What is an Adjustable Rate Mortgage?

An adjustable-rate mortgage (ARM), also known as a variable rate mortgage or a floating mortgage, is a type of mortgage where the interest rate on the loan may change throughout the term of the loan.

The interest rate will initially be locked in for a set period. After that, the rate will intermittently be reset for the remainder of the loan.

There are limits on how much the interest rates can rise per year on an adjustable mortgage rate, giving the borrower some stability and assurance that they can afford to make the repayments.

Adjustable-rate mortgages or ARMs are useful financial tools that you can use to avoid overpaying for your home loan.

How Does an Adjustable-Rate Mortgage Work?

You may have seen terms like 7/1 ARMs or 2/28 ARMs when looking at adjustable-rate mortgages. What does this mean?

For a 7/1 ARM, it means that the loan will have a fixed rate for 7 years. After that, the loan updates to a variable rate that adjusts every year for the rest of the mortgage term.

Similarly, a 2/28 ARM will have an interest rate that is fixed for 2 years. Then the interest rate will be floating for the remaining 28 years of the 30-year mortgage.

Borrowers often ask, “what is an advantage of an adjustable-rate mortgage?” The answer is simple: it generally offers lower interest rates than fixed-rate mortgages.

An easy way to understand how the interest rate structure of an ARM works is shown below:

(Years of fixed-rate / Years adjustable-rate)

Who Should Get An Adjustable Mortgage?

An adjustable mortgage would benefit those that want to pay down their mortgage in a shorter period of time.

There is a chance with a floating rate that you will pay off more interest per repayment than with a fixed loan which means you may pay off your home faster.

The security of a fixed-rate mortgage comes at a significant cost when compared with ARM loans, especially when you consider that most people either refinance or move before paying off their mortgage according to the National Association of Realtors.

This cost comes in the form of higher interest rates and monthly payments.

You could be paying for 15 or even 30 years of interest rate security that you only use for 5 years!

Maximizing Savings While Minimizing Risk

It’s no secret that ARM loans generally have lower interest rates than their fixed-rate counterparts.

The shorter the initial fixed-rate period, the more favorable the interest rate.

This is why it makes financial sense to choose an ARM product based on your long-term goals for the home. Consider these scenarios:

- Will you be selling the home in six years when your youngest child leaves for college? Then a 7/1 ARM could give you rate and payment stability while you need it, without the higher interest rate for a 30 year fixed-rate loan.

- Will you be refinancing at a planned point in the future when your credit has improved? If your credit rating is only mediocre when you take out the loan, but you have a plan to improve it over the next three to four years, then a 5/1 ARM could be a benefit. The payment savings over a 30 year fixed-rate loan could be used to pay down other debts and boost your FICO scores.

- Will you be nearing retirement in 15 years and want to be mortgage-free? Then a shorter term fixed-rate loan could be the best option for you, rather than an ARM. If you intend to make every payment, from the first to the last, and own the home free-and-clear, the added security of a fixed rate loan just might be worth the cost.

Leveraging Your ARM to Pay Your Home Off Sooner

If you really want to ‘flex your ARM’, then use the payment savings from the lower interest rate to pay your home off sooner.

As long as your loan doesn’t have a prepayment penalty, making extra payments to the principal balance can save you thousands of dollars of interest.

Consider this example:

The principal and interest payment on a 5/1 ARM for $300,000 at 4.0% is $1,432.25 and on a 30-year fixed at 4.5% is $1,520.06.

If you applied the difference of $87.81 to your principal balance for just five years (the fixed period on a 5/1 ARM), your new principal balance would be $265, 520.83 versus $273,473.75 for the 30-year fixed-rate loan.

Test out your own scenario using our loan calculator.

Understanding Market Cycles and Planning to Refinance

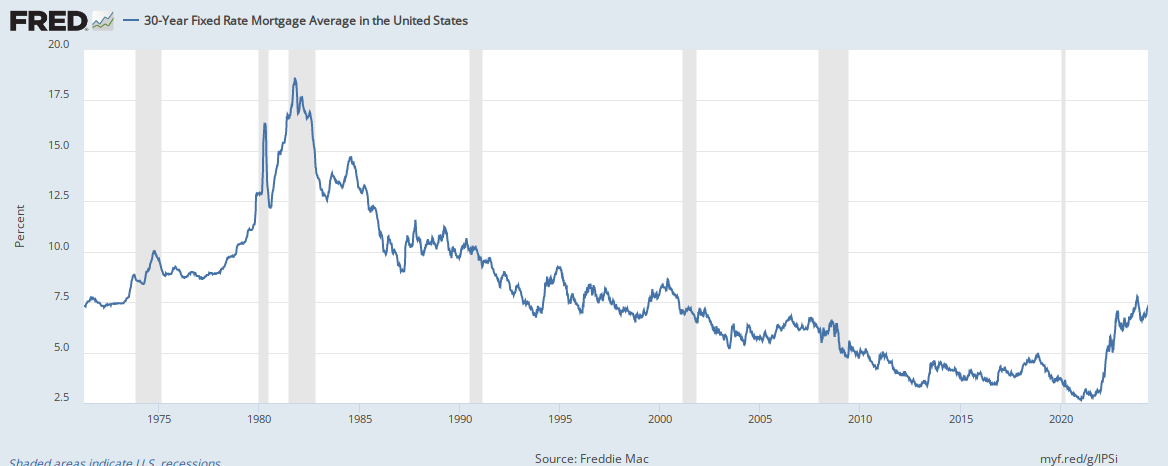

In the U.S., the highs and lows of mortgage interest rates are historically cyclical — rising and falling over time with changes in the housing market, stock markets, and other economic factors.

Since the 1980s, the prevailing trend has been towards lower and lower rates.

In an effort to not stall economic growth, the Federal Reserve has been cautious and calculating lately about monetary policy and rate adjustments to the target federal funds rate.

Here are a few of the adjustable rate mortgage pros and cons:

Pros of Adjustable-Rate Mortgages

- Frequently lower rates than fixed-rate mortgages

- Potentially pay off more principal per payment

- You are paying a market rate based on the index for your money ensuring you are not paying more than the current market value.

Repayment amounts will vary

There is a chance interest rates will rise over time

Principal repayments will vary

Cons of Adjustable-Rate Mortages

By paying attention to market trends, and being prepared to refinance when the market is favorable, you can “re-ARM” your loan — resetting the fixed-rate period — when it’s advantageous and attempt to wait out the market if it’s not.

With firm interest rate caps in place on ARM loans nowadays, the potential for payment shock due to a rapidly increasing rate market is mitigated.

Now that you know what is an adjustable rate mortgage and its pros and cons, you can apply for a mortgage online.

FAQs

What does adjustable rate mean in mortgage?

Is adjustable rate mortgage ever a good idea?

What are the risks of an adjustable rate mortgage?

Sources

- Bankrateaccessed on July 20, 2022

- National Association of Realtorsaccessed on July 20, 2022

- Bankrateaccessed on July 20, 2022