PersonalLoans.com provides personal loans of up to $35,000. The company has a large network of lenders and offers loans to borrowers with bad credit.

The repayment periods for PersonalLoans.com loans typically vary from 90 days up to 72 months, based on the terms offered by each lender.

Loans obtained from PersonalLoans.com can be used for various purposes, like debt consolidation, home improvement, medical expenses, or major purchases.

Note:

PersonalLoans.com is not a direct lender, but rather a service that matches borrowers with lenders based on their credit profile, income, and loan amount.

How We Rate PersonalLoans.com

At Financer, all lenders go through a thorough research and review process. Here's how we rate PersonalLoans.com:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend PersonalLoans.com?

Yes, we recommend PersonalLoans.com as a reliable lender marketplace. See our full review on them below.

PersonalLoans.com Overview

PersonalLoans.com offers different types of personal loans and each type has its own pros and cons, depending on your situation and preferences.

They are quite transparent about the terms and fees lenders may charge, and they do provide a few representative loan examples.

Here's a quick summary of PersonalLoans.com:

| Overview | Features |

|---|---|

| Loan type: | Personal installment loans, peer-to-peer loans, bank personal loans |

| Loan amount: | $250 - $35,000 |

| APR | From 5.99% |

| Min. credit score: | Varies by lender (typically 580-600+) |

| Monthly fees: | None |

| Payout time: | 1-5 business days |

| Weekend payout: | No |

Their service is free to use and funding is provided directly to your account as soon as the next business day.

Their extended lender network offers competitive rates and potential customers access to services such as credit repair, debt relief, and credit monitoring.

Products Offered

PersonalLoans.com offers loans that range from $250 to $35,000. These loan types are generally available from lenders:

Peer-to-peer loans

Personal installment loans

Bank personal loans

The application process is very fast and loan offers are available within minutes. PersonalLoans.com works with a large network of lenders to provide a range of personalized loan offers for every borrower.

Borrowers with bad credit are welcome to apply.

How PersonalLoans.com Works

Getting loan offers from PersonalLoans.com is easy and straightforward. It takes only a few minutes to receive personalized loan offers online.

The company uses proprietary technology to evaluate loan requests while also searching for potential lenders. Applicants can benefit from a simple three-step loan request to find out if they qualify.

Once a loan offer is located, PersonalLoans.com redirects applicants to the lender’s page, which contains the specific details of the loan.

Loan Requirements

Loan requirements vary between lenders, however, PersonalLoans.com matches you with suitable loan offers based on your unique needs.

It's important to review loan offers and their terms, to ensure you have the best possible chance of being approved. Loan requirements vary between lenders, but these are the typical qualifying criteria:

Be at least 18 years or older

Be a U.S. citizen

Have a credit score of at least 600

Have a steady income

Payment Terms

PersonalLoans.com offers repayment terms from 90 days up to 72 months, and loans can typically be repaid once or twice a month.

Specific loan terms will depend on the lender as well as the borrower's credit profile and payment history.

Depending on your choices or the terms set out by the lender, personal loans are typically repaid either monthly or every two weeks.

You might be able to arrange for money to be automatically taken out of your bank account on the day that you and your lender have agreed.

Make sure you read and understand all loan repayment policies to know what you must do as a borrower in order to pay back the loan.

Simulation

Representative example: A personal loan of $8,500 over a 24-month period with an APR of 6.99% will have monthly payments of $380.53 for a total loan amount of $9,132.68.

Who Is PersonalLoans.com For?

PesonalLoans.com is ideal for borrowers looking to compare loan offers from multiple lenders offers online without requiring a high credit score.

By comparing multiple offers, PersonalLoans.com can give you personalized loan offers from leading U.S. lenders and there are no application fees.

If you're looking for the best loan rates and you have an excellent credit score, you may want to consider other lenders that can offer you competitive rates.

Who It's For

PersonalLoans.com is for you if:

You want to compare multiple lenders

You have a bad credit score

You want a fast application process

You want a completely online application

They also have FAQs available, as well as clear terms and requirements.

Their website is straightforward and easy to navigate, with contact information and service terms clearly available.

Privacy and Security

PersonalLoans.com takes privacy seriously by encrypting and protecting all information according to the legal requirements and 256-bit encryption.

Similar to other loan marketplaces and online lenders, PersonalLoans.com collects and shares user information with partners in their network.

How Financer Rates PersonalLoans.com

Is PersonalLoans.com legit? Yes. PersonalLoans.com connects applicants with suitable lenders that offer loan products that meet their individual needs.

With a wide network of reputable lenders, PersonalLoans.com is able to provide personalized loan offers to each borrower within minutes.

The loan application process is fast and the website offers transparency about loan rates, terms, and requirements.

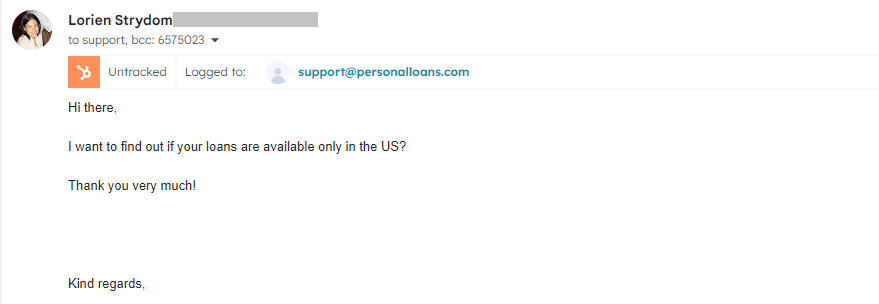

Customer Service

PersonalLoans.com offers customer service via telephone and email from Mondays to Fridays, 6am to 7pm PST.

We've tested out their email support and received a reply within a few hours:

FAQs

How much can I borrow?

How much can I borrow?

PersonalLoans.com works with a network of lenders that offer loans up to $35,000. Loan amounts may vary from one lender to the next and will depend on each borrower's credit profile.

What are the loan rates?

What are the loan rates?

This varies between lenders but APRs are typically between 5.99% and 35.99%.

What happens if I miss a payment?

What happens if I miss a payment?

If you think you won't be able to pay your loan on time, you should get in touch with your lender as soon as possible to find out what your options are. You may qualify for a new payment arrangement but be aware that some lenders may charge late fees for missed payments.

Is PersonalLoans.com a direct lender?

Is PersonalLoans.com a direct lender?

No. PersonalLoans.com works with a network of lenders and connects you with suitable loan offers from specific lenders.

Is PersonalLoans.com legit?

Is PersonalLoans.com legit?

Yes. PersonalLoans.com is a reputable online lending platform that connects borrowers with a network of lenders for personalized loan offers.

PersonalLoans.com Alternatives

Here's a list of alternatives to PersonalLoans.com and how they compare:

| Lender | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|

| 5KFunds | $500 – $35,000 | 5.99-35.99% | Up to 6 years | Yes |

| BadCreditLoans | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

Should you take a loan with PersonalLoans.com?

PersonalLoans.com has been around for quite a while and has proven to be a leading U.S. lending platform where borrowers can get personalized loan offers.

One of the best reasons for applying for a loan with PersonalLoans.com is they work with reputable U.S. lenders and they are transparent about their terms.

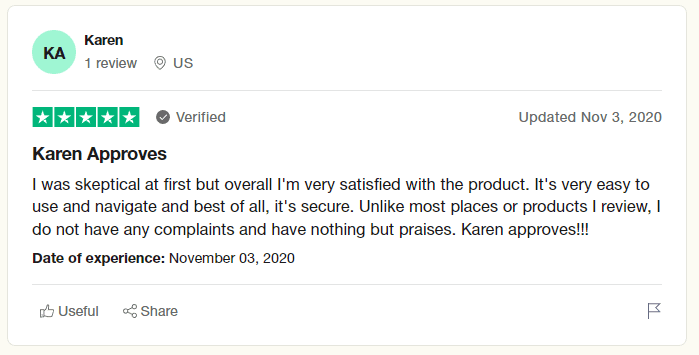

Their customer service is responsive and they have a good feedback rating from past customers.

Read more PersonalLoans.com reviews from customers below or add your own.

More PersonalLoans.com Reviews

5KFunds gets 4.6 out of 5 stars on Trustpilot, with users being happy about their user experience on the platform:

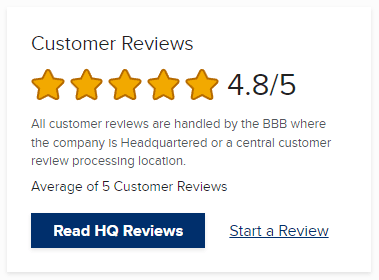

Although PersonalLoans.com is not BBB accredited, they get a 4.8 out of 5 stars:

More User Reviews - Add Your Rating

Read more reviews on Financer from verified users below.

Have you used PersonalLoans.com before? Leave your review below.