SoFi Review 2025

If you are looking for a large loan and you have an excellent credit history, then SoFi may be the ideal lender for you.

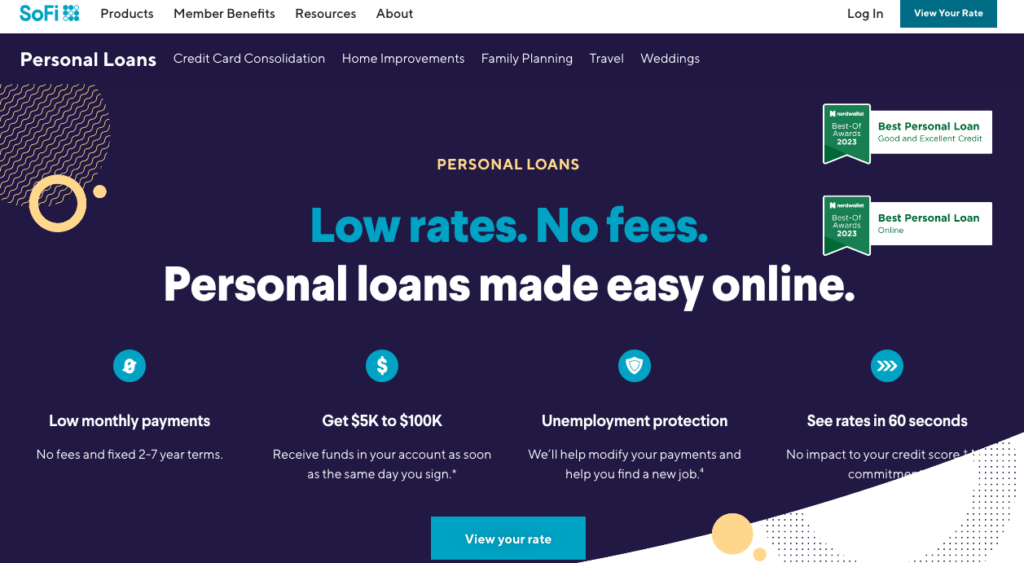

SoFi offers an array of loan packages, from personal loans to mortgages as well as mortgage refinancing. Loans are available from $5,000 to $100,000 with rates starting at 8.99% APR*.

Loan terms range from two to seven years and the minimum credit requirement is 680.

SoFi loans are available in all US states except Mississippi.

How We Rate SoFi

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate SoFi:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend SoFi?

Yes, we recommend SoFi as a reliable lender. Skip to our full review below and see how we rate SoFi.Want to skip the details? Jump to our final verdict here.

SoFi Overview

SoFi – or Social Finance, Inc. – launched in 2011 offering student loan refinancing for Stanford alumni. The company has since expanded its offering into other categories such as mortgage loans and auto loan refinancing.

SoFi offers perks to customers such as estate planning, career coaching, and financial planning. The company uses its coaching and planning services to help its customers stay on top of their finances.

SoFi loans range from $5,000 to $100,000 and are available in all US states except Mississippi.

In states like Massachusetts, Arizona, and New Hampshire, the minimum loan amount is $10,001 while the baseline is $15,001 in Kentucky.

Here’s a quick summary of SoFi:

| Overview | Features |

|---|---|

| Loan type: | Personal loans, mortgage loans, auto loan refinancing |

| Loan amount: | $5,000 to $100,000 |

| Loan term: | Up to 7 years |

| APR: | 8.99% – 25.81% |

| Min. credit score: | 680 |

| Monthly fees: | None |

| Payout time: | 1-3 days |

| Weekend payout: | No |

| Requirements: | At least 18 years old U.S. citizen, permanent resident, or visa holder Live in an eligible state Good credit |

SoFi’s APRs are consistent with lenders offering credit to borrowers with excellent credit. They also offer rate discounts for autopayments and all loan rates and terms are disclosed on their website.

Prequalifying for a SoFi loan requires a soft credit check which means your credit score won’t be affected until you accept the offer.

Want to find out more about the full range of offerings? Read our SoFi review below or view SoFi reviews from customers.

SoFi Pros and Cons

Here are some of the pros and cons of SoFi as a lender:

Pros

- Competitive APRs, no prepayment fees, and flexible repayment terms

- Soft pull to prequalify

- Interest-rate discount with automatic payments

- Same day funding

- Member-only perks like career coaching and financial advising, networking events, referral bonuses, and even complimentary estate planning, among others.

- Unemployment protection

- Live customer support seven days a week

SoFi personal loans are aimed at borrowers who have a good credit history and a strong cash flow. Since many online lenders cap personal loans at around $40,000, SoFi is the ideal lender for borrowers looking for a huge online loan.

SoFi offers competitive interest rates, especially if you have strong credit. You’ll also be eligible for a 0.25% rate discount if you set up AutoPay.

-

People with less-than-fair credit may have a tough time qualifying

-

$5,000 minimum loan amount (may be higher in some states)

-

SoFi loans cannot be used to buy securities, real estate, investments, or used for business purposes. Loans can also not be used to cover postsecondary educational expenses.

Cons

Who Is SoFi For?

SoFi loans are ideal for borrowers with good to excellent credit looking for a large loan with flexible repayment terms and zero fees.

Eligibility Requirements

To qualify for a SoFi loan, you have to meet the following requirements:

- Be at least 18 years old

- Be a U.S. citizen, permanent resident, or visa holder

- Live in an eligible state

- Have a credit score of at least 680

- Must be employed, have sufficient income, or an offer of employment

Who It’s For

SoFi may be a good option for you if:

- You have good to excellent credit

- You are looking for a huge loan

Who It’s Not For

SoFi may not be a good option for you if:

- You have bad credit or limited credit history

- You are looking for a loan of less than $5000

- You live in Mississippi

How to Apply for a SoFi Loan

Go to the SoFi website and see what rates you may qualify for

You can apply for a SoFi loan online. Pre-qualification only takes a few minutes and won’t hurt your credit score.

Submit an application

Complete an application if you like the rates and terms.Wait for approval

Application review and approval can take anywhere from two to four days.Sign documents

Sign the loan agreement to receive the funds.Receive funds

Loan proceeds will be sent to your personal bank account after you sign the documents.What To Consider Before Applying

- What you need the loan for: SoFi loans cannot be used to buy securities, real estate, investments, or used for business purposes. Loans can also not be used to cover postsecondary educational expenses.

- How much you need: SoFi loans start from $5000 ($10,001 in Massachusetts, Arizona, and New Hampshire and $15,001 in Kentucky).

- Your credit score: SoFi loans are ideal for borrowers with good to excellent credit.

SoFi Fees and Payment Terms

- APRs vary between 8.99 – 25.81% (with all discounts).

- SoFi doesn’t charge origination fees, late fees, or prepayment fees.

- SoFi offers repayment terms between two and seven years and loans between $5,000 and $100,000.

How Financer.com Rates SoFi

Is SoFi legit? Yes, at Financer.com we recommend SoFi.

At Financer.com, all lenders go through a thorough research and review process. We don’t make recommendations lightly.

SoFi is one of the best options out there if you are looking for a large loan with fair rates, zero fees, and flexible repayment terms.

SoFi loans are ideal for borrowers with good credit looking for a huge loan with flexible repayment terms.

SoFi’s APRs are consistent with lenders offering credit to borrowers with excellent credit. They also offer rate discounts for autopayments and all loan rates and terms are disclosed on their website.

What’s more, SoFi offers unemployment protection which means that if you lose your job, your payments may be modified temporarily and the lender may help you find a new job.

Application process

Applying for a SoFi loan is an easy and simple process. It’s easy to see if you qualify for a loan without hurting your credit.

Since prequalifying for a SoFi loan only requires a soft credit check, your score won’t be affected until you accept the offer.

SoFi reports to all three credit bureaus.

Costs

SoFi doesn’t charge origination, prepayment, or late payment fees. With APRs ranging from 8.99% to 25.81%, SoFi’s rates are consistent with lenders offering credit to borrowers with good to excellent credit.

SoFi also offers discounts for autopayments and all loan rates and terms are disclosed on their website.

Payments

SoFi offers repayment terms that range from two to seven years and loans between $5,000 and $100,000. If you are looking for a large loan amount and you have an excellent credit history, SoFi may be the ideal lender.

Customer Service

SoFi has a customer service that runs seven days a week. The lender provides customer support by phone, email, and live chat. SoFi attends to inquiries and complaints Mondays through Thursdays from 5 a.m. to 7 p.m. PT and 5 a.m. to 5 p.m. PT on weekends.

For inquiries or complaints, you can contact SoFi directly at (855) 456-SOFI (7634) or send an email to [email protected].

You can also reach customer support on Twitter at https://twitter.com/SoFi.

SoFi FAQs

FAQs

Is SoFi a reliable lender?

What types of loans does SoFI offer?

How much can I borrow with SoFi?

What does SoFi do?

SoFi Alternatives

Here’s a list of alternatives to SoFi and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| LendKey | View | $5,000 – $300,000 | 4.49-10.68% | Up to 20 years | No |

| Ascent | View | $2,001 – $200,000 | 5.74% to 15.76% | Up to 20 years | Yes |

| Upstart | View | $1,000 to $50,000 | 6.50% – 35.99% | Up to 5 years | Yes |

| Earnest | View | $1,000 to 100% of school cost | 4.79% to 13.50% | Up to 15 years | No |

Should You Take a Loan With SoFi?

If you are looking for a large loan and you have good credit, then SoFi is one of the best options out there.

SoFi offers competitive interest rates, especially if you have excellent credit. You’ll also be eligible for a 0.25% rate discount when you set up AutoPay.

SoFi offers attractive perks, zero fees, and no prepayment penalties. What’s more, SoFi’s unemployment protection feature means that if you lose your job, your payments may be modified temporarily and the lender may help you find a new job.

Read more SoFi reviews from customers below or add your own.

More SoFi Personal Loan Reviews

What Users On the Web Are Saying

SoFi is rated 4.5 out of 5 stars on Trustpilot, with users generally satisfied with the lender:

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used SoFi before? Leave your review now.

*Disclaimer: Fixed rates from 8.99% APR to 25.81% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 05/19/23 and are subject to change without notice. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors. Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-6%, which will be deducted from any loan proceeds you receive. Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi. Direct Deposit Discount: To be eligible to potentially receive an additional (0.25%) interest rate reduction for setting up direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A. or eligible cash management account offered by SoFi Securities, LLC (“Direct Deposit Account”), you must have an open Direct Deposit Account within 30 days of the funding of your Loan. Once eligible, you will receive this discount during periods in which you have enabled payroll direct deposits of at least $1,000/month to a Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements to be determined at SoFi’s sole discretion. This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a Loan.