Sofi Relay Review (2023)

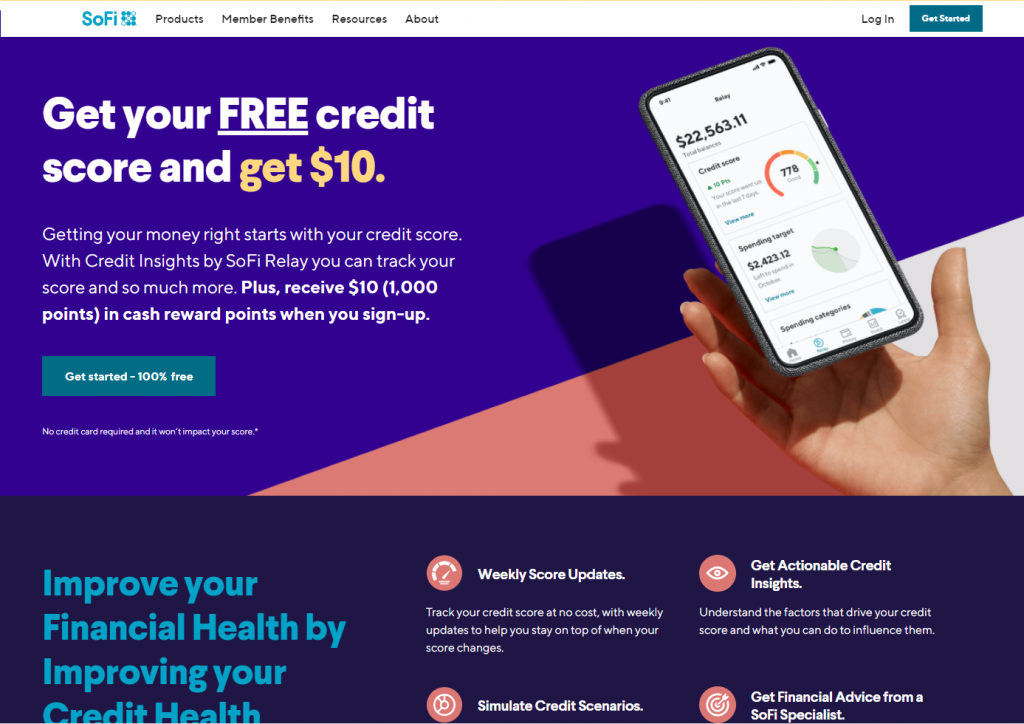

SoFi Relay tracks all your money in one place. You get free credit score monitoring, detailed spending breakdowns, financial insights, and more.

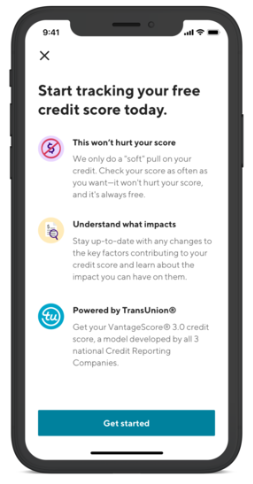

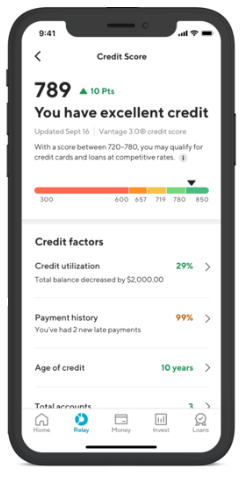

With SoFi Relay you can get your credit score at no cost with weekly updates to help you stay on top of when your credit score changes.

You can also get financial advice from a SoFi specialist and understand how certain financial decisions can impact your credit score.

SoFi Relay makes it easy to know where you stand and how much you spend. It makes it easy to reach your financial goals – all in one app.

Using SoFi Relay won’t hurt your credit score and you can check your credit score as often as you want. Best of all, it’s free.

How We Rate SoFi Relay

At Financer.com, all financial apps go through a thorough research and review process. Here’s how we rate SoFi Relay:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐⭐⭐ |

| Safety | ⭐⭐⭐⭐ |

| Tools and features | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐⭐ |

Do We Recommend SoFi Relay?

Yes, we recommend SoFi Relay as a reliable personal finance tool. Skip to our full review below and see how we rate SoFi Relay.Here’s what we’ll cover in this review:

Want to skip the details? Jump to our final verdict here.

SoFi Relay Overview

SoFi Relay is a free money management app. It allows you to see information about your assets, liabilities, and financial goals in one place.

SoFi Relay is powered by TransUnion’s VantageScore® 3.0 credit score. This model is used by all three credit reporting companies.

You can link checking, savings, investment, and retirement accounts to Relay, as well as student loans, mortgages, credit cards, and other debts.

Checking your own credit score doesn’t hurt your credit as it is considered a soft credit inquiry. The VantageScore® 3.0 credit score model uses the following components to determine your score:

- Payment history

- Credit utilization

- Credit type and age

- Balances

- Available credit

- Inquiries

Your credit score is used by lenders to review your credit applications and determine your creditworthiness. It is used by prospective employers and landlords, so it’s a good idea to keep track of your score.

SoFi Relay allows you to view charts that show your debit and credit card transactions by category. You get historical inflows and outflows of cash from accounts to help you estimate how much you earn and spend.

You can set up a monthly budget target and keep track of how you are progressing. The app tracks and displays upcoming recurring transactions to help you plan ahead for monthly expenses.

With SoFi Relay you get tips and insights to help you reach your goals, and invites you to apply for products from SoFi and its affiliates.

Security

SoFi Relay is housed in the SoFi app, which offers two-factor authentication. So, in addition to a passcode, you’ll need a security code, fingerprint recognition, or Face ID to get into your account.

Pricing

SoFi Relay is free of charge.

SoFi Relay Pros and Cons

Pros

- Get your credit score free of charge.

- Compile and view information from multiple accounts so you can see what you own, owe, and spend.

- Connected accounts are automatically refreshed.

- The Relay app is free to use and you can activate it through your SoFi.com login or by downloading the SoFi mobile app.

- Uses the trusted VantageScore 3.0 credit score model from TransUnion.

One of the most attractive benefits of SoFi Relay is that it’s free to use. Monitoring your credit doesn’t impact your credit score.

Another significant benefit of using SoFi Relay is the ability to link to things beyond just deposits, investments, or retirement accounts. You can add your credit cards, loans, and property, like a car or home you own.

For example, a car owner can put in the model and year of their car and SoFi Relay will calculate its value, which then appears on their dashboard.

Having these assets and liabilities laid out in front of users gives them a better sense of their overall net worth.

Built on the SoFi platform, SoFi Relay is a solid app that is free of charge and able to help you easily track your net worth, assets, and liabilities.

-

Only available for those on the SoFi network.

Cons

The only real drawback is that SoFi Relay is only available to SoFi users.

How to sign up for SoFi Relay

Login to SoFi

SoFi Relay vs Mint

If you compare SoFi Relay vs Mint you’ll notice there are some similarities, like being able to track your net worth, but there are some differences too.

One of the main differences between Relay from SoFi and Mint is that Mint offers Bill Negotiation – a feature that negotiates your bills for you to save you money.

Both SoFi Relay and Mint offer a free mobile app, credit monitoring, free credit score updates, help with budgeting, and spending analysis.

How Financer.com Rates SoFi Relay

Do we recommend SoFi Relay? Yes. SoFi’s free tool is a great way for users to accurately monitor their credit and keep track of all their important accounts.

The app is very user-friendly and easy to navigate, making it a great addition to the overall SoFi user experience.

Privacy and security

In terms of privacy, SoFi explains why they need personal information at every step and they are quite transparent about how they use users’ info.

Housed in the SoFi app, Relay is protected with two-factor authenticity. So in addition to your password, you’ll need a Face ID, fingerprint, or security code to access the feature.

Your personal data is secure as it’s stored on both SoFi’s servers and their partner Plaid, hosted by Amazon Web Services (AWS). SoFi itself does not have access to your personal account credentials.

SoFi Relay Alternatives

If you are not on the SoFi app you can consider these alternatives:

| App Name | Fees | Features |

|---|---|---|

| myFICO | $19.95 – $39.95 per month | FICO scores Credit reports $1 million identity theft protection 24×7 identity restoration Identity monitoring Monthly updates |

| PocketGuard | Free or $7.99 per month | Budgeting and insights Bill tracking Accounts aggregation Savings goals Income and net worth tracking |

| Mint | Free | Free credit score monitoring Free credit monitoring Helps to improve credit score Credit monitoring alerts |

Do you have experience with SoFi Relay? Share your review below.