As seen in

What is a Cryptocurrency?

A cryptocurrency is a digital asset that may be traded freely, independent of a bank or centralized authority.

There are currently more than 20,000 cryptocurrency projects active, which together make up the $1.07 trillion global cryptocurrency market.

From Ethereum and Bitcoin to Tether and Dogecoin, there are thousands of different cryptocurrencies, making it overwhelming for anyone getting into crypto for the first time.

To help you get started, we've listed the top cryptocurrencies based on the total value of coins in circulation or their market capitalization.

The Top 15 Cryptos by Market Cap

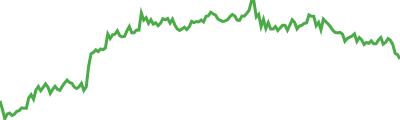

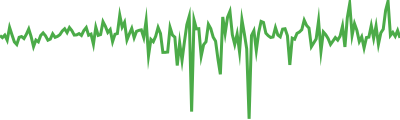

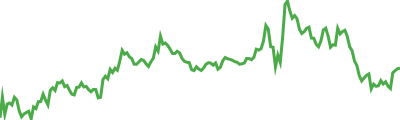

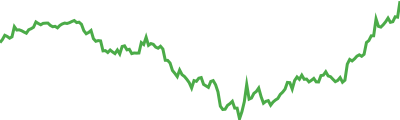

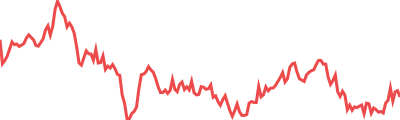

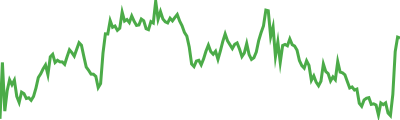

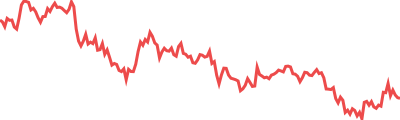

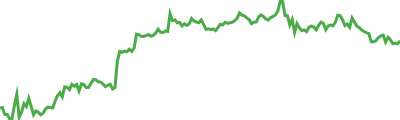

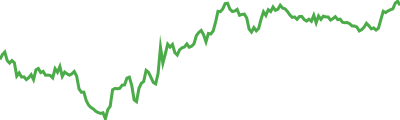

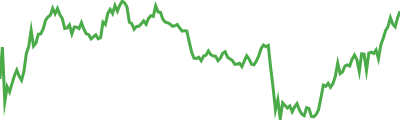

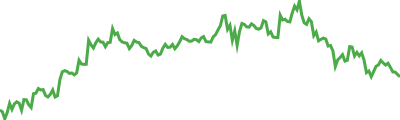

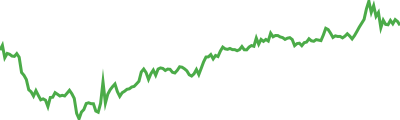

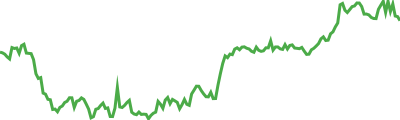

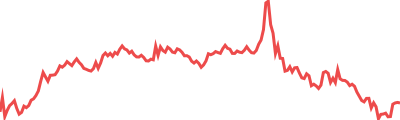

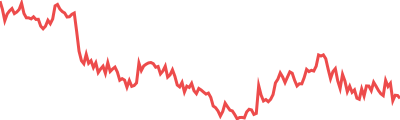

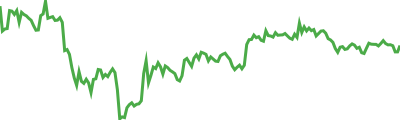

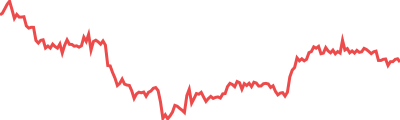

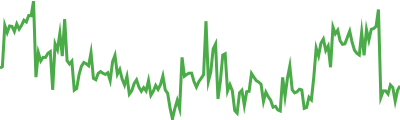

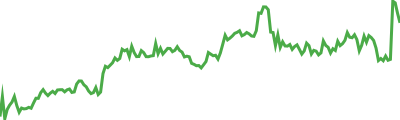

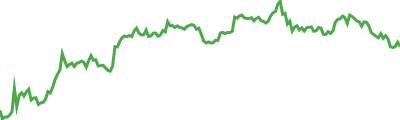

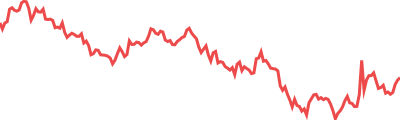

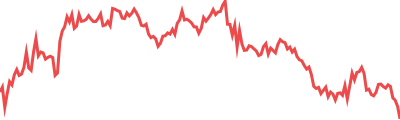

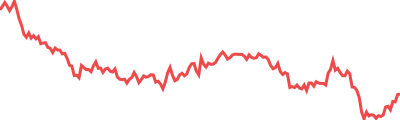

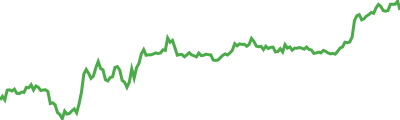

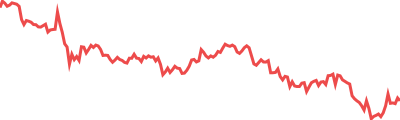

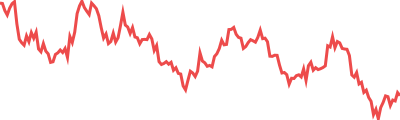

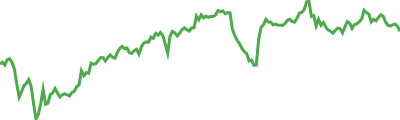

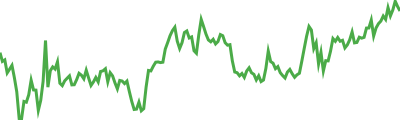

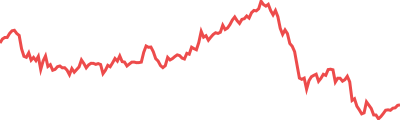

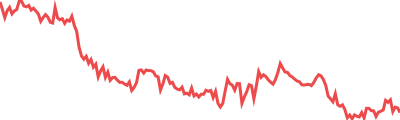

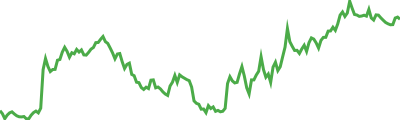

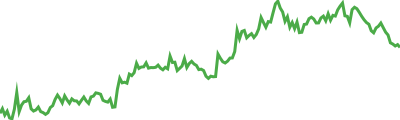

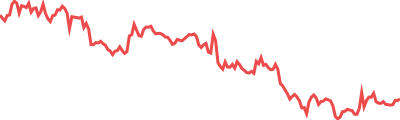

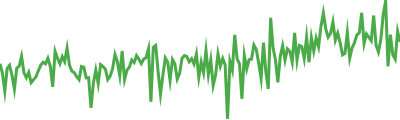

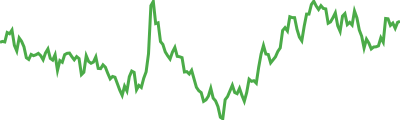

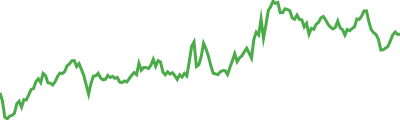

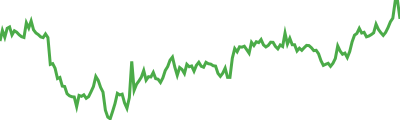

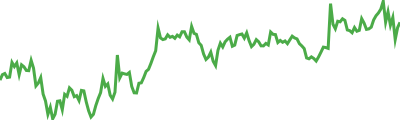

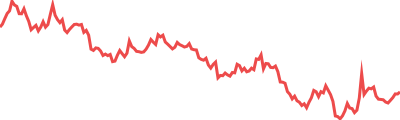

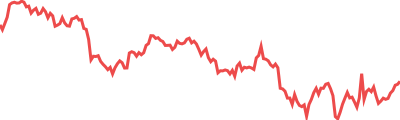

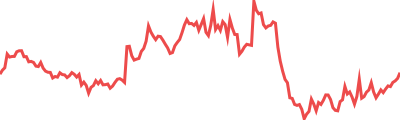

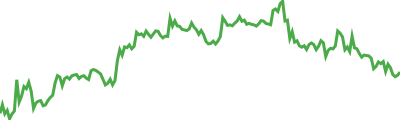

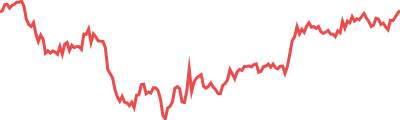

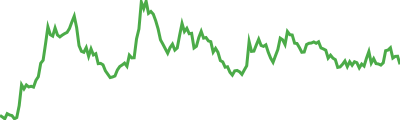

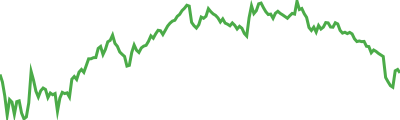

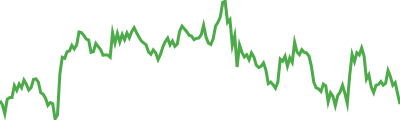

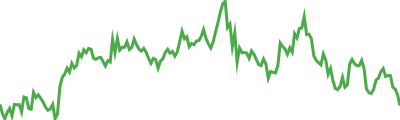

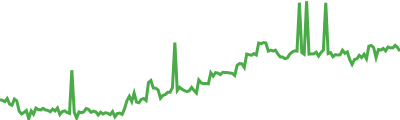

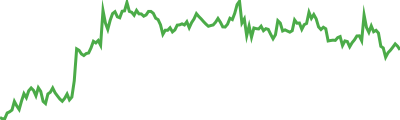

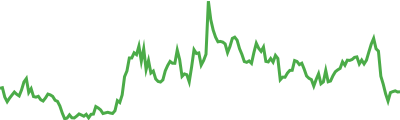

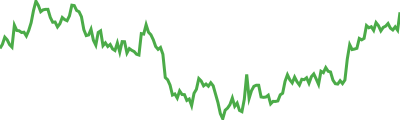

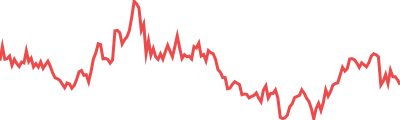

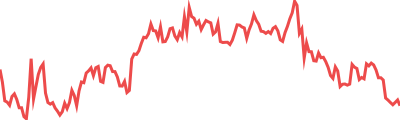

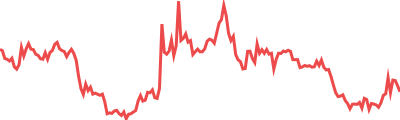

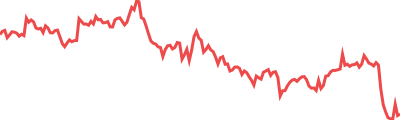

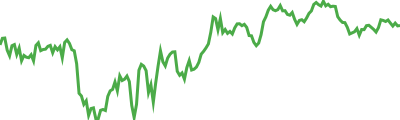

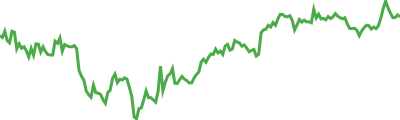

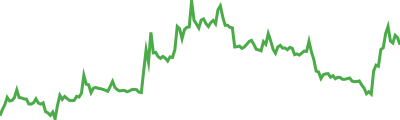

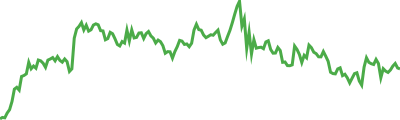

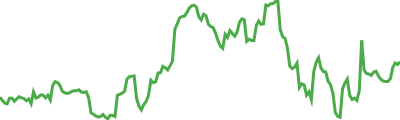

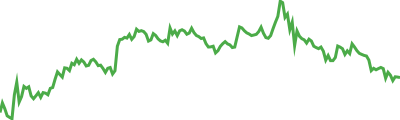

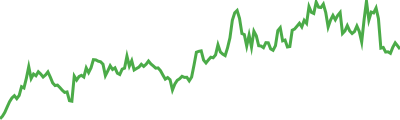

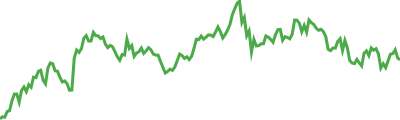

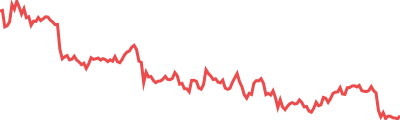

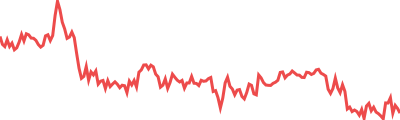

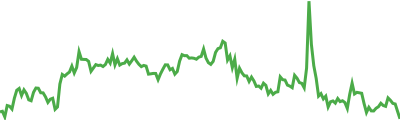

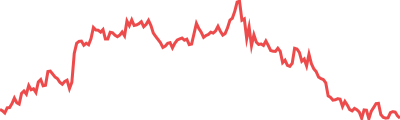

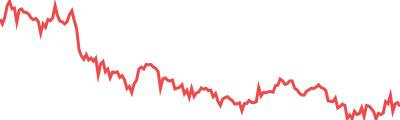

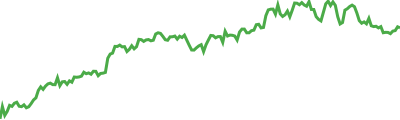

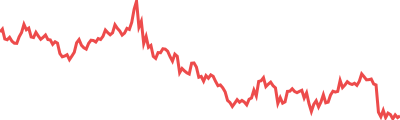

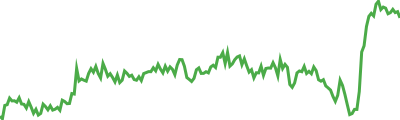

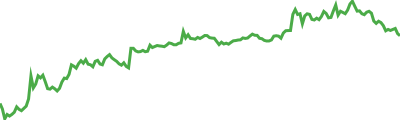

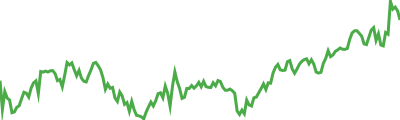

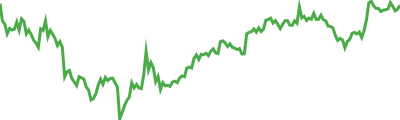

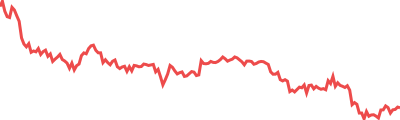

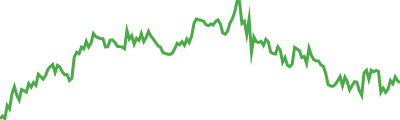

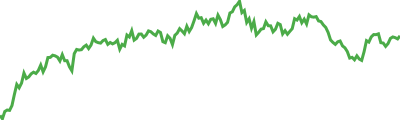

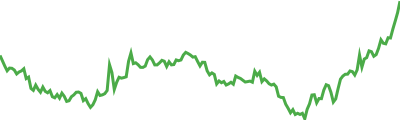

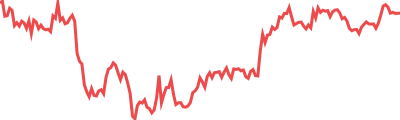

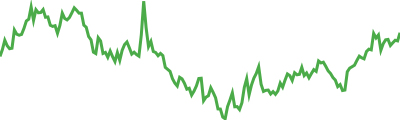

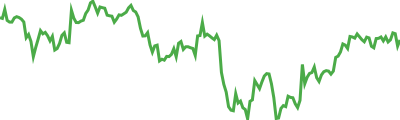

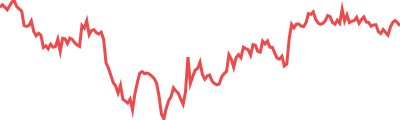

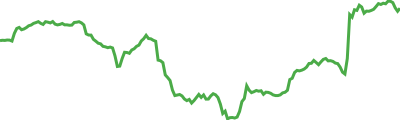

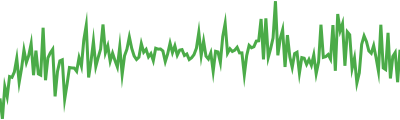

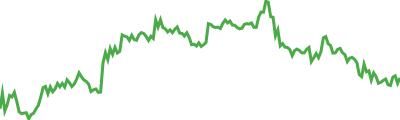

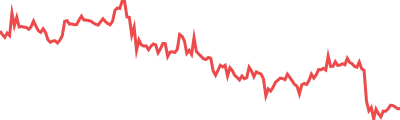

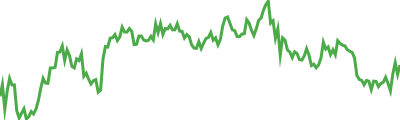

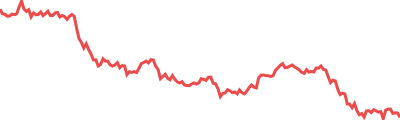

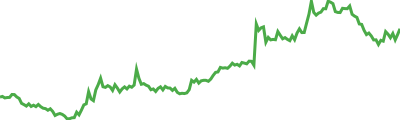

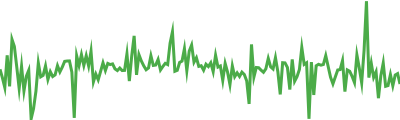

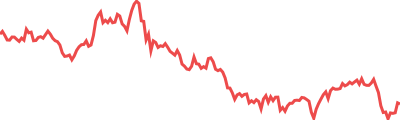

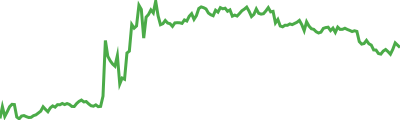

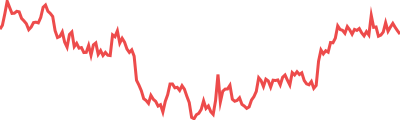

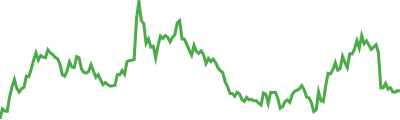

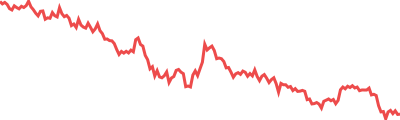

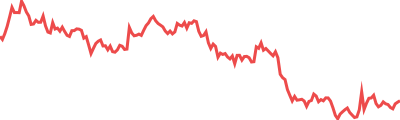

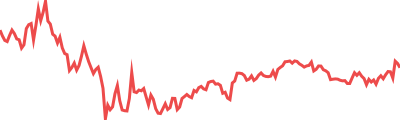

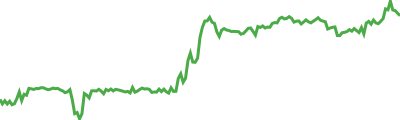

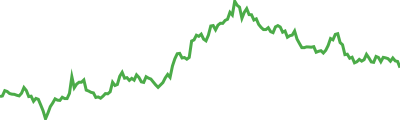

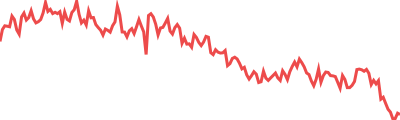

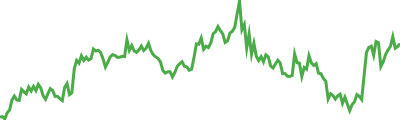

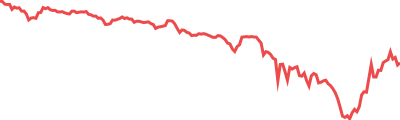

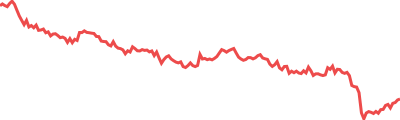

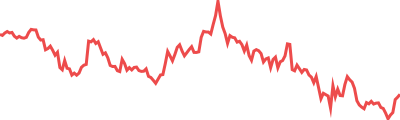

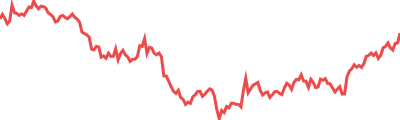

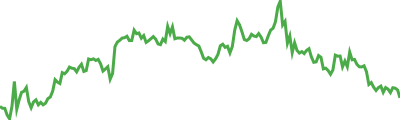

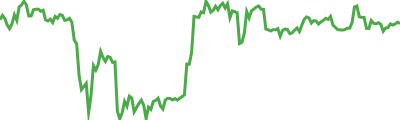

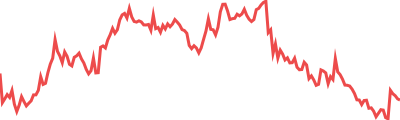

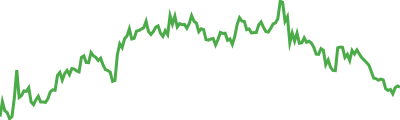

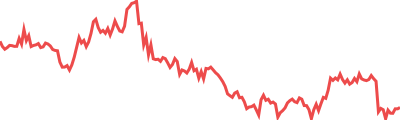

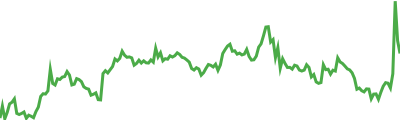

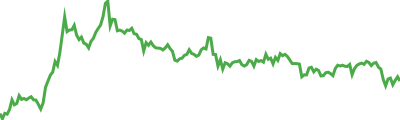

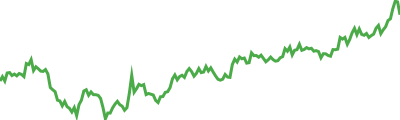

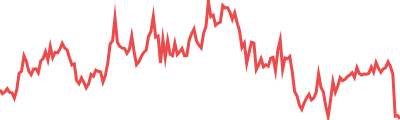

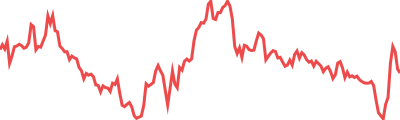

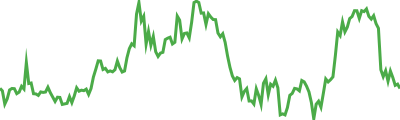

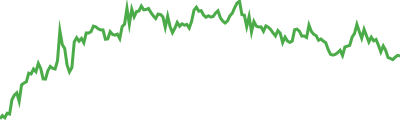

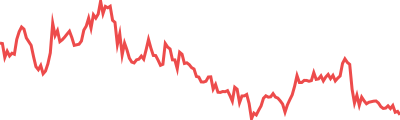

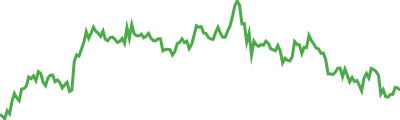

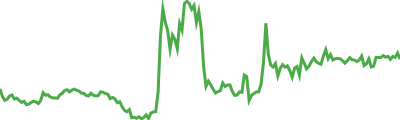

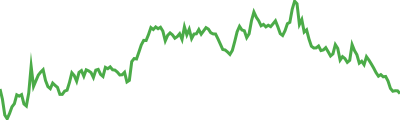

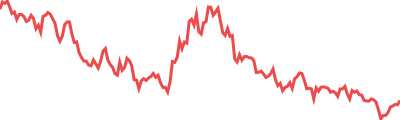

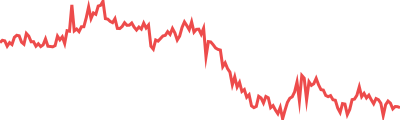

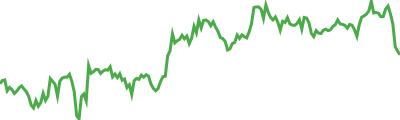

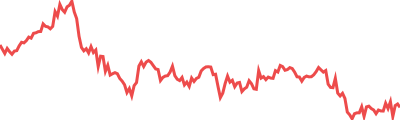

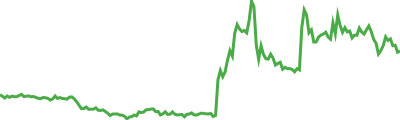

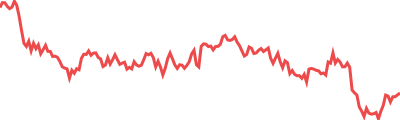

Here's how the top crypto currency prices have evolved during the last 10 years:

Top Crypto Exchanges for April 2024

- Invest in stocks, NFTs, crypto, ETFs, NFTs, and more

- Automated dividend reinvesting

- Earn stock & crypto

- Company-specific analysis

Important

Why Do Crypto Coin Prices Fluctuate?

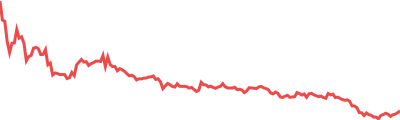

As mentioned above, cryptocurrency pricing fluctuates due to the change in supply and demand. Also, it can fluctuate because of the competition in the market and the crypto exchanges it trades on.

Keep in mind that cryptocurrencies are highly volatile and similar to the stock market, fluctuations in crypto market prices can happen because of market news and current developments, which typically affect the economy as a whole.

What Determines the Price of Crypto?

Like stocks, commodities, securities, and other trading assets, cryptocurrencies are a digital form of money. They simply live in a blockchain's coding and have no physical presence.

Cryptocurrency prices are influenced by two factors: supply and demand.

Supply refers to how many are available for purchase on the market. Demand refers to how much interest there is in purchasing them. The cost depends on how the two are related.

A coin's price will rise if there is a high demand for it but a small supply currently on the market.

Occasionally, demand for coins increases despite the currency's actual value; this is known as overbuying. Alternately, a coin is said to be oversold if a sizable amount of it is sold without a good reason.

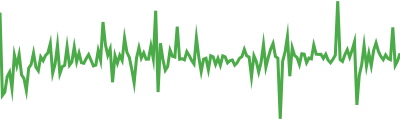

Other factors that can influence the price of crypto prices include the node count, rising demand, and mass adoption.

Node Count

The number of nodes is a reliable measure of a cryptocurrency's value.

Node count is a measurement of how many active wallets are present on the network and are searchable online or on a currency's home page.

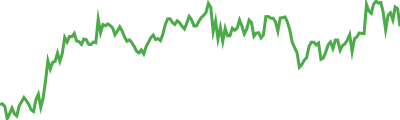

Rising Demand

Large online exchanges, like those on Financer.com's list of popular cryptocurrency exchanges, have made cryptocurrencies much more usable, which has led to a sharp increase in market cap over the past few years.

As a result of their growing acceptance and appeal among businesses, more and more governments and nations are attempting to figure out how to adopt them.

Mass Adoption

A currency's value may skyrocket if it becomes widely adopted. This is because the entire supply of the majority of cryptocurrencies is finite, and an increase in demand directly causes a rise in price.

But what other conditions must exist before the general public fully adopts cryptocurrencies? One is the extent to which cryptocurrencies may be used in everyday life, or the number of locations that accept them as a form of payment.

Key takeaways:

- Price is determined by the relationship between supply and demand.

- The total amount of most cryptocurrencies is limited by max supply.

- Overbought coins are typically expensive and in high demand.

- Oversold coins are typically underpriced and in high supply.

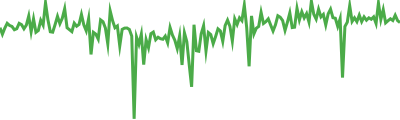

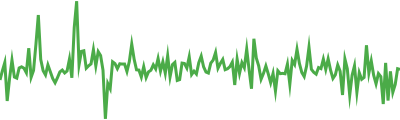

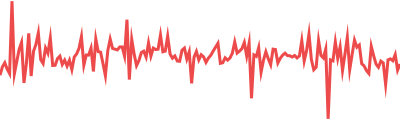

Crypto's High Volatility

The potential for high gains makes excessive volatility attractive to certain crypto investors.

And while appearing to be less volatile, Bitcoin frequently rises by double-digit percentages in a single week, making "buying the dip" methods possible.

There are methods for reducing the negative effects of volatility for investors who are less risk-tolerant, such as dollar-cost averaging.

Stablecoins, which include USD Coin and Dai, are cryptocurrencies that have been expressly created to have low volatility and have their price tied to a reserve asset like the U.S. dollar.

Why Compare Current Crypto Prices at Financer.com

View today's live cryptocurrency prices and buy crypto from top exchanges

The Different Types of Cryptocurrencies

Cryptocurrencies typically fall into two types: coins and tokens.

Bitcoin was the very first blockchain and the term 'altcoins' refer to all the cryptocurrencies that were developed after Bitcoin. Cardano and Litecoin are good examples of altcoins.

Tokens/dApps is the third major category of cryptocurrencies. Good examples include Civic (CVC), BitDegree (BDG), and WePower (WPR).

What Are Cypto Coins?

Cryptocurrency coins are strings of computer code that can represent a tangible, intangible, or digital object, idea, or project that is meant for a variety of purposes and has variable values. These coins were initially intended to serve as a form of money.

Contrary to conventional currencies like the dollar, euro, or yen, cryptocurrencies are not legal tender. You can trade any fiat for products and services. Fiat money is physical, is controlled by centralized authority, and it serves as a store of value. But cryptocurrencies, including the several coin types we've covered here, can be used for a variety of things than just exchanging money.

The use of cryptocurrency as "currency" barely scratches the surface of blockchain technology's potential. Some cryptocurrencies, which are based on blockchain technology, can provide solutions to persistent issues in practically every area of our economy.

What Are Tokens?

Similar to an initial public offering (IPO) for stocks, initial coin offerings (ICOs) are used to produce and distribute tokens. They consist of value tokens (like Bitcoin), security tokens (much like stocks), and utility tokens (meant for specific uses).

Like a fiat currency (think of USD), tokens represent value. But the token itself doesn't hold any value. Tokens differ from coins in that they are constructed within the blockchain of an existing coin, like Ethereum or Bitcoin.

Although they are both regarded as forms of cryptocurrency, coins and tokens serve different purposes. Coins were designed with currency in mind and are constructed on their own blockchain. Generally speaking, an altcoin is any blockchain-based cryptocurrency that is not Bitcoin.

What are Altcoins?

Altcoin refers to 'alternative coins', in other words, a group of cryptocurrencies other than Bitcoin.

There are currently more than 500 altcoins in existence and most are based on Bitcoin.

Some of the most well-known altcoins include Ethereum, Litecoin, Bitcoin Cash, and Tether.

Certain altcoins serve a larger purpose than simply exchanging the coin for something of value.

These altcoins can be classified as utility tokens or security tokens, for example.

Top Altcoins for April 2024

| Crypto | Ticker | Price | Market Cap ($B) |

|---|---|---|---|

| Dai | DAI | $1.00 | $6.9 |

| Tron | TRX | $0.068 | $6.3 |

| Shiba Inu | SHIB | $.0000113 | $6.03 |

| Avalanche | AVAX | $19.89 | $5.6 |

| Wrapped Bitcoin | WBTC | $21,443.32 | $5.5 |

Buy Cryptocurrencies Online

See live crypto prices updated in real-time and buy crypto from top crypto exchanges.

What is the Top Cryptocurrency to Buy?

Buying crypto depends on your own preferences and investment goals, but Bitcoin remains one of the most popular cryptocurrencies in the U.S.

Since Bitcoin is the first cryptocurrency and by far the largest cryptocurrency by market value, it is definitely a good idea for any cryptocurrency investor to have some exposure to it.

There can only ever be 21 million Bitcoins, earning Bitcoin the title of "digital gold." It also has appeal because it is unrelated to a central bank or government that has the power to produce money whenever it wants.

What Customers Say About Us

4.60 based on 324 reviews

from Reviews.io

Compare Top Cryptos with Financer.com

At Financer.com we update our crypto pricing in real-time so you can see the top cryptocurrencies and live crypto prices every day.

We also list the best crypto exchanges where you can buy crypto online. Comparing financial products, lenders, and exchanges with Financer.com is completely free and we are constantly updating our comparisons to help you make better financial decisions.