A Deep Dive into SoFi’s High Yield Savings Account

- January 17, 2024

- 9 min read

-

399 reads

Quick Take

- High-yield savings accounts usually offer higher APYs than traditional banks.

- SoFi’s high-yield saving account offers one of the highest APYs in the industry.

- There are zero account fees and a generous signup bonus (up to $250).

- Like a traditional bank account, your SoFi deposits are insured up to $250k.

- SoFi’s Insured Deposit Program extends the coverage up to $2M.

With zero account fees, high APY rates, and a generous welcome bonus, SoFi’s high-yield online savings account is a good way to supercharge your savings strategy.

This guide covers:

An Overview of SoFi’s Savings Account

SoFi’s high-yield savings account is an online savings account that offers a 4.60% APY on savings, with zero account fees and FDIC protection up to $2 million.

The account is a 2-in-1 package comprising two linked accounts: a savings and a checking account. It also comes with a welcome bonus of up to $250.

To qualify for the $250 bonus, set up direct deposits totaling $5000 within 25 days. Deposits under $1000 qualify for a $50 bonus.

High Yield Savings Accounts (HYSAs)

High-yield savings accounts are mostly online-only bank accounts that usually offer higher APYs than traditional banks. n Since online-only banks have considerably less overhead costs compared to traditional banks (for example, the need to maintain retail branches), they can offer high APYs. n With HYSAs, you get high yield, low-risk, and maximum returns which makes them a good way of turbocharging your savings strategy.Just like with a traditional bank, SoFi deposits are insured up to $250,000. What’s more, SoFi has an Insured Deposit Program that extends the coverage to $2 million.

This means if the bank were to go under, your deposits would be covered up to $2M which is remarkable considering that the standard FDIC insurance amount is $250,000.

Note that you must enroll in the Insured Deposit Program if you want the extra coverage.

Annual Percentage Yield (APY)

At a basic level, APY is what you earn in one year through compound interest. Most high-yield savings accounts offer APYs above 4% while traditional banks offer anywhere from 0.01% to 0.05%. SoFi’s current APY of 4.6% is one of the highest in the industry.Features of SoFi’s Online Savings Account

Sofi’s online savings account offers several features:

- Vaults: Think of Vaults as individual saving accounts or subaccounts designated for specific purposes or goals. For example, you can create a vault for rent or an investment fund. You can have up to 20 different vaults at the same time. Vaults are a good way to save for particular purchases or investments.

- Roundup Debits: The Roundups feature allows you to save a percentage of your expenses each time you use your SoFi debit card. Each purchase is rounded up (to the nearest dollar) and the amount is transferred from your main account to the savings vault of your choice.

- Auto-save: With Auto-save, you can have a percentage of your paycheck automatically sent to savings.

- Zero Fees: One of the standout features of SoFi’s savings account is the freedom from traditional banking fees. There are no monthly fees or account maintenance fees. There are also no ATM fees and no overdraft fees. In short, there are no account fees. Keep in mind that this might change in the future.

Pros and Cons of SoFi’s Online Savings Account

Here are some of the pros and cons associated with SoFi’s savings account.

Pros

- Competitive rate: With an APY of 4.6%, SoFi offers one of the highest rates in the industry. Note that you must have direct deposit set up to qualify for the 4.6% APY.

- Sign-up bonus (up to $250): The SoFi savings account also comes with a welcome bonus of up to $250. To qualify for the $250 bonus, set up direct deposits totaling $5000 within 25 days. Deposits under $1000 qualify for a $50 bonus.

- SoFi is an actual bank: SoFi has a national banking charter, which means unlike some of its competitors (which are backed by a banking partner), SoFi is actually a bank.

- A bunch of Perks: SoFi also offers a bunch of perks such as personalized financial advice from certified financial planners.

Online bank: SoFi savings account may not be for you if you prefer in-person banking. If you prefer traditional banks with physical locations, SoFi is not for you.

2-in-1 account: While this might be a pro for some, if you just want a savings account, you might not appreciate the 2-in-1 feature. You must hold both a savings and checking account at the same time. Since it’s a 2-in-1 package, you can’t have one without the other.

There’s a minimum deposit to get the $250 bonus: To qualify for the $250 welcome bonus, you need to have direct deposits of $5000 or more in a 25-day period.

Cons

Learn more about the pros and cons of high-yield savings accounts here.

Best For:

SoFi savings account is best suited for those seeking competitive rates and preferring digital customer service over in-person banking.SoFi’s Online Savings Account Versus Traditional Banks

First off, you get significantly better rates with SoFi than with traditional banks. Major banks offer 0.01% APY on their checking and savings accounts – which pales in comparison to SoFi’s 4.6%.

Unlike traditional banks, SoFi offers a welcome bonus (when you set up direct deposit). What’s more, unlike traditional banks, there are zero account fees.

Breaking Down SoFi’s HYSA

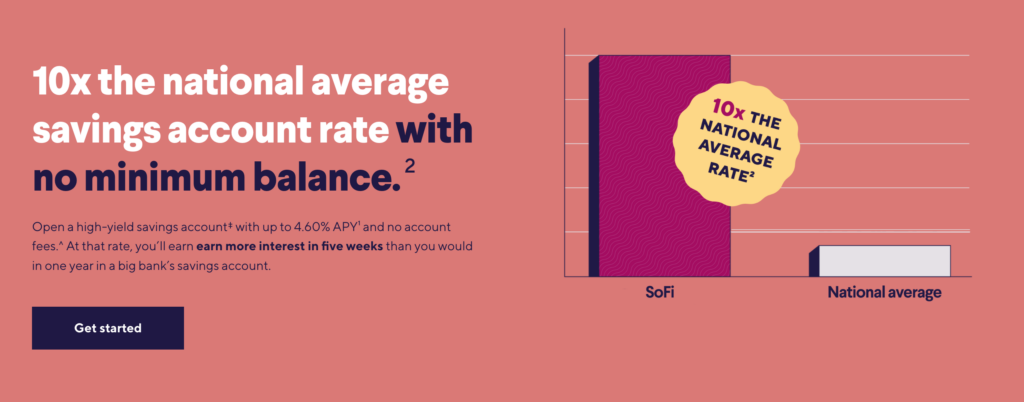

SoFi’s online savings account offers up to 4.6% APY which is 10x higher than the national average rate (0.46% as of Nov 20, 2023).

This means you can earn more interest in five weeks with your SoFi savings account than you would in one year with another average savings account interest rate.

For Example

At the current rate of 4.6%, $10,000 in your SoFi savings account will yield $460 per year which is $38.3 a month. n This estimate assumes the deposited amount remains untouched and accrues interest at the stated rate.To qualify, you need to set up direct deposit to your SoFi account and add $5000 or more to your account within a 25-day period.

Should You Open a SoFi Savings Account?

That depends on your current financial priorities and preferences. If you are looking for an online savings account offering competitive rates with zero account fees and no minimum balance requirements, then SoFi savings account is worth considering.

If the high yields, perks, and digital experience offered by a high-yield savings account seems like a better deal to you than a traditional banking experience, then SoFi is a good choice.

Disclaimer: The information provided in this article is solely for educational purposes. It is not financial, investment, or legal advice. Kindly consult a certified financial expert before making a decision related to finance or investments.