Caribou Review 2024

Caribou, previously MotoRefi, is an online lending platform that offers auto refinancing loans. Their secure digital platform makes it easy for borrowers to see how much they can save by refinancing their auto loans.

Caribou is backed by leaders in the automotive, technology, and finance industries, with venture capital investors like Accomplice, Motley Fool Ventures, QED Investors, and others.

How We Rate Caribou Auto Refinance

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate Caribou:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend Caribou?

Yes, we recommend Caribou as a reliable lender. Skip to our full review below and see how we rate Caribou.Here’s what we’ll cover in this Caribou review:

Want to skip the details? Jump to our final verdict here.

Caribou Overview

Caribou allows borrowers to pre-qualify online in a few easy steps.

Caribou is not a direct lender, which means you can’t get a car loan directly from them. They partner with various lenders to provide car refinance loans.

Here’s a quick summary of Caribou refinance:

| Overview | Features |

|---|---|

| Loan type: | Auto loans |

| Loan amount: | Varies |

| Loan term: | Up to 72 months |

| APR: | From 5.69% |

| Min. credit score: | 650+ |

| Monthly fees: | None |

| Other fees: | $399 loan processing fee |

| Requirements: | At least 18 years old U.S. citizen Have an SSN |

This is the ideal solution if you want to refinance a car loan and complete a loan application completely online. If you apply and get approved, you can create an account and upload all your documents online.

They will then handle the vehicle title change and pay off your old lender.

You can’t refinance a commercial vehicle or a motorcycle, and you can get a lease buyout loan from Caribou either.

The company also partners with auto insurance companies to offer extended warranties, gap insurance, and key replacement coverage that can be added to your refinance loan.

Only car, truck, and SUV loans are offered by Caribou. You can’t refinance a motorcycle or a commercial vehicle, and you can’t get a lease buyout mortgage either.

Even though it only provides one type of loan, it works with auto insurance companies to provide coverage, gap insurance, and extended warranties that can be added to any refinance loan.

The loan process is very easy and is ideal for people who prefer getting loan offers online without a hard credit pull, and a company that offers great customer service.

Loan Requirements

Applying for pre-qualification through Caribou auto refinance won’t hurt your credit score because it only triggers a soft credit inquiry.

Rates & Fees

Caribou fees are lower than many other lenders – often up to two percentage points lower – but there is a $399 processing fee that is added to the loan.

Terms

With Caribou you get APRs as low as 5.48% with loan terms of between 12 and 60 months. Loans are available from $5,000 to $50,000 and you’ll get a decision when finishing your application, or within 24 hours.

The funding time depends on the lender and the lender fee is $399 to process your documents and retitle your vehicle.

Other benefits include a $0 fee for early payoff, however, there is a late fee that is lender-dependent.

You typically need a minimum credit score of 650 or more and an income of $2,000 per month ($24,000 per year).

If you have a bad credit history you may want to work on your credit profile to ensure you have an excellent credit score when you go through the refinancing process to get the best rates.

Other requirements include:

- Be at least 18 years old

- Be a U.S. citizen or permanent resident

- Have an SSN

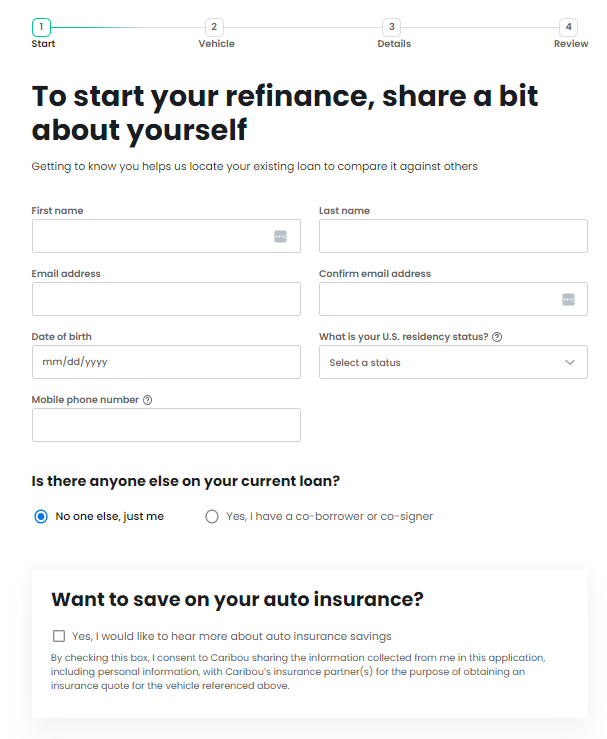

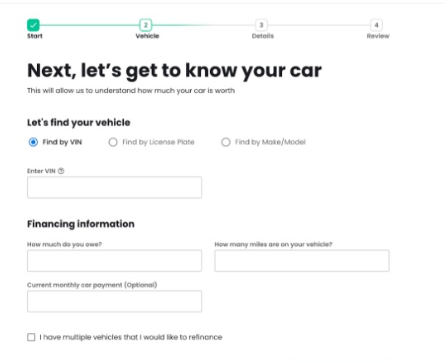

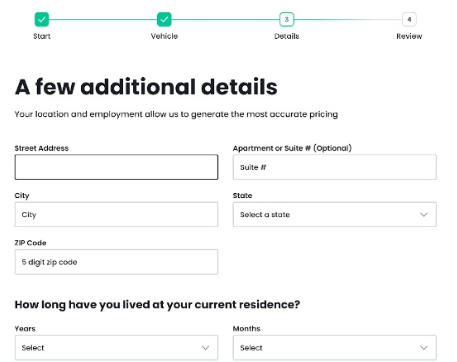

How To Apply for Caribou Auto Refinance

Check Your Rate

Select Your Offer

Finalize Your Refinance

More Information for Applying with Caribou

- Origination fee: Lenders can charge processing fees of up to $399. This fee can be added to the loan amount.

- Personal information: Information you may need to apply include your address, citizenship status, phone number, email address, employment status, home owner status, and more. You may also need to supply the vehicle’s license plate and VIN number, along with the make or model. Your Social Security number is not required until applicant proceeds with a loan.

- Pre-qualification: Pre-qualification is available and borrowers can receive multiple offers with estimated rates that are good for 45 days.

- Online, in-person or both: Process is 100% online, including document upload.

- Approval speed: 24 hours maximum but typically less than an hour.

Caribou Pros and Cons

Pros

- Lower rates than other lenders

- Convenient online platform

- No Social Security number needed to prequalify

- Prequalify with only a soft credit check

- Available in all U.S. states except MD, MI, NE, NV, PA, WI, and WV

- Support throughout refinance process

-

Can’t refinance motorcycles or commercial vehicles

-

Only offers auto refinance loans

-

Limited loan information on the website

Cons

Loan Restrictions

There are some additional loan restrictions: the maximum vehicle mileage is 125,000 miles gas/175,000 miles diesel. No commercial vehicles or motorcycles are covered. Finally, the maximum loan amount is $175,000.

Who is Caribou for?

Caribou is ideal for those who:

- Want to compare rates. You can pre-qualify with a soft credit check that won’t hurt your credit score.

- Want to apply online. Caribou’s application process is completely online, from doing a pre-qualification to signing the papers and transferring the vehicle title.

- Want to add car insurance. Caribou added car insurance as a bundled option with auto loan refinancing, so you can apply for refinancing and request a car insurance quote in one application.

Our Caribou Review

Is Caribou a good company?

Yes, Caribou is a great option for an auto refinance loan. With an easy-to-use platform and results within minutes, Caribou is a reputable lender.

They offer customer support throughout the car refinance process and allow for a fast and easy way to apply for an auto refinance online.

The Caribou phone number for customer support is 1-877-445-0070.

Caribou auto refinance offers pre-qualification and lower fees than most other lenders. They have been around since 2017 and have an A+ rating with the BBB.

You can read more Caribou reviews below.

Transparency

Caribou has only existed for a short time, but it has already received a good reputation from the Better Business Bureau and has even achieved a 5-star rating on the BBB website.

Better Business Bureau: Since 2018, Caribou has been accredited by the Better Business Bureau. They’ve been awarded an A+ rating.

Caribou is fairly open about the terms of its auto refinance loans. They don’t disclose an overall maximum APR, but they do allow you to prequalify and see your actual rate.

While certain pieces of information, such as minimum credit, and income requirements are not readily available on the website, they were happy to share them over the phone.

*Disclaimer: APR is the Annual Percentage Rate. Your actual APR may be different. Your

APR is based on multiple factors including your credit profile and the loan to value of the vehicle. APR ranges from 5.69% to 36.00% and is determined at the time of application. Lowest APR is available up to a 36-month term, to borrowers with excellent credit, and only in certain states. Conditions apply. Advertised rates and fees are valid as of 2/22/2023 and are subject to change without notice. Insurance savings will not result from a lower APR.

**Disclaimer: This information is estimated based on consumers who were approved for an auto refinance loan through Caribou between 3/1/2022 and 3/1/2023, had an existing auto loan on their credit report, and accepted their final terms. These borrowers saved an average of 4.7% on their interest rate. There is no guarantee of savings. Your actual savings, if

any, may vary.

***Disclaimer: This information is estimated based on consumers who were approved for an auto refinance loan through Caribou between 6/1/2022 and 3/1/2023, had an existing auto loan on their credit report, and accepted their final terms. These borrowers saved an average of $113.78 per month. Refinance savings may result from a lower interest rate, longer

term, or both. There is no guarantee of savings. Your actual savings, if any, may vary based on interest rates, the repayment term, the amount financed, and other factors.

Caribou FAQs

Is it smart to refinance your auto loan?

Who is caribou lender?

Was caribou formerly known as MotoRefi?

What is the going rate for auto refinance?

Caribou Alternatives

Here’s a list of alternatives to Caribou and how they compare:

| Lender | Reviews | Loan Amount | APR | Min. Credit Score |

|---|---|---|---|---|

| Upstart Auto Loans | View | $9,000 – $60,000 | 2.25-29.99% | 510 |

| Ally | View | $7,500-$99,999 | 7.54-22.49% | 520 |

| RefiJet | N/A | $5,000-$100,000 | 3.39-22.00% | 550 |

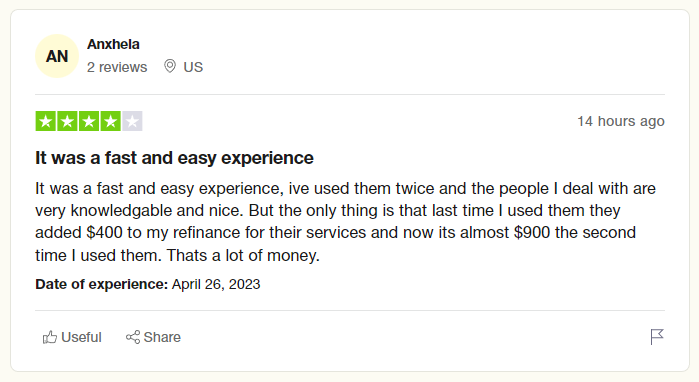

More Caribou Auto Refinance Reviews

What Users On the Web Are Saying

Caribou gets 4.5 out of 5 stars on TrustPilot, with most users happy with the service from Caribou:

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used Caribou before? Leave your review now.