Xlence: all you need to know about the trading platform

Are you looking to dive into the world of online trading? Look no further! In this guide, we’ll explore Xlence, a rising companyin investing. From its flexible leverage options to its diverse range of tradable instruments, we’ll cover everything you need to know to decide if Xlence is the right platform for your trading journey.

This review is not investment advice

Our goal is to share information about the company and our own team’s experience using the platform. Since almost every financial transaction involves risks, we suggest that you make your own judgment and only proceed if you are confident.

What is Xlence?

Xlence is a relatively new player in the international forex and CFD brokerage scene, but it’s quickly gaining recognition for its exceptional trading services. Founded with the mission to simplify trading for both beginners and professionals, Xlence has become a go-to platform for traders seeking a comprehensive and user-friendly trading environment.

Xlence is making significant strides in a short time. The company already offers access to over 300 trading instruments across six major asset classes, enabling different trading strategies and preferences.

Limited availability

Unfortunately, Xlence does not offer its services to residents of US right now, so if you’re American, you have to wait a little longer until the platform is available in your location. The same goes for Iran, Cuba, Sudan, Syria and North Korea.

The company stands out for its flexible trading conditions, with leverage options up to 1:1000 and competitive spreads starting as low as 0.5 pips. This makes it an attractive option for traders looking to maximise their market exposure while keeping costs low.

One of Xlence’s features is its commitment to education. The platform provides rich educational content for free, ensuring that traders at all levels can continually improve their skills and market knowledge.

The platform also emphasises fast execution and hassle-free deposits and withdrawals, addressing two critical aspects of the trading experience. With its user-friendly interfaces and comprehensive educational resources, Xlence aims to cater to traders of all experience levels.

Now, let’s break down some key information about Xlence:

| Characteristic | Xlence |

|---|---|

| Available Markets | Forex, Metals, Indices, Commodities, Futures and Shares |

| Products | Over 300 available |

| Tools | MetaTrader 4 (MT4) and WebTrader |

| Customer Service | 24/5, Multilingual support |

| Leverage | Up to 1:1000 |

| Spread Types | Floating |

| Spread costs | From 0.7 pips to 2.7 pips |

| Commissions | No commission except for $10/Lot applied to Future Indices, FX Futures and Future Commodities |

| Features | Xlence Academy and Economic Calendar |

| Create an account | Free |

| Demo account | Available |

| Regulation | Only Seychelles Financial Services Authority |

| Account types | Essential, Prime, Deluxe and Ultimate |

| Mobile app | Not available |

| Stop out | 20% |

| Dedicated Manager | Available for Prime, Deluxe and Ultimate accounts |

Xlence Pros and Cons

Get to know Xlence’s main pros and potential drawbacks:

Flexible leverage options up to 1:1000

Low spreads, especially on higher-tier accounts

Wide range of tradable instruments (300+)

Comprehensive educational resources

Pros

Regulated only for Seychelles Financial Services Authority

Relatively new in the market

Services not available in US yet

Limited platform options

Cons

Types of accounts

Investing can be a complex world, and each trader has unique needs when it comes to tools, costs, and features. That’s why Xlence offers various types of accounts which meet different trading styles and experience levels.

Don’t worry, we’ll explain each account type, so you can understand which fits you better.

Xlence Essential Account

This is the entry-level account, perfect for beginners or those who prefer straightforward trading conditions.

- Spread EUR/USD Min: 1.1 pips

- Spread EUR/USD Average: 1.4 pips

- Spread XAU/USD Min: 0.23 pips

- Spread XAU/USD Average: 0.25 pips

- Commission: No commission, except for $10/Lot applied to Future Indices, FX Futures and Future Commodities.

- Leverage: Flexible, up to 1:1000

- Products: Forex, Metals, Indices, Commodities, Futures, Shares

- Stop out: 20%

Xlence Prime Account

If you’re looking for more competitive conditions, this is the one for you.

- Spread EUR/USD Min: 0.9

- Spread EUR/USD Average: 1.2 pips

- Spread XAU/USD Min: 0.18 pips

- Spread XAU/USD Average: 0.20 pips

- Commission: No commission, except for $10/Lot applied to Future Indices, FX Futures and Future Commodities.

- Leverage: Flexible, up to 1:1000

- Products: Forex, Metals, Indices, Commodities, Futures, Shares

- Stop out: 20%

- Bonus: Dedicated account manager

Xlence Deluxe Account

Really active traders, this is the right account for you.

- Spread EUR/USD Min: 0.6 pips

- Spread EUR/USD Average: 0.9 pips

- Spread XAU/USD Min: 0.18 pips

- Spread XAU/USD Average: 0.20 pips

- Commission: No commission, except for $10/Lot applied to Future Indices, FX Futures and Future Commodities.

- Leverage: Flexible, up to 1:1000

- Products: Forex, Metals, Indices, Commodities, Futures, Shares

- Stop out: 20%

- Bonus: Dedicated account manager

Xlence Ultimate Account

The account that fits professional traders seeking the best conditions.

- Spread EUR/USD Min: 0.4 pips

- Spread EUR/USD Average: 0.7 pips

- Spread XAU/USD Min: 0.18 pips

- Spread XAU/USD Average: 0.20 pips

- Commission: No commission, except for $10/Lot applied to Future Indices, FX Futures and Future Commodities.

- Leverage: Flexible, up to 1:1000

- Products: Forex, Metals, Indices, Commodities, Futures, Shares

- Stop out: 20%

- Bonus: Dedicated account manager

To simplify everything, here’s a quick comparison table of the key features:

| Feature | Essential | Prime | Deluxe | Ultimate |

|---|---|---|---|---|

| EUR/USD Spread | 1.1/1.4 | 0.9/1.2 | 0.6/0.9 | 0.4/0.7 |

| XAU/USD Spread | 0.23/0.25 | 0.18/0.20 | 0.18/0.20 | 0.18/0.20 |

| Max Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| Dedicated Manager | No | Yes | Yes | Yes |

All accounts offer a minimum lot size of 0.01 and a lot increment of 0.01, making them suitable for various trading strategies and risk appetites.

How to create an account

Ready to start trading with Xlence? Let’s walk through the account creation process step by step. It’s easier than you might think!

Step 1: Visit the Xlence website

Click here for a shortcut. Then, click on “Sign Up” on the top right corner of the screen.

Step 2: Fill in your information

Provide your personal information, including your name, e-mail address and phone number. Remember, your phone number and Country of Residence must be one of the countries listed. Xlence operates in approximately 100 countries, but does not offer its services to residents of certain jurisdictions such as the US, Iran, Cuba, Sudan, Syria and North Korea.

Step 3: Create a secure password

In this step, you must choose a password for your account. Make sure to choose a strong and unique one to ensure your security.

You also have to accept the terms and conditions. We recommend reading them carefully to understand the rules and regulations governing your trading account. After reviewing and agreeing to them, mark the box and click on “Open Account”.

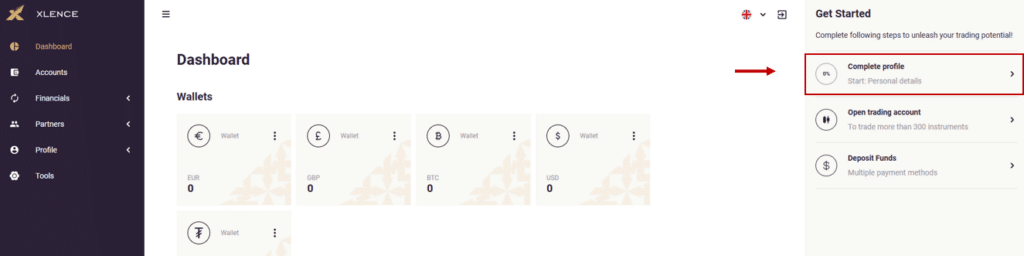

Step 4: Complete your information

Your account is already created, but you have to activate it. To do this, go to the homepage and click on “Complete profile” on the right side of the screen.

Here you will have many fields to fill in, such as personal details, address details and documentation.

Step 5: Verify your email

After filling all the information, check your inbox for a verification email from Xlence. Click on the verification link to confirm your email address.

Step 6: Add a trading account

Now that you’ve completed everything, you can add a trading account. Click on “Accounts” in the left side menu where you have two options: a real account and a demo account.

Demo Account

You can try the Xlence demo account for free before investing any money. It’s a great way to practice and familiarise yourself with the features of the platform.

Select the option you want and fill in the necessary information. If you choose the real account, you’ll also have to select the type of account.

Step 8: Fund your account

Once your account is verified and your trading account has been created, you must make your first deposit. Xlence offers various payment methods to suit different needs, including bank transfers and e-wallets. We’ll explain them later.

Understanding Xlence Cost Structure

We already mentioned some spreads, but now it is time to dive into Xlence’s costs. After all, knowing what you’re paying for is crucial when choosing a trading platform. First of all, let’s remember each account costs:

Essential Account

- Spread on EUR/USD: Starts from 1.1 pips, averaging around 1.4 pips

- Spread on XAU/USD (Gold): Minimum of 0.23 pips, averaging 0.25 pips

- Commission: Zero commission on most trades

For example, if you’re trading 1 lot of EUR/USD (100,000 units) with a spread of 1.4 pips, your cost would be $14 per trade.

Prime Account

- EUR/USD spread: From 0.9 pips, averaging 1.2 pips

- XAU/USD spread: Minimum 0.18 pips, average 0.20 pips

- Commission: Still zero for most trades

Using the same 1 lot EUR/USD example, your cost would drop to $12 per trade.

Deluxe Account

- EUR/USD spread: From 0.6 pips, averaging 0.9 pips

- XAU/USD spread: Minimum 0.18, average 0.20 pips

- Commission: Remains at zero for most trades

Trading 1 lot of EUR/USD on the Ultimate account could cost as little as $7 per trade.

Ultimate Account

- Ultimate EUR/USD spread: From 0.4 pips, averaging 0.7 pips

- XAU/USD spread: Minimum 0.18, average 0.20 pips

- Commission: Remains at zero for most trades

The same example of Deluxe Account goes for the Ultimate: Trading 1 lot of EUR/USD could cost as little as $7 per trade.

Future Costs

While Xlence boasts no commission on most trades, there’s a $10 per lot commission on Future Indices, FX Futures, and Future Commodities. This works in the same way for every kind of account.

Main tools available on Xlence

When investing, it’s important to have strong support. Xlence isn’t just a trading platform, but a complete platform, designed to empower investors with knowledge and resources. Let’s explore some of the standout tools:

Xlence Academy

The Xlence Academy is your personal trading university, right at your fingertips.

An educational resource packed with courses on trading strategies, technical analysis, and market fundamentals, totally free. It’s designed to help both beginners and experts to achieve a higher level.

In the fast-paced world of trading, knowledge is power. The Xlence Academy helps you build a solid foundation of trading skills, potentially reducing costly mistakes and improving your decision-making process.

Pros of using Xlence Academy

- Totally free

- Self-paced learning

- Covers a wide range of topics

- Helps demystify complex trading concepts

Economic Calendar

Staying on top of market-moving events is crucial for any trader, and Xlence’s Economic Calendar makes this task easier. Besides economic events and other market-impacting occurrences, it provides forecasts, historical trends and real-time updates.

Pros of using Xlence’s Economic Calendar

- Real-time updates

- Customisable to focus on your preferred instruments

- Helps in fundamental analysis

- Aids in planning trading strategies around major events

MetaTrader 4 (MT4)

MT4 is the go-to platform for many traders worldwide, and Xlence offers full support for this powerful platform. MetaTrader4 provides real-time market data, advanced charting tools and the ability to use automated trading strategies through Expert Advisors (EAs).

Pros of using MT4 on Xlence

- Available on desktop, web, and mobile devices

- Customisable interface

- Supports algorithmic trading

- Large community for support and strategy sharing

WebTrader

For those who prefer not to download software, Xlence offers a browser-based trading solution. WebTrader is a trading platform that offers most of the functionality of MT4 without requiring any downloads or installations. This is particularly useful for traders who are often on the move or use multiple devices.

Pros of using Xlence WebTrader

- No download required

- Access from any internet-connected device

- User-friendly interface

- Seamless integration with your Xlence account

Customer Support

This isn’t exactly a tool, but it’s worthy to mention Xlence’s Customer Support. The platform provides 24/5 multilingual support through various channels, including live chat, email, and phone.

So, if you have any trouble when using the platform, count on Xlence’s help during the weekdays.

By leveraging these tools, you can potentially enhance your trading performance and make more informed decisions.

Remember

Successful trading is about more than just buying and selling – it’s about continuous learning and adapting to market conditions. Xlence’s suite of tools aims to support you on this journey.

Available options to pay and withdraw

When it comes to trading, getting your money in and out of your account smoothly is crucial. Xlence understands this and offers a range of options for both deposits and withdrawals.

The most important thing: Xlence doesn’t charge any fees for deposits or withdrawals, so you can take your money in and out whenever you want.

Deposits

Funding your Xlence account is straightforward, with several methods available to suit different preferences.

Bank Wire Transfer

If you prefer a traditional method, Xlence allows you to make deposits directly from your bank account. The main benefit is that this method is secure for large deposits. On the other hand, it can take 1-3 business days to process.

Credit/Debit Cards

Now, if you’re the kind of person who prefers cards, Xlence accepts major credit and debit cards. This is good for those who want agility, because the funding is virtually instantaneous, but some banks may charge additional fees.

E-Wallets

Now we’re talking about technological people. Xlence supports popular e-wallets for quick and easy deposits. While processing is fast, it may have limits on deposit amounts.

Withdraw

Getting your money out is even more important than putting it in. Xlence understands it and offers several withdrawal methods.

Bank Wire Transfer

The most common method for larger withdrawals is a bank wire transfer directly to your bank account. Though it has no upper limit for amounts, the process may take 3-5 business days.

Credit/Debit Cards

Xlence allows you to withdraw funds back to the card you used for deposits, in a relatively quick process. But be aware that some cards may have withdrawal limits.

E-Wallets

For smaller amounts, you can have a fast and convenient method: e-wallets. In this case, the limits can be much lower than bank transfer, but your withdrawal is usually processed within 24 hours.

Get to know

It’s worth noting that Xlence processes most withdrawal requests within 24 hours, which is faster than many competitors in the industry. However, the actual time it takes for the funds to reach your account can vary depending on the method chosen.

Platform safety and data protection

In the digital age, security is primordial, especially when it comes to your financial data.

SSL Encryption

Xlence employs industry-standard SSL (Secure Socket Layer) encryption to protect all data transmitted between your device and their servers.

SSL encryption scrambles your data, making it unreadable to anyone who might intercept it. This means your personal and financial information stays safe from prying eyes.

Xlence final rating

After diving deep into Xlence’s offerings, it’s clear that this broker has both strengths and areas for consideration. Let’s break down why you might want to choose Xlence, and where you might pause for thought.

Flexible leverage up to 1:1000: This high leverage can be a powerful tool for experienced traders looking to maximise their market exposure.

Competitive spreads: With spreads as low as 0.4 pips on EUR/USD for Ultimate accounts, Xlence offers cost-effective trading conditions.

Diverse range of instruments: Access to over 300 trading instruments across six asset classes provides ample opportunities for portfolio diversification.

Educational resources: The Xlence Academy offers valuable learning materials for traders at all levels.

User-friendly platforms: With both MT4 and WebTrader available, Xlence caters to different trading preferences and styles.

Fast execution and hassle-free deposits/withdrawals: These features contribute to a smooth trading experience.

Why Chosse Xlence

Relatively new player: As a newer entrant in the forex market, Xlence doesn’t have the long-standing reputation of some established brokers.

Limited regulation: Xlence is regulated only by the Seychelles Financial Services Authority. Besides, the company doesn’t operate in the US. These factors might concern risk-averse traders.

High leverage risk: While high leverage can amplify profits, it also increases the risk of significant losses, especially for inexperienced traders.

Limited platform options: Some traders might prefer a wider range of platform choices beyond MT4 and WebTrader.

Why you might hesitate

Xlence appears to offer a solid trading package, particularly appealing to those comfortable with higher leverage and looking for a diverse range of instruments. The educational resources and user-friendly interfaces make it accessible for beginners, while the competitive spreads and fast execution could attract more experienced traders.

However, it’s crucial to consider your personal trading goals and risk tolerance when choosing a broker. If you’re comfortable with a new player in the market, with a single regulation, and have the skills to manage high leverage responsibly, Xlence could be a good choice.

An important reminder

Remember, no matter which broker you choose, always trade responsibly and never invest more than you can afford to lose!

All trading involves risks. It is possible to lose all your capital.

Xlence FAQs

How can I create an account on Xlence?

Creating an Xlence account is a straightforward process that takes less than 10 minutes. Click here to see a complete step-by-step.

How secure is Xlence for online transactions?

Xlence employs industry-standard SSL encryption to protect all data transmissions.

Does Xlence offer customer support?

Yes, Xlence provides comprehensive customer support. They offer 24/5 multilingual assistance through various channels, including live chat, email, and phone. Xlence also maintains a FAQ section and educational resources to help users find quick answers to common questions and improve their trading knowledge.

What payment methods does Xlence accept?

Xlence accepts a variety of payment methods for deposits and withdrawals. These include bank wire transfers, credit/debit cards, and popular e-wallets. Most deposits are processed instantly, while withdrawals are typically handled within 24 hours. Bank transfers may take 1-3 business days. The platform aims to provide hassle-free transactions, with no fees charged by Xlence for deposits or withdrawals.