TradeStation is a financial services company that provides trading technology, brokerage services, and investment education to active and professional traders.

Founded in 1982, the company has over 40 years of experience in the industry and has grown to become a well-respected name in the trading world.

This review will provide an in-depth analysis of TradeStation, including an overview of its trading platform, commission and fee structure, customer service, security measures, and regulations.

The aim is to provide investors with a comprehensive understanding of the company's offerings, as well as its pros and cons.

How We Rate TradeStation

At Financer, all traders go through a thorough research and review process. Here's how we rate TradeStation:

| Category | Rating |

|---|---|

| Investment options | ⭐⭐⭐⭐ |

| Ease of use | ⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend TradeStation?

Yes, we recommend TradeStation as a reliable broker. Skip to our full review below and see how we rate TradeStation.

Here's what we'll cover in this review:

Want to skip the details? Jump to our final verdict here.

What Is TradeStation? An Overview

TradeStation was founded in 1982 by William Porter, a veteran trader and computer programmer, with a vision to provide advanced technology to traders.

The company initially started as a trading software development firm, and today offers a suite of powerful trading tools and brokerage services.

This includes equities, options, futures, and cryptocurrency trading, as well as a range of analytical tools, market data, and educational resources.

The company is headquartered in Plantation, Florida, and has offices in Chicago, New York, Richardson, and London.

TradeStation has won numerous awards and has also been recognized for its innovative trading technology and commitment to security and transparency.

Here's a quick summary of TradeStation:

| Overview | Features |

|---|---|

| Minimum investment: | $0 |

| Trading fees: | $0 per trade up to 10,000 shares, $0.005 per share thereafter |

| Investment options: | Stocks, bonds, mutual funds, ETFs, options, futures, crypto |

| Account fees: | $35 IRA annual account fee, $1 per option contract |

| Ease of use: | Platform is user-friendly |

| Crypto availability: | 11 cryptocurrencies |

| Customer support: | Phone, email, and chat |

How TradeStation Works

TradeStation's trading platform is a powerful and versatile tool designed for active traders who demand speed, reliability, and advanced functionality.

The platform offers a range of advanced features and tools that cater to the needs of professional traders, including charting tools, trading strategy builders, and customizable layouts.

One of the key strengths of TradeStation's trading platform is its customizable charting tools. There's a wide range of customizable indicators, chart types, and drawing tools, which allow traders to create unique trading strategies.

Traders can also create and backtest their automated trading strategies using TradeStation's proprietary programming language, EasyLanguage.

TradeStation's platform offers advanced order types, including conditional orders, bracket orders, and one-cancels-other (OCO) orders, which help traders manage their risk and optimize their trading strategies.

The platform also offers a range of analytical tools, including market scanners, heat maps, and real-time market data, which provide traders with valuable insights into market trends and conditions.

User Experience

In terms of user experience, TradeStation's platform is easy to navigate and user-friendly, with a customizable interface.

The platform is available on desktop, web, and mobile devices, making it accessible to traders on the go.

Overall, TradeStation's trading platform is a robust and reliable tool that offers advanced features and functionality for active traders.

While the platform may be overwhelming for beginners, experienced traders will appreciate the platform's flexibility and depth of features.

TradeStation Fees

For equities and ETFs, TradeStation offers a flat rate of $0 per trade, with no minimum opening deposit needed.

For options trading, TradeStation charges $0.50 per contract, with a $10 minimum commission per trade.

Futures trading is also available, with commissions ranging from $1.50 to $4.00 per contract, depending on the volume and type of contract being traded.

In addition to commissions, TradeStation charges various fees, including platform fees, data fees, and inactivity fees.

The platform fee ranges from $99 to $249 per month, depending on the level of access and the number of contracts traded. Data fees range from $10 to $175 per month, depending on the type and level of data required.

TradeStation charges an inactivity fee of $50 per year, which is waived for accounts with a minimum account balance of $2,000 or for accounts that have executed at least five trades in the preceding 12 months.

Overall, TradeStation's commission and fee structure is competitive with other online brokers, particularly for active traders who trade in high volumes.

However, the platform and data fees can add up, particularly for traders who require access to advanced features and real-time data.

Note: Although there are no minimum deposits, you need to deposit at least $2,000 for free access to the desktop platform.

Security and Regulations

TradeStation takes security and regulations very seriously, implementing a range of measures to protect its traders' assets and personal information.

The company is registered with the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA) and the National Futures Association (NFA).

TradeStation's platform and website are protected by SSL encryption, ensuring that all data transmitted between the trader's browser and TradeStation's servers is secure.

The company employs two-factor authentication and IP address restrictions to prevent unauthorized access to accounts.

In terms of asset protection, TradeStation holds all client funds in segregated accounts with top-tier banks, ensuring that trader funds are separate from the company's funds.

The company also participates in the Securities Investor Protection Corporation (SIPC), which provides traders with up to $500,000 in protection if the company goes bankrupt.

TradeStation's regulatory compliance is overseen by its compliance team, which ensures that the company is following all applicable laws and regulations.

The company also provides traders with access to its regulatory disclosures and reports, which provide transparency and insight into its compliance efforts.

Overall, TradeStation's commitment to security and regulatory compliance is strong, providing traders with peace of mind and protecting their assets and personal information.

The company's participation in regulatory bodies and its adherence to industry standards demonstrate its commitment to maintaining a secure and transparent trading environment

Who Is TradeStation For?

Who It's For

TradeStation is a good choice for active traders who require a sophisticated and customizable trading platform, with access to advanced charting, technical analysis, and trading tools.

The company's competitive commissions and fees, along with its excellent customer service and strong security and regulatory compliance, make it an attractive option for experienced traders who are looking for a reliable broker.

Who It's Not For

TradeStation may not be a good option for beginner investors as the platform may seem overwhelming.

With a minimum deposit of $2,000 to access the desktop platform, if you don't meet the minimum trades, it will be $10 per transaction, which can be high for traders who are just starting out.

How To Get Started with TradeStation

Getting started with TradeStation is easy. Here are the steps:

TradeStation offers the following options:

Stocks

ETFs

Mutual Funds

Bonds

Options

Futures

Forex

International Markets

Penny Stocks

Advisory Services

Cryptocurrency

Fractional Shares

Cash Management Services

Helpful Resources

TradeStation's online knowledge base is a comprehensive resource that includes user guides, video tutorials, and FAQs, which cover a wide range of topics related to the trading platform and brokerage services.

The community forum is also a helpful resource, providing traders with access to a community of fellow traders who can share insights and experiences.

How Financer Rates TradeStation

Is TradeStation good? Yes, at Financer we recommend TradeStation.

At Financer, all brokers go through a thorough research and review process. We don't make recommendations lightly.

Overall, TradeStation offers an advanced trading platform, competitive commissions, excellent customer service, and strong security and regulations.

However, traders should be aware of the platform and data fees, limited education resources, and lack of mutual funds when considering TradeStation as a broker.

Sign Up Process

The signup process is relatively straightforward and opening an account takes a few minutes online. See above.

Fees

Generally, TradeStation's commission rates are competitive with other online brokers, particularly for high-volume traders.

Customer Service

TradeStation provides customer support through phone, email, and live chat, as well as through its online knowledge base and community forum.

Their customer service team is available 24/7, providing traders with support at all hours. The phone and live chat support are particularly helpful, offering fast response times and knowledgeable agents who can assist with a range of queries, from technical issues to account questions.

The email support is also prompt, with agents typically responding within a few hours.

TradeStation Alternatives

Here's a list of TradeStation alternatives and how it compares to other brokers:

| Lender | Reviews | Fees | Account Minimum |

|---|---|---|---|

| TradeStation | View | $0 per trade, other fees may apply | $0 |

| Fidelity Investments | View | $0per trade | $0 |

| Empower | View | 0.49%-0.89% | $100,000 |

| Ameritrade | View | $0per trade | $0 |

| Betterment | View | 0.25% – 0.40% | $0 |

More TradeStation Reviews

What Users On the Web Are Saying

TradeStation gets 3.7 out of 5 stars on Forbes:

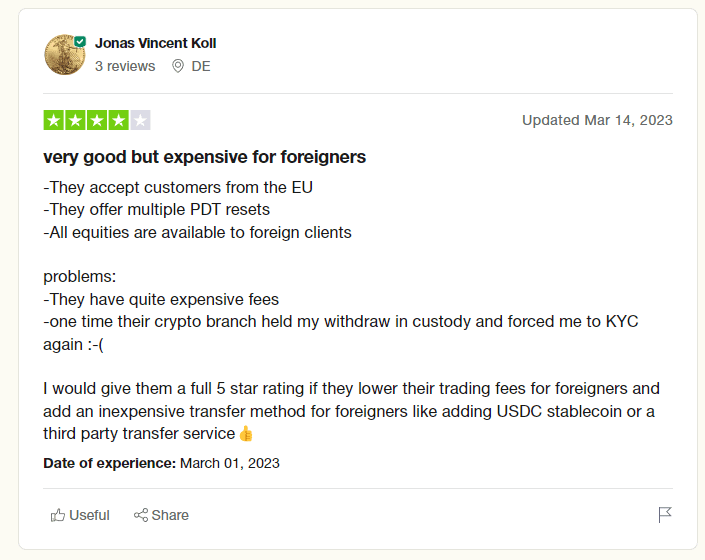

Some users on TrustPilot complained about the complexity of the system, although some reviews are visibly inaccurate. Other users were happy with the overall service and recommend TradeStation:

TradeStation Overview

TradeStation offers an advanced and customizable trading platform, with advanced charting, technical analysis, and trading tools that are particularly useful for experienced traders.

TradeStation's commissions and fees are competitive with other online brokers, particularly for active traders who trade in high volumes.

Their customer service is prompt, knowledgeable, and available 24/7, providing traders with multiple channels of support.

The platform takes security and regulations very seriously, employing a range of measures to protect its traders' assets and personal information.

It charges platform and data fees, which can add up, particularly for traders who require access to advanced features and real-time data.

While TradeStation offers a range of educational resources, including webinars and video tutorials, its educational offerings may be more limited compared to other brokers.

The platform does not offer mutual funds, which may be a drawback for traders who prefer to invest in these types of products.