LendKey Review 2023

LendKey is a student loan platform that connects borrowers with multiple lenders in the form of banks and credit unions.

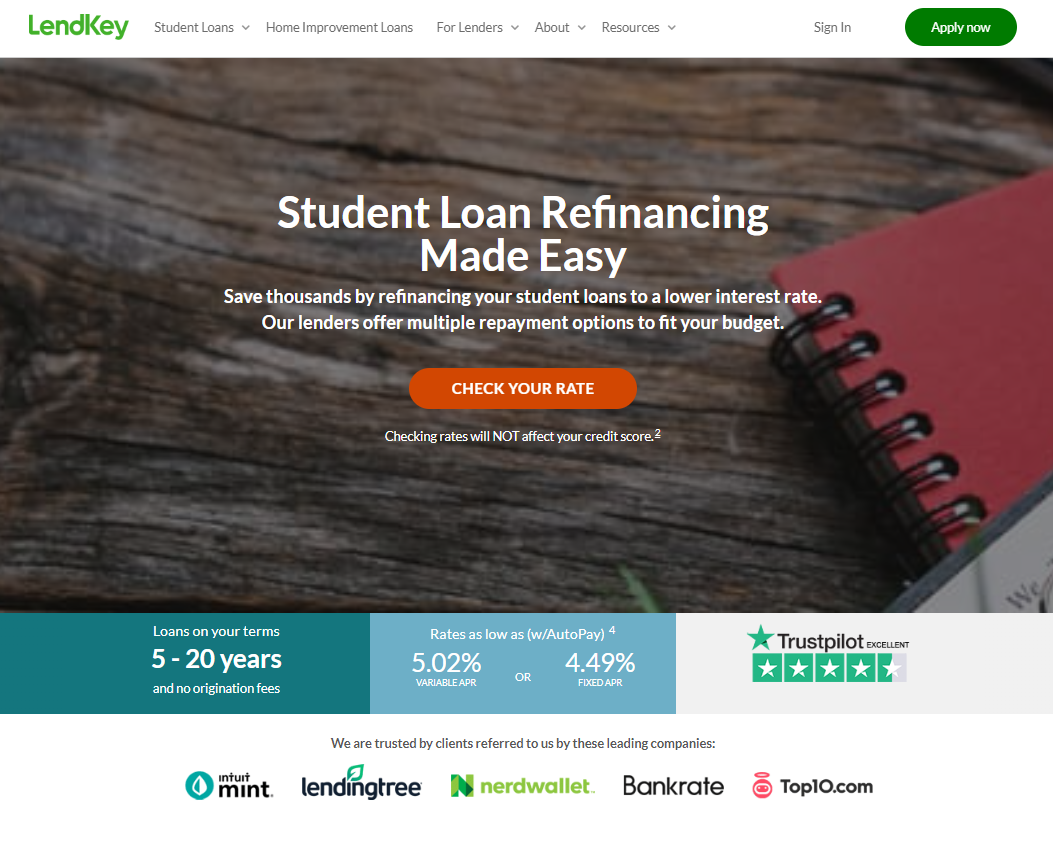

They have low APRs starting at 4.49% and there are no fees to apply. LendKey’s forbearance terms are typically also longer than most other lenders.

How We Rate LendKey

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate LendKey:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend LendKey?

Yes, we recommend LendKey as a reliable lender marketplace. Skip to our full review below and see how we rate LendKey.Here’s what we’ll cover in this review:

Want to skip the details? Jump to our final verdict here.

LendKey Overview

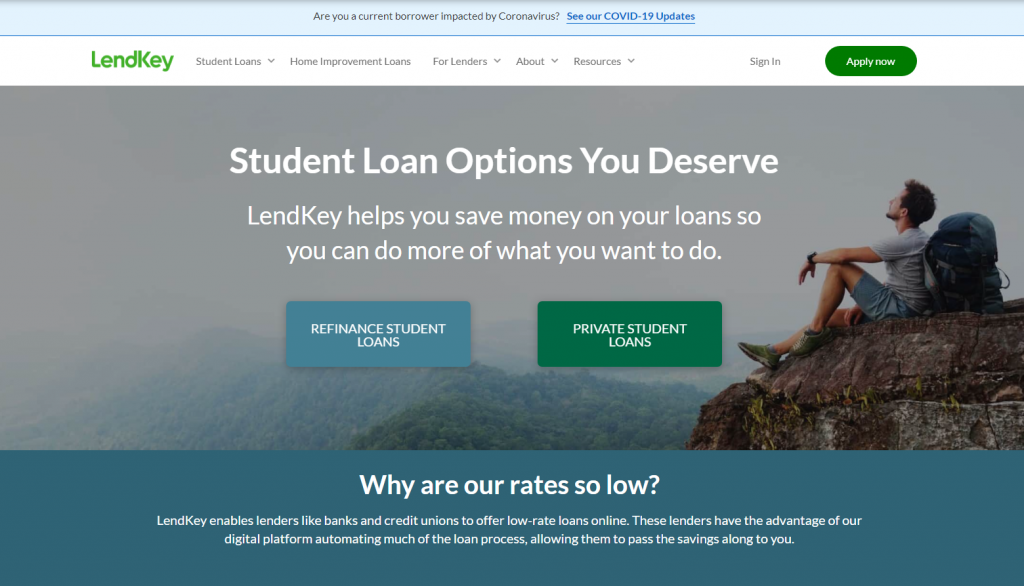

LendKey was founded in 2009 as a lending service platform. The company simplifies the borrowing process by connecting borrowers with multiple banks and credit unions through a straightforward platform.

LendKey prides itself on offering a seamless online lending service.

Here’s a quick summary of LendKey:

| Overview | Features |

|---|---|

| Loan type: | Student loans |

| Loan amount: | Up to $300,000 |

| Loan term: | Up to 20 years |

| APR: | From 4.49% |

| Min. credit score: | 660 |

| Monthly fees: | None |

| Requirements: | U.S. citizen or permanent resident Min. credit score of 660 Min. income of $24,000 a year Minimum DTI of 33% |

LendKey values privacy and does not share personal information with third parties. With over 99,000 customers and counting, LendKey has serviced more than $2 billion in loans to date.

The main LendKey offerings are new and refinanced private student loans and home improvement loans.

LendKey Pros & Cons

Pros

- APRs from 4.49% fixed or 5.02% variable

- No application fees payable

- Cosigner option to reduce rates

- No early payment penalties

- Loan terms up to 20 years

LendKey offers good APRs starting at 4.49% (fixed) which is lower than other student loan lenders. For lower rates, applicants can add a cosigner.

Longer loan terms of up to 20 years have the option of longer forbearance.

Applicants need a credit history and a steady income or a cosigner to be considered for approval

-

Loan acceptance can take up to 30 days

Cons

The loan payout process can take a few weeks but LendKey has their own in-house customer service team for support and guidance.

Products Offered

LendKey offers the following:

- Private student loans

- Student loan refinancing

- Home improvement loans

Private Student Loans

With private student loans from LendKey, you could get up to 100% of your school-certified cost of attendance. You don’t need a cosigner although you may get better rates when adding a cosigner to your loan.

Rates are as low as 4.49% fixed APR or 5.02% variable APR with AutoPay. There are no application fees with private student loans.

It is recommended that you apply at least one month prior to when your funds are due. You may get conditional approval quickly, but it’s not a final approval yet, as you may need to provide proof of income and identification.

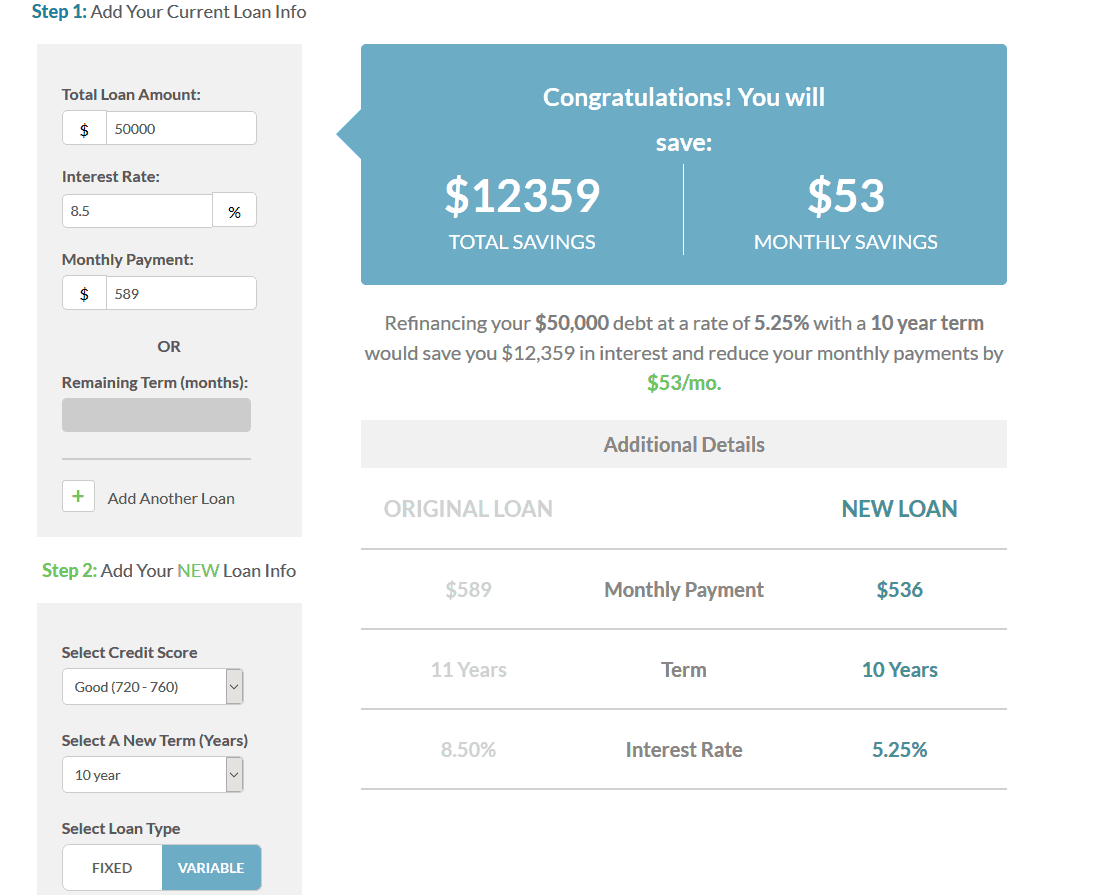

Refinancing Student Loans

Refinancing student loans from LendKey offers rates as low as 4.49% fixed APR with AutoPay. Loan rates are available from five to 20 years.

There are no origination fees on student loan refinancing.

The minimum loan you can borrow is $5,000 unless you are a resident of AZ ($10,000), CT ($15,000), or MA ($6,000).

Home Improvement Loans

LendKey also offers loans to contractors and homeowners, at low rates. These loans are provided by community lenders like credit unions and community banks, with affordable repayment options.

All funds for home improvement loans are paid directly to the contractors.

How LendKey Works

LendKey partners with hundreds of banks and non-profit credit unions to help borrowers achieve their dreams. Loans are funded by these partners and this helps to keep interest rates lower.

Loan Requirements

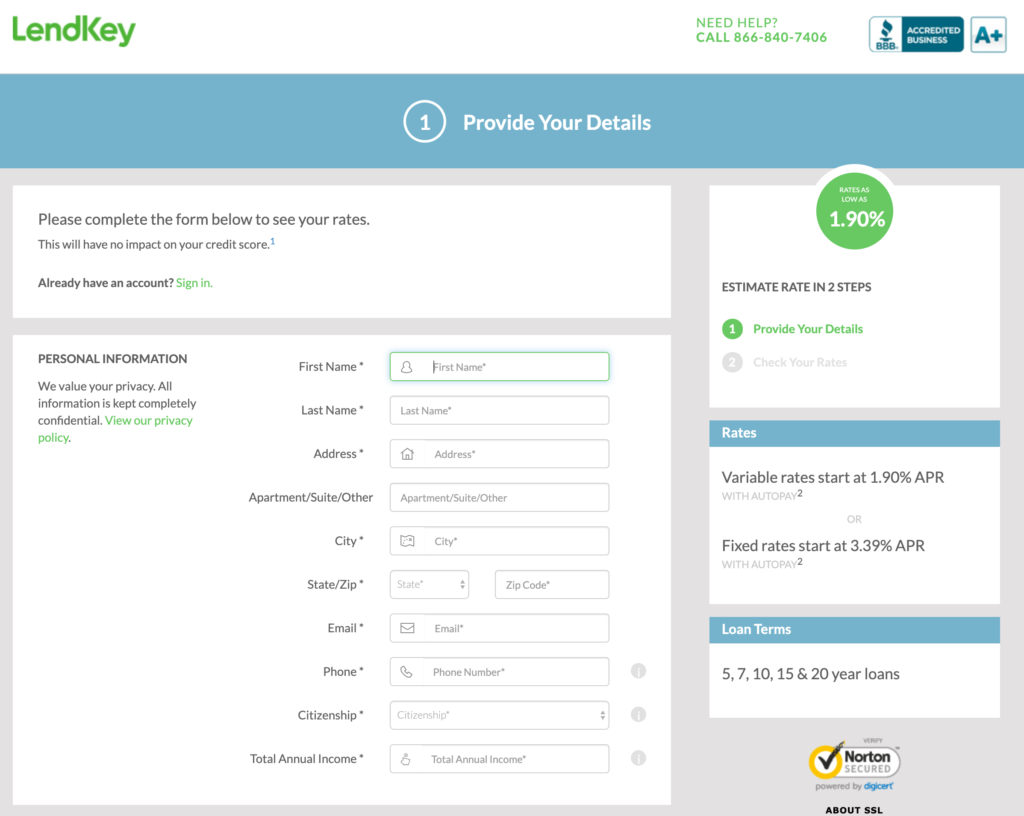

When applying for a LendKey student loan, borrowers need to provide information on the school they are attending, the loan amount required, the academic period they are applying for, and their Social Security number.

To qualify for student loan refinancing, you need to:

- Be a U.S. citizen or permanent resident

- Have an associate degree or higher from an approved institution

- Have a minimum credit score of 660

Rates & Fees

Your credit score determines your APR; therefore, if you are young and do not have a great credit score yet, you may pay a higher interest rate. They do offer a consigning option, which will reduce your interest rate.

These student loans are credit-based so your APR will be determined by your credit history. Please note that some lenders may charge late fees.

Payment Terms

- No academic or military deferment.

- Forbearance is available on 5, 7- and 10-year loans, but only for up to 4 months at a time, and also not longer than 12 months in total.

- You can postpone 15- and 20-year loans for up to 6 months at a time, but only for a total of 18 months.

- Co-signers can be released after 12 months providing all payments have been made on time.

- Loan agreements do not guarantee death or disability discharge.

How To Apply for a LendKey Student Loan

Sign up with LendKey

Fill in your details

Review your offers

How Financer.com Rates LendKey

LendKey is a trusted online lending platform with almost 100,000 customers. They have hundreds of partners in the form of credit unions.

With low rates and a smooth, straightforward process, LendKey has built a strong, trustworthy reputation. LendKey focuses on private student loans and home improvement loans.

Website

The LendKey website is streamlined. They have created a simple process that connects borrowers to hundreds of community banks and credit unions. Because of their automated online lending system, they can offer lower loan rates.

LendKey offers a simple application process through its website. Once accepted, you can access your LendKey account information through the online login.

Customer Service

Although they are an online company LendKey offers customer service support calls between 9 am – 8 pm EST Monday to Friday. They are also contactable through email at [email protected].

Does Financer.com Recommend LendKey?

Yes. LendKey is a proven, trusted lending service that connects borrowers with banks and credit unions.

If you have exhausted all of your college funds, scholarship options, and federal student aid, then LendKey is an optimal lending platform to consider.

Read more LendKey reviews below or add your own.

LendKey FAQs

How much can I borrow?

Do I need a cosigner?

When should I apply?

Is LendKey a bank?

Do I need to work with a contractor to apply for finanancing?

When do contractors get paid?

LendKey Alternatives

Here’s a list of alternatives to LendKey and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term |

|---|---|---|---|---|

| Ascent | View | Up to $200,000 | 5.99-35.99% | Up to 15 years |

| Your Premier Lending | View | Up to $20,000 | 5.99-35.99% | Up to 7 years |