How Much Money Is Enough – According To Research

- December 26, 2023

- 6 min read

-

11400 reads

How much money is enough? Well, that’s a question we have all asked ourselves at one point. Here’s what the research says.

How much money is enough to have a comfortable and enjoyable life without a financial burden weighing over our heads?

How much you thought you needed a few years ago may be much higher than what you realize you need now.

How Much Money Is Enough According to Research?

They say that money can’t buy happiness, but research would suggest that it might actually can.

So, how much money do you need to live?

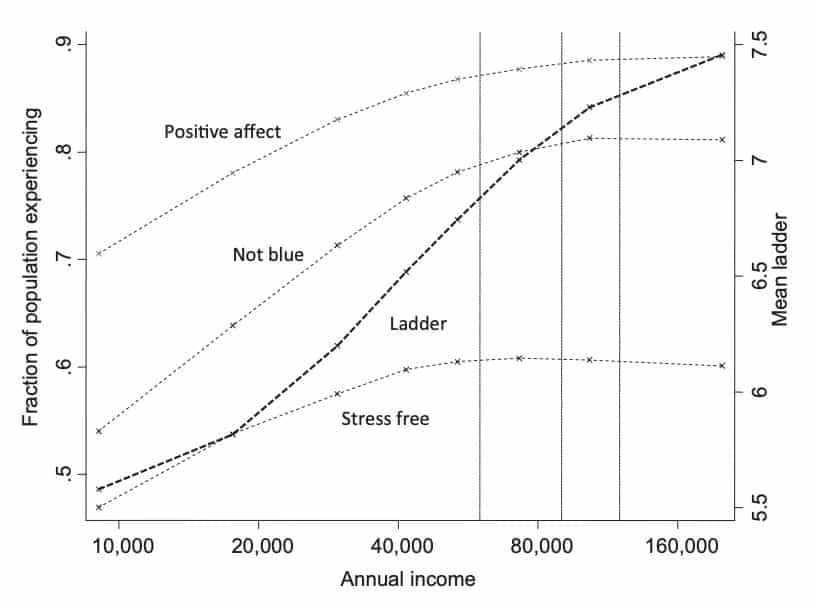

In 2010 D. Kahneman and A. Deaton conducted a study hoping to see if income affects emotional wellbeing and personal life evaluation.

As scientists do, they broke down emotional wellbeing into measurable categories such as joy, stress, sadness, anger, and affection as indicators of what makes your life enjoyable or not.

Personal life evaluation referred to the way someone thinks about their life.

What was interesting was the study found as household incomes increased stress, feeling blue, sadness, and worry (which are all parts of emotional wellbeing) decreased.

The study discovered a sweet spot where emotional wellbeing and personal life evaluation peaked, $75,000 gross annual income.

They found that income above $75,000 did not increase wellbeing anymore and began to level off, indicating that higher incomes did not improve the happiness or quality of life for their sample group.

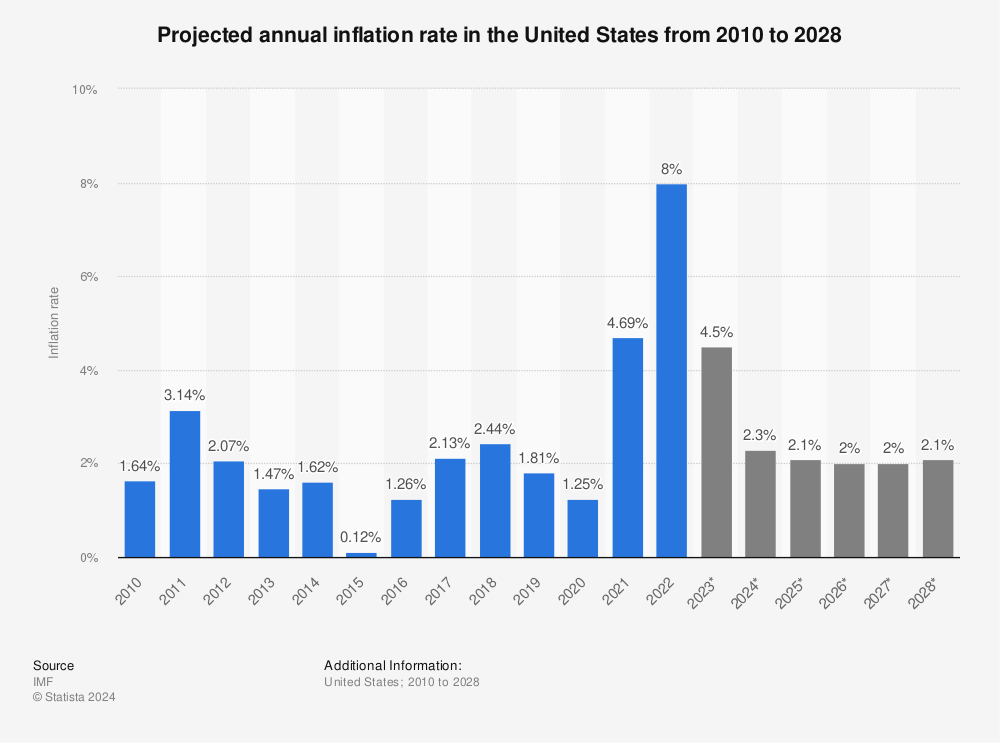

Now it’s important to remember that this study was conducted a decade ago. Since then, the economic climate and inflation have changed.

Inflation has risen 18.33% over the last 10 years. Therefore, it’s not a stretch to suggest that the sweet spot for income to peak our happiness is around 18.33% higher than the $75,000 10 years ago.

It is fair to say that an optimal income would be about $88,747.50 in today’s financial climate (yes, I’m sure that 50 cents will make all the difference to your life)

Find more statistics at Statista

How Much Money Is Enough To Live?

So, how much money is enough? Should we trust research?

Although the previously mentioned study gives us a guide on how much we need to live at our peak level of happiness and comfort, it is important to note that every state is different.

Taxes and living costs vary considerably from state to state. If you live in New York City, obviously earning $88,000 a year is going to get you a much smaller lifestyle than if you earn that amount in Houston, Texas.

A cost of living calculator can help you figure out how much income you need in another state to have the same level of living you have now in your home state.

What Is A Good Salary?

A good salary is one where you can afford to save for retirement, pay off a mortgage, cover all needed expenses, and have a little leftover for a few wants.

It is also earning that income within a time period that leaves you a little time to spend with friends and family and enjoy things that are not income-focused.

If $88,000 is now your new income goal, then start to consider ways to increase your income. Whether it be a side hustle or upskilling with night classes, investing in your skillset will pay dividends in your future.

It will also increase your self-confidence and open up new opportunities.

How To Earn More Money Without More Stress?

It may be a good time to figure out how much money is enough money for you to have a comfortable and enjoyable life.

It can be challenging to find more money without finding the stress and pressure that goes along with it.

Data from the Gallup World Poll results indicated that Americans are stressed out. I mean, really stressed out! In fact, we rank 5th in the highest stress levels out of 151 countries.

It’s not what you make; it’s what you save

– Dad.

Consider renovating your budget to work out how much more income you need to reduce your stress levels. Then consider all the opportunities you are interested in that could increase your income.

You can find out more about the cost of living here.

Do you think $88,000 is the peak income of happiness in the US? Comment below.

How much money is enough for retirement?

How much you need to retire depends on a number of factors:

- Your current lifestyle versus the kind of life you want to live after retiring

- Your current age versus the age you want to retire

- Anticipated returns from your investments

- Alternative sources of income

How much money is enough to live comfortably?

According to research by Daniel Kahneman and Angus Deaton, the sweet spot where emotional well-being and personal life evaluation peaked was $75,000 gross annual income.

How much is considered rich?

According to a survey conducted by Schwab, Americans believe it takes a personal net worth of $1.9 million to be considered rich.

How do you know how much money is enough?

It depends on where you live. You can use a cost of living calculator to estimate how much money you need to live in a particular state.

Sources

- Princeton Universityaccessed on August 19, 2021