Blue Trust Loans Review

Summary

- Loans from $100 to $3,000

- Repayment period of up to 6 months

- Higher APR rates

- Rewards customers in good standing with better rates.

What is Blue Trust Loans?

Blue Trust Loans is a tribal lender that is owned and operated by the Lac Courte Oreilles Band of Lake Superior Chippewa Indians.

Blue Trust Loans offer personal installment loans between $100 to $3,000, although first-time borrowers will be limited to $1,200.

Installment loans from Blue Trust Loans typically have a high APR — usually between 471.78% to 841.45%. Loan terms can be up to six months.

Blue Trust states that it is a better alternative to a traditional payday loan.

- Loans of up to $3,000

- Repayment period of up to 6 months

- Higher APR rates

- Rewards customers who are in good standing

How Blue Trust Loans Work

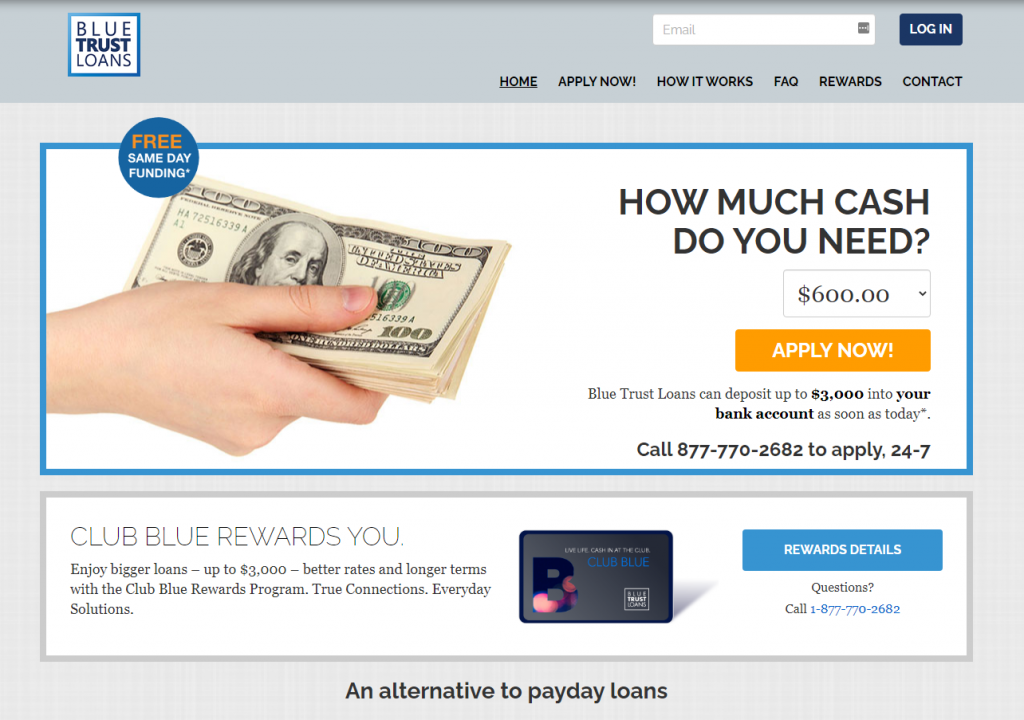

The moment you arrive on the website, you see an offer to apply for a loan of up to $3,000 that will be deposited into your bank account as soon as the next day.

Blue Trust Loans does not offer loans to Active Duty Military, their dependents, or spouses. In addition to this, loans are not available in all states.

Loan Requirements

Here are the loan requirements when applying for a loan:

- Be at least 18 years old

- Have an active bank account that accepts direct deposits.

- Have a regular stream of income.

- Have a valid contact number and an active email address.

- No minimum credit score is required.

Rates & Fees

APR rates range from 4.71.7846% to 841.4532% depending on the loan origination fees and the duration of the loan.

There is no cost to use the Blue Trust Loans website and there may be a loan origination fee, which will be disclosed in the terms prior to accepting the loan.

- Loans of up to $3,000

- Repayment period of up to 6 months

- Higher APR rates

- Rewards customers who are in good standing

Payment Terms

Loan repayment terms range from 270 to 300 days.

Failure to make repayments on time will incur late fees and penalties, as stated in the loan agreement. Loans may be paid in full with no early payment penalty.

How To Apply for a Loan with Blue Trust Loans

Fill out the online application

Completing the online application takes only a few minutes and if approved you can eSign your documents immediately.Verify your information

A customer service representative will call to verify you rinformation, or you can call them 24/7. Once your details have been confirmed you will receive a copy of your loan agreement via email.Receive your funds

The money will be deposited into your bank account as soon as the same day.Blue Trust Loans are convenient for borrowers that need cash quickly but don’t have time to complete an in-person loan application.

All documents are eSigned after approval, so the loan can be finalized.

When performing a Blue Trust Loans review, you’ll find that it doesn’t specify income requirements or checking account duration.

This information will be provided by the representative once the loan request is made.

Our Blue Trust Loans Review

Loans up to $3,000 for existing customers

Fast online loan application process

Early repayment without any penalties

Reliable customer service

Pros

APRs may be on the higher side

Loans are not available in all states

Cons

Blue Trust Loans is different from payday loan lenders because it offers installment loans that give the customer six months to pay it back in full.

Instead of applying an interest rate, the loan costs the customer for every $100 borrowed, and this is charged monthly, biweekly or weekly.

Fortunately, the option is there to pay back the loan early to save money.

You’ll also find during a Blue Trust Loans review that the company is operated by Hummingbird Funds, LLC, which is a sovereign enterprise of the Lac Courte Oreilles Band of Lake Superior Chippewa Indians.

Loans serviced by this tribe-regulated entity are not subject to government oversight.

While the American Indian Tribe is recognized by the federal government, any complaints are resolved using Tribal Law and the loan agreement.

This is something to consider carefully before signing up for this fast and completely legitimate loan option.

Is Blue Trust Loans Safe?

Yes. Blue Trust Loans is a member of both the Native American Financial Services Association and the Online Lenders Alliance.

The privacy policy of Blue Trust Loans outlines how they collect and share your personal information, which can include your bank account information, Social Security number, or credit history.

You can choose to limit some of this sharing by contacting their customer service department. The Blue Trust Loans phone number is 1-877-770-2682.

Blue Trust Loans FAQs

What happens after I complete the application?

How soon will I get my money?

What is the maximum loan amount available?

When should I repay my loan?

Can I pay back a loan early?

What happens if I can’t make a payment?

What will a loan cost?

Weekly Pay Period | Bi-Weekly Pay Period | Semi-Monthly Pay Period | Monthly Pay Period | |

|---|---|---|---|---|

up to $14.75 | up to $29.50 | up to $29.50 | up to $59.00 |