Upstart partners with banks to provide personal loans to customers ranging from $1,000 to $50,000. The company offers a range of loans including personal loans, debt consolidation loans, and credit card refinancing.

As the world's largest lending platform, qualifying for a loan doesn't damage your credit score and APRs start as low as 6.70%.

Note: Upstart offers its service in most U.S. states except West Virginia or Iowa.

The Upstart model accepts 27% more borrows than traditional models and on average they claim to yield 16% lower APRs for their approved loans.

How We Rate Upstart

At Financer, all companies go through a thorough research and review process. Here's how we rate Upstart:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend Upstart?

Yes, we recommend Upstart as a reliable lender marketplace. Skip to our full review below and see how we rate Upstart.

Upstart Overview

Upstart was created by ex-Googlers and boasts the AI platforms' ability to provide fair and fast personal loans.

The company offers loans to borrowers with fair credit from $1,000 to $50,000 and APRs starting at 6.70%. They offer a range of personal loans as well as auto refinancing.

Borrowers have 36 or 60 months to pay and the approval process is very fast.

Here's a quick summary of Upstart:

| Overview | Features |

|---|---|

| Loan type: | Unsecured personal loans |

| Loan amount: | $1,000 - $50,000 |

| Loan term: | 36 or 60 months |

| APR: | From 6.70% to 35.99% |

| Min. credit score: | 300 |

| Monthly fees: | None |

| Payout time: | One business day |

| Weekend payout: | No |

| Requirements: | Minimum age: 18Residing in the United States (don’t have to bea citizen or permanent resident) (exception formilitary)Minimum credit score of 300 in most statesNo bankruptcies or public records on your creditreportNo accounts that are currently in collections ordelinquentLiving in the 50 US states |

Upstart has a transparent application process and you can check your rate without affecting your credit score.

Upstart has a unique AI system. As a lot of Americans are blocked from accessing credit, even with a stable payment history, Upstart implements a smarter credit model for lenders.

Fees

Upstart's fees are as follows:

Origination fees: One-time origination fee between 0% - 12%

Prepayment fees: None

Late fees: 5% of the amount or $15, whichever is greater

Failed payment fees: $15 for each unsuccessful payment

APRs: Range from 6.70% to 35.99%

Repayment Terms

Upstart's loan terms are either three or five years, i.e., 36 or 60 months. This is ideal for borrowers who want a longer repayment term.

You may repay your loan earlier and there are no prepayment penalties.

Who Is Upstart For?

Upstart is ideal for borrowers with fair credit who are looking for a low-APR loan from $1K-$50K. Upstart is available in most US states.

Eligibility Requirements

Here are the loan requirements when applying through Upstart:

Be of legal age to contract in your state of residence 18 or 19 years

Be a US citizen or a Permanent Resident

Have an annual income of higher than $12,000 or a signed contract to start within six months

Cannot have a current or recent bankruptcy

Cannot be a resident of West Virginia or Iowa

Tip: Our online loan calculator can help you find a loan if you live in a state that Upstart does not service.

Who It's For

Upstart is for you if:

You have a good credit history

Need funds fast

Don't have collateral

Want to complete an online application

Who It's Not For

Upstart may not be a good option for you if:

You want no origination fees

Need a loan of more than $50,000

Want to take out a secure loan

Live in these states: WV or IA

How To Apply for a Loan Through Upstart

Visit Upstart online

Visit Upstart online and choose the type of loan you need.

Choose the amount

Choose the amount you want to borrow.

View your terms

Get an estimate on your rates and terms to get an idea of the affordability.

Confirmation

If you want to go ahead with the loan, you'll see a confirmation of your details.

Get your funds

Once you accept, your fund will be deposited into your bank account as soon as the next day.

How Financer Rates Upstart

Our review of Upstart is that it is a good option for borrowers who have fair credit and need good rates.

They have a relatively streamlined approach to their approval system and do accept more borrowers than traditional models.

Their rate-determining factors are not just based on your credit score but also on other factors such as your education, the length of your credit history, your areas of study, and your job history.

This enables them to accept borrowers straight out of university that are yet to build their credit history.

Compare personal loan rates here

Reputation

Upstart has a good reputation across the board. It is the world’s largest lending platform. Their fast application process takes only a few minutes.

The results are shown quickly. Their reputation holds due to their ability to accept more customers than traditional methods.

Upstart provides loans that are generally paid into the borrower's account the next day. Those take three days to be approved by law.

Website and Functionality

Our experience with the Upstart website and customer feedback we have received is that it is very straightforward and simple to navigate.

The site having simplicity allows the borrower to find information quickly that is relevant to their individual needs.

Does Financer recommend Upstart?

Yes, we do recommend Upstart to customers that have a short credit history and have a guaranteed future income.

Compare personal loan rates here

More Upstart Reviews

What Users On the Web Are Saying

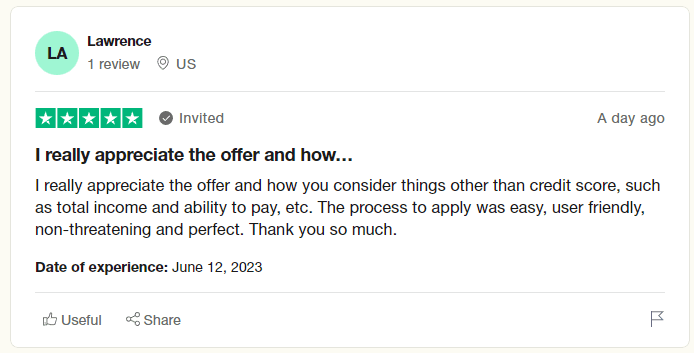

Upstart gets 4.9 out of 5 stars on Trustpilot, with users generally giving positive feedback:

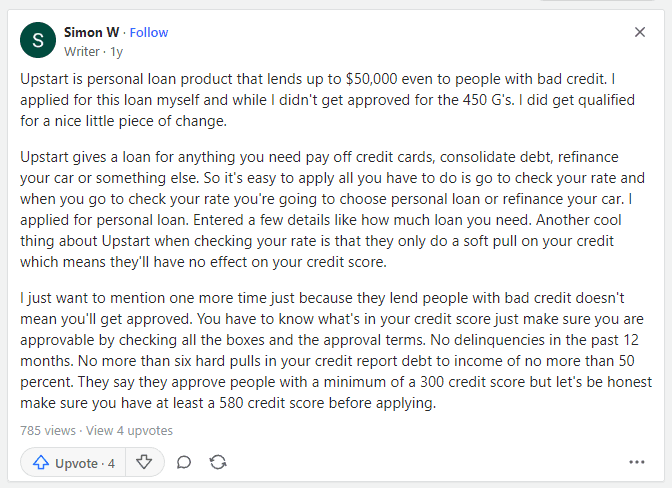

On Quora, Upstart also gets generally positive user feedback:

More User Reviews - Add Your Rating

Read more reviews on Financer from verified users below.

Have you used Upstart before? Leave your review now.