Klarna Review 2024

Klarna is a Swedish fintech company that provides buy now pay later (BNPL) solutions for consumers and merchants around the world.

In the US, Klarna entered the market in 2015 and has since become a popular payment provider for e-commerce businesses.

Klarna processes more than two million transactions per day and is available in 45 countries.

Klarna’s products and services in the US include a variety of payment options such as pay later in four interest-free installments, pay later in 30 days, and financing options with fixed monthly payments.

The company also offers a shopping app where users can discover and shop at various online retailers, and manage their payments and purchases in one place.

How We Rate Klarna

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate Klarna:

| Category | Rating |

|---|---|

| Application process | ⭐⭐⭐⭐⭐ |

| Repayment terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend Klarna?

Yes, we recommend Klarna as a reliable buy now pay later provider. Skip to our full Klarna review below and see how we rate Klarna.Want to skip the details? Jump to our final verdict here.

Here’s what we’ll cover in this review:

Klarna Overview

Klarna is a popular buy now pay later (BNPL) lender in the US. They partner with reputable retailers, allowing consumers to make purchases and split up the cost into interest-free payments.

These payments are essentially the same as interest-free, short-term installment loans with a more traditional financing model.

Here’s a quick summary of Klarna:

| Overview | Features |

|---|---|

| Loan type: | Buy now pay later |

| Availability: | In-store and online |

| Repayment options: | Pay in 4, Pay in 30, financing |

| Terms: | Up to 36 months |

| Late fees: | $7 or 25% of your order amount, whichever is less |

| Other fees: | None |

| Min. credit score: | None |

| Requirements: | At least 18 years old U.S. citizen Active bank account Regular income Valid phone number and email |

Klarna has partnered with many major retailers in the US, including H&M, Sephora, and Adidas. The company has also collaborated with major financial institutions such as Visa and Mastercard, to expand its payment services and increase its reach in the US market.

Klarna’s payment solutions are designed to simplify the checkout process and provide a seamless experience for users.

The company also offers customer service and support, including chat and email support, to assist customers with any issues or questions they may have.

How Does Klarna Work?

Klarna offers several payment options to consumers in the US:

Pay in 4

This payment option allows consumers to split their purchase into four equal payments, with no interest or fees charged.

This payment option is particularly popular among younger consumers who prefer to spread out their payments over time.

Example: If you make a purchase for $400 you’ll pay $100 at checkout. The three remaining payments of $100 each would be billed to your card every two weeks.

Pay in 30

This payment option allows consumers to delay their payment for up to 30 days after their purchase, with no interest or fees charged as long as payment is made in full within the 30-day period.

This payment option is useful for consumers who may not have the funds available at the time of purchase but expect to have them in the near future.

Financing

Klarna also offers financing options with fixed monthly payments.

Consumers can choose to finance their purchase over a period of 6-36 months, with interest rates ranging from 0-24.99% APR.

This payment option is useful for consumers who need to make a larger purchase and prefer to spread out their payments over a longer period.

Klarna’s payment options are designed to be flexible and convenient for consumers, with a focus on providing a smooth and simple checkout process.

The company also provides reminders for upcoming payments and offers the ability to manage payments through their mobile app or online account.

Overall, Klarna’s payment options provide a useful alternative for consumers who prefer to pay over time or need more flexibility in their payment options.

Klarna Pros and Cons

Here are some of the pros and cons of Klarna as a payment provider:

Pros

- No-interest financing options

- Very few qualification requirements

- Available at multiple retailers

- Easy application process

Klarna’s no-interest payment options make it easy to shop from popular merchants directly from the Klarna app without having to pay upfront.

This makes shopping easier and more affordable for most consumers as you only pay one-fourth (25%) of the order amount at checkout.

The remaining balance is paid over six weeks or more, depending on your repayment option.

It’s relatively easy to qualify for Klarna compared to traditional loans. This is because Klarna only does a soft credit check to check if you qualfy, and consumers with bad credit may also apply.

-

Late fees apply

-

Small loan amounts compared to traditional lenders

-

Doesn’t help build your credit score

Cons

If you choose Klarna’s Pay in 4, you will be charged a late fee of $7 or 25% of the order amount, whichever is less.

Another downside is that Klarna offers small amounts compared to traditional lenders, who typically offers loans up to $50,000 or more.

Making payments to Klarna won’t help improve your credit score, so it’s not a benefit to borrowers that need to rebuild their credit.

Who Is Klarna For?

Klarna is for consumers who want to shop online or instore without having to pay for the order in full. Interest-free payments make it easier to afford the things you want without having to pay the full purchase amount.

Eligibility Requirements

To be eligible for Klarna you have to:

- Be at least 18 years old

- Be a US citizen or resident

- Have a valid bank account

- Have a working phone number to receive verification codes

It’s important to note that Klarna makes decisions on an order-by-order basis so if you’re declined for a purchase, you may be approved by changing your order or removing some of the items.

If you are a regular Klarna user who makes payments on time you’ll increase your chances of approval for future orders.

You may have more than one Klarna loan at a time, although it’s not recommended as it may hurt your chances of approval for more loans.

Who It’s For

Klarna is best for consumers who:

- Have low credit scores

- Don’t want to pay interest on purchases

- Not worried about building credit

- Need to buy something where they can’t afford the full puchase price

- Can pay off a purchase in a short time

Who It’s Not For

Klarna is not best-suited for consumers who:

- Want to build credit

- Make a lot of purchases regularly

- Can’t afford repayments between four to six weeks

How To Use Klarna

Download the app

Add items to your shopping cart

You won’t know whether you are approved until you’ve add items to your shopping cart and checking out.Choose Klarna as a payment option

When you go through the checkout process, see if Klarna is available as a payment option. If it’s available, you can review and accept the option, and choose your repayment terms.Pay 25% of the order amount

When choosing Klarna, you only need to make a 25% payment (one-fourth) of the order amount.Follow through with payments

Depending on the payment option you’ve chosen (Pay in 4, Pay in 30, or Finance), your payments will be deducted from your bank account or card every two weeks, or every month until the balance is settled in full.How Financer.com Rates Klarna

Is Klarna trustworthy? Yes. Klarna has a A+ rating on BBB and has been around since 2005 and has more than 25 million US customers.

Klarna works with hundreds of thousands of merchants worldwide.

In our experience, Klarna offers fast response times and great customer service. The company is also backed by reputable investors like VISA and Sequoia.

Application Process

The application process is extremely straightforward as you can check immediately when placing an order if you qualify for Klarna.

The fact that there is no lengthy application process makes Klarna accessible for many consumers – including those with less-than-perfect credit.

Compared to alternatives like Sezzle and Afterpay, Klarna is more affordable.

Fees

Klarna has no sign-up or monthly fees, but does charge a late fee of $7.

This is cheaper than competitors like Zip, who charges up to $10 late fee, or Afterpay who charges a late fee of $8.

Payments

Klarna’s flexible payment options make it perfect for consumers who want to spread out payments for larger purchases.

Consumers can choose to pay in four installments, due ever two weeks, or to pay the entire remaining order balance in 30 days.

Customer Service

Klarna offers customer service via live chat, phone, and email.

Their live chat is available 24/7 and they also offer a comprehensive help centre with plenty of resources for new and existing customers.

We’ve tested out Klarna’s live help and they have real human service agents who respond to requests immediately.

Klarna Alternatives

Here’s a list of alternatives to Klarna and how they compare:

| Lender | Terms | APR | Fees |

|---|---|---|---|

| Affirm | 4 installments, due every 2 weeks; monthly payment plans up to 60 months. | 0%-30% | None |

| Afterpay | 4 installments, due every 2 weeks | 0% | $8 late fee |

| Klarna | 4 installments, due every 2 weeks, or pay in 30 days, or financing up to 36 months | 0-24.99% | $7 late fee |

| PayPal | 4 installments, due every 2 weeks | 0% | None |

| Sezzle | 4 installments, due every 2 weeks | 0% | $5 rescheduling fee, $10 account reactivation fee |

| Zip | 4 installments, due every 2 weeks | 0% | $1 convenience fee, up to $10 late fee |

Should You Use Klarna?

We do recommend Klarna as one of the leading buy now pay later (BNPL) providers in the US.

Read more: How Buy Now Pay Later Works

Klarna is conveniently availble online and in-store and users can also create a one-time virtual card with a limit to use for planned purchases.

Combined with no-interest payments, Klarna is a great option for consumers without perfect credit looking to make larger purchases instantly.

Overall, Klarna has quickly become a popular payment option in the US, particularly among younger consumers.

The company’s focus on user experience and partnerships with major retailers and financial institutions has helped it gain a strong foothold in the US market.

More Klarna Reviews

What Users On the Web Are Saying

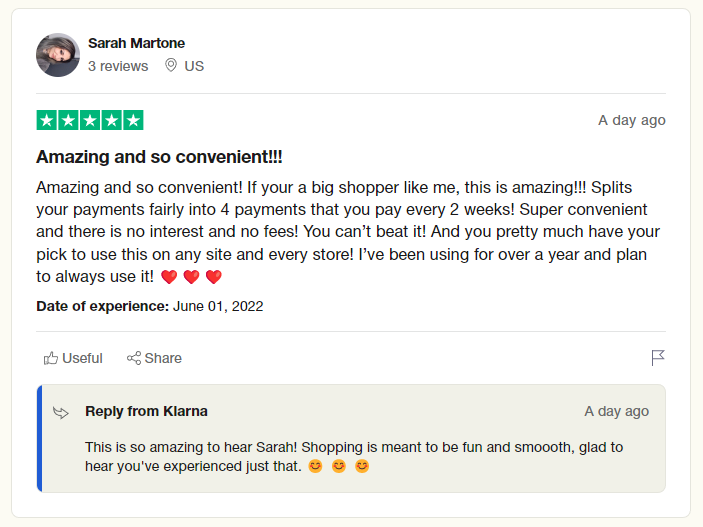

Klarna gets a 3.9 out of 5 stars on TrustPilot, with users generally feeling positive:

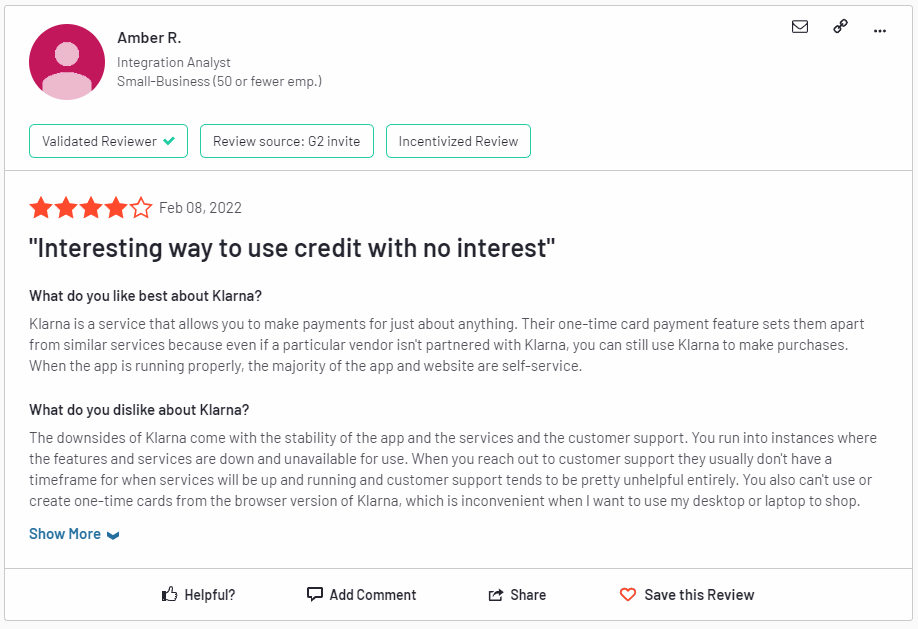

Klarna gets a 3.4 out of 5 stars on G2 with some users showing mixed feelings:

More User Reviews on Klarna – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used Klarna before? Leave your review now.