What is the Personal Saving Rate?

The Personal Saving Rate (PSR) is an economic indicator which reflects the percentage of US incomes that are saved each month. While the PSR is not a valuation metric for the stock market, it provides insights into consumer spending and capital available for investing.

Savings include income that is saved as bank deposits and other investments.

While the PSR reflects the amount that consumers are saving and making available for investments, it’s also inversely proportional to ‘spending’. This means the PSR also provides valuable information about potential corporate profits.

The PSR is published by the US Bureau of Economic Analysis on a monthly basis.

How to calculate the Personal Saving Rate?

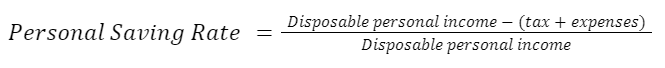

The PSR is calculated as the percentage of disposable personal income (DPI) that is not spent each month.

DPI includes all income less the tax paid on that income. All monthly expenditures are then deducted from DPI to arrive at personal savings.

What is the current Personal Saving Rate?

As of January 2022, the US personal saving rate was 6.4%.

- The highest PSR in the last 12 months was in March 2021 when it reached 26.6%.

- The lowest PSR in the last 12 months was in January 2022, when it fell to 6.4%

- Since 1985, the highest and lowest PSR levels were 2.1% and 33.8% respectively.

Key Personal Saving Rate trends and levels

Between 1985 and 2020, the US PSR remained in a range between 2% and 11%. The average level drifted lower from 1985 to 2005, when it reached 2.1%, the lowest level on record. The average then rose until 2020.

In March 2020, the PSR rose to an unprecedented level of 33.8% because of measures taken to prevent the spread of Covid-19. Travel restrictions and social distancing guidelines prevented consumers from spending money on travel and hospitality, both of which are key areas for discretionary spending. In addition, the US government sent out stimulus cheques which some consumers could save.

How to use the Personal Saving Rate?

When analyzing the PSR, we can consider short-term changes and long-term trends.

Personal savings can impact the stock market directly if those savings flow into stocks. The personal saving rate can also affect the stock market indirectly by affecting spending levels in the economy, which affects corporate profits and valuations.

There is an interesting relationship between savings, spending and the economy. In the short term, spending flows through the economy, which benefits corporate profits. However, in the long term, savings lead to investment in productivity, which also benefits the economy and corporate profits. So, high and low savings rates can both be beneficial to the stock market over different time periods.

The direct impact of the Personal Saving Rate on stock prices

When consumers spend less and save more, they have more capital available to buy stocks. A sharp increase in the PSR sometimes precedes a rally in stock prices. In several instances, an increase in the PSR has helped sustain an extended rally in stock prices, too.

By contrast, a sharp decline in the savings rate may precede a correction or bear market in stocks. This makes sense as investors are diverting less of their income to savings.

While sudden changes in the savings rate can precede reversals in stock prices, there is usually a lag of several months before stock prices change course.

The Indirect Impact of the Personal Saving Rate on Stock Prices

Longer term trends in the personal saving rate affect corporate profits. Companies benefit from increased spending when the savings rate falls. The immediate beneficiary is consumer facing companies, although increased spending ultimately filters through to the entire economy.

There is often an inverse correlation between the P/E ratios of stocks and the PSR when there is a clearly defined trend in the savings rate. When the PSR is in a downtrend, investors expect increased future spending. This results in higher valuations and P/E ratios for stocks. Similarly, when the PSR trends higher, investors expect lower spending and P/E ratios fall.

Savings rates tend to affect valuations over longer periods of time, while their direct effect on stock prices can occur over shorter periods. As always, savings rates should be used with other sentiment and valuation indicators, including:

- AAII Sentiment

- VIX Index

- The Buffet Indicator

- Put/Call Ratio

- Margin Debt to Cash

- Velocity of M2 Money Stock

- Debt / GDP ratio

- Unemployment rate

- Shiller P/E ratio

- DXY index

What are the limitations of the Personal Saving Rate?

Savings rates undoubtedly play a role in the economy and in the amount of capital flowing into the stock market. However, there isn’t a direct relationship between the savings rate and stock prices. The PSR is just one of many factors that affect stock prices and valuations.

The PSR is not a good timing tool, either. While changes in the PSR often precede reversals in stock prices, the lag between the two can last as long as 12 months.

Is the Personal Saving Rate a reliable indicator?

The PSR isn’t really a standalone indicator, but it can provide a valuable context regarding investment flows, spending, and valuations. In particular, the savings rate can be used alongside the Shiller P/E ratio, sentiment indicators like the AAII Sentiment indicator, and the Margin Debt to Cash ratio.

Besides the Personal Saving Rate, you can use our complete list of 12- essential market indicators to make educated financial decisions.