Cash App Review

CashApp Borrow is a feature of Cash App that allows you to borrow small amounts from family and friends.

Cash App also provides you with many financial tools, such as buying Bitcoin, buying and selling stocks, earning rewards, and sending funds instantly.

We’ll look at how Cash App works, it’s features, and whether it’s a good fit for you.

Note: Not everyone can borrow money from Cash App and it depends on your credit history, among other things.

How We Rate CashApp

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate CashApp:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐⭐ |

Do We Recommend CashApp?

Yes, we recommend CashApp as a reliable lender for small loans. Skip to our full review below and see how we rate CashApp.Here’s what we’ll cover in this review:

Want to skip the details? Jump to our final verdict here.

What Is CashApp?

CashApp is a mobile payment platform that enables users to send and receive money easily, purchase Bitcoin, and invest in stocks.

The app is available for iOS and Android devices and is free to download. It was launched in 2013 by Square, Inc, and has gained popularity in recent years.

Here’s a quick summary of CashApp:

| Overview | Features |

|---|---|

| Loan type: | Personal loans |

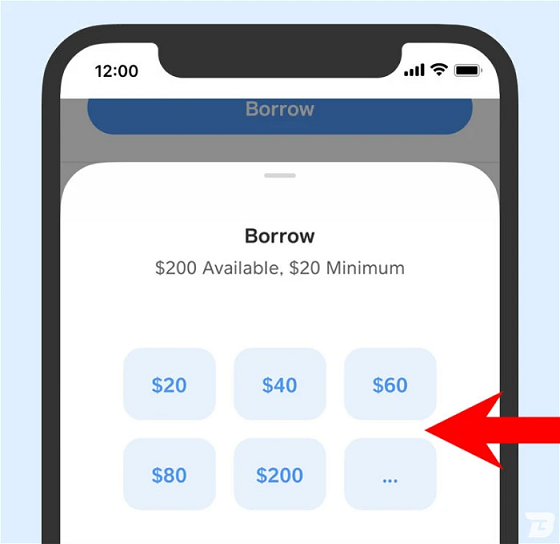

| Loan amount: | $20 – $200 |

| Loan term: | 4 weeks |

| Fees: | 5.00% |

| Late payment fees: | 1.25% |

| Payout time: | Immediately |

| Requirements: | At least 18 years old U.S. citizen Good credit score |

Cash App is ideal for borrowing small amounts quickly, as long as you can repay the loan within four weeks.

Related: Here’s how to borrow money from Cash App.

Cash App Pros and Cons

Here are some of the pros and cons of Cash App as a lender:

Pros

- The app is very easy to use.

- Many features to manage your money.

- Perfect for small loans up to $200.

- Debit cards are available to account holders.

- Cash App is available in all US states.

One of the most significant advantages of Cash App is its user-friendly interface, which makes it easy to send and receive money with just a few clicks.

Users can also purchase Bitcoin and invest in stocks through the app, which makes it a one-stop shop for financial transactions.

Should you qualify, Cash App allows you to easily borrow small amounts and repay the loan within four weeks.

CashApp also offers a debit card that users can use to make purchases, withdraw cash from ATMs, and earn cashback on select purchases.

Limited use of the Cash App debit card

-

All loans are charged a 5% flat fee.

Cons

One issue is that Cash App is not widely accepted as a payment method, so users may not be able to use it everywhere.

All loans from Cash App Borrow come with a flat fee, which may be a drawback for some borrowers as most lenders don’t charge a fee.

Who Is Cash App For?

CashApp is ideal for people who want a quick and easy way to send and receive money, purchase Bitcoin, and invest in stocks.

It is also a great option for people who want to earn cashback on their purchases and have access to a debit card for convenient spending.

Eligibility Requirements

Although there aren’t specifically any requirements to qualify for a Cash App loan, borrowers typically have to have a fair to good credit score and be active on the app. Sometimes you also need to have a Cash App debit card activated.

Note that Cash App Borrow is only available in these states:

- Alabama

- California

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Mississippi

- Missouri

- North Carolina

- Ohio

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

Who It’s Not For

Cash App may not be a good option for you if:

- You want the lowest APR rates

- Need a loan of more than $200

- Want to secure a personal loan with longer repayment periods

How To Apply for a Cash App Loan

Tip: Here are more details on how to borrow from Cash App.

Borrowing from Cash App is fast and easy. Here are the steps:

Download the app

Downloading Cash App takes a few minutes and it’s available for iOS and Android.

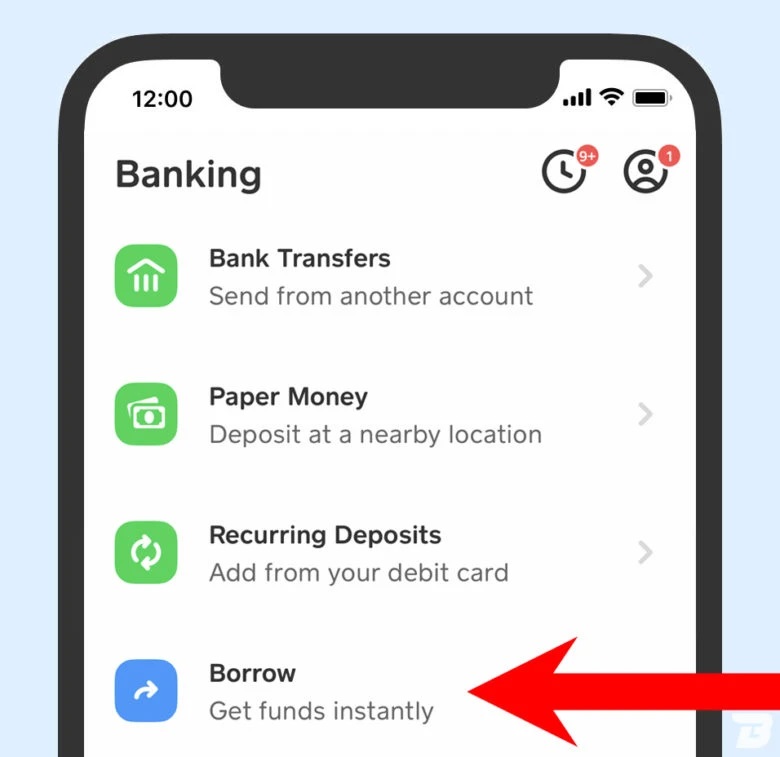

Go to the banking section and click on ‘Borrow’

Choose your amount

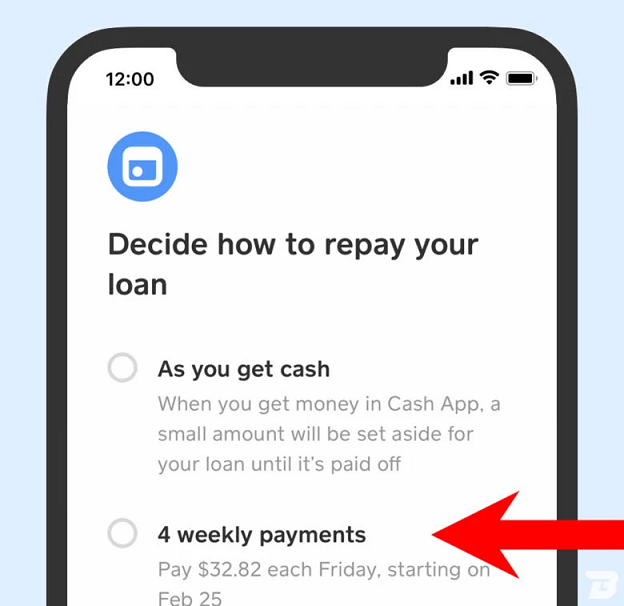

Choose your repayment option

Agree and accept

If you want to take up the loan, read the loan agreement carefully and accept it if you agree.The decision will be made instantly and you’ll know if you qualify for the loan within a few seconds.

Cash App Fees

Sending and receiving money with CashApp is free, but there are fees for using other services such as instant deposits and Bitcoin transactions.

The fees are reasonable, with instant deposit fees being 1.5% and Bitcoin transaction fees ranging from 1.75% to 3.75% depending on the transaction amount.

Cash App Payment Terms

mall loans from Cash App Borrow have to be repaid within four weeks. This is similar to many buy now pay later (BNPL) services.

How Financer.com Rates Cash App

Is CashApp legit? Yes, at Financer.com we recommend Cash App.

At Financer.com, all lenders go through a thorough research and review process. We don’t make recommendations lightly.

All loan applications are made through their easy-to-navigate app with a simple process that takes less than five minutes to complete. The results are instant.

Cash App is great for small loans and as long as you pay on time you’ll avoid additional fees. There is a flat 5% fee for each loan, which may be a drawback.

Fees

Seeing that there is no interest charged on these loans, this is a benefit for anyone looking for a quick small loan.

Payments

You have up to four weeks to repay a loan from Cash App. This is very similar to most BNPL services and is ideal for small purchases and quick cash emergencies.

Customer Service

CashApp offers customer support via email, phone, and social media. However, some users have reported long wait times and difficulty resolving issues with frozen accounts.

We tested out Cash App’s customer service by requesting information via email. Although we did receive confirmation of our inquiry, we only received a formal reply a few days later.

Borrowers will likely get faster responses by using the in-app chat.

Privacy and Security

CashApp uses industry-standard encryption to protect users’ personal and financial information. The app also allows users to enable two-factor authentication and set up a PIN for added security.

However, users should be aware that CashApp is not FDIC-insured, which means that their funds are not protected in the event of a bank failure.

Users should also be cautious when using CashApp to purchase goods or services from unverified sellers, as the app does not offer buyer protection.

5KFunds FAQs

How much is $100 in Cash App?

Do I need a bank account for Cash App?

What are the disadvantages of Cash App?

How much can I borrow with Cash App?

Cash App Alternatives

Here’s a list of alternatives to Cash App and how they compare:

| Lender | Reviews | Loan Amount | Fees | Repayment |

|---|---|---|---|---|

| Chime | View | Up to $200 | None | Next payday |

| MoneyLion | View | $50 to $250 | $0.49-$8.99 | Next payday |

| Empower | View | Up to $250 | $8 | Next payday |

Should You Take a Loan with CashApp?

CashApp is a good option if you’re looking for a fast small loan. However, not all new borrowers qualify for a loan so it might be best to compare all lenders if you’re looking to be approved for a short-term loan with the best rates.

CashApp only charges a 5% fee on loans, which is much lower than the APR for typical personal loans, especially payday loans.

Read more CashApp reviews from customers below or add your own.

More Cash App Reviews

What Users On the Web Are Saying

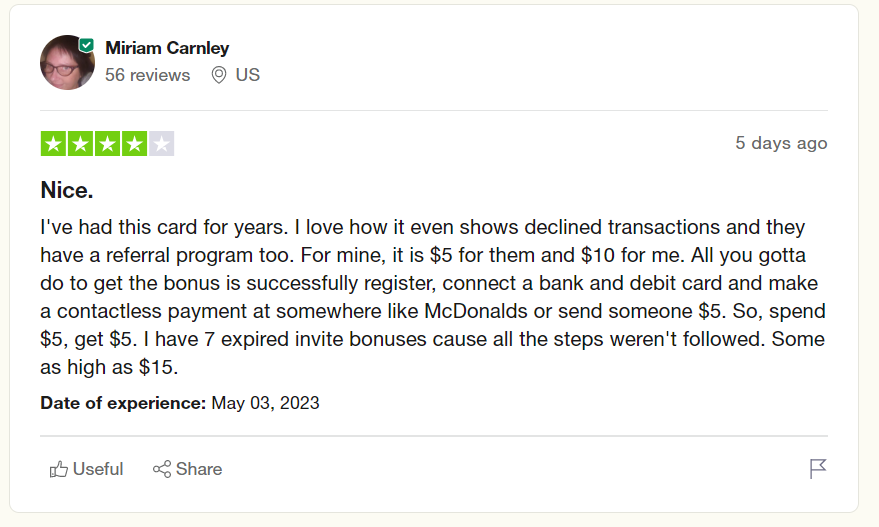

Cash App gets 1.2 out of 5 stars on Trustpilot, with most users being disappointed with the service they received. However, there are positive reviews too:

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used Cash App before? Leave your review now.