Blog article

Diversify Wisely with EXANTE

Adheres to

Adheres to

8 Min read | Invest

Quick Take

Spreading risk across various asset classes, industries, and geographic areas helps you mitigate the impact of a downturn in any single investment.

Alternative investments provide unique growth opportunities that traditional assets may not offer.

EXANTE offers a one-stop shop comprising of over one million financial instruments across fifty markets, providing various alternative investment options.

Alternative investments are becoming increasingly popular. The reason isn’t farfetched: they offer a better chance of creating wealth than traditional investments.

Why You Should Diversify Your Portfolio

All investments carry risk. What you invest in doesn't matter - there’s still a risk of losing money.

To manage risk, diversify your portfolio. By diversifying, you spread risk across various asset classes, industries, and geographic areas, mitigating the impact of a downturn in any single investment.

Alternative Assets

The US dollar has lost over 90% of its value in the last 50 years. As the Federal Reserve prints more money, purchasing power declines and inflation rises. To combat this, it's essential to invest in alternative assets that can outpace inflation, as they often perform better than traditional investments.

Beyond risk management, diversification opens doors to potentially higher returns and unique growth opportunities, tapping into different market movements and protecting against unforeseen economic or geopolitical events.

By including alternative investments alongside traditional options, a diversified portfolio not only strengthens long-term growth potential but also provides a sense of security and peace of mind amid market uncertainties.

Exploring Alternative Investments

Alternative investments are a great way of diversifying your portfolio beyond conventional assets, spreading risk across various investment avenues.

This diversification reduces correlation with traditional markets, potentially enhancing portfolio stability and minimizing the impact of market fluctuations on overall returns.

Unique opportunities

Alternative investments offer unique opportunities for potential growth and diversification, allowing you to mitigate risk while seeking higher returns in non-traditional asset classes.

Exploring alternative investment options can offer unique avenues for diversification beyond traditional stocks and bonds. Examples of alternative investments include commodities, cryptocurrencies, options, and futures.

Good and bad

While alternative investments offer diversification benefits, they often come with higher risk due to their volatility and complexity.

Let's take a look at a one-stop shop of sorts for alternative investments.

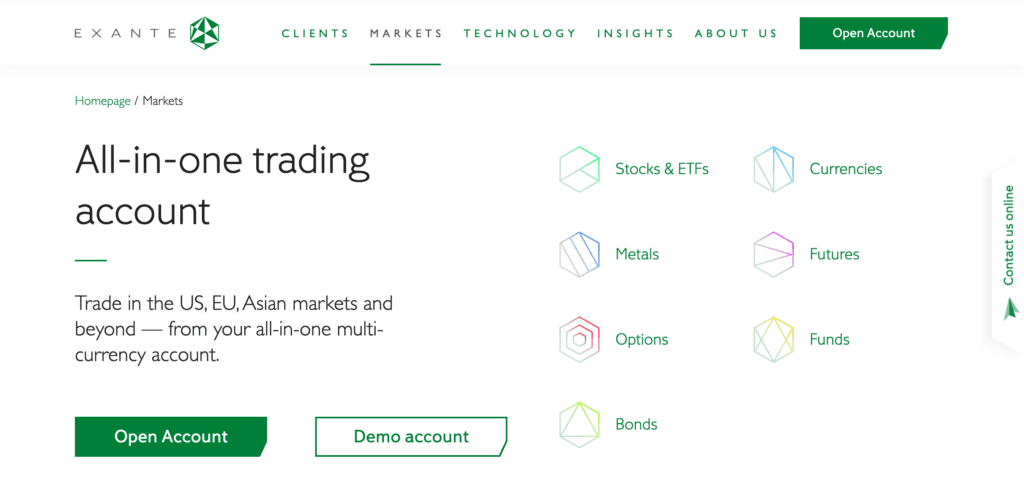

EXANTE: Your All-in-One Investment Shop

EXANTE is a brokerage company offering access to a diverse range of global financial markets through a single platform.

What sets it apart is its extensive offerings covering stocks, bonds, currencies, and alternative investments like metals, futures, and options, all accessible from one account.

EXANTE provides a user-friendly platform that grants investors access to over one million financial instruments across more than 50 markets. Through this unified account, users can seamlessly navigate and trade in various markets worldwide.

Good choice

If you are looking for a broker with a large basket of alternative investments, EXANTE is a good choice.

Headquartered in Cyprus with offices in various global financial centers, EXANTE serves investors worldwide, offering a wide array of financial products and services.

EXANTE at a glance

| Broker | EXANTE |

|---|---|

| Owned and Run By | EXT LTD |

| Official Website | https://exante.eu/ |

| Financial Instruments | 1,000,000 |

| Asset Types | Stocks & ETFsMetalsFuturesOptionsFundsBonds |

| Markets | 50+ |

| Threshold of Entry | 10000 EUR |

| Licensed By | FCA (UK)CySEC (Cyprus)SFC (Hong Kong) |

| Head Office | 28 October Avenue, 365 Vashiotis, Seafront Building, 3107, Limassol, Cyprus |

| Phone | +357 2534 2627 |

| Countries Serviced | 100+ |

Alternative Investments Offered by EXANTE

EXANTE stands out in the investment landscape by offering a good collection of alternative investment options, catering to investors seeking opportunities beyond traditional asset classes.

Here are some of the alternative investment avenues available through EXANTE:

Metals

Metals like gold and silver provide a hedge against inflation and currency devaluation and often exhibit a low correlation with traditional assets. Metals available on EXANTE include:

| Gold | Platinum |

|---|---|

| Silver | Palladium |

| Copper |

Options

EXANTE offers options trading, allowing investors to buy or sell options contracts based on the movement of underlying assets, such as stocks, indices, or commodities. Here are the supported exchanges on EXANTE:

| Australian Stock Exchange (Australia) | Chicago Mercantile Exchange (US) |

|---|---|

| Chicago Board of Trade (US) | Commodity Exchange, Inc. (US) |

| Chicago Board Options Exchange (US) | EUREX (DTB, SOFFEX) (Germany) |

| Hong Kong Exchange (China) | New York Mercantile Exchange (US) |

| Osaka Securities Exchange (Japan) |

Currencies

EXANTE also supports forex trading, allowing for up to 50 currency pairs.

| GBP/USD | EUR/GBP |

|---|---|

| EUR/USD | EUR/JPY |

| USD/CHF | AUD/USD |

| USD/JPY | USD/CAD |

Funds

EXANTE also offers access to a diverse selection of hedge funds, allowing investors to explore strategies that deliver positive returns regardless of market conditions.

EXANTE Fees

| Metals | From $3 |

|---|---|

| Forex | From 0.3 spread |

| Options | From $1.5 |

| Funds | From 0.5% |

High brokerage fees are eating your profits

Save thousands by choosing the best investment broker in 2026. Compare the options for free within minutes.

Compare investment brokers here!

EXANTE: Pros and Cons

Pros

Global Reach: EXANTE spans 50 countries, offering over a million financial instruments across multiple asset classes.

Streamlined Trading: Its user-friendly interface simplifies trading in different markets across continents.

Diverse Investment Opportunities: EXANTE provides a vast array of investment options from established markets like the New York Stock Exchange (NYSE) to emerging markets in Asia or Europe.

Advanced Tools: EXANTE offers advanced trading tools, research, and analytics, empowering investors to make informed investment decisions.

Regulatory Compliance: The platform adheres to stringent regulatory standards, ensuring a secure trading environment.

Customer Support and Service: EXANTE offers dedicated customer support, assisting users with their trading needs, account inquiries, and technical assistance. The platform's responsive customer service ensures a smooth and hassle-free trading experience.

Cons

High Minimum Deposit Threshold: With a minimum deposit of €10,000, EXANTE has a considerably higher minimum deposit threshold than most traditional brokers.

Complex for Beginners: The diverse range of investment options and advanced trading tools offered by EXANTE might be a bit complex for novice investors. Navigating through various markets and understanding complex investment instruments may require a learning curve.

Closing Thoughts

If you are looking to diversify your investment portfolio, then alternative investments are a worthy consideration.

With a wide array of options to choose from, EXANTE allows you to spread risk across asset classes, industries, and geographies.

Disclaimer: The information provided in this article is solely for educational purposes. It is not financial, investment, or legal advice. Kindly consult a certified financial expert before making a decision related to finance or investments.

FAQs

What sets EXANTE apart from other brokers?

What sets EXANTE apart from other brokers?

EXANTE distinguishes itself by providing a vast array of investment options from different asset classes and global markets, offering a streamlined trading experience, advanced tools, and global market access, all through a single user-friendly platform.

How secure is EXANTE's platform?

How secure is EXANTE's platform?

EXANTE adheres to stringent regulatory standards and employs robust security measures to safeguard users' sensitive information and assets. The platform is licensed by regulatory bodies such as FCA (UK), CySEC (Cyprus), and SFC (Hong Kong), ensuring compliance and security.

How do I get started with EXANTE?

How do I get started with EXANTE?

To get started, visit the official website and follow the account opening process. This typically involves providing personal and financial information, completing verification procedures, and funding the account to meet the minimum deposit requirement.

Comments

Only registered users can leave comments.