What is the Debt-to-GDP ratio?

The debt / GDP ratio is an economic indicator that reflects a country’s total public debt as a percentage of GDP. The ratio indicates how manageable a country’s debt is given its economic output.

Public debt includes all government borrowing, while GDP includes personal consumption, business investment, government spending, and net exports. The term ‘debt-to-GDP’ is typically used to refer to public (government debt) as a percentage of GDP. However, it may also refer to a country’s total debt, which includes public, personal and corporate debt.

The basic premise behind the debt to GDP ratio is that a country’s ability to pay off its debt increases as its GDP increases. This occurs as tax revenues typically increase in line with economic activity. If debt rises faster than GDP, the interest on those debts will consume more tax revenue, leaving less for other spending. Ultimately, this will act as a drag on GDP growth and eventually the government may not repay the debt.

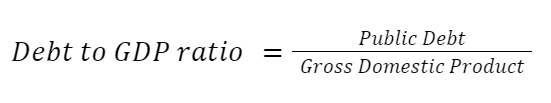

How to calculate the Debt to GDP ratio?

The debt-to-GDP ratio is calculated by dividing a country’s total public debt at the end of a 12-month period by its GDP during that period. It is typically expressed as a percentage.

What is the current US debt to GDP ratio?

In the fourth quarter of 2021, the US Debt / GDP ratio was 123.36%.

During 2021, the highest and lowest US debt to GDP levels were 127.65% and 122.52% respectively.

Key US debt / GDP ratio trends and levels

US government debt as a percentage of GDP has changed significantly over the last 100 years, though it’s important to remember the economy and financial system have also changed considerably.

Prior to 1940, the ratio remained between 8% and 44%. During the second world war it increased to 121% as the government increased its borrowing to fund the war effort. After the second world war, the debt to GDP ratio quickly fell back to below 50% as GDP increased rapidly. It eventually reached 30.6%, the lowest level of the last 70 years, in 1981.

US Debt as a percentage of GDP has increased steadily since 1981. The increases have typically begun during recessions, but continued to rise after the recessions have ended. Significant increases began during the global financial crisis in 2008, and the Covid-19 pandemic in 2020.

The ratio reached a record high of 135.94% during the second quarter of 2020.

While the ratio has declined slightly since 2020, there is no sign that it will fall meaningfully in the future.

How to use the debt-to-GDP ratio?

There isn’t a direct relationship between a country’s debt to GDP ratio and its stock market, but it is something to be aware of. A high debt to GDP ratio can be a problem if it becomes unsustainable, and high levels of debt can impact economic growth.

Risks of high debt to GDP ratios

If a country’s debt becomes unsustainable, its economy and financial system can face several risks:

- Debt service levels (the interest that needs to be paid on the debt) increase along with debt. This money needs to be diverted from other fiscal programs like infrastructure investment. The World Bank believes that a ratio above 77% leads to lower GDP growth. Debt service levels also depend on interest rates, so a country can service more debt when interest rates are low.

- Default risk increases when debt levels are high. As a country takes on more debt, the probability that it cannot repay its creditors increases. As the risk of default rises, so does the cost of further borrowing.

- If a country’s debt becomes unsustainable, its financial markets are at risk of ‘capital flight’. This happens when investors sell a country’s bonds, currency, and equities to avoid the fallout from a default.

When a country faces a debt crisis, it will often be forced to reduce spending and make structural reforms. These are likely to constrain the economy until debt becomes manageable again.

When does debt become a problem?

High levels of debt can be manageable if a country’s currency and financial system remain stable and interest rates remain relatively low. Japan’s national debt has remained above 100% since 2000 and above 200% since 2012. Japan has sustained this level of debt because interest rates are very low, and the financial system is relatively stable. However, high levels of debt can lead to stagflation (low growth and high inflation) if the debt weighs on economic growth.

Debt is most likely to become an issue for countries when it is combined with a current account deficit, a weak or volatile currency, inflation and political instability. The risk is even higher when a country’s debt is denominated in a foreign currency. These risk factors are more common amongst developing economies.

High levels of debt can also be a problem for European Union member countries as they don’t have control over the currency and interest rates. This led to Greece’s sovereign debt crisis in 2009.

US debt and the stock market

The US is in a unique position in that the US Dollar is the global trading and reserve currency and US bonds are safe haven assets. This means the currency has remained strong and interest rates have fallen. This has allowed the US to carry a relatively high level of debt.

The high debt to GDP ratio in the US has not been viewed as a problem yet – but it may become a risk in the future. The risk would increase if the currency and bond market fell out of favor with global investors. If it becomes apparent that US debt has become unsustainable, it would likely affect the stock market significantly.

There is one important lesson that stock market investors can draw from the high US debt to GDP ratio. The US government has always been prepared to use very large amounts of debt during a recession or financial crisis. Debt has typically increased dramatically during a recession and has been used to provide liquidity and to support asset prices.

As always, we recommend referring to a variety of indicators and not relying on a single indicator. Useful indicators include:

AAII Sentiment

VIX Index

Personal Savings Rate

Buffet Indicator

Put/Call Ratio

Margin Debt to Cash

Velocity of M2 Money Stock

10Y Treasury Yield

Unemployment rate

Shiller P/E ratio

DXY index

What are the limitations of the debt / GDP ratio?

There isn’t a direct relationship between a country’s Debt/GDP ratio and stock prices. However, it can highlight potential risks, particularly when a country has a high debt to GDP ratio and weak economic indicators.

Critics of the debt to GDP ratio point out that while it includes government debt, it doesn’t include other potential liabilities. These can include loans underwritten by the government, welfare and healthcare programs and municipal debt.

Is the debt / GDP ratio a reliable indicator?

This indicator provides valuable information about investment risk for a country, but isn’t necessarily a valuation or timing indicator.

Besides the Debt / GDP ratio, you can use our complete list of 12- essential market indicators to make educated financial decisions.