With 5KFunds you can get a loan in as little as one business day and choose repayment periods of up to 72 months. With APRs starting at 5.99%, a 5KFunds loan can be a great option if you're looking for fast funding.

Founded in December 2015, they operate under Sincerely, LLC. Their business address is located in Boca Raton, Florida.

Note: 5KFunds loans are available in most U.S. states except New York, Connecticut, Vermont, West Virginia, Alaska, and Georgia.

How We Rate 5KFunds

At Financer, all lenders go through a thorough research and review process. Here's how we rate 5KFunds:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

5KFunds Overview

5KFunds offers loans from $500 to $35,000 and APRs from 5.99%. They have flexible payment options and there are no minimum credit score requirements.

Borrowers have up to 72 months to pay and the approval process is very fast.

Here's a quick summary of 5KFunds:

5KFunds is committed to providing loan options regardless of credit score - one of the many advantages of using 5KFunds.

5KFunds also offers lines of credit to customers who are typically underserved at traditional financial institutions.

Want to find out more about the full range of offerings? Read our 5KFunds review below or view 5KFunds reviews from customers.

Who Is 5KFunds For?

5KFunds are for borrowers looking for a fast online loan without requiring a high credit score. By comparing multiple lenders, 5KFunds can give you personalized loan offers from leading U.S. lenders and there are no application fees.

If you're looking for the best loan rates and you have an excellent credit score, you may want to consider other lenders that can offer you competitive rates.

Eligibility Requirements

Here are the loan requirements when applying for a 5KFunds loan:

Be at least 18 years old.

Be a U.S. citizen.

Have an active bank account that accepts direct deposits.

Have a regular stream of income.

Have a valid contact number and an active email address.

No minimum credit score is required.

Who It's For

5KFunds is for you if:

You have a less-than-perfect credit history

Need funds fast

Want to get multiple loan offers

Don't have collateral

Want to complete an online application

Who It's Not For

5KFunds may not be a good option for you if:

You want the lowest APR rates

Need a loan of more than $35,000

Want to take out a secure loan

Live in these states: NY, CT, VT, WV, AK, or GA

How To Apply for a 5KFunds Loan

Applying for a 5KFunds loan is fast and easy. Here are the steps:

Once a loan is approved, customers must communicate directly with their individual lenders to get personalized information.

Loan amounts range from $500 to $35,000 depending on the lender.

Each loan contract contains different requirements. It is essential that you thoroughly read your agreement before committing.

What To Consider Before Applying

Before you apply for a personal loan, confirm that you reside in one of the states where 5KFunds operates in.

Make sure you understand the costs involved in a 5KFunds loan, always research the offers from lenders and look for origination fees, prepayment penalties, late fees, and more.

Double-check any policies and terms before agreeing to a loan from a lender as 5kFunds just operates the marketplace and does not guarantee terms.

Although there is no minimum credit score required based on our 5kFunds review, keep in mind that the lender might do a hard credit check to determine your eligibility when you complete your loan application.

5KFunds Fees

APRs differ between lenders ranging from 5.99% - 35.99%. There are NO fees associated with using the 5KFunds site itself, though many lenders may have their own fees. Fees are dependent on the lender, not 5KFunds.

There are no prepayment penalties or hidden fees. Contact your lender directly If you are unsure whether you'll be able to afford the repayments.

5KFunds Payment Terms

The repayment terms range from a 61-day minimum to a 72-month maximum. 5KFunds does not determine the rates and terms, as these are decided by the lending partners.

Some lenders allow payments to be debited automatically from your account to help you avoid late or missed payments. Payment schedules and late payments are worked out directly with the lender.

Be sure to read the terms of your loan offer before you agree and accept.

How Financer Rates 5KFunds

Is 5Kfunds legit? Yes, at Financer we recommend 5KFunds.

At Financer, all lenders go through a thorough research and review process. We don't make recommendations lightly.

All loan applications are done through their easy-to-navigate website with a simple process that takes less than five minutes to complete. There are NO fees and many lending partners in one location.

5kFunds.com is your guide to over 100 validated lenders, enter your details and let 5KFunds prepare options that best suit your personal needs.

Application Process

The application process with 5KFunds is very quick and easy. It takes only a few minutes to complete the steps and get your loan offers.

Costs

5KFunds don't charge any fees. But some lenders may charge fees and interest.

Similar to many other short-term lenders in the U.S., the lenders' APRs start at 5.99% and are capped at 35.99%. This is much lower than payday loans.

We feel that these rates are quite attractive given that many U.S. lenders start with 10.99% APR.

There are no application fees either, making 5KFunds a good option for borrowers.

Payments

You have up to 72 months to repay a loan from 5KFunds. This is very similar to most other short-term U.S. lenders and gives you the freedom to have lower monthly payments over a longer period.

Customer Service

5KFunds provides customer service via email and phone from Mondays to Fridays, 9 am to 6 pm.

We tested out 5KFunds' customer service by requesting information via email. Although we did receive confirmation of our inquiry, we only received a formal reply a few days later, making their email support mediocre.

Privacy and Security

5KFunds takes privacy seriously by encrypting and protecting all information according to the legal requirements and 256-bit encryption.

Similar to other loan marketplaces and online lenders, 5KFunds collects and shares user information with partners in their network.

5KFunds FAQs

How much can I borrow with a 5K Funds loan?

How much can I borrow with a 5K Funds loan?

You can borrow up to $35,000.

What is the cost to use 5KFund?

What is the cost to use 5KFund?

5KFunds does NOT charge any fee, however individual lenders may have their own origination and application fees.

Is my personal information secure?

Is my personal information secure?

5KFunds takes your privacy seriously, and the personal information you enter protected with 256-bit bank-level SSL encryption.

Who do I contact about late payments?

Who do I contact about late payments?

Contact the lender directly if you have any issues repaying your loan. Late Payment penalties differ from lender to lender. Some lenders may automatically add a fee if it is in their agreement.

Why is 5KFunds a unique loan comparison service?

Why is 5KFunds a unique loan comparison service?

5KFunds partners with over 100 unique lenders and offers unsecured of up to $35,000. Once approved, money is directly deposited into the borrower's bank account as soon as the next business day.

How much does a 5KFunds loan cost?

How much does a 5KFunds loan cost?

The 5KFunds marketplace is 100% free to use. However, the APRs from lenders vary from 5.99% to 35.99%.

What can I use the loan for?

What can I use the loan for?

You can use your 5KFunds personal loan for anything you want.

When do I repay my loan?

When do I repay my loan?

Loan repayment terms differ by lender but repayment periods vary from 61 days to 72 months.

What can I use a personal loan for?

What can I use a personal loan for?

You can use your personal loan from 5KFunds for almost anything - home improvements, a holiday, medical expenses, shopping, or more.

Is 5KFunds legitimate?

Is 5KFunds legitimate?

Yes, 5KFunds is a legitimate lender marketplace that connects borrowers with lenders across the US.

How easy is it to get a 5K loan?

How easy is it to get a 5K loan?

This depends on the lender; most lenders offering 5k loans allow for repayments of up to 5 years or more, with APRs between 5.99% and 35.99%. Many lenders also accept borrowers with bad credit.

Is lending for bad credit real?

Is lending for bad credit real?

There are many lenders that offer loans to borrowers with bad credit. Getting a bad credit loan is possible, however keep in mind that this may come with higher interest rates and fees.

5KFunds Alternatives

Here's a list of alternatives to 5KFunds and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| PersonalLoans.com | View | $500 – $35,000 | 5.99-35.99% | Up to 6 years | Yes |

| BadCreditLoans | View | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | View | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

Should you take a loan with 5KFunds?

5KFunds has been around for quite a while and has proven to be a leading U.S. lending platform where borrowers can get personalized loan offers.

One of the best reasons for applying for a loan with 5KFunds is that interest rates from participating lenders are listed transparently.

Their customer service is responsive and they have a good feedback rating from past customers.

Read more 5KFunds reviews from customers below or add your own.

More 5KFunds Personal Loan Reviews

What Users On the Web Are Saying

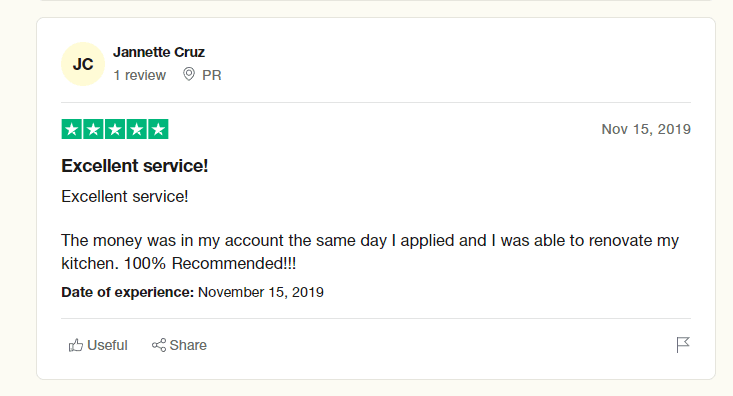

5KFunds gets 1.6 out of 5 stars on Trustpilot, with users showing mixed feelings:

Some users were unhappy about their personal information being shared, while others felt the service was fast and easy.

On Quora, 5KFunds generally gets positive reviews from users:

More User Reviews - Add Your Rating

Read more reviews on Financer from verified users below.

Have you used 5KFunds before? Leave your review below.