Compound Interest Calculator

Understanding Compound Interest

Compound interest is one of the most powerful forces in personal finance, yet many people don't fully grasp how it works. Simply put, compound interest is earning interest on your interest.

Here's a basic example: You invest $1,000 and earn 10% interest in the first year, giving you $1,100. In year two, you earn 10% on the full $1,100 (not just your original $1,000), which equals $110 in interest. That extra $10 comes from earning interest on the previous year's interest.

This compounding effect grows exponentially over time. While the quote "Compound interest is the eighth wonder of the world" is often attributed to Albert Einstein, historians have found no evidence he actually said this. The phrase first appeared in 1916 advertising copy. Regardless of its origin, the concept remains incredibly powerful for building wealth.

How Compound Interest Works

The mechanics of compound interest are straightforward: interest gets added to your principal balance each compounding period, and future interest calculations include that added amount.

This means you earn returns not just on your original investment, but on all the growth that investment has generated over time. The frequency of compounding - daily, monthly, or annually - affects how quickly your money grows.

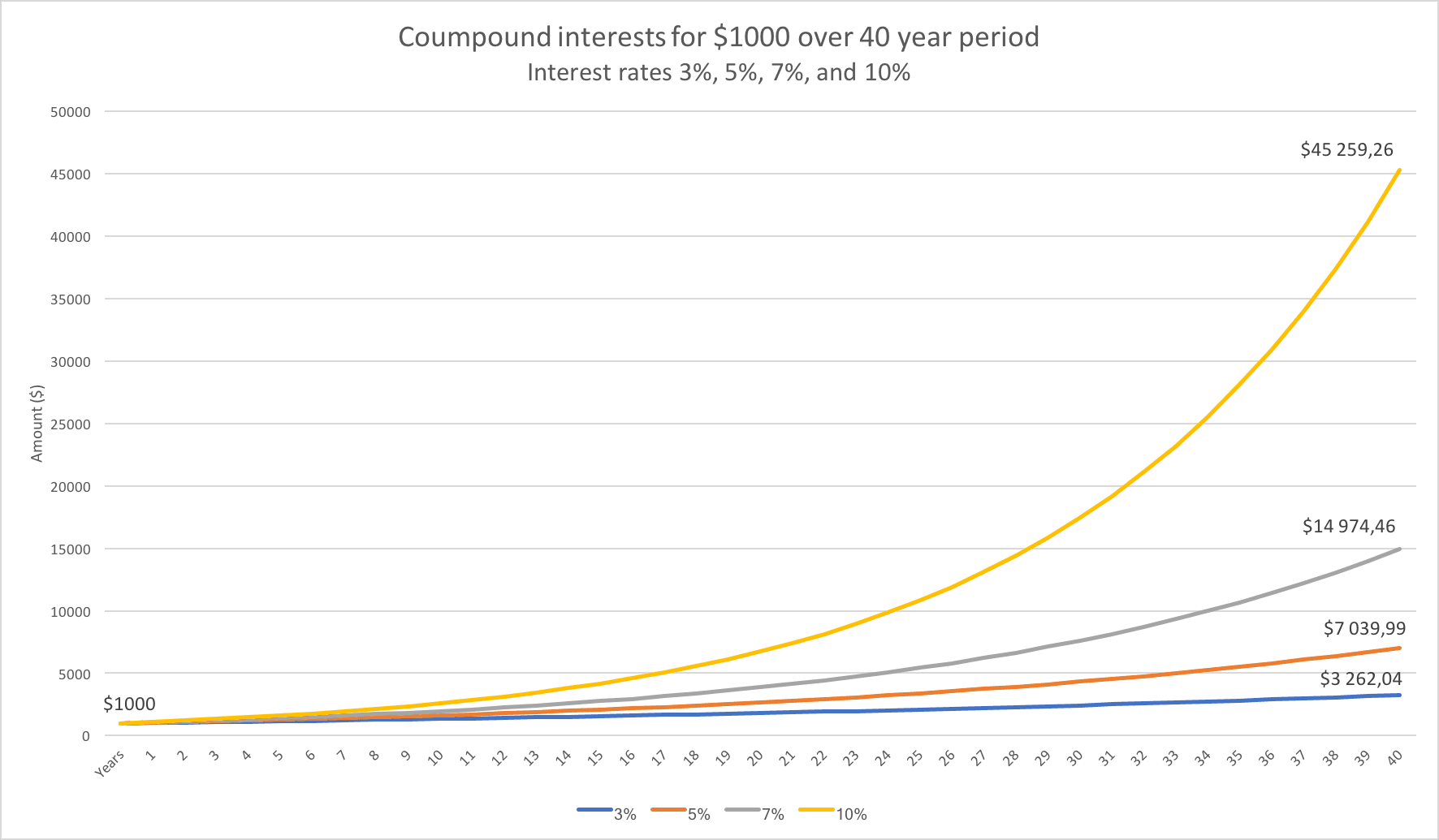

You can see an example of how the compound interest effect works on a $1,000 investment below.

The Rule of 72: Quick Compound Interest Calculations

Want to quickly estimate how long it takes your money to double? Use the Rule of 72. Simply divide 72 by your annual return rate:

- At 4% returns: 72 ÷ 4 = 18 years to double

- At 6% returns: 72 ÷ 6 = 12 years to double

- At 8% returns: 72 ÷ 8 = 9 years to double

This rule works for any compound interest scenario and helps you understand the power of higher returns over time. A $10,000 investment at 8% becomes $20,000 in 9 years, $40,000 in 18 years, and $80,000 in 27 years, all without adding a single dollar.

Current Interest Rates and Compound Interest Opportunities in 2026

The interest rate environment has changed dramatically in recent years. Here's what you can earn on your money today:

- High-Yield Savings Accounts: Up to 5.00% APY (compared to 0.61% national average)

- Certificates of Deposit: 3.70%-4.25% APY depending on term length

- Series I Savings Bonds: 4.03% with inflation protection

- Series EE Savings Bonds: 2.50% fixed rate for 20 years

- Money Market Accounts: Up to 4.25% APY

These rates represent genuine earning power. A $5,000 deposit in a 5% high-yield savings account grows to $8,235 after 10 years through daily compounding alone.

Check out our article: Best Investments of 2026 to see our recommended providers for your next investment

Three Ways Compound Interest Affects Your Finances

Compound interest impacts nearly every aspect of your financial life, sometimes working for you and sometimes against you.

Investing and Saving - Your money grows exponentially over time. A $100,000 investment earning 7% annually becomes $365,838 after 20 years, while the same amount at 3.5% grows to only $198,979 - a difference of $166,859.

Building Wealth Through Regular Contributions - Adding money regularly amplifies compound interest. Investing $200 monthly at 8% annual return yields approximately $36,000 after 10 years, with only $24,000 contributed and $12,000 from compound growth.

Debt Acceleration - Compound interest works against borrowers. With credit card interest averaging 21.39% APR and compounding daily, a $5,000 balance takes over 10 years to pay off with minimum payments, costing nearly $7,627 total.

Real vs. Nominal Returns

Don't forget about inflation when calculating compound interest. A 4% return with 3% inflation gives you only 1% real purchasing power growth. Always consider what your money can actually buy in the future, not just the dollar amount.

The Compound Interest Formula

The standard compound interest formula is:

A = P (1 + [r / n]) ^ nt

Where:

- A = Future value including interest

- P = Principal (initial amount)

- r = Annual interest rate (as a decimal)

- n = Number of compounding periods per year

- t = Number of years

Example: $1,000 at 5% annual interest, compounded monthly for 5 years:

P = $1,000, r = 0.05, n = 12, t = 5 A = $1,000 (1 + 0.05/12) ^ (12×5) = $1,283.36

For compound interest only: Total Interest = A - P = $283.36

Compound Interest and Credit Cards

Credit cards demonstrate compound interest's destructive power when working against you. With the average credit card APR for accounts assessed interest at 22.83% as of Q3 2025, balances grow exponentially if you only make minimum payments.

Credit card interest compounds daily, meaning your balance increases every single day you carry debt. This daily compounding turns a manageable balance into a financial burden quickly.

Real Example: A $5,000 credit card balance at 22.83% APR with minimum payments takes over 10 years to pay off and costs significantly more in interest than the original balance.

The key to avoiding this trap is paying off credit card balances in full each month, preventing compound interest from working against you.

Tax Considerations

Remember that compound interest in taxable accounts gets reduced by taxes. Someone in a 24% tax bracket earning 4% interest actually nets only 3.04% after taxes. Consider tax-advantaged accounts like 401(k)s and IRAs where compound growth occurs tax-deferred.

Starting Early: The Most Powerful Compound Interest Strategy

Time is compound interest's most important ingredient. Starting early beats contributing more money later.

The Twin Example

Twin A invests $500 monthly from age 30 to 67 at 6% annual return: $763,609

Twin B invests $800 monthly from age 40 to 67 at 6% annual return: $611,575

Twin A contributed $222,000 and ended up with $152,034 more, despite investing less money. The 10-year head start made all the difference.

Why This Works: Early contributions have more time to compound. Money invested at age 25 has 40 years to grow before retirement. Money invested at age 45 has only 20 years - half the compounding time.

Making Compound Interest Work for You

Compound interest becomes your wealth-building ally when you understand how to harness it:

- Start immediately: Even small amounts compound significantly over decades. Time matters more than timing the market.

- Automate contributions: Set up automatic transfers to investment accounts. Consistent investing amplifies compound growth.

- Reinvest returns: Whether dividends, interest, or capital gains, reinvesting accelerates compounding.

- Choose tax-advantaged accounts: 401(k)s and IRAs let compound growth occur without annual tax drag.

- Eliminate high-interest debt: Credit card interest compounds against you faster than most investments compound for you.

Warren Buffett, whose wealth largely comes from compound interest, said: "My life has been a product of compound interest." Understanding these principles puts you on the path to building substantial wealth over time.

For more information and guides - check out our Investment Hub - where we have many resources to help you choose your investments.

Compound Interest FAQs

What's the difference between simple and compound interest?

What's the difference between simple and compound interest?

Simple interest is calculated only on the principal amount. Compound interest is calculated on the principal plus any previously earned interest. Over time, compound interest grows much faster.

How often should interest compound for maximum benefit?

How often should interest compound for maximum benefit?

Daily compounding provides the best results for savers and investors. However, the difference between daily and monthly compounding is relatively small compared to the impact of interest rate and time.

Does inflation affect compound interest?

Does inflation affect compound interest?

Yes, significantly. Inflation reduces the purchasing power of your returns. A 4% return with 3% inflation gives you only 1% real growth. Always consider real returns when planning investments.

What's the minimum amount needed to benefit from compound interest?

What's the minimum amount needed to benefit from compound interest?

Any amount benefits from compound interest. Even $100 grows over time. The key is starting early and being consistent with contributions, not having a large initial amount.

Should I pay off debt or invest for compound interest?

Should I pay off debt or invest for compound interest?

Generally, pay off high-interest debt first. Eliminating 20% credit card debt provides a guaranteed 20% "return" that's hard to beat with investments.