The Best Tribal Loans

Our top pick for Tribal Loans in the US is Low Credit Finance, particularly for its high approval rates even for those with bad credit. They offer a wide range of loan amounts, catering to various financial needs, and feature flexible repayment options.

The platform stands out for its user-friendly interface, ensuring a hassle-free application experience. Additionally, its rapid approval process makes it a reliable choice for those who need cash quick, and ideal for borrowers seeking solutions despite poor credit.

| Company | Best For |

|---|---|

| Low Credit Finance | All loan sizes and flexible repayment options |

| Wizzay.com | Rapid processing and privacy |

| Credit Clock | Loans for poor credit with fast applications |

| LoanInPersonal | Long repayment terms and all credit types |

| BadCreditLoans | Comprehensive services, including debt relief |

| Viva Payday Loans | Short-term payday loans in all states |

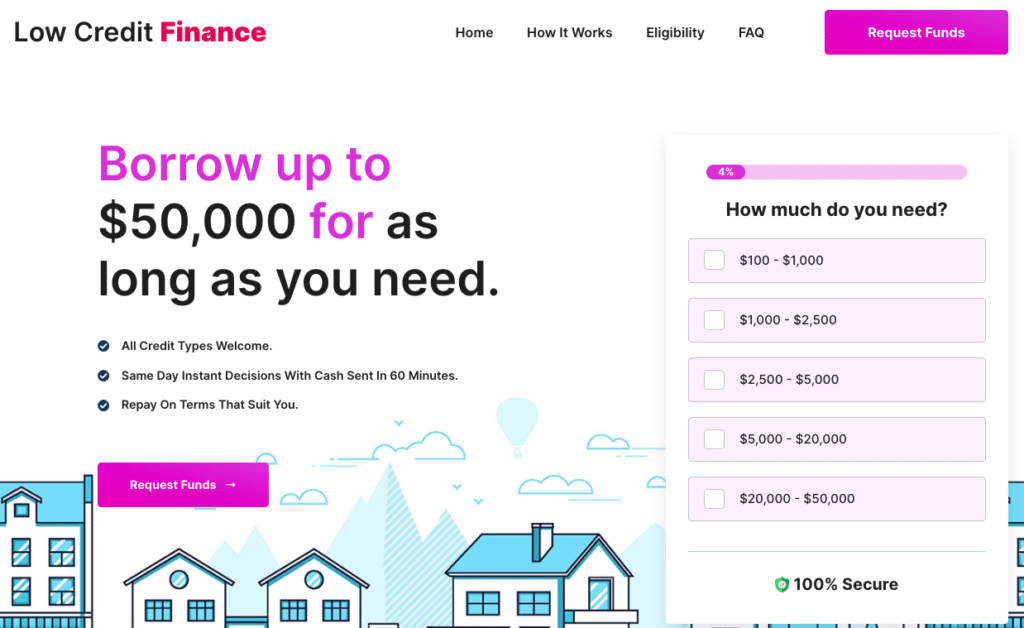

Low Credit Finance

Company Overview

Low Credit Finance emerges as a notable choice for those seeking the best tribal loans, catering to those with both good and bad credit. They offer loan amounts up to $50,000 with a simple online application process.

Their service connects applicants to a network of lenders and alternative loan options, providing almost instant online lending decisions.

Notably, Low Credit Finance is not a lender itself and does not charge fees for their service. The loans available through their network have APRs ranging from 5.99% to 35.99%, with repayment periods starting from 61 days. The service is not available in certain U.S. states.

Features:

- Offers personal loans up to $50,000.

- Caters to both good and bad credit profiles.

- Quick online application process.

- Connects with a network of lenders.

- APRs range from 5.99% to 35.99%.

- Repayment terms start from 61 days.

- Service is not available in Arkansas, Connecticut, New Hampshire, New York, Montana, South Dakota, Vermont, West Virginia, Indiana, and Minnesota.

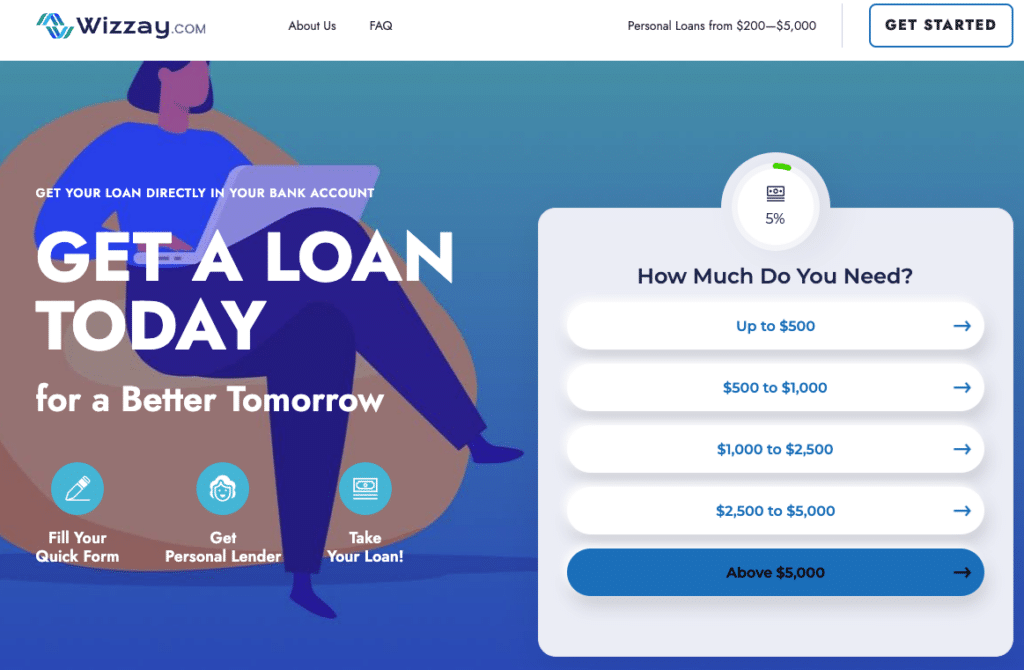

Wizzay.com

Company Overview

Wizzay.com is an excellent solution for individuals with poor credit seeking tribal loans. Known for its rapid service, Wizzay offers personal loans ranging from $200 to $5,000, often disbursed as swiftly as within 24 hours. This makes it an ideal choice for urgent financial needs.

Wizzay’s online platform is user-friendly and secure, ensuring privacy and ease during the application process. While Wizzay isn’t a direct lender, it connects users with a diverse network of lenders, accommodating various financial situations.

The loans’ terms, including interest rates, are determined by these lenders. Wizzay operates under state regulations, ensuring legal compliance in its services.

Features:

- Provides personal loans from $200 to $5,000.

- Offers fast processing, potentially within 24 hours.

- Simple online application form.

- Emphasizes privacy and security of personal information.

- Acts as a connector to a network of lenders.

- Loan terms, including APRs, are set by lenders.

- Availability subject to state regulations and legal restrictions.

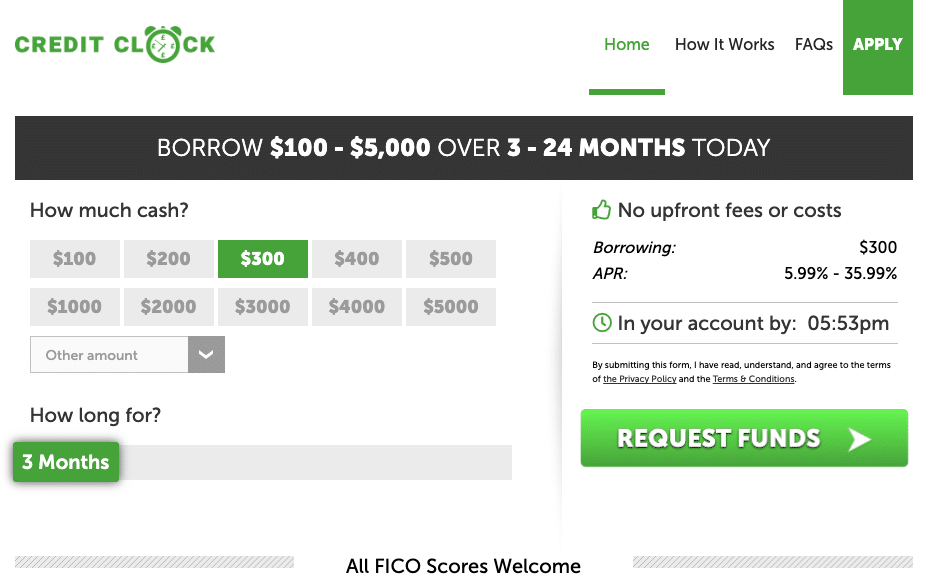

Credit Clock

Company Overview

Credit Clock offers tribal loans ranging from $100 to $5,000, with repayment periods of 3 to 24 months. They cater to individuals with poor credit scores, focusing on a quick and automated application process.

Credit checks are not the sole factor in loan approval, allowing for a broader range of applicants.

Applicants must be at least 18 years old, hold a valid ID, have a steady income of $1,000 per month, and provide proof of income for eligibility.

Features:

- Specializes in loans for poor credit.

- Offers $100 to $5,000 loans.

- 3-24 month repayment terms.

- Fast, automated application.

- Minimum $1,000 monthly income required.

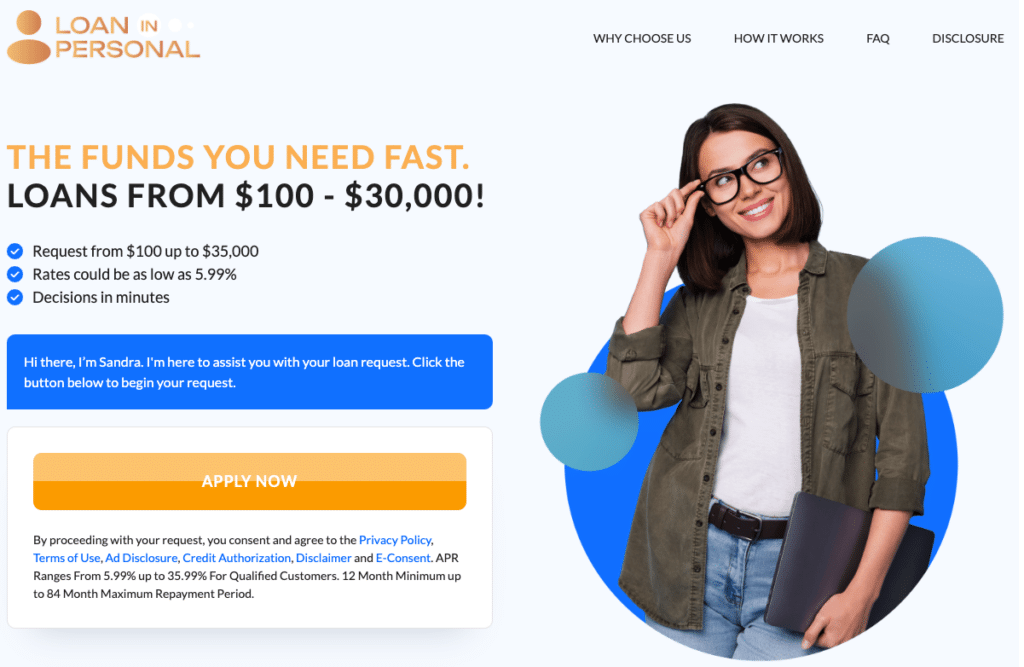

Loan In Personal

Company Overview

LoanInPersonal offers personal loans up to $35,000, notable for its rapid processing and secure, user-friendly application. They accommodate all credit types, enhancing loan accessibility.

A key feature is their flexible repayment terms, ranging from a minimum of 12 months up to a maximum of 84 months. This extended period allows borrowers more time to manage repayments comfortably, making it a suitable option for those needing longer to repay their loans.

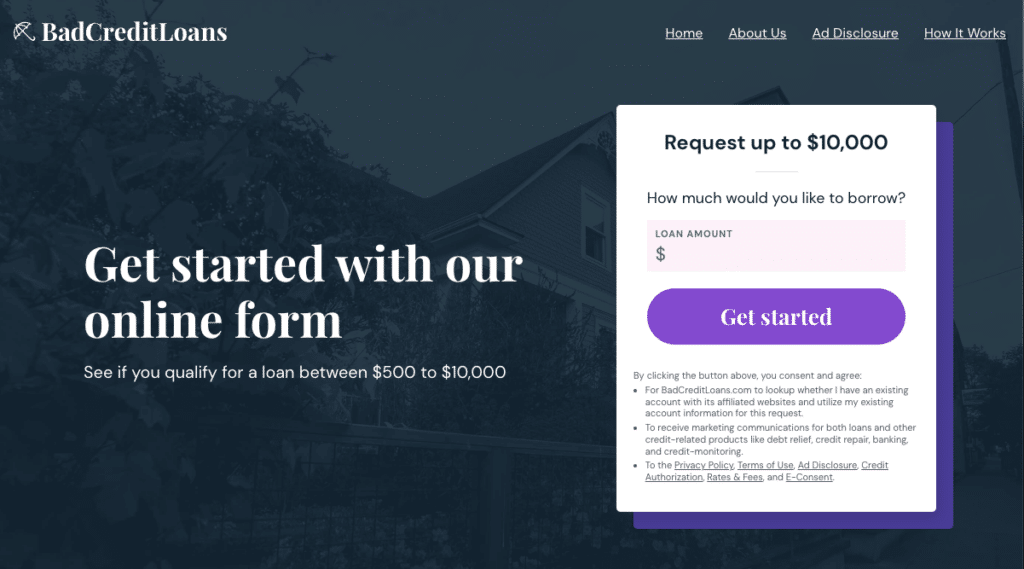

BadCreditLoans

Company Overview

BadCreditLoans.com specializes in providing loan options for those with poor credit, offering loans ranging from $500 to $10,000.

Unique for its comprehensive approach, the platform not only connects borrowers with potential lenders but also provides options for related credit services such as debt relief and credit repair.

They emphasize security and privacy, using advanced encryption technology to protect customer information, and are available 24/7 to assist customers.

Features:

- BadCreditLoans.com offers loans between $500 and $10,000 for individuals with poor credit.

- They provide a 100% free service, connecting borrowers with a network of lenders.

- Features advanced encryption technology for data security and operates 24/7.

- Loans have APRs ranging from 5.99% to 35.99%, with terms up to 72 months.

- They also offer related credit services like debt relief and credit repair.

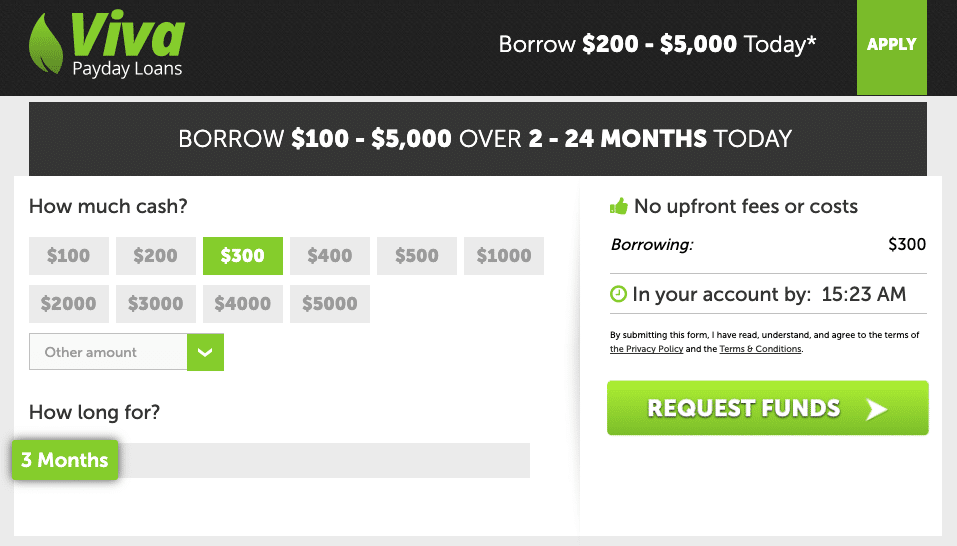

Viva Payday Loans

Company Overview

Viva Payday Loans is notable for offering payday loans available in all states, with amounts ranging from $100 to $5,000.

They feature the shortest repayment periods in the market, spanning from 2 to 24 months, catering specifically to urgent financial needs.

This service is especially convenient for those with bad credit, providing quick, online applications and fast decisions. Their widespread availability and focus on short-term lending make them a versatile option for immediate cash requirements.

Features:

- Offers payday loans from $100 to $5,000.

- APRs range between 5.99% and 35.99%.

- Repayment periods of 2 to 24 months.

- Quick online application with fast decisions.

- Accessible to various credit scores.

- Focuses on quick fund disbursement.

What are Tribal Loans?

Tribal loans are a type of financial assistance that falls under the category of personal loans. These are financial products offered by lenders owned by Native American tribes and operated within the jurisdiction of tribal lands.

These lending entities claim sovereignty under their respective tribal governments and are bound not by state regulations, but by federal and tribal laws.

This distinction has significant implications for borrowers, lenders, and the regulatory framework governing these financial instruments.

Sovereignty and Legal Framework

The concept of tribal sovereignty means that tribal nations have the authority to govern themselves within the borders of the United States.

As such, tribal lenders operate under their own legal systems and are not subject to state laws regarding interest rates, loan terms, and other regulatory aspects typically overseen by state financial regulators.

This sovereignty allows them to offer tribal installment loans that might not be permissible under the laws of the borrower’s state of residence.

Who are Tribal Loans Best For?

- Individuals with Bad Credit Scores: Those who have difficulty qualifying for traditional conventional loans due to credit issues may find tribal loans more accessible.

- Emergency Cash Seekers: People in need of quick disbursement of funds who cannot afford the wait associated with traditional lenders might turn to tribal loans for their speed.

- Residents in Restrictive States: If you live in a state with strict lending regulations, tribal loans might be one of the few avenues to obtain quick cash legally.

- Inhabitants of Remote Locations: For individuals far from traditional financial institutions, the online application process of tribal loans is convenient.

Pros and Cons of Tribal Loans

Tribal loans can fill a gap when money is tight and you need a loan quickly, especially if your credit isn’t great. But they come with steep costs and less safety nets, so weigh these factors carefully before applying.

Pros:

- High Approval Rate: They are often more accessible for people with poor credit scores or no credit history.

- Quick Transfer of Funds: Processing times are fast, providing emergency funds swiftly.

- Online Application: One can apply from any location, bypassing the need to visit a bank.

Requirements for Tribal Loans

To obtain a tribal loan, you don’t need to be a Native American.

Lenders in the network of lenders each set their loan eligibility criteria, typically requiring proof of age, employment, and a source of income, alongside a valid bank account.

The online application requires submission of personal and financial details, and the approval process considers all information provided.

While tribal loans have a generally high approval rate, approval is not guaranteed. If approved, the loan agreement will detail the terms, including flexible loan amounts and repayment terms.

Are Tribal Loans Safe?

Tribal loans are different from regular loans because they’re run by Native American tribes and not all the usual loan rules apply to them. Here’s what you need to know:

- They Can Cost More: Tribal loans often have higher fees and interest rates than regular loans, which can make it hard to pay them back.

- Tough to Argue: If there’s a problem with your loan, it might be harder to fix because tribal loans don’t follow the same rules as other loans.

- Read The Loan Agreement: Make sure the tribal lender tells you all about the loan costs and that they follow federal laws that protect you.

- Keep Your Info Safe: When you apply through an online lender, make sure the lender’s website is secure so your personal details don’t get stolen.

- Choose Carefully: Not all tribal lenders are the same. Pick one that’s official and follows the law.

Types of Online Tribal Loans

Tribal Loans Direct Lenders

Most services marketed as ‘tribal loans direct lenders’ are in reality indirect lenders. They serve as intermediaries between the borrower and the actual funding source, which can lead to misunderstandings about loan terms.

Easiest Tribal Loan to Get

The term ‘easiest tribal loan to get’ is subjective and misleading. Approval for any loan depends on various individual factors, including credit history and financial stability, making it impossible to universally determine which loan is the easiest to obtain.

Tribal Payday Loans

‘Tribal payday loans’ often incorrectly describe what are actually installment loans. True payday loans are designed to be repaid by the next paycheck, typically within 30 days, which is not the structure of most tribal loans.

Tribal Installment Loans

This term accurately describes most tribal loans. Unlike payday loans, tribal installment loans are repaid over a set period with scheduled payments, offering a more structured and potentially manageable repayment plan.

Guaranteed Tribal Loans

‘Guaranteed tribal loans’ is a marketing term without basis in reality. No lender can guarantee loan approval without first evaluating the borrower’s application against specific eligibility criteria.

Tribal Loans Online

While many tribal loans are accessible online, providing convenience and fast access, it’s essential for borrowers to do due diligence on the lender’s credibility and fully understand the loan agreement terms.

Tribal Loans Online Guaranteed Approval

Similar to ‘guaranteed tribal loans’, ‘tribal loans online guaranteed approval’ is a misleading marketing phrase. All loan approvals are contingent on various factors, including the applicant’s creditworthiness and the lender’s criteria.

Easy Tribal Loans for Bad Credit

Targeted towards individuals with bad credit, these loans imply easier approval for those who might struggle to secure traditional loans. However, ‘easy’ approval is not a given, and all applications are subject to the lender’s review process.

What Are Tribal Loans Direct Lenders?

How to Determine the Easiest Tribal Loan to Get?

Identifying the easiest tribal loan to get depends on individual circumstances. Various factors, including credit history and income, play a role in loan approval.

Are Tribal Payday Loans Different from Regular Payday Loans?

Yes, tribal payday loans often refer to short-term installment loans offered by tribal lenders, which are different from conventional payday loans that are typically due by the next paycheck.

Can I Find Guaranteed Tribal Loans?

While the term ‘guaranteed tribal loans’ is used in advertising, in reality, all loan applications undergo a review process, and no loan is guaranteed without considering the borrower’s eligibility.

Is There Such a Thing as Tribal Loans Online Guaranteed Approval?

No, ‘tribal loans online guaranteed approval’ is a marketing phrase. Loan approval always depends on various eligibility criteria set by the lender.