Making a SIMPLE Budget

Intro video, generally about budgeting

- Financial freedom is not about how much you earn, it’s about how much you keep. Loads of people make a lot of money but they spend it all too. You should be more concerned with your current trajectory.

This is the hardest lesson

The better implement everything in this lesson, the easier all the following lessons will be.

What is a budget?

A budget is like a map or financial plan for your personal finances. It helps you:

- Track income: Identifying all sources of income, such as salary, investments, or business revenue.

- Record expenses: Listing all anticipated expenses, including fixed costs (like rent or mortgage), variable costs (like groceries), and discretionary spending (like entertainment and dining out).

- Make informed decisions: Based on the budget you can make better decisions because you know what is happening.

Overall, a budget helps in making informed financial decisions, ensuring that spending aligns with goals, and maintaining financial stability.

Why budget in the first place?

To see where you stand, you need to know how much money is coming in and how much is going out.

Simply looking at and becoming aware of what is happening with your money can teach you a lot.

You will use our tool to list every single income stream and every single expense you have. That’s all a budget is.

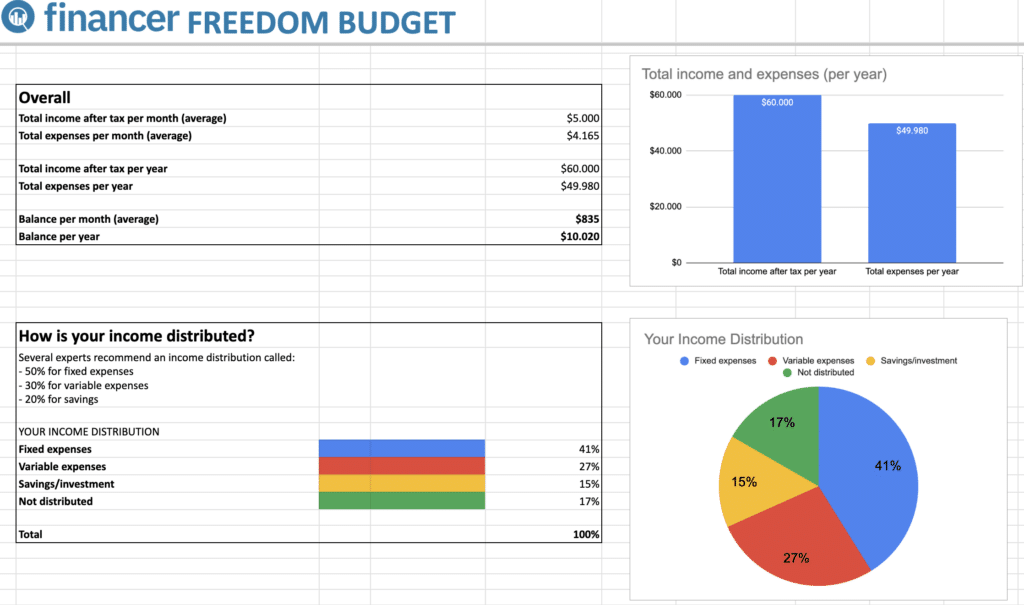

Financer Freedom Budgeting Tool

The tool is a simple spreadsheet that allows you to list your income after taxes, fixed expenses and variable expenses.

Here’s how to do it:

- Make a copy of the budgeting tool either in Google Sheets or Excel

- Enter income or expense in the ‘Amount’ column

- Enter the number of payments per year

- Repeat with each row

- You will see an overview of how you spend your money at the bottom of the page

The tool automatically calculates your total income, how your income is distributed between fixed expenses, variable expenses, investing, debt and more.

Why we’re not using an automated budgeting tool

There are many AI and budgeting tools out there that can help you make a budget semi-automatically.

The reason we’re not using any of those is so that you get full awareness. We don’t want an AI tool to have awareness, we want YOU to have awareness.

There is really no better way to achieve that than by doing it yourself. That way you also don’t miss anything, and it doesn’t have to take a lot of extra time.

Step 0: Find Your Statements

Go to your bank account and find your bank statement for the past 12 months or more.

If you have several bank accounts, find all of them. here are some examples of providers and account types:

- Online bank

- Mobile app

- Credit/debit card

- Payoneer

- Wise/Revolut

- PayPal

- Xero

Step 1: Adding your income

The first (and possibly most fun) step is documenting all your income sources.

For most people salary payments are the main source of income, but do not overlook various grants, cash gifts, dividends from investments and bonuses.

Simply note down everything. The goal is to have a full overview. Don’t forget to add everything after taxes.

Tips:

- You should add income after tax

- If your income differs a lot, make a conservative estimate

- Find the average and add in.

Step 2: Adding recurring expenses

Recurring expenses are anything that is the same amount every single month, or pretty much the same:

Tips:

- Make sure you check your statements for an entire year, so you don’t miss any yearly recurring expenses.

Step 3: Adding variable expenses

Variable expenses can be a bit more tricky to budget for because, well, they vary. For this step, it’s best to simply

Now you know your monthly disposable funds

Congratulations on completing your budget! This is an interesting moment.

If you have added every income source, recurring and variable expense, you now know how much money you have left over to live for each month.

Take two minutes to reflect on it. You have just achieved a lot of awareness and are probably already thinking of ways to lower your recurring expenses.

If you are surprised at some of the things you spend on, GOOD. It means there is a lot of room for easy improvements.

We’ll get into all that in the next lesson.

0 Comments