Wiki

What is a Debt-to-Income Ratio?

Adheres to

Adheres to

Reviewed by Ricardo Laizo

Reviewed by Ricardo Laizo3 Min read | Loans

What is a Debt-to-Income Ratio?

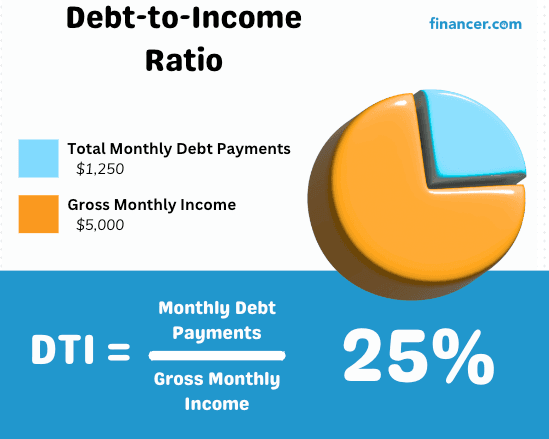

A debt-to-income ratio (DTI) is your total monthly debt payments divided by your gross monthly income. It represents how much of your income is already tied up in debt payments.

Your debt-to-income ratio (DTI) is one of the most important numbers lenders look at when deciding whether or not to give you a loan.

Pro Tip

Aim for a Debt-to-Income (DTI) ratio below 36% when seeking loans or credit lines. A lower DTI is favorable for loan approval and can secure better interest rates.

[Check lenders with less DTI restrictions](https://financer.com/results/)

To calculate your debt-to-income ratio

List Your Monthly Debt Payments

Write down each monthly payment you make for debts. This includes credit card minimum payments, car loan payments, student loan payments, mortgage or rent, and any other loans or financial obligations you pay regularly.

Tip: Check your bank statements or online accounts to make sure you don’t miss anything.

Add Up Your Debts

Total the monthly payments you've listed. Make sure you only add the monthly payment amounts, not the total debt owed.

Tip: Use a calculator to avoid errors, especially if you have multiple debts.

Find Your Monthly Income Before Taxes

Determine how much you earn in a month before any taxes or deductions are taken out. This is your gross income.

Tip: If your income varies (like if you're a freelancer), average your income over the past 3-6 months for a more accurate figure.

Divide Total Monthly Debt by Monthly income

Divide the total of your monthly debts by your gross monthly income. This will give you a decimal number. Multiply this decimal by 100 to convert it into a percentage.

| Company | Overall Rating | Interest | Loan Amount | |

|---|---|---|---|---|

| 5kFunds | 4.2 | 5.99% – 35.99% | $500 – $35,000 | See Offer |

| Credit Clock | 5.0 | 5.99% – 35.99% | $100 – $5,000 | See Offer |

| Low Credit Finance | 5.0 | 5.99% – 35.99% | $100 – $50,000 | See Offer |

| Wizzay.com | 4.8 | Not disclosed | Not disclosed | See Offer |

Debts Included in the DTI Calculation

When calculating your debt-to-income (DTI) ratio, lenders consider all of your recurring monthly debts. These include:

Credit Card Minimum Payments

Student Loan Payments

Mortgage Payments

Child Support

Alimony

Other Regular Monthly Debts

Monthly Income Included in DTI Calculation

Lenders will consider various sources of your monthly income for calculating your debt-to-income ratio. This can include:

Pre-Tax Salary and Wages: Your primary income from employment before any taxes are taken out.

Bonuses and Overtime Pay: Regular or consistent bonuses and overtime payments you receive.

Part-Time Job Income: Earnings from any part-time work, if it's a regular income source.

Self-Employment Income: Monthly income from any self-employed or freelance work.

Alimony or Child Support: Regular payments received for alimony or child support.

Investment Dividends: Regular income generated from investments such as stocks or mutual funds.

Rental Income: Monthly earnings from properties you rent out.

Social Security or Pension Payments: Regular payments received from social security, pensions, or other retirement plans.

Government Assistance Programs: Any consistent income from government assistance programs.

Frequently Asked Questions

What debts do I include in my debt-to-income calculation?

What debts do I include in my debt-to-income calculation?

Include all recurring monthly debt payments in your DTI calculation. This includes credit card payments, car loans, student loans, mortgages, and any other regular debt obligations. Do not include the total outstanding debt, just the monthly payments.

Should I use gross or net income to calculate my debt-to-income ratio?

Should I use gross or net income to calculate my debt-to-income ratio?

Use your gross income, which is your income before taxes and other deductions. Calculating your DTI ratio using net income (take-home pay) can lead to inaccuracies.

How do I handle annual bonuses or irregular income in my DTI calculation?

How do I handle annual bonuses or irregular income in my DTI calculation?

If your income varies due to bonuses or irregular earnings, calculate an average monthly income based on the past year's total income.

Do I need to include debts I’ve co-signed for in my debt-to-income ratio?

Do I need to include debts I’ve co-signed for in my debt-to-income ratio?

Yes, include any debt you've co-signed or guaranteed in your DTI calculation. These are considered potential financial obligations, even if you're not the one making regular payments.

Should rental income be included in my gross income for debt-to-income calculations?

Should rental income be included in my gross income for debt-to-income calculations?

Yes, include rental income in your gross income. However, only include the profit after deducting expenses related to the rental property.

How often should I recalculate my debt-to-income ratio?

How often should I recalculate my debt-to-income ratio?

Recalculate your DTI ratio regularly, especially when your income or debt levels change. This is also important before applying for new credit or loans.

Is it important to include small or irregular debts in my debt-to-income ratio?

Is it important to include small or irregular debts in my debt-to-income ratio?

Yes, include all debts, even small or irregular ones, in your DTI ratio. Overlooking these can impact the accuracy of your calculation.

Comments

Only registered users can leave comments.