Revolut Review 2023

Summary

- Send money abroad in over 30 currencies

- Unlimited free ATM withdrawals at in-network ATMs

- Get a Revolut Metal card online

- Save money with Revolut Rewards

- Manage your Revolut card from the app

- PROMO: Sign up free and get 3 months of Revolut Premium

What is Revolut?

Revolut is a digital bank with a payment card and a banking app designed for people who want the type of flexibility that you can’t get from traditional banks.

With more than 18 million customers worldwide, Revolut supports 30+ in-app currencies and is available in 35+ countries. Launched in 2015, Revolut is a financial super app that gives you more control over your money.

International money transfers can be expensive and banks are typically focused on localized financial services, based on your place of residence.

With Revolut, money transfers become hassle-free and users have more options than ever before. With a fresh look at international money transfers, Revolut lets users save money and even contribute towards their saving goals.

Revolut has a host of great features, including the ability to get your salary up to two days earlier. As soon as your employer deposits your salary, Revolut will make the money available – this is often up to two days earlier than most traditional banks make the funds available.

Revolut Current Account

Revolut is the fastest-growing digital bank and is ideal for frequent travelers. Revolut accounts can hold several currencies and there are premium subscription options with attractive perks, like travel insurance.

Revolut’s current account is available in 28 currencies: AED, AUD, BGN, CAD, CHF, CZK, GBP, HKD, HRK, ILS, ISK, JPY, MAD, MXN, NOK, NZD, PLN, QAR, RON, RSD, RUB, SAR, SEK, SGD, THB, TRY, USD, ZAR.

Your funds are held by Metropolitan Commercial Bank and are insured by the FDIC for up to $250,000.

Note: Revolut currently offers new customers three months of their Premium subscription when signing up for a free account.

Revolut Card

With the contactless Revolut card users can spend their money abroad without having to pay any hidden fees.

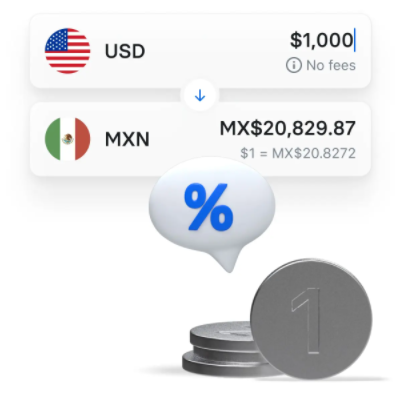

The Revolut virtual card works in more than 150 currencies and gives users the ability to benefit from the real exchange rate without having to rely on brokers that offer higher exchange rates.

The Revolut card works on the real exchange rate and is perfect for traveling abroad. You can also connect your Revolut virtual card with Apple or Google Pay to instantly tap and pay with your phone.

A few more features of the Revolut prepaid card include:

- Make payments with your phone or Apple Watch

- Manage your card from the app

- Get instant payment notifications

- Stand out with an 18g solid reinforced steel card

- Round up your spare change to reach your saving goals

Revolut Rewards

Every time you use your Revolut Card you earn rewards. You’ll also get insider offers from chosen brands that will earn you discounts and cashback.

Cashbacks earned are sent straight to your account and if you have a Metal card, you will earn Metal Cashback on all the physical and virtual card payments you make with eligible merchants in 31 fiat currencies and five cryptocurrencies.

Revolut App

With the Revolut app, you can easily manage your card. Adjust spending limits, freeze your card, and even create single-use cards whose details refresh once you’ve completed a purchase.

Budgeting & Analytics

With Revolut you can set limits on your spending to help you stick to your budget. You can also set up notifications with the Revolut app to be notified when you’re nearing your spending limit.

With a proper budget in place, you’ll avoid over-spending and this is exactly what you can achieve with the Revolut app. You’ll get a clear view of your spending, with a breakdown by category, country, merchant, and more.

Revolut Junior

With a Revolut Junior card, you can get instant alerts on their spending and control their settings for online and contactless payments.

You can also have a unique card created for your kids and they can choose their own design from a colorful range of cards.

With Revolut Junior you can discover other features like Goals and Tasks. Set chores for kids and reward them when they complete them. Or, just digitize their piggy bank; this account is designed specifically for kids.

Revolut Money Transfers

With the Revolut app, you can transfer money internationally at excellent exchange rates. You can send and receive money in more than 130 currencies with no hidden fees, and Revolut users can send money to each other instantly and free of charge.

Sending money in three simple steps:

- Start your transfer. Choose how much you want to send and to who you want to send it.

- Great rates. Revolut offers great exchange rates with no hidden fees.

- Send your money. Complete the beneficiary’s details and Revolut will take care of the rest.

Track the status of your money transfer in real time with the Revolut app.

What’s more – you’ll get 10 free international money transfers monthly. This means you can send money in more than 30 fiat currencies from Mondays to Fridays without any fees.

Requesting Money

Send payment links or QR codes to request payments from someone. You can even split bills with anyone – whether they are on Revolut or not. Revolut makes it easy to pay and get paid anywhere in the world.

ATM Withdrawals

With ATMs offering a very convenient way of accessing your money overseas, it also leads to high banking fees.

With Revolut, you can withdraw cash without fees at their ATM network. Users can benefit from unlimited free ATM withdrawals at more than 55,000 locations worldwide.

Revolut users can get 20 free overseas transfers to non-Revolut users every month. Transfers to other Revolut users are free.

Revolut Fees

Revolut fees are charged based on the subscription you choose.

There are three plan options available:

| Standard | Premium | Metal |

|---|---|---|

| Free | $9.99/mo | $16.99/mo |

| ✔ Free Revolut card ✔ Spend in over 140 currencies at the market exchange rate ✔ Exchange in 28+ fiat currencies up to $1000 per month with no hidden fees ✔ No cost out-of-network ATM withdrawals up to $1,200 per month ✔ 100% fee-free ATM withdrawals at 55,000+ ATMs ✔ Trade Crypto commission-free up to $200,000 p/m ✔ Earn 0.05% APY on your savings ✔ Instant access to a range of crypto tokens ✔ Revolut Junior account for 5 kids ✔ 10 fee-free international transfers p/m to any bank account | Everything in Standard, and also includes: ✔ Overseas medical insurance ✔ Global express delivery ✔ Priority customer support ✔ Earn 0.07% APY on your savings ✔ Premium card with exclusive designs ✔ Disposable virtual cards ✔ LoungeKey Pass access ✔ Free lounge passes for you and a friend if your flight is delayed by more than an hour | Everything in Premium, and also includes: ✔ Trade Crypto commission-free up to $200,000 per month ✔ Delayed baggage & delayed flight insurance ✔ Exclusive Revolut Metal card |

Revolut Business

Businesses can use the Revolut Business App to receive and send domestic and international payments, approve and track spending, and send invoices. You will have different features depending on which plan you choose.

Revolut Business Account Pros and cons

Pros of a Revolut Business Account

- Local accounts are available in pounds sterling and euros

- All plans include up to 200 virtual debit and three plastic cards.

- Mobile app dedicated to tracking spending and recording receipts

- Sync with accounting software such as Sage and Xero QuickBooks

- Application in 10 minutes or less

- Option without fees

- More than 30 currencies are available to receive, hold, and exchange funds

Cons of a Revolut Business Account

- There is no bank or people that you can speak to directly

- No cash paying-in facilities

- No cheque deposits

- ATM withdrawal fees of 2%

- Limited fee-free payments

- Credit and overdrafts are not available

- Priority 24/7 support only available for certain

What plans is Revolut Business offering?

Revolut Business has three plans with the option of customizing a plan to suit their needs. Each plan has more features, but the less extensive plans allow customers to access some features for a small fee still.

Revolut also offers a free account. However, they offer two paid account offers: Grow and Scale. Each has different options and fees.

You can also choose to have a Custom Enterprise account, which costs depending on what features you select.

What are the Revolut Business account charges?

Revolut Business offers a free account for businesses that do not require a monthly fee.

The table below shows the fees associated with business accounts.

| Monthly Fee | Card Purchases | Bank Transfers | Monthly Fee |

|---|---|---|---|

| Revolut Free | Free | Free | Free |

| Revolut Grow | Free | Free | £25 |

| Revolut Scale | Free | Free | £100 |

| Revolut Enterprise | Free | Free | Contact |

What are the features that Revolut Business offers customers?

Revolut Business accounts include many features that are essential for any business’s operation. These are the most basic features of all business accounts available. You can send and receive payments, withdraw cash, and keep track of your money.

Revolut Business accounts offer additional services that help businesses manage their finances. These services include:

- Revolut Business customers can use a dedicated mobile app

- Local accounts are available in Euro and Pound Sterling

- More than 30 currencies to hold, receive, and exchange money

- Track spending with the mobile app

- Approve payments

- Issues virtual and physical cards

- Issues up to 200 virtual card per team member

- Syncs with platforms like Slack

- Receipts for records in app

- Cash withdrawal

- Integrated card payment

What are the Revolut customer reviews?

While customer reviews may not always be an accurate predictor of how a particular experience with a company will be, they can still help to gauge the business’s general quality.

You can find many positive reviews online about Revolut Business if you want to evaluate it based on their user testimony.

Trustpilot 4.4/5.0 based on more than 100,000 user reviews with 76% indicating it to be ‘excellent’. Apple Store 4.8 of 5, based upon 7,700 reviews. Google Play 4.6/ 5, based upon 8,683 reviews.

These details were correct at the time they were written.

Popular questions on Revolut Business

What’s Revolut Business Banking?

Revolut was established in 2015 by a growing number of challenger bank. These companies are often online-only and attempt to reduce the inefficiencies and costs associated with traditional banking.

Revolut is one of many challenger banks that does not offer the same services as banks. They instead focus on how technology can simplify the banking process.

Is Revolut an institution?

Revolut is currently not registered in the UK as a bank because it doesn’t have a UK banking license.

Revolut in the UK is considered an electronic money institution, so it is still regulated and supervised by the FCA.

Revolut plans to apply for a UK banking license in the near future. This will allow it to become a full-fledged bank.

Is Revolut safe for my money?

The FCA regulates Revolut, meaning that it must take steps to protect customers’ funds. Register banks are responsible for protecting your money.

Revolut isn’t a bank registered in the United States, so you won’t be covered by the Financial Services Compensation scheme (FSCS) if Revolut goes bust.

Instead, money sent to Revolut will be held in a designated client money bank account at an accredited bank. Because they are separate from Revolute’s finances, the money would be protected in these external accounts.

Revolut Business also includes a number of security features such as two-factor authentication. The company that issued the card protects card payments.

What is a Revolut Business Account?

Revolut Business accounts can be opened online via its app. There are no branches.

You can access your account like any other once it is opened. You can make payments, receive payments, use the card, and explore all the other features available to you through the app and account.

What is the Revolut Business login?

To log into your Revolut Business Account, you will need to generate a code via the app. This code is sent to you by email. You can log in to the app by clicking on the email link.

This additional level of authentication can make all the difference in your account’s security.

Does Revolut Business offer an app?

Revolut Business is available on Google Play and in the Apple App Store. It’s free to download, and it is essential for creating an account and accessing the features.

To access almost all features of your Revolut Business account, you will need the app. You can use the app to record receipts, track spending and sync with business services.

Revolut has a variety of apps that can be used for personal and business banking. Make sure to download the right one.

Does Revolut offer support for traditional customers?

You can contact Revolut Business support if you have any issues with your account. You can access the support services of a paid account 24 hours a day, seven days a săptămână if you subscribe.

Revolut Business support is available through both the app and the website. This is a web-only chat system. You will not be able to speak with someone over the phone or meet face-to-face.

How do I open a Revolut Business Account?

Fill out an online application to apply for a Revolut Business Account. This should take less than 10 minutes according to Revolut.

Revolut might contact you to get more information about your application. The complexity of your business, as well as your ability to provide certain documents (e.g. proof of your address or the nature of the company) will determine the time it takes to complete the application.

Why Choose Revolut

There are many reasons to choose Revolut:

- Revolut makes it easy to buy, hold, and exchange cryptocurrencies.

- You can swap Bitcoin, Ether, and Litecoin with fiat currencies at the best rate.

- Revolut offers convenient methods for users to save money by setting up recurring or once-off payments to your Vault, or rounding up your transactions.

- With Revolut you can set up direct debits and recurring payments.

- Revolut allows you to track your spending with instant payment notifications and analytics that categorize transactions.

How to open a Revolut account

Download the Revolut app

Visit the Revolut website and enter your phone number to download the Revolut app.

Choose your account

Choose the type of Revolut account you want to open.Add your personal information

Provide basic information such as your name, date or birth, address, and employment info. You’ll also need to scan and upload your proof of identity, which can be your ID card, bank statement, or more.Start transacting

After you’ve provided all the info and verified your identity, you’re good to go.Our Revolut Review

Depending on what you do with your money, Revolut can save you a lot of money on a regular basis. For people who do international transfers regularly or those who travel frequently, Revolut has the potential to help them save big.

The other benefit of the Revolut card and the Revolut app is the convenience. The app allows you to do immediate international transfers with no hidden fees, and you can use your Revolut card to withdraw money at more than 55,000 ATMs worldwide without any fees.

It’s the perfect way to manage your money internationally while working towards your saving goals at the same time.

Is Revolut safe? Yes. Revolut is a revolutionary money app and card that changes the way you work with money and make payments internationally.

Revolut Customer Service

Revolut offers solid customer service support, with priority support for Premium and Metal account holders. Customer service is available via phone at +44 (203) 322-8352 and via email at [email protected].

Customers can also use the in-app chat that is available 24 hours a day, seven days a week.

Conclusion

Revolut is a quick and easy way to manage your company’s finances. You have access to a wide range of features and strong customer reviews.

Revolut Business is a great option if your business involves international transactions. Many companies would find it easier to have a local account in sterling or euros. They also have the option of receiving, holding, and exchanging funds in more than 30 other currencies.

Revolut Business simplifies spending approvals, expenses and other daily tasks by integrating the processes into the app. It may be useful for syncing with other business services.

These features can be a huge benefit for companies, but you need to consider the cost. Consider the features that you will use most often and what additional fees you may have to pay. This will help you choose the right tier for you business. Revolut isn’t a bank so if you rely on cash transactions or cheques, there are more options.

Revolut FAQs

What is Revolut?

How much is Revolut?

Can I withdraw money from ATMs?

How do I sign up for Revolut?

What are Revolut’s transfer limits?

Image credits: Revolut