Cash Advance® is a loan broker that offers loans from $200 to $10,000.

The company has been in business for more than 25 years and is a trusted lender marketplace for short-term loans in most US states.

Applying for a loan on CashAdvance.com only triggers a soft credit check, making it easy for people to apply for a short-term loan online.

How We Rate CashAdvance.com

At Financer, all lenders go through a thorough research and review process. Here's how we rate CashAdvance.com:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend CashAdvance.com?

Yes, we recommend CashAdvance.com as a reliable lender marketplace. Skip to our full review below and see how we rate CashAdvance.com.

Here's what we'll cover in this review:

Want to skip the details? Jump to our final verdict here.

CashAdvance.com Overview

Founded in 1997, Cash Advance® is an online loan broker that offers loans from $200 to $10,000. It works with a large network of reputable lenders in the US.

Borrowers have up to 12 months to pay and the approval process is very fast.

CashAdvance.com is a member of the Online Lenders Alliance (OLA) and is dedicated to best practices and transparency.

CashAdvance.com is owned and operated by Hawk, LLC, which is in turn owned by the Ute Indian Tribe.

Read more: Compare tribal loans

Here's a quick summary of Cash Advance®:

| Overview | Features |

|---|---|

| Loan type: | Short-term loans |

| Loan amount: | $200 - $10,000 |

| Loan term: | Up to 12 months |

| APR: | 15% - 1,564% |

| Min. credit score: | None |

| Monthly fees: | None |

| Payout time: | One business day |

| Weekend payout: | No |

| Requirements: | At least 18 years oldU.S. citizenValid checking accountBe employed for at least 3 monthsValid phone number and email |

Cash Advance® is committed to providing loan options regardless of credit score. This is one of the main advantages of using Cash Advance®.

Want to find out more about the full range of offerings? Read our Cash Advance® review below or view Cash Advance® reviews from customers.

Who Is CashAdvance.com For?

Cash Advance® is aimed at borrowers who are looking for fast short-term loans online without requiring a good credit score.

By comparing multiple lenders, Cash Advance® can give you personalized loan offers from leading U.S. lenders and there are no application fees.

If you're looking for the best loan rates and you have an excellent credit score, you may want to consider other lenders that can offer you competitive rates.

Eligibility Requirements

Here are the loan requirements when applying for a Cash Advance® loan:

Be at least 18 years old

Be a U.S. citizen

Have an active bank account that accepts direct deposits

Be employed for at least three months

Have a valid contact number and an active email address.

No minimum credit score is required

You must meet your Lenders' specific minimum income requirements

Who It's For

Cash Advance® is for you if you:

Have a low credit score or bad credit history

Need funds fast

Want to get multiple loan offers

Don't have collateral

Want to complete an online application

Don't need a large, long-term loan

Who It's Not For

Cash Advance® may not be a good option for you if you:

Want the best loan APRs

Need a loan of more than $10,000

Want to take out a secure loan

Live in these states: AR, AZ, CT, GA, ME, MD, MA, MT, NH, NJ, NY, NC, OR, PA, TX, UT, VT, WV

How To Apply for a Cash Advance® Loan

Applying for a CashAdvance.com loan is fast and easy. Here are the steps:

Once a loan is approved, customers must communicate directly with their individual lenders to get personalized information.

Loan amounts range from $200 to $10,000 depending on the lender.

Each loan contract contains different requirements. It is essential that you thoroughly read your agreement before committing.

What To Consider Before Applying

Before you apply for a personal loan, confirm that you reside in one of the states where CashAdvance.com operates in.

Ensure you understand the costs involved in a Cash Advance® loan, always research the offers from lenders, and look for origination fees, prepayment penalties, late fees, and more.

We suggest you always double-check any policies and terms before agreeing to a loan from a lender as Cash Advance® just operates the marketplace and does not guarantee terms.

Although there is no minimum credit score required based on our CashAdvance.com review, lenders may do a hard credit check to determine your eligibility when you complete your loan application.

Cash Advance®Fees

APRs differ between lenders but can be as high as 1,584%.

There are no fees when using the CashAdvance.com site, although many lenders may charge their own fees. Fees are dependent on the lender, not Cash Advance®.

There are no prepayment penalties or hidden fees. Contact your lender directly If you are unsure whether you'll be able to afford the repayments.

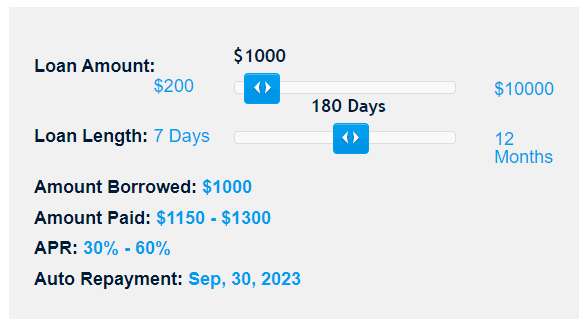

Loan Terms: Example

CashAdvance.com has a tool available where borrowers can get an idea of what their installments may look like. You can move the sliders based on the loan amount and length you need and it will show you your likely terms.

Cash Advance® Payment Terms

The repayment terms range from a 7-day minimum to a 12-month maximum. Cash Advance® does not determine the rates and terms, as these are decided by the lending partners.

Most lenders allow payments to be debited automatically from your account every month to help you avoid late or missed payments. Payment schedules and late payments are worked out directly with the lender.

Be sure to read the terms of your loan offer before you agree and accept.

How Financer Rates Cash Advance®

Is Cash Advance® legit? Yes, at Financer we recommend Cash Advance®.

At Financer, all lenders go through a thorough research and review process. We don't make recommendations lightly.

Loan applications are fast and easy and are done completely online. Their website is easy to navigate and discloses all the necessary information to potential borrowers to help them make informed decisions.

There are NO fees to apply and Cash Advance® works with reputable lenders.

One of the only downsides is that Cash Advance® is not available in all states.

Application Process

We've tried out CashAdvance.com and the application process took only a few minutes. Offers are presented to you immediately. See above.

Costs

Cash Advance® doesn't charge any fees, although some lenders may. This is standard for all lender marketplaces throughout the U.S.

Similar to many other short-term lenders in the U.S., the lenders' APRs start at 15%, however, some lenders charge APRs as high as 1,584%.

This is much higher than traditional personal loans.

Payments

The maximum loan term of 12 months is standard when compared to other short-term lenders. However, this means you won't get rates as low as with other personal loans that offer longer loan terms of up to 72 months or more.

Customer Service

Cash Advance® provides customer service via email and phone from Mondays to Fridays, 9 am to 6 pm.

Customers can also contact the OLA consumer hotline at 1-866-299-7585 with any concerns, or questions, or to report possible occurrences of fraud.

We tested out CashAdvance.com's customer service by requesting information via email. Although we did receive confirmation of our inquiry, we only received a formal reply a few days later, making their email support mediocre.

Privacy and Security

Cash Advance® takes privacy seriously by encrypting and protecting all information according to the legal requirements and 256-bit encryption.

Similar to other loan marketplaces and online lenders, Cash Advance® collects and shares user information with partners in their network.

Cash Advance Highlights

Cash Advance® is seen as one of the top lending marketplaces for U.S. borrowers as it has an extensive range of approved lenders onboard.

With the Cash Advance® platform, borrowers can apply for short-term loans online and get pre-qualified in minutes.

Loan payouts are typically fast (next business day) and the terms vary by lender.

One of the best features of Cash Advance® is their 100% free online application process which also offers a fast turnaround time.

There is no minimum credit score required and borrowers with bad credit can also apply. This makes Cash Advance® a good option for people with lower credit scores.

As Cash Advance® specializes in unsecured loans from a network of lenders, you don't need collateral to apply.

The only real drawback of Cash Advance® is that they don't operate in all U.S. states. Cash Advance® is available in most US states except:

- Arkansas

- Arizona

- Connecticut

- Georgia

- Maine

- Maryland

- Massachusetts

- Montana

- New Hampshire

- New Jersey

- New York

- North Carolina

- Oregon

- Pennsylvania

- Texas

- Utah

- Vermont

- West Virginia

Note: If you're looking for custom loan offers in these states, we list a range of verified lenders that offer personal loans online.

There is unfortunately no live chat option, so customers need to send an email to customer support with their inquiry. They do offer a fast turnaround time, though.

Compared to other U.S. lenders, there is no toll-free helpline available, which might be a dealbreaker for some potential borrowers.

Although the rates vary by lender, some lenders may charge APRs of up to 1,564%.

Cash Advance® Alternatives

Here's a list of alternatives to Cash Advance® and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| CashAdvance.com | View | $200 – $10,000 | 15-1,548% | Up to 12 months | Yes |

| BadCreditLoans | View | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | View | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

| ACE Cash Express | View | $100 - $2,000 | 91.52% - 630.13% | Up to 1 month | Yes |

Should you take a loan with Cash Advance®?

Cash Advance® has been around for more than two decades and has proven to be a reputable U.S. lending platform for short-term loans.

One of the best reasons for applying for a loan with CashAdvance.com is that borrowers get access to loan offers from a wide range of U.S. lenders.

Their customer service is responsive and they have a good feedback rating from past customers.

Read more Cash Advance® reviews from customers below or add your own.

More Cash Advance® Reviews

What Users On the Web Are Saying

Cash Advance® gets 2.3 out of 5 stars on TrustPilot, with some users complaining about a slow process, while others seem to be happy:

On ConsumerAffairs, they get a 1.5 rating, with users complaining about high APRs, and others about lenders harassing them - although this is not on the part of CashAdvance.com but rather a reflection of the individual lender:

Other users were mostly happy with their service:

More User Reviews - Add Your Rating

Read more reviews on Financer from verified users below.

Have you used CashAdvance.com before? Leave your review now.