Best Online Payday Loans for Fast Cash & Easy Approval

Payday loans are designed for emergencies or unexpected expenses.

They require only proof of identification, income and a bank account, and are tailored to borrowers with poor or no credit history in times of urgent financial need.

Roughly 32,850 Americans opt for them every day and with such a high demand, it’s no surprise the list of payday loans is endless.

So which is the best payday loan option when you need cash fast and your credit score is far from perfect?

Here is where Financer.com can help you.

Our team has dedicated over 30 hours to meticulously review and filter through a long list of online payday lenders and alternatives.

In this article, you will learn:

- Which are our top 6 picks for payday loan companies?

- How do payday loans work and what to watch out for?

- What do you need in order to qualify for a payday loan?

- Plus, what are some valuable alternatives to payday loans that could offer you safer financial routes?

Our goal is to help you make a decision that’s informed and safe.

Check our payday loan comparison, read our insider tips and see if you find a payday loan that helps you meet your emergency needs.

Payday loans could be expensive and risky. Their regulations vary greatly depending on the State you live in and financial experts recommend alternative lenders instead.

We’d like to advise you that payday loans should be treated as a last resort funding when all of your other options have been exhausted.

Payday loans have high fees and APRs and could easily trap you in a cycle of debt. Be careful and never take out a loan if you are unsure about its terms or your repayment ability.

This article is not a financial advise and should not be interpreted as such.

Comparing The Best Online Payday Loan Companies

Our team is constantly monitoring the market to keep this list of best payday loans up-to-date.

We research and evaluate all companies taking into account factors like terms, customer satisfaction and speed of service.

This guide has mostly filtered out the offers with APRs completely out of proportion but, please, keep in mind accessibility to fast funding with bad credit comes at a high cost.

| Lender | Best for | Loan amount | Est. APR | Loan term | Credit score |

| BadCreditLoans.com | 24/7 service | $500 – $10,000 | 5.99% to 35.99% | 3 months – 6 years | $1,000 limit for people with very low credit score |

| LowCreditFinance.com | 60-minute funding | $100 – $50,000 | 5.99% to 35.99% | Minimum 61 days | Good and bad credit accepted |

| Wizzay.com | Getting offers from wide net of lenders | $200 – $5,000 | 5.99% to 35.99% | 90 days – 24 months | Good and bad credit accepted |

| VivaPaydayLoans.com | Short repayment | $100 – $5,000 | 5.99% to 35.99% | 2 months – 24 months | Good and bad credit accepted |

| 5kfunds.com | Flexible repayment periods | $500 – $35,000 | 5.99% to 35.99% | 61 days – 72 months | Good and bad credit accepted |

| OppLoans.com | Alternative to payday loans | $500 – $4,000 | 160% to 180% | 9 months – 18 months | Bad credit score accepted |

Let’s dive into a bit more details about each option from this list of online payday loans and alternatives.

BadCreditLoans.com

Best for: 24/7 service and getting multiple offers with one application

Loan amount: $500 – $10,000

Est. APR: 5.99% to 35.99% APR

Loan term: 3 months – 6 years

Overview: BadCreditLoans.com is not a direct lender. Instead you fill out an application with them and they will match you with suitable offers in minutes.

The service is convenient because you fill out an application once and get to receive multiple offers from available lenders.

You can do this for free, there is no obligation to accept an offer and you get to compare real proposals tailored to your specific profile.

Importantly, BadCreditLoans.com offers more control over your personal data compared to many bad credit lenders. They provide options for customers to manage how their information is handled.

If you decide to use their services, it’s important to review their privacy policy for details on how to request that your data not be shared or sold. This feature gives an added layer of privacy and control, setting them apart in the market.

Free access to a large network of lenders

Service 24/7

No fees or obligations

No need for any collateral

Fast funding after approval

More control over personal data

Pros:

If you have a very low credit score you can’t borrow more than $1,000

Exact fees vary depending on the lender

Cons:

Eligibility criteria:

- Above 18 years old

- Proof of citizenship, such as a Social Security number, or legal residency

- Have a regular income

- Have a checking account in your name

- Provide work and home telephone numbers

- A valid email address

How long it takes to apply: 10-15 minutes

How to apply: You just need to go to their website and fill out the form.

Low Credit Finance

Best for: 60-minute funding

Loan amount: $100 – $50,000

Est. APR: 5.99% to 35.99% APR

Loan term: minimum 61 days

Overview: Similarly to BadCreditLoans.com, Low Credit Finance allows you access to a network of lenders that can offer a loan for slightly higher amounts according to your profile and needs.

This said, do not use this service if you are unsure of your repayment ability.

If you are approved and accept an offer, cash could be sent to you in 60 minutes.

Repayment terms are flexible and start at 61 days.

Free access to a large network of lenders

Suitable for borrowers with bad credit scores

Same working day payout if approved

Their customer service has good reputation

Pros:

Service is not available in Arkansas, Connecticut, New Hampshire, New York, Montana, South Dakota, Vermont, West Virginia, Indiana, and Minnesota

Accessibility comes with a higher cost. Avoid using this service for big amounts

Personal data will be sold to 3rd-parties

Cons:

Eligibility criteria:

- Above 18 years old

- Proof of citizenship, such as a Social Security number, or legal residency

- Have a regular income of at least $1,000 per month

- Have a bank account with direct deposit

- Proof of ID and residential address

How long it takes to apply: 10 minutes

How to apply: Get suitable offers by filling out their application form here.

Wizzay.com

Best for: Getting offers from wide net of lenders

Loan amount: $200 – $5,000

Est. APR: 5.99% to 35.99% APR

Loan term: 3 months – 24 months

Overview: Wizzay.com saves users time and hassle by connecting them with qualified lenders that can assist with their needs.

Fast Approval and Funding

Poor Credit Accepted

Pros:

High fees

Personal data will be sold to 3rd-parties

Cons:

Eligibility criteria:

- Be employed in your current position for approximately 90 days or have another source of adequate and predictable income;

- Be at least 18 years old

- Be a US citizen or a permanent resident;

- Have an income of approximately $1,000 per month;

- Have a valid email address, work phone number and home phone number.

How long it takes to apply: 10-15 minutes

How to apply: Fill out an application form on their website.

Viva Payday Loans

Best for: urgent small loans

Loan amount: $100 – $5,000

Est. APR: 5.99% to 35.99% APR

Loan term: 2 months – 24 months

Overview: Viva Payday Loans does exactly what it promises – it offers quick payday loans and is a suitable option for situations where you need small sums urgently.

It accepts all FICO scores but beware, accessibility comes with a higher price tag.

Make sure you’ll be able to repay the loan within the agreed term.

Approval decision in 2 minutes

Accepts all credit types

Short repayment Term Options

Pros:

Unlikely to receive low APR offer

High fees

Personal data will be sold to 3rd-parties

Cons:

Eligibility criteria:

- Be at least 18 years old;

- Be a US citizen or a permanent resident;

- Have a regular monthly income of at least $1,000;

- Have a bank account;

- Have a valid email address, work phone number and home phone number.

How long it takes to apply: 10-15 minutes

How to apply: You can apply by filling out an online form. An application decision will be sent to your email in as little as 2 minutes.

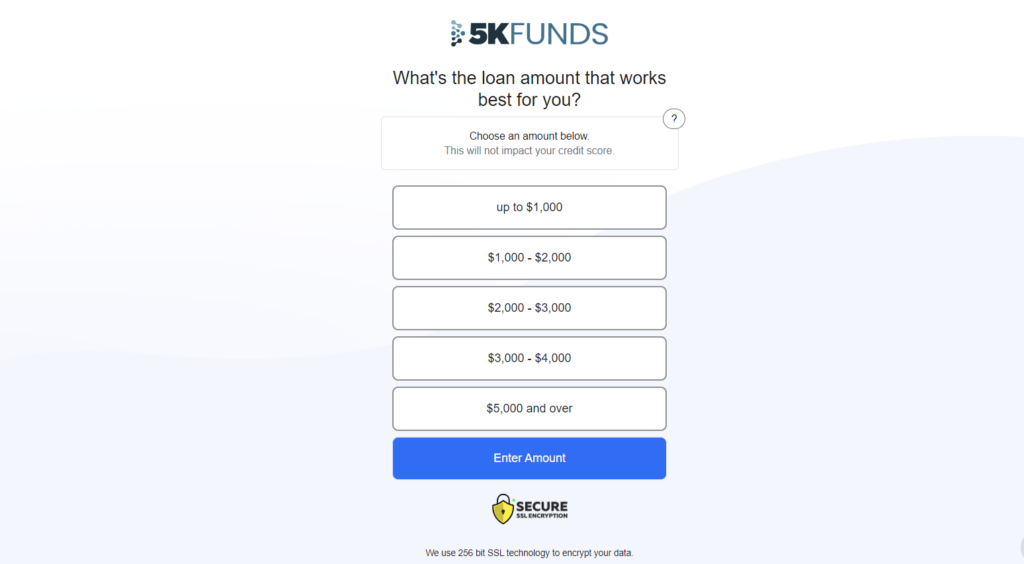

5kfunds

Best for: flexible repayment periods

Loan amount: $500 – $35,000

Est. APR: 5.99% to 35.99% APR

Loan term: 61 days – 72 months

Overview: 5kfunds.com caters to various financial needs like home improvements, car repairs, medical bills, or unexpected expenses.

Their services are best suited for individuals seeking a wide range of loan amounts with tailored repayment periods, ranging from 61 days to 72 months.

Like all other companies here, no credit check is performed and no collateral is required.

There are some geographical restrictions, though. See the table below.

All credit types are acceptable, no credit check

Simple and 100% free application process with a quick turnaround

Funding on the next business day

Pros:

Not available in NY, CT, VT, WV, AK, and GA

No online chat feature.

No toll-free helpline for assistance.

Cons:

Eligibility criteria:

- Be at least 18 years old;

- Be a US citizen or a permanent resident;

- Have a regular monthly income;

- Have an active bank account that accepts direct deposits;

- Have a valid contact number and an active email address.

How long it takes to apply: 10-15 minutes

How to apply: Applying for an offer is free and does not impact your credit score. All you need to do is fill out an application form on their website.

OppLoans

Best for: an alternative option to payday loans for quick funding

Loan amount: $500 – $4,000 (depending on your state of residency)

Est. APR: from 160% – 180%

Loan term: 9 months – 18 months

Overview: OppLoans is an online loans platform that offers funding to individuals who have lower credit scores and might not be able to get financing elsewhere.

It’s an alternative to payday loans, however, be mindful – APRs here are still quite high.

With OppLoans, there are no prepayment or originator fees and funding is sent within 1 business day. Their reputation on TrustPilot is surprisingly good, and same applies to the reviews left on our own web.

OppLoans also offers free money management courses that can help you improve you financial knowledge.

No minimum credit score

No prepayment penalties

Funding on the next business day

Free money management courses

Good online reputation

Pros:

Available in only 36 states

High APRs

Maximum 18 months repayment period

Cons:

Eligibility criteria:

- Be at least 18 years old (19 in Alabama and Nebraska);

- Have a bank account (checking account or saving account)

- Be a US citizen or a permanent resident;

- Have a regular monthly income;

- Receive income through direct deposit.

How long it takes to apply: 10 minutes

How to apply: Applying for a loan with OppLoans is free and does not impact your credit score. You can request an offer on their website.

How to compare payday loans?

When you’re in the market for payday loans, knowing how to compare offers is vital to securing a deal that won’t break your bank.

Here’s are some tips that will help you navigate this:

Check total repayment costs and APR

Consider a $500 payday loan with an APR of 400%.

If the loan term is one month, you would end up paying around $667 in total, which includes the original $500 and approximately $167 in interest and fees.

In contrast, a loan with a 200% APR would cost around $583 in total, comprising the original $500 plus about $83 in interest and fees.

This example illustrates how a lower APR can significantly reduce the overall repayment amount, even if the principal loan amount remains the same.

Compare lender fees and terms

Look beyond the APR to understand all the fees and terms.

Some lenders might have lower APRs but include additional fees not reflected in the APR, such as late payment fees or rollover charges.

Assess each lender’s reputation

Research each lender’s history and customer reviews. The experience of past clients will provide you with insights regarding the service and treatment you can expect from a company.

On Financer.com you can find real customer reviews as well as share your own experience.

Terms alignment

Consider how the loan’s repayment schedule aligns with your financial situation.

A longer-term loan might have a lower APR but could result in more interest paid over time.

Additionally, when you are in the market for a payday loan, there are some lenders it’s best you stay away from.

Here are Financer.com’s expert tips on how to spot them:

Verify if the financial service provider is licensed to operate in your state.

You can do this by checking the directory of the NMLS consumer access website.

Confirm if the company is easy to contact.

The company should list a phone number and an email address for easy reach.

Search for other customer reviews

You can look up the company online and see what other customers say about it. This could be tricky because borrowers who have had difficulties returning their debt are prompt to leave negative reviews. This is normal.

However, if there are no reviews whatsoever about a company, it’s best to stay away.

Check the quality of the website

Spelling mistakes or missing key pages like Terms and conditions might be signs for a suspicious activity.

When should you consider a payday loan?

Life happens and emergencies can catch any of us off guard.

While it’s no secret that payday loans are expensive and it’s generally advisable to avoid them, sometimes they might be the only option available.

Such scenarios could be:

When you need less or around $500 immediately.

Securing such small sums could be tough regardless of your credit score. Payday loans are a viable option.

When you have bad credit (or no credit history) and need quick cash.

In this case, other short-term options might be unavailable or even more costly, and payday loans could be the route to go.

If you require funds the same day.

Many payday loans offer funding within minutes, this is not true for most other financial options.

If you don’t have a regular salary.

Most payday lenders require proof of regular income but this is not limited to regular salary. It could also be from an alternative source of income like government benefits, alimony or rent.

When should you avoid payday loans?

If you find yourself in any of the following situations, it’s best to reconsider applying for a payday loan:

You have the opportunity to qualify for a more affordable alternative.

While payday loans are quick and accessible for those with less-than-perfect credit, there are cheaper, less risky alternatives if you have a fair credit score or can offer a collateral.

You live in a state where payday loans are illegal.

States like Arizona, Arkansas, District of Columbia, Georgia, Hawaii, New Mexico, North Carolina prohibit payday loans, so if you live in any of them and you find a payday loan option there, it’s likely from an unauthorized lender.

You’re facing continuous financial issues.

Payday loans are meant for short-term financial gaps. For ongoing financial challenges, it’s better to consult with a credit counselor for other solutions.

You already have an outstanding payday loan.

Rolling over a payday loan can lead to a debt cycle and excessive fees. If you’re struggling with repayment, credit counseling might be a better option.

You need to borrow more than $500.

Payday loan amounts usually max out around $500. For larger amounts, this type of loan might not be suitable.

You’re unsure about repayment.

Do not take a payday loan if you do not have the means for repayment.

Payday loan requirements: what do you need for a payday loan?

According to the Consumer Financial Protection Bureau, to be eligible for a payday loan, you generally need to:

Be at least 18 years old and have valid identification

Have an active bank, credit union, or prepaid card account

Show a proof of income from a job or other source

Additionally, some payday lenders may also request a Social Security number.

It’s important to note that not everyone who meets these basic requirements will be approved for a payday loan.

For example, lenders with annual percentage rates (APRs) above 36% are legally restricted from lending to individuals who are on active military duty, as well as their spouses and dependents.

Important

On July 7, 2020, the CFPB removed the requirement that payday lenders should assess a borrower’s ability to repay the loan, so approval now does not take into account the borrower’s true capability of repayment.How do payday loans work?

At first glance, payday loans offer a simple promise: quick cash when you need it most, often to be repaid by your next payday.

They typically range between $300 and $1,000, and states set their own limit on payday loan size.

For example, in Virginia the maximum amount is $2,500, while in California, it’s $300.

This said, there’s more beneath the surface.

Payday loans can escalate if not managed properly.

The lender verifies your income and bank account details.

You provide either a post-dated check or authorization for automatic deductions from your bank account.

The repayment of the loan is usually aligned with your next payday.

The process for obtaining a payday loan can be quick, with approval possible in as little as 2-15 minutes.

If approved, the lender either hands you the cash in-person (if you are in their office) or they’ll make a same day transaction (if you’ve applied online).

For loans obtained from a physical store, you have the option to return and pay off the loan on or before its due date.

If you fail to do so, the lender will cash the provided check or initiate the bank withdrawal for the owed amount, plus interest.

For online transactions, repayments are made through automated bank withdrawals.

Payday loans work like this:

Why are payday loans tempting?

The short answer is because of their accessibility.

Unfortunately, millions of people have empty savings accounts and maxed out credit cards which leaves them vulnerable to unexpected expenses, such as a medical bill or a car repair.

Payday lenders typically skip the credit check, don’t require a collateral, approve fast and send the money on the same or the next day.

Where is the catch?

The allure of quick cash comes with a price – notably high APRs (Annual Percentage Rates), sometimes more than 300% and steep fees.

This can lead to a cycle of debt if the loan isn’t repaid on time.

Beyond their high APRs and fees, a major concern is the lenders’ practice of monetizing customer data. This is especially prevalent for those with bad or no credit.

When applying for these loans, individuals often inadvertently agree to have their personal information, such as contact details and financial history, collected and sold.

This practice is a standard part of the payday loan industry, leading to a high likelihood of receiving unsolicited offers and solicitations from third parties. Applicants must be aware of this aspect, understanding that they’re not only agreeing to a loan’s terms but also to potential privacy and data handling compromises.

Read The Fine Print:

Before accepting a payday loan, scrutinize the terms carefully. Be aware that your personal data may be shared or sold, leading to unexpected solicitations. Understand all implications, not just the financial ones.Payday loans regulations

By now, you already know payday loan regulations vary by the state you live in.

We have compiled the maximum loan amounts for each of the states and have specified which ones prohibit this kind of funding.

If you are interested in applying and wonder if your state allows payday loans, consult the information below.

States where you can not get a payday loan

Payday loans are prohibited in: Arizona, Arkansas, District of Columbia, Georgia, Hawaii, New Mexico and North Carolina.

What to do: If you live in any of these states, you might still be able to get financing through some of the companies listed in the article above.

This is one of the reasons, we have included not only strict payday loans but also similar to them alternatives.

If a service is not available in your area, you will see this mentioned in the Cons section of the company.

Remember: applying for offers here will not impact your credit score.

States where you can get a payday loan

Verify the maximum amount you can get for a payday loan in your state with our simplified table.

More information on the exact payday loan regulations of your state can be found on the National Conference of State Legislatures website.

| Maximum Loan Amount | State |

|---|---|

| $300 | California, Montana |

| $350 | Louisiana, Minnesota |

| $500 | Alabama, Alaska, Colorado, Iowa, Kansas, Kentucky, Mississippi, Missouri, Nebraska, New Hampshire, North Dakota, Oklahoma, Rhode Island, South Dakota, Tennessee |

| $550 | Indiana, South Carolina |

| $600 | Michigan |

| $700 | Washington |

| $1,000 | Delaware, Idaho, Illinois, Ohio |

| $2,500 | Virginia |

| $50,000 | Oregon |

| Allowed with varying max amounts | Florida, Nevada, Maine, Texas |

| None | Utah, Wisconsin, Wyoming |

How to apply for a payday loan?

Applying for a payday loan is pretty straightforward and easy.

In case you have never done it before, here are the steps to follow:

Steps

Gather your personal information

You’ll need to show a valid ID, a proof of income and an active bank or check account.

Having these details in advance will save you time and increase your chances of approval.

Reminder: Do you due diligence and make sure your financial situation guarantees you you’ll be able to repay the amount on time.

Compare payday loan lenders

Use Financer.com and verify the amounts, terms, rates, and review scores of an extensive list of online payday lenders in our payday loan comparison.Apply directly online

Select a company and fill out the application form on their website.

After you submit your application, you’ll normally receive an answer within 15 minutes. If it is positive, you will also get an offer.

Tip: if you aren’t comfortable submitting your information online, then you’ll need to visit their physical store.

Review your loan agreement and sign it only if all terms are clear

Upon approval, your lender will provide a loan agreement that should clearly detail the costs, term, APR, and fees of the loan.

It’s important to review the loan agreement and make sure you understand the total cost.

Remember, you’re not obligated to accept the loan if the repayments seem unaffordable or if anything in the document seems dubious.

Get your funds

Depending on the application method, you’ll either receive your money in cash immediately or via a bank transfer within the same or the next business day.Repay your loan

Remember, payday loans are meant for short-term unexpected expenses. Repay your debt within the agreed term to avoid hefty fees.

Pros and Cons of Payday Loans

Payday loans are a financial tool that, like any other, come with their own set of benefits and drawbacks.

Understanding these is key for making an informed decision.

Quick Access to Funds

Designed for emergencies, payday loans often provide funds within 24 hours and help you cover unexpected expenses like car repairs or medical bills.

Minimal Qualification Requirements

Even applicants with low credit scores can be approved, making these loans accessible to a broader range of individuals.

Flexibility

They can be used for any immediate financial need, providing a degree of flexibility not always available with other types of loans.

Payday loans pros:

High Interest Rates and Fees

The APR for payday loans often exceeds 300%, making these loans significantly more expensive than traditional options.

Risk of Debt Cycle

Borrowers who cannot repay on time may need additional loans, leading to a continuous cycle of borrowing and escalating fees.

Potential for Negative Impact on Credit

Late or missed payments can be reported to credit bureaus, potentially damaging your credit score and affecting future borrowing capability.

Payday loans cons

Alternatives to Payday Loans

When faced with financial emergencies, payday loans might seem like a convenient option due to their quick approval times and the promise of instant cash.

However, they often come with high interest rates and short repayment periods, leading to a cycle of debt for many borrowers. Fortunately, there are several alternatives that offer safer and more affordable ways to manage financial shortfalls.

Exploring these options can help you avoid the pitfalls of high-cost payday loans.

Personal Loans

Personal loans are a viable alternative to payday loans, typically offering lower interest rates and longer repayment terms. Unlike payday loans, which usually require repayment within a few weeks, personal loans allow borrowers to spread their payments over months or even years.

This extended repayment period can make monthly payments more manageable. Additionally, personal loans are offered by banks, credit unions, and online lenders, providing a range of options for borrowers with different credit scores.

Cash Advance Apps

Cash advance apps are a modern, lower-cost alternative to payday loans, offering short-term advances on your next paycheck with minimal fees or interest. These mobile apps allow you to access funds quickly and conveniently, with a repayment plan typically aligned with your next payday.

These apps stand out by offering flexible repayment options and often include financial management tools to help users budget better and avoid future cash shortfalls. Requirements usually include a steady income, and while some apps may charge a subscription fee or suggest tips, they generally present a more affordable solution for emergency funding.

Before using a cash advance app, it’s essential to understand its terms and conditions. While these apps can provide immediate financial relief, they should be used judiciously within a broader financial management strategy.

Credit Union Loans

Payday Alternative Loans (PALs) provided by credit unions have maximum APRs capped at 28% by law, with loan amounts ranging between $200 and $1,000.

These loans offer significantly lower interest rates compared to traditional payday loans. To qualify, you generally need to be a member of the credit union for a certain period.

PALs emphasize affordable payments and longer repayment periods, making them a more sustainable option for emergency funds.

Payment Plans

Negotiating a payment plan with your creditors can be an effective way to avoid taking out a payday loan. Many creditors are willing to work with you to establish a repayment schedule that fits your budget.

This could involve extending your payment due date, reducing the interest rate, or waiving certain fees. Payment plans can help you manage your debt more effectively without the added financial strain of high-cost loans.

Credit cards

A credit card allows you to borrow funds up to a set limit and offers the flexibility to repay the amount over time.

You have the option to settle your balance in full right away or adjust your payments to align with your financial situation and budget.

On average, credit card interest rates hover around 16.12%.

Maintaining your account in good standing requires at least the minimum monthly payment.

However, it’s important to note that routinely making only the minimum payment is not recommended, as it can result in significant debt issues.

Financial Assistance Programs

For immediate financial assistance, exploring community programs can offer relief without the need for a loan.

Many local charities, non-profits, and government agencies provide support to individuals in financial distress. This may include help with food, utilities, rent, or medical expenses.

Taking advantage of these resources can address immediate needs while avoiding the debt trap associated with payday loans.

You can find available programs in your state here and here.

Borrowing from Friends or Family

This option can provide an interest-free loan, but it’s important to agree on repayment terms upfront to avoid misunderstandings.

Documenting the agreement in writing can help maintain clarity and trust.

These alternatives can provide more manageable and financially sound options compared to the high costs and risks associated with payday loans.

Frequently asked questions about Payday Loans

What is a payday loan?

Payday loans are short-term, high-cost loans, typically for amounts below $1,000.

They are mostly used to cover urgent financial needs until your next paycheck.

Their key characteristics are:n

- accessibility for people with bad credit score;

- high interest rates;

- short repayment terms (often two weeks or by the next payday);

- and quick approval times.

Due to the risk of a debt cycle, payday loans should be used with caution.

Can you have two payday loans at once?

Whether or not you can have two payday loans at once depends on your state’s regulations.

Some states permit individuals to obtain multiple payday loans while others prohibit payday loans altogether.

The fact that it’s allowed to have more than two payday loans at once, does not mean it is a wise financial move.

CFPB statistics show that 15% of new payday loans start a 10-loans long sequence. This goes to show that you should be very careful when making such a decision.

Is a payday loan secured or unsecured?

Payday loans are considered an unsecured form of debt.

Though, you do not have to provide a collateral for your payday loan, you will have to provide a post-dated check or electronic access to your bank, credit union, or prepaid card account.

Are payday loans fixed or variable?

The Truth in Lending Act (TILA) requires lenders to disclose information about all charges and fees associated with a loan.

Do payday loans go on your credit?

Good question! The answer is payday loans are unlikely to impact your credit score positively in case of on time repayment because they are generally not reported to the three major reporting companies.

However:

- If you do not pay your payday loan on time and your lender sells your debt to a debt collector company, they will most likely report your debt and this will hurt your credit score.

- Likewise, your payday lender may decide to bring a lawsuit against you to collect the payday loan. If you lose a court related to your payday loan, this information will be included in your credit reports and will negatively impact your credit score.

What interest rates can I expect for payday loans?

The annual percentage rate (APR) for payday loans can range from 300% to over 600%.

Payday lenders usually charge interest of $15-$20 for every $100 borrowed. This means if you borrow $200, you could expect to pay between $30 and $40 in interest alone.

Keep in mind, these numbers vary depending on your state regulations.

For example, Texas has the highest payday loan rates in the U.S. The typical APR for a loan there is 664%, which is more than 40 times the average credit card interest rate of 16.12%.

How much do payday loans cost?

Payday loans usually come with these expenses:n

- The cost per $100 borrowed ranges from $10 to $30, which varies based on the regulations of each state.

- A typical charge is $15 for every $100 borrowed, resulting in an almost 400% Annual Percentage Rate (APR) for a loan taken for two weeks.

- Rollover fees are applied when the loan can’t be repaid on the original due date, though the initial loan amount remains unchanged.

- In certain states, lenders are required to provide plans for repayment without any additional cost.

- Additional charges like late payment fees and fees for insufficient funds might be applicable.

- Loans issued on prepaid debit cards can attract additional fees.

Always thoroughly review the loan agreement and make sure you understand all the fees involved.

For detailed information, you can visit the Consumer Financial Protection Bureau’s website.

How many payday loans can I get?

As we’ve already mentioned, the amount of payday loans you can get depends on your state’s regulations.

Our advice is to limit payday loans to a minimum and focus on improving your credit score in order to qualify for better options.