Financer score™ is our own point system which is updated live and based on several criteria that gives you a balanced view of the company quality.

Pricing

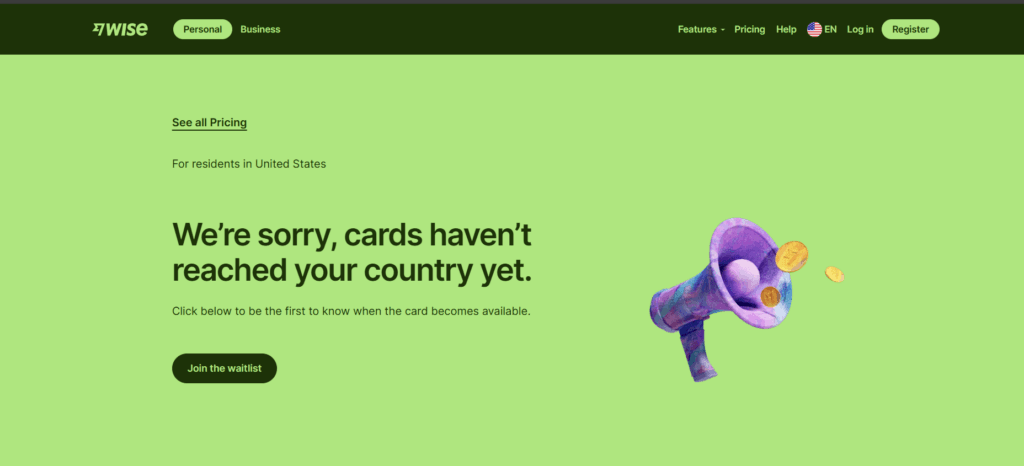

When you compare Wise’s near-transparent, low-cost structure to traditional banks’ often opaque and expensive pricing, Wise stands out as nearly the gold standard in cost efficiency.

Customer Support

We found Wise to offer clear, personalized, and insightful support response during our testing, avoiding generic answers and making the customer feel well taken care of.

Terms and Flexibility

Wise is known for its industry-leading transparency, offering fully itemized fee schedules and no hidden charges. Beyond that, Wise consistently receives high marks for its ease of use.

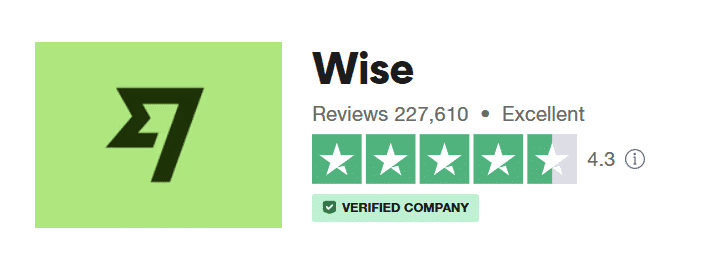

Popularity

The popularity score indicates the percentage of customers choosing this company the last 90 days.

Customer Experience

Customer experiences vary significantly. Many users report excellent experiences with fast, reliable transfers, while others face frustrating account freezes, delayed verification processes, and inconsistent customer service response times.