MaxLend Review

MaxLend is an online tribal lender that offers short-term installment loans of up to $3,000. New customers can borrow up to $1,500.

MaxLend offers an alternative to payday loans and MaxLend loans can be available as soon as one day and do not require any collateral.

MaxLend is a lender owned by the Mandan, Hidatsa, and Arikara Nation — the Three Affiliated Tribes of the Fort Berthold Reservation, a sovereign nation located within the United States of America.

MaxLend offers quick approval installment loans to help you stay afloat during financially challenging times.

Since the payments are spread out over a period of time in equal installments, it gives you more control over your budget.

How We Rate MaxLend

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate MaxLend:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐ |

| Transparency | ⭐⭐⭐ |

| Customer support | ⭐⭐ |

| Overall | ⭐⭐⭐ |

Do We Recommend MaxLend?

Yes, we recommend MaxLend as a reliable lender. Skip to our full review below and see how we rate MaxLend.Here’s what we’ll cover in this review:

Want to skip the details? Jump to our final verdict here.

MaxLend Overview

MaxLend offers installment loans up to $3,000 with repayments of up to nine months.

You can borrow as much as $3,000 via a MaxLend loan. And if you’re a first-time customer you can apply for up to $1,500.

Here’s a quick summary of MaxLend:

| Overview | Features |

|---|---|

| Loan type: | Personal loans |

| Loan amount: | $100 – $3,000 |

| Loan term: | Up to 9 months |

| APR: | Between 471% and 841% |

| Min. credit score: | None |

| Monthly fees: | Between $12.75 and $59 per $100 borrowed |

| Payout time: | One business day |

| Weekend payout: | No |

| Requirements: | At least 18 years old U.S. citizen Active bank account Regular income Valid phone number and email |

MaxLend loans are easily accessible and you can have funds in your account on the following business day.

As a first-time borrower, you can qualify for a loan of up to $1,500 and borrowers with bad credit can apply.

You can make an additional payment toward principal interest on any scheduled payment date. There is also no penalty for early repayment of a MaxLend loan.

Personal loans can be difficult to qualify for if you have bad credit. This is because most personal loans are unsecured so there is no collateral to back up the loan. MaxLend doesn’t require collateral and you don’t need good credit.

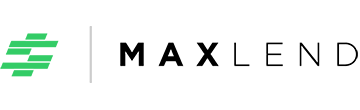

You don’t need to provide collateral when taking out a MaxLend installment loan. All you will need to provide is proof of income, a checking account, and a valid social security number.

Loan Requirements

Here are the loan requirements when applying for a MaxLend loan:

- You must be 18 years or older

- You must be a US resident

- You must have an open checking account

- You must have a source of income

Rates & Fees

MaxLend offers fast access to cash, but it has a downside: MaxLend loan fees are quite high, with APRs between 471% and 841%.

In comparison, typical payday loans have APRs of around 400%, according to the Consumer Financial Protection Bureau. This makes MaxLend more expensive than other average payday loans.

MaxLend bases its fees on a rate per $100 borrowed. For example, if you make weekly payments, you’ll pay up to $14,75 in fees for every $100 you borrow. With monthly repayments, you’ll pay up to $59 for every $100 you borrow.

MaxLends offers loans from $1,500 to $3,000 and the typical repayment period is around nine months for a new borrower.

| Weekly Pay Period | Bi-Weekly Pay Period | Semi-Monthly Payment | Monthly Pay Period | |

|---|---|---|---|---|

| New Customer | Up to $14.75 | Up to $29.50 | Up to $29.50 | Up to $59 |

| Returning Customer | $12.75* | $24.50* | $24.50* | $49.00* |

Payment Terms

MaxLend offers loan repayment terms of up to nine months. You can settle your loan early with no penalties.

Your repayment dates will typically correspond with your pay dates. Once you’ve paid your loan in full, you will qualify for MaxLend Preferred Rewards.

There are three ways to pay:

| Standard Pay | Payoff Now | Payment Plus |

|---|---|---|

| No action needed. | Pay off your entire loan in a single payment. | Add an amount to any scheduled payment. |

| Payments are collected automatically on the payment dates in your loan document. | Contact customer support at least one day before your payment is due. – One larger payment – Save on fees – Payment based on outstanding principal | Contact customer support at least three days before your payment. – The added amount pays down your principal. – Save on fees. – Choose this option as many times as you want. |

MaxLend Pros and Cons

Pros

- No prepayment penalty

- Ideal for emergency use

- Loans are funded in one day

- Customer service is available 24/7

- Fast online application process

MaxLend has a fast application process that can be done online in a few minutes. They also typically fund loans within one day which is in line with other tribal lenders. There is no prepayment penalty.

-

Loans aren’t available in every state

-

High APRs compared to other payday loans

-

As a tribal lender, MaxLend is not subject to suit or service of process.

Cons

One of the main drawbacks of MaxLend is that they may ask high APRs which can often go into triple digits. Compare tribal loans carefully before choosing an offer.

How to Apply for a MaxLend Loan

Apply online

Verify your information

A customer service representative may give you a quick call to verify your information.Get approved

If approved, you can sign your loan documents online. You can use the MaxLend login to manage your account.Receive your funds

The money will be sent to your bank account and this usually takes one day.How Financer.com Rates MaxLend

If you’re looking to take a loan from Max Lend, all the terms and requirements are not transparent on their website but are provided in detail on your loan agreement.

Although the interest rates are very high on Max Lend loans, if you can manage to repay your loan within the next payday, it can be quite manageable.

Missing payments can mean fees and cause more debt, so it really isn’t something to consider if you’re trying to consolidate a credit card or auto loan.

You can also consider applying for a payday alternative loan from a federal credit union. These small short-term loans can’t have interest rates higher than 28%, and you can’t be charged more than $20 to apply.

Is MaxLend legit? Yes. MaxLend is a sovereign enterprise, wholly-owned and controlled by the Mandan, Hidatsa, and Arikara Nation.

Customer Service

MaxLend offers customer service 24/7 via email and telephone. Advance customer service is also available from Mondays to Saturdays.

You can read more MaxLend reviews below.

FAQs

How much can I qualify for?

Is MaxLend a credible lender?

Is my information safe?

Can I pay back my loan early?

MaxLend Alternatives

Here’s a list of alternatives to MaxLend and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| PersonalLoans.com | View | $500 – $35,000 | 5.99-35.99% | Up to 6 years | Yes |

| BadCreditLoans | View | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | View | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

More MaxLend Personal Loan Reviews

What Users On the Web Are Saying

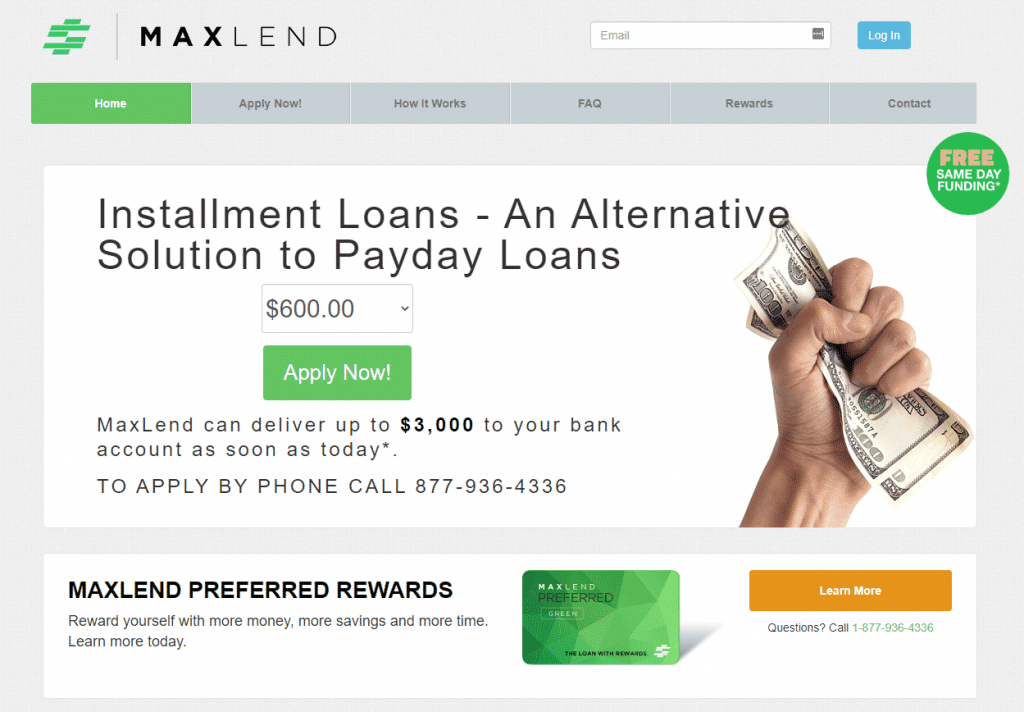

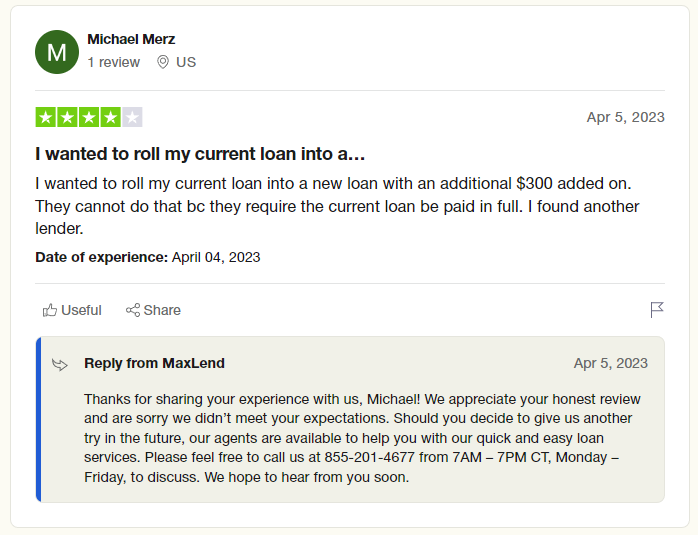

MaxLend gets 3.8 out of 5 stars on Trustpilot, with users showing mixed feelings:

Some users were unhappy about the high loan rates, while others felt the service was fast and easy.

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used MaxLend before? Leave your review now.