduces a groundbreaking way to validate transactions without the need for extensive information exchange between network nodes. Imagine each node having its own cryptographic clock. As transactions occur, this clock timestamps them.

Unlike conventional methods where nodes communicate extensively to verify transaction validity, Solana leverages these timestamps to effortlessly establish consensus on the order of transactions. Recursive calculations are employed to synchronize nodes, where each result informs the subsequent calculation, creating a rhythm that all validators follow.

This synchronized rhythm, powered by Proof-of-History, is the foundation for Solana’s high-speed, low-cost transactions.

By eliminating the need for continuous timestamp broadcasting, the network becomes remarkably efficient, achieving speeds of up to 50,000 transactions per second.

What is Solana used for?

Here are some things Solana is used for:

- Lightening Fast Blockchain: Solana proudly claims the title of being one of the most efficient blockchains on the market. This distinction stems from its groundbreaking technology, which boasts the remarkable ability to process tens of thousands of transactions per second.

To put this in perspective, Solana outpaces its notable competitor, Ethereum, by a substantial margin. Ethereum, with its current structure, manages around 30 transactions per second at best. The speed difference is palpable and positions Solana as a true powerhouse in the blockchain realm.

In fact, Solana’s rapid and secure transaction processing rivals the swiftness of traditional fiat money transfers. With the capability to process transactions more swiftly than Visa’s 24,000 transactions per second, Solana is setting new standards for transaction speed in the digital age.

- Cost-Effective Blockchain: Solana extends its advantages to cost-effectiveness. Transactions on the Solana blockchain are often priced at less than a cent.

- DeFi Applications: The high-performance nature of Solana’s blockchain, combined with its cost efficiency, positions it as an appealing platform for DeFi developers. The integration of smart contracts and the ability to launch custom tokens on Solana’s network make it a strong competitor against Ethereum in the DeFi space.

- NFTs: Solana’s blockchain supports the creation and trading of NFTs, offering a low-cost alternative to Ethereum’s more established presence in the NFT market. The affordability factor, coupled with Solana’s technological prowess, makes it a compelling choice for artists, collectors, and creators.

Who is the Founder of Solana?

Solana was founded by Anatoly Yakovenko, a Russian software engineer. Yakovenko was born in Moscow, Russia, in the late 1970s.

In 2013, Yakovenko delved into the potential of blockchain technology and its myriad applications. An early adopter of cryptocurrencies like Bitcoin and Ethereum, he recognized the transformative power of blockchain to reshape data storage and transfer methods.

In the same year, Yakovenko founded BitFury, a startup focusing on Bitcoin. Beyond BitFury, he has been actively engaged in numerous blockchain projects.

Yakovenko’s journey eventually led to the establishment of Solana, a platform designed to address the limitations of existing blockchains.

What makes Solana unique?

Solana distinguishes itself as a trailblazing blockchain, showcasing remarkable attributes that set it apart from its peers.

Here are exceptional aspects that define Solana’s uniqueness:

- The Speedster of Blockchain: Solana processes around 5,000 transactions per second during regular usage. It is capable of supporting up to 65,000 transactions per second.

- Cost-Effective Transactions: One of Solana’s standout features is its cost-effectiveness. With an average transaction fee as low as $0.00025, Solana brings affordability to the forefront of its design.

- NFT Revolution: Solana isn’t just about speed and cost-effectiveness—it’s also a platform for creativity. Supporting the creation and trading of NFTs, Solana unlocks possibilities for digital artists and collectors.

- Unique Consensus Mechanism: At the heart of Solana’s architecture lies the distinct “Proof-of-History” consensus mechanism. This innovative approach, unlike any other in the crypto landscape, enhances the platform’s efficiency and minimizes energy consumption.

How is Solana secured?

Solana takes a multifaceted approach to security. Here are key parts of Solana’s security:

- SPL Protocol: At the heart of Solana’s security lies the SPL (Solana Program Library) framework. SPL mirrors Ethereum’s ERC-20 token standard and provides a structured framework for creating and managing tokens on the Solana blockchain.

This consistency allows developers to implement token-related functionalities while adhering to established norms, enhancing both security and usability.

- Proof-of-Stake (PoS) Consensus Mechanism: Solana’s security architecture relies on a PoS consensus mechanism. Unlike traditional Proof-of-Work models that demand energy-intensive computations, PoS empowers validators to secure the network by staking a certain amount of cryptocurrency as collateral.

- Decentralization and Validators: Solana’s security architecture encourages decentralized participation. Token holders have the opportunity to become network validators, further reinforcing the democratic and collaborative nature of the platform.

This collective effort to validate transactions safeguards the network against malicious activities and centralization risks, fostering a secure and trustworthy environment for all participants.

FAQs

What is Solana, and how does it compare to Ethereum?

Solana is a blockchain network that supports smart contracts and decentralized applications (dApps), offering high efficiency and speed. It competes with Ethereum in features, boasting the ability to process up to 65,000 transactions per second compared to Ethereum’s 30 transactions per second.

How cost-effective are transactions on the Solana blockchain?

Transactions on Solana’s blockchain are notably affordable, with fees often less than a cent and sometimes even lower. This is a stark contrast to other blockchains where fees can range from tens of cents to several dollars.

Can Solana be used for creating and trading NFTs?

Solana supports the creation and trading of NFTs (Non-Fungible Tokens). NFTs, which represent unique digital assets, such as artwork, can be created and traded on Solana’s blockchain, offering an attractive alternative to the more established Ethereum NFT market.

What is SOL, and how is it utilized on the Solana network?

SOL is Solana’s native cryptocurrency and acts as a utility token within the network. It is used to pay transaction fees and interact with smart contracts on the Solana blockchain. Additionally, SOL token holders can become network validators.

What are the key benefits of Solana for DeFi applications?

Solana’s high transaction speeds, low costs, and support for smart contracts make it an attractive platform for DeFi (Decentralized Finance) applications. Developers can leverage Solana’s efficiency to create peer-to-peer lending platforms, decentralized exchanges, and more within the DeFi space.