MoneyKey Review

MoneyKey is a direct lender founded in 2011. In Texas, MoneyKey arranges and services loans as a Credit Access Business / Credit Services Organization.

MoneyKey offers loan products to underserved consumers in 9 states across the U.S.

Over time, it has proven to be one of the most popular lenders in the states where they do business.

How We Rate MoneyKey

At Financer.com, all lenders go through a thorough research and review process. Here’s how we rate MoneyKey:

| Category | Rating |

|---|---|

| Affordability | ⭐⭐⭐ |

| Application process | ⭐⭐⭐⭐ |

| Loan terms | ⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Customer support | ⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

Do We Recommend MoneyKey?

Yes, we recommend MoneyKey as a reliable lending marketplace. Skip to our full review below to see how we rate MoneyKey.- 1.MoneyKey Overview

- 2.Products Offered

- 3.Installment Loans Through MoneyKey

- 4.MoneyKey Line of Credit

- 5.MoneyKey Pros and Cons

- 6.How MoneyKey Works

- 7.Loan Requirements

- 8.Rates and Terms

- 9.Payment Terms

- 10.How Financer.com Rates MoneyKey

- 11.Responsible Lending

- 12.Support

- 13.Website

- 14.Does Financer.com recommend MoneyKey?

- 15.MoneyKey Alternatives

- 16.Should you take a loan with MoneyKey?

- 17.More Money Personal Loan Reviews

- 18.What Users On the Web Are Saying

- 19.More User Reviews – Add Your Rating

MoneyKey Overview

MoneyKey offers loans from $200 to $2,500 and APRs from 173%. They have flexible payment options and there are no minimum credit score requirements.

Borrowers have up to 12 months to pay and the approval process is very fast.

MoneyKey offers lines of credit and online personal loans in specific US states.

Here’s a quick summary of MoneyKey:

| Overview | Features |

|---|---|

| Loan type: | Personal loans, line of credit |

| Loan amount: | $500 – $2,500 |

| Loan term: | Up to 12 months |

| APR: | 270% – 306% |

| Min. credit score: | None |

| Monthly fees: | None |

| Payout time: | One business day |

| Weekend payout: | No |

| Requirements: | At least 18 years old U.S. citizen Active bank account Regular income Valid phone number and email |

- Fast funding, as soon as the same business day

- No early repayment penalty fees

- Quick online process

Products Offered

MoneyKey offers the following:

- Installment loans

- Lines of credit

Installment Loans Through MoneyKey

MoneyKey offers or arranges installment loans, which have a broad borrowing range. Depending on the state you live in, you can borrow between $200 and $2,500 with easy repayment terms.

Repayment on Money Key loans usually starts on your next pay date and the remaining installment loan payments are set to line up with your pay frequency.

You can choose to pay off an installment loan through MoneyKey early without being charged extra fees.

Installment loans are available in Delaware, Idaho, Mississippi, Missouri, Texas, Utah, and Wisconsin.

MoneyKey Line of Credit

A line of credit is an open-ended loan that gives you all the benefits of a traditional loan; however, you have flexibility over how much you draw at a time.

With MoneyKey you can apply for a line of credit 24 hours a day. The MoneyKey Line of Credit is available in Tennessee and Kansas.

If approved, you can withdraw funds as needed up to your credit limit. For MoneyKey, the credit limit ranges from $200 to $2,500, depending on your state and certain qualification criteria.

If you have an outstanding balance, you’ll have to make your minimum payments and you only pay interest charges on the amount of credit you use.

- Lines of credit are available in Kansas and Tennessee

- CC Flow Line of Credit is available in Alabama, Alaska, Arizona, Arkansas, Florida, Hawaii, Indiana, Kentucky, Louisiana, Michigan, Minnesota, Montana, Nebraska, Oklahoma, and Wyoming.

MoneyKey Pros and Cons

Pros

- Broad Loan Range: Credit limits and amounts through MoneyKey range from $200 to $2,500. Applying is fast and easy, the amount depends on your state of residence.

- Same Business Day Funding: Funds are deposited in your bank account as soon as the same business day, depending on the time of the request. Funding times are subject to your bank’s policies.

- Early Repayment Option: Pay off your loan early without being charged extra.

- Hassle-Free Cancellation: No fee for canceling your loan within 3 days of your loan being approved.

- Transparent Fees: All fees are made clear during borrowing, no surprise future fees.

- Easy Repayment: Payment schedules are generally in line with your pay frequency.

APRs can be as high as 299%.

Cons

How MoneyKey Works

MoneyKey is a direct online lender in most states. In Texas, MoneyKey arranges and services loans as a Credit Access Business.

Installment loans and lines of credit through MoneyKey are offered to consumers who are typically underserved at traditional financial institutions.

Applying for an installment loan or line of credit through MoneyKey is easy and convenient, as it can be done 24 hours a day from the comfort of your home. MoneyKey also has a Customer Care team that can help you with your application during their operating hours when you need cash fast.

Loan Requirements

- Be of legal age to contract in your state of residence

- Be a U.S. citizen or a Permanent Resident

- Have an active bank account

- Have a regular source of income

- Have a valid contact number and an active email address

Installment loans and lines of credit through MoneyKey are available in these states:

- Delaware

- Idaho

- Kansas

- Mississippi

- Missouri

- Tennessee

- Texas

- Utah

- Wisconsin

Rates and Terms

The APRs of loan products offered through MoneyKey vary based on your state but in general, they can range between 270% and 306%.

Payment Terms

Repayment terms between six months and 12 months are available for installment loans. MoneyKey does not charge an origination fee for any of their loan products.

MoneyKey also does not charge a late fee if you miss a payment and there is no charge for early prepayments.

How To Apply for a Loan Through MoneyKey

Apply online

Submit an online application form on the MoneyKey website.Review and sign

Once completed, review and sign your loan agreement.Get approved

If approved, you will receive your funds as early as the same business day.There’s no need to subject yourself to a lengthy, in-person experience as getting a loan through MoneyKey is hassle-free and convenient.

As an online lender and service provider, MoneyKey makes borrowing money fast and easy.

- Fast funding, as soon as the same business day

- No early repayment penalty fees

- Quick online process

How Financer.com Rates MoneyKey

MoneyKey is a leading online lender and service provider, having built its reputation over the years on outstanding customer service and transparency.

MoneyKey makes all of its charges clear during the borrowing process and does not add additional fees for late payments.

- You can contact MoneyKey’s Customer Care team to find out more about charges and the types of loans available in your state. Your state of residence may determine if you may apply for a line of credit or installment loan.

Responsible Lending

MoneyKey does not want to see you sink deeper into debt and therefore encourages responsible lending.

As with any loan, there are financial risks involved in taking out a loan or line of credit through MoneyKey. They should only be used when you’re temporarily short on cash, not as a long-term financial solution.

MoneyKey encourages you to read its loan terms and conditions carefully to ensure the loan is right for you.

It’s also important to ensure you:

- Read the privacy policy. MoneyKey safeguards your personal information and has a privacy policy in line with industry standards.

- Are able to repay the money according to your agreement.

- Are not taking out a loan to pay off another loan.

- Understand applicable fees/interest.

Support

We have had a good experience with MoneyKey’s customer support. They can be reached via their online chat feature, or on their toll-free helpline and they’re well trained and friendly when assisting their customers.

We opened up the live chat (during their posted hours) and got connected to a representative immediately who helped us with general questions.

MoneyKey’s email response times have been impressive with same-day communication.

Website

We love simplicity, both in functionality and design, and the MoneyKey site delivers on each of these fronts. It’s easy to understand their website, and the loan application was very smooth.

It took us less than 10 minutes to fill out the application from beginning to end. They do a particularly good job of making every step clear and straightforward.

Customers can use the MoneyKey login directly from their home page via email and password. The website is straightforward and easy to navigate.

Does Financer.com recommend MoneyKey?

Yes, we do. This is one of the most popular lenders we have reviewed.

Their site and application process are streamlined and simple and provide reliable customer support.

As with any installment loan or line of credit, make sure you understand the interest rates/fees so that you can ensure you can afford to repay.

FAQs

How much can I borrow with MoneyKey?

What are the rates?

Can I cancel my loan?

How can I qualify for a loan?

Can I verify my bank statements electronically?

MoneyKey Alternatives

Here’s a list of alternatives to MoneyKey and how they compare:

| Lender | Reviews | Loan Amount | APR | Max. Loan Term | Bad Credit? |

|---|---|---|---|---|---|

| 5KFunds | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

| PersonalLoans.com | View | $500 – $35,000 | 5.99-35.99% | Up to 6 years | Yes |

| BadCreditLoans | View | $500 – $5,000 | 5.99-35.99% | Up to 2 years | Yes |

| CashUSA.com | View | $500 – $10,000 | 5.99-35.99% | Up to 6 years | Yes |

| Fast5KLoans | View | $500 – $35,000 | 5.99-35.99% | Up to 5 years | Yes |

Should you take a loan with MoneyKey?

MoneyKey has been around for quite a while and has proven to be a trustworthy lending platform where borrowers can get personalized loans and credit lines.

One of the best reasons for applying for a loan with MoneyKey is that the application process is done online and money is available fast.

Their customer service is responsive and they have a good feedback rating from past customers.

Read more MoneyKey reviews from customers below or add your own.

More Money Personal Loan Reviews

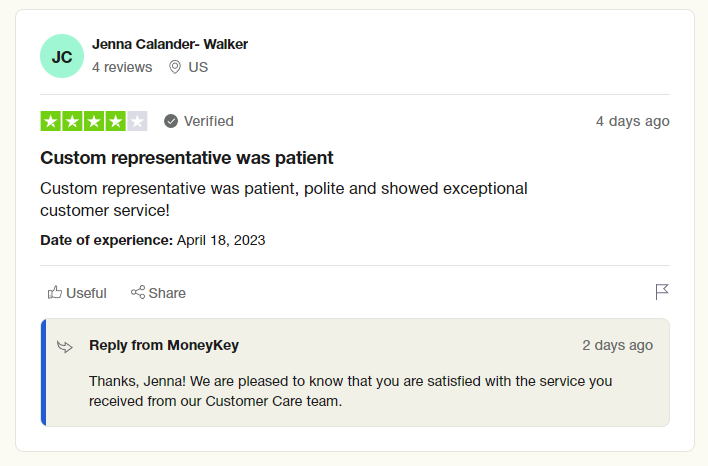

What Users On the Web Are Saying

MoneyKey gets 4.6 out of 5 stars on TrustPilot, with users showing mixed feelings:

MoneyKey is quick to reply to reviews and seems to take customer service seriously, which is a positive feature for borrowers.

More User Reviews – Add Your Rating

Read more reviews on Financer.com from verified users below.

Have you used MoneyKey before? Leave your review now.