Stuck in a financial bind and need cash fast? You're not alone. Millions of Americans struggle to find reliable, quick loan solutions amidst a sea of confusing options. CashUSA claims to be the answer – but is it really the financial lifeline you're looking for?

We've spent over 15 hours analyzing CashUSA to bring you this review. Whether you're facing unexpected bills, looking to consolidate debt, or just need to bridge a gap between paychecks, we'll help you decide if CashUSA is the right choice for your wallet.

Here's a snapshot of what CashUSA offers:

| Feature | Details |

|---|---|

| Loan Amount | $500 - $10,000 |

| Loan Terms | 90 days - 72 months |

| Credit Score Requirement | All credit types accepted |

| Funding Speed | As fast as 1 business day |

| Application Fee | No fee to apply |

| Repayment Method | Automatic monthly payments |

| Security | 256-bit SSL encryption |

What is CashUSA?

CashUSA is an online loan broker that connects borrowers with suitable lenders.

Through its network of lenders, CashUSA offers borrowers loans between $500 and $10,000. The maximum loan amount available to a borrower will depend on their creditworthiness.

However, according to CashUSA's website, consumers with low credit scores will unlikely receive a loan greater than $1,000.

Borrowers can repay their loans in 90 days or stretch the payment terms to up to 72 months on approved credit.

Read more Cash USA reviews below or submit your own.

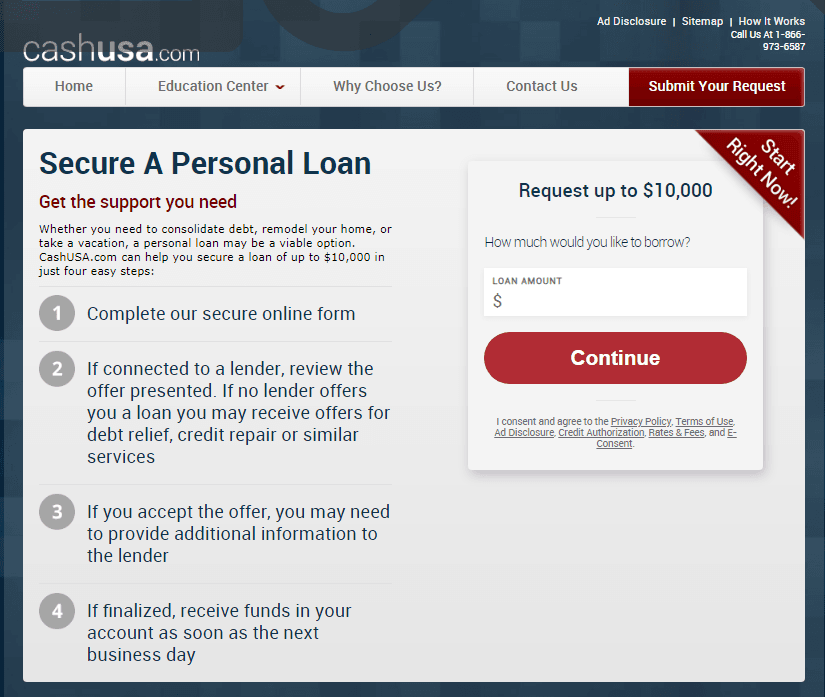

How CashUSA Works

With more than a million users every month, CashUSA offers a simple and straightforward online loan platform.

Borrowers simply need to enter their details online and they will receive offers from reputable lenders. CashUSA sends your submitted form to multiple lenders at the same time, so that you can compare multiple offers.

You can also read more CashUSA.com reviews at the bottom of this page.

Loan Requirements

Here are the loan requirements when applying for a CashUSA loan:

Be at least 18 years of age (older dependant of state)

U.S Citizen or permanent resident

Have a minimum post-tax income of $1000 per month

Provide a current email and phone number

Have an active checking account

Applications usually take only a few minutes and once you receive your offers, you can review and accept the loan terms immediately.

Rates & Fees

CashUSA loans come with APR rates of between 5.99% and 35.99%.

Example: A loan of $5,000 over 36 months with an APR of 18% will equal monthly payments of $179.35 with a total loan amount of $6,456.68.

Payment Terms

Repayment terms on a CashUSA loan are from 3 months to 72 months.

Loan offers from Cash USA may come with an origination fee, depending on the lender. Different offers may also have unique interest rates and payment terms.

How To Apply for a CashUSA Loan

Apply Online

Visit CashUSA.com and submit your loan request. This will require some basic information like the loan amount, what you need it for, your date of birth, and zip code. This will also trigger a soft credit inquiry.

Receive Loan Offers

Once you've submitted your details you'll be presented with suitable loan offers. Review the offers to see if one suits you needs, before you proceed to apply. Once you do, it will trigger a full credit check.

Loan Approval

Once your application has been submitted and reviewed, you'll be notified of the outcome. Since the terms differ from one lender to the next, you may receive your loan as soon as the next day.

Requesting a personal loan from CashUSA.com only takes a few minutes. This will result in a soft credit pull that does not impact your credit score.

You'll get the process started by sending the network your initial online loan request. Your zip code, birth year, and the last four digits of your Social Security number are needed for this.

Your full name, address, whether you are an active duty military member, the amount of the loan, and your credit score range will all be requested on the page that follows. This can range from subpar (a score of 579 or lower) to outstanding (at or above 740).

As this is a personal loan, there are no restrictions on how you can use the money. You can use it for debt consolidation, emergency expenses, car repairs, home improvements, and more.

FAQs About CashUSA.com

How much can I borrow?

How much can I borrow?

You can borrow up to $10,000 with a Cash USA loan.

What happens if I pay late?

What happens if I pay late?

When you accept the loan agreement you agree to pay back to loan principle and charges in a specific time. If you are late with payments, late fees may apply. CashUSA can't determine the specific penalty or late fee as this depends on the lender you take out your loan from.

Is CashUSA.com secure?

Is CashUSA.com secure?

Yes. CashUSA.com uses industry-standard encryption to process your personal information. Read more about their privacy policy here.

What are the loan terms?

What are the loan terms?

You can borrow up to $10,000 for up to 72 months. The APR on CashUSA loans varies from 5.99-35.99%.

Is CashUSA loan legit?

Is CashUSA loan legit?

CashUSA is a reputable lending platform that works with many lenders throughout the US.

Is CashUSA a payday loan?

Is CashUSA a payday loan?

CashUSA provides a range of payday loans for US consumers with an easy online application process.

How long does CashUSA take?

How long does CashUSA take?

Loan requests from CashUSA can be approved in minutes and money can be deposited into your account as soon as the next business day.

CashUSA.com Alternatives

Some alternatives to CashUSA.com include:

| Lender | Loan Amount | Terms | Apply > |

|---|---|---|---|

| PersonalLoans.com | $500 - $35,000 | Up to 72 months | Apply |

| BadCreditLoans | $500 - $10,000 | Up to 36 months | Apply |

| 5KFunds | $100 - $35,000 | Up to 72 months | Apply |

| LoansUnder36 | $500 - $35,000 | Up to 72 months | Apply |

You can view a complete list of online lenders here.