Seeking Alpha Premium Review

- April 30, 2025

- 12 min read

-

421 reads

As a long-time personal subscriber to Seeking Alpha Premium, I have firsthand experience with why this platform has been a favorite in the investment community since 2004. With over 20 million monthly visits, its popularity is evident: Seeking Alpha provides a depth and detail in stock research that is unmatched.

For years, I’ve relied on my premium membership as my go-to resource for transparent and insightful research on individual companies.

I strongly recommend Seeking Alpha Premium to anyone seeking (pun intended) high-quality, in-depth investment research.

However, Seeking Alpha Premium isn’t for everyone. If you’re new to investing, prefer a passive approach, or are looking for general investment news, the platform’s detailed and active nature might be overwhelming.

Seeking Alpha is ideal for those seeking deep market analysis and high-quality investment research, not curated by a single company or entity, but sourced from a diverse community of experts.

Test Your Investment Strategy With Plus500

Plus500’s demo account stands out as one of the best in the industry, offering an unlimited practice environment with virtual $40,000 that automatically replenishes when funds drop below $200.

This allows traders to test strategies and familiarize themselves with the platform without time pressure.

| Information | Seeking Alpha Overview |

|---|---|

| Founded | 2004 |

| Monthly Visits | Over 20 million |

| Target Audience | Intermediate to Advanced Investors, DIY Investors |

| Best For | In-depth Analysis, Varied Opinion, Individual Stock Research |

| Membership Types | Basic (Free), Premium ($299/year), PRO ($2400/year) |

| Key Features | Quant Ratings, Author Ratings, Dividend Grades, Stock Screener |

| Content Variety | Articles, Podcasts, Newsletters, Real-time Alerts |

| Assets Covered | Stocks, ETFs and more |

| Community Aspect | Active community discussions and debates providing diverse perspectives |

| Mobile Access | Available on both desktop and mobile platforms |

What is Seeking Alpha?

Seeking Alpha is a platform that offers a wide range of financial research and analysis. Primarily, it serves as a crowd-sourced content service for financial markets, where articles and research are provided by independent contributors who submit their own analyses and opinions on stocks, investing, financial markets, and related topics.

Seeking Alpha doesn’t depend on just one company or group for stock analysis, but instead sources knowledge from experienced professionals worldwide.

Seeking Alpha offers:

- Investment Research: Seeking Alpha provides detailed analyses of 1000s of stocks, ETFs, and more. This content includes both bullish and bearish opinions, which can help investors see different sides of the investment case.

- Earnings Call Transcripts: The platform publishes transcripts of earnings calls from numerous companies, which are valuable for investors to understand the company’s performance and the management’s perspective.

- Stock Ratings: Users can find stock ratings based on the assessments and predictions of contributors. These are often accompanied by detailed analyses explaining the reasoning behind the ratings.

- Financial News and Analysis: In addition to individual stock analysis, Seeking Alpha also provides broader financial news and analysis, helping investors stay informed about market trends and economic factors.

- Community and Comments: Each article allows for community engagement through comments, where investors and contributors can discuss and debate the analysis presented.

- Subscription Services: While many features on Seeking Alpha are available for free, the platform also offers premium subscription services that provide more in-depth analyses, exclusive content, and other advanced features.

In 2025, Seeking Alpha continues to stand as a go-to resource for investors who value community wisdom, diverse perspectives, and a comprehensive toolkit for making informed investment decisions.

Are high broker fees eating your profits?

Save $500+ annually by choosing the right stock broker.

Pros

- In-Depth Analysis: Offers insightful, detailed research on individual stocks.

- Diverse Range of Opinions: Features articles and insights from a variety of contributors, allowing for a broad perspective.

- Active Community: Engages users in discussion and debates, providing a platform for shared knowledge and insights.

- Quant Ratings: Proprietary rating system offers a unique approach to evaluating stocks with impressive results.

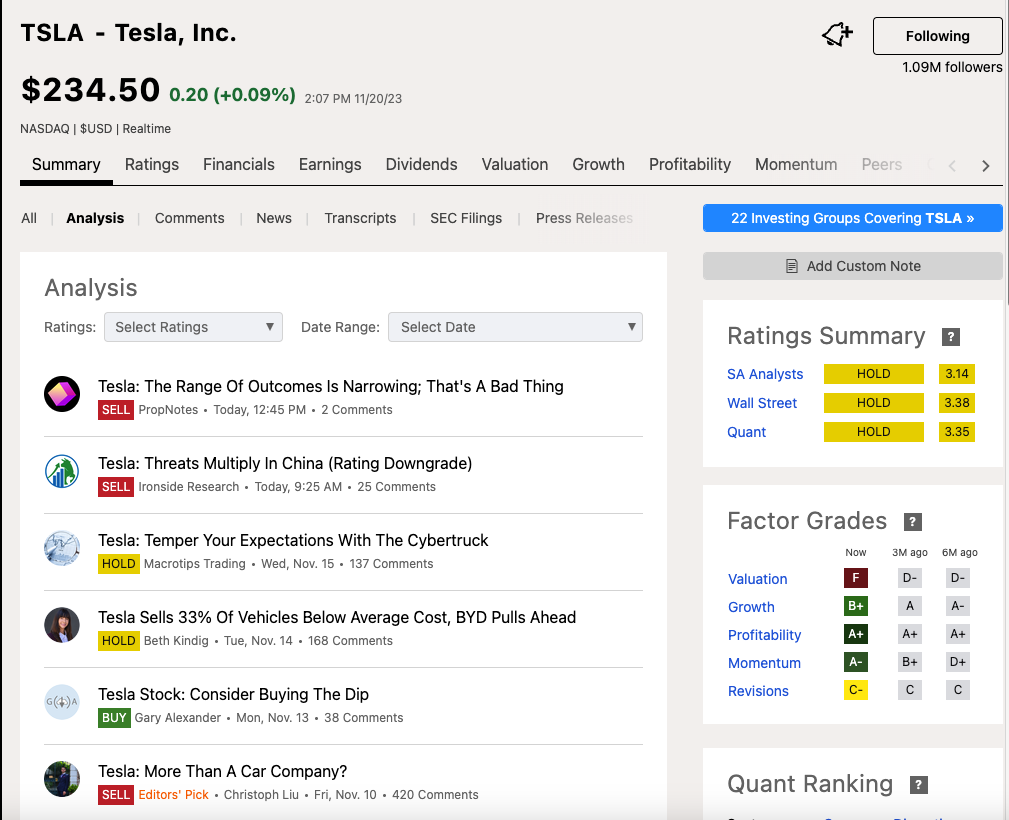

- Intuitive Sidebar with Key Insights: Each article includes a sidebar offering quick access to the current stock chart, the author’s historical rating accuracy, and collective ratings from Seeking Alpha, Wall Street, and the SA Quant rating.

Cons

- Not Beginner-Friendly: The platform’s depth and complexity can be overwhelming for new investors.

- Limited Free Content: Free users will hit a paywall after viewing a certain number of articles.

- Potential Information Overload: The vast volume of articles and opinions might be daunting and time-consuming to navigate.

- Limited Focus on Mutual Funds: Not the ideal resource for those primarily interested in mutual funds.

- Requires Active Engagement: Users need to actively engage and perform their own analysis to fully benefit from the platform.

Who is Seeking Alpha Premium For?

- People with Some Investing Experience: For those with a grasp of the stock market looking to enhance their investment strategies, Seeking Alpha offers an array of detailed, insightful tools. It’s perfect for those who are comfortable navigating the complexities of market analysis.

- Investors Who Like to Do Their Homework: If you’re the type who likes to roll up your sleeves and analyze each stock, pouring over data and differing opinions, then Seeking Alpha is your kind of playground. It’s for those who don’t mind getting their hands dirty in the nitty-gritty of market data.

- Those Looking to Invest in Different Things: Whether you’re interested in growth stocks, dividend stocks, ETFs and more, Seeking Alpha covers a wide range of investment options.

- Investors Planning for the Future: Those who think about investments as a marathon, not a sprint, especially in terms of dividends and long-term growth, will find the insights on Seeking Alpha valuable.

- Community-Oriented Investors: For those who believe in the power of collective wisdom and enjoy engaging in lively investment debates, Seeking Alpha’s community is a rich resource for discussion and shared learning.

Seeking Alpha Premium is not for:

- Investment Beginners: If you’re still learning the ABCs of stocks, Seeking Alpha could feel like jumping into the deep end without a life jacket. It’s rich with information but might be too much, too soon.

- Passive Investors: For those who prefer a hands-off, autopilot approach to investing, Seeking Alpha’s detailed analyses and active community are not for you.

- Day Traders: Seeking Alpha primarily focuses on detailed analyses and long-term investment strategies rather than the rapid buying and selling that characterizes day trading.

In short, if you’re just starting or prefer a simpler, less interactive investment experience, Seeking Alpha might not align with your needs.

While it’s a goldmine for the proactive and seasoned investor, it could feel overwhelming for those just starting or who favor a more straightforward, less hands-on approach to investing.

Seeking Alpha’s Most Valuable Features

In the following section, I’ll highlight the features of Seeking Alpha that I find most valuable.

These tools and insights have been essential in shaping my investment strategy and are key reasons why I continue to subscribe year after year.

Expert Contributor Insights

Imagine a place where financial guidance is shared not as a sales pitch but as a true exchange of knowledge. That’s the essence of what Seeking Alpha’s expert contributors provide.

Here, professionals and passionate enthusiasts offer a variety of viewpoints without any hidden agendas. It’s a space where you’re not just a passive reader but an active participant.

Every month, over 10,000 articles are published, presenting a wide range of ideas and their counterarguments. This rich diversity of content not only aids in making informed decisions but also sparks meaningful discussions.

When an article catches your eye or provokes thought, you’re encouraged to join the conversation, question assumptions, and deepen your understanding. Seeking Alpha is more than just an information source; it’s a vibrant community fostering open and unbiased financial discussion.

Quant Ratings

Seeking Alpha’s Quant Ratings make understanding stock performance straightforward and effective. Here’s what sets it apart:

- Comprehensive Analysis: Imagine over 100 experts analyzing each aspect of a stock against its sector counterparts — a complete health check for every stock.

- Five Key Factors: Stocks are evaluated across five crucial areas: Value, Growth, Profitability, Momentum, and EPS Revisions, offering a detailed view under the financial hood.

- Sector-Specific Comparisons: Stocks are compared within their own sectors, ensuring a relevant and fair analysis, much like comparing athletes within the same sport.

- Weighted for Accuracy: The Quant Ratings emphasize factors with a track record of predicting success, ensuring you get the most reliable insights.

- Clear Rating System: The ratings range from ‘Strong Sell’ to ‘Strong Buy’, providing clear insights on stock potential.

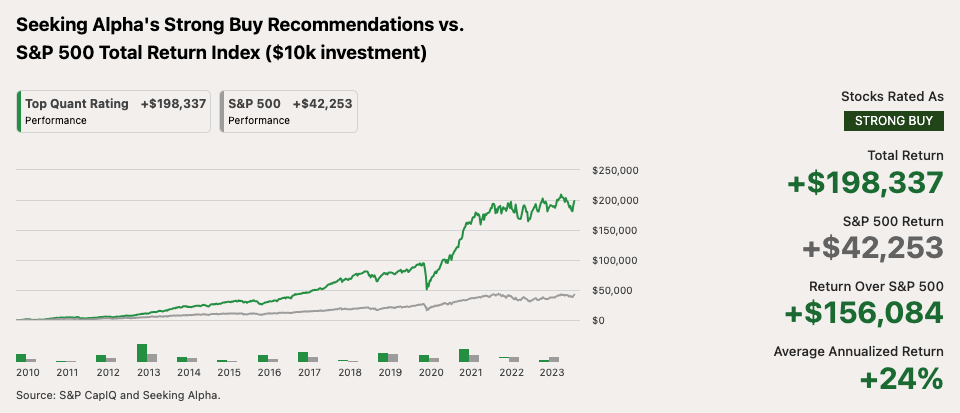

Numbers Don’t Lie:

Seeking Alpha’s Quant Ratings have an impressive history of success, consistently ebeating the S&P 500. This track record highlights their value as a tool for making informed investment decisions.

Author Track Records

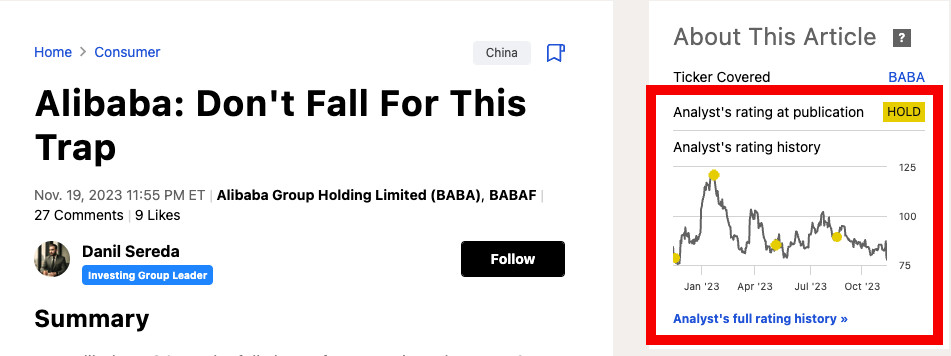

In investing, credibility is everything, and Seeking Alpha deeply understands this. That’s why they spotlight their authors’ track records so prominently.

It’s not just about opinions; it’s about proven results over time. The platform shows the author’s rating for each specific stock next to their articles. It’s a direct, no-nonsense way to see how accurate their past predictions have been.

You also have the option to dive deeper, exploring an author’s full history of analysis and outcomes.

This transparency ensures that you’re getting advice from voices that have been tested and proven in the market, not just those who talk a good game.

Increase your investing returns in 5 minutes

Dedicated stock broker are typically much cheaper than banks

Is Seeking Alpha Premium Worth It?

Yes, absolutely. As a long-time subscriber who renews year after year, I can confidently say that Seeking Alpha Premium is an invaluable investment for anyone serious about stock market analysis.

Its depth and quality of content, combined with diverse expert insights and powerful tools like the Quant Ratings and stock screeners, make it more than worth the cost of the subscription.

The platform provides clear, useful data and different viewpoints, which helps investors refine their strategies and make better decisions. For experienced investors and those wanting to learn more about the market, Seeking Alpha Premium is a vital tool.

FAQ

What is Seeking Alpha?

Who should use Seeking Alpha Premium?

How does Seeking Alpha stand out from other investment platforms?

What are some of the key features of Seeking Alpha Premium?

Is there a free version of Seeking Alpha?

How much does Seeking Alpha Premium cost?

The regular price for Seeking Alpha Premium is $299 per year. However, special promotions, like the Black Friday deal, often offer substantial discounts.