Litecoin Price Data

The live Litecoin price today is $74.3800 with a 24-hour trading volume of $270,701,966.

We update our LTC to USD price in real-time. The price of Litecoin has changed -1.11% in the last 24 hours.

Currently, Litecoin is the #21 largest cryptocurrency by market cap, with a live market cap of $5,557,618,232.00. It has a circulating supply of 74,703,583 LTC coins and a maximum supply of 84,000,000 coins.

See where to buy Litecoin or use our Litecoin Profit Calculator to calculate and track the performance of your investment.

Litecoin at a glance

In the words of Litecoin’s founder, Litecoin is a “light version” of Bitcoin and a coin that is silver to Bitcoin’s gold. Litecoin offers fast and low-cost transactions and serves as a valuable store of value and medium of exchange.

What determines the price of Litecoin?

The price of Litecoin is primarily influenced by supply and demand dynamics. Specific determinants of Litecoin’s price include trading volume, market sentiment, adoption by businesses, and macroeconomic events can impact its price. Learn more here.

What is Litecoin?

Litecoin is an alternative coin created in 2011 by Google engineer Charlie Lee. It was one of the first altcoins. Lee’s goal was to create a better version of Bitcoin.

Alternative coins or “altcoins” for short are cryptocurrencies other than Bitcoin

Litecoin allows for fast and low-cost transactions when compared to traditional banking systems.

Think of Litecoin as a “light” version of Bitcoin designed to be faster, cheaper, and more scalable.

While Bitcoin is often seen as digital gold, Litecoin is often referred to as digital silver.

Litecoin is based on the Scrypt hash algorithm, allowing it to process transactions faster than Bitcoin. While new blocks are created in the Bitcoin blockchain approximately every 10 minutes, new blocks are created in the Litecoin blockchain every 2.5 minutes.

In addition to speed, more people can join the Litecoin network mining process compared to Bitcoin.

Charlie Lee’s goal was to make sure that mining power was better distributed among many people, rather than being concentrated in the hands of a few big players who could afford expensive equipment for efficient mining.

What Determines the Price of Litecoin (LTC)?

The price of Litecoin is primarily determined by demand and supply dynamics in the crypto market.

In recent times, an increasing number of service providers have embraced Litecoin as a form of payment. This trend has contributed to the growing value of LTC. As the adoption of Litecoin continues to rise, the demand for LTC also increases, consequently pushing its price higher.

Similar to Bitcoin, the rewards for miners are divided following the validation of a block. Over time, Litecoin becomes progressively scarcer, leading to the potential for LTC’s price appreciating in the long run.

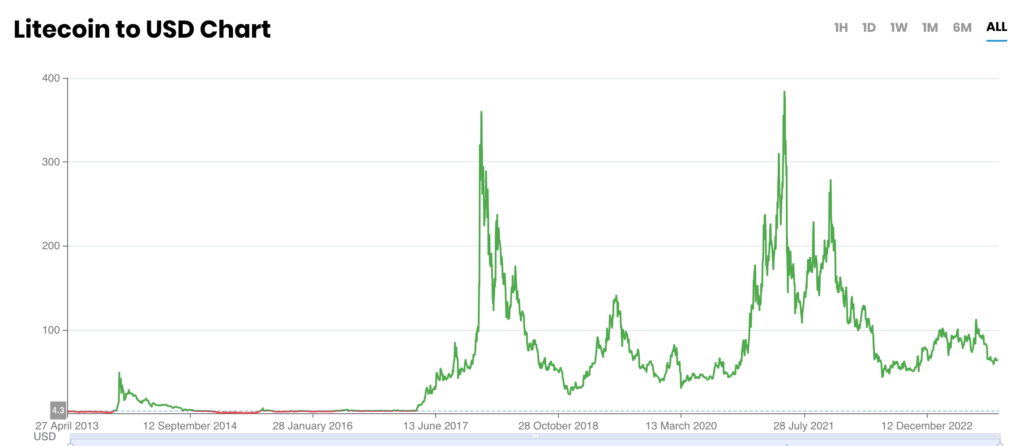

Litecoin Price History

Litecoin’s price history has been marked by significant volatility, much like other cryptocurrencies. It experienced rapid growth in its early years, with notable price spikes in 2013 and 2017. However, it’s important to note that cryptocurrency markets are highly speculative, and past performance may not necessarily predict future price movements.

When Litecoin was created in 2011, its price stood at a mere $0.30. After a few years, it briefly surged to nearly $30 in value, only to gradually recede, fluctuating between $2 and $4 until 2017.

The year 2017 marked a turning point for Litecoin. Its price began a steady ascent, eventually skyrocketing to over $300. Simultaneously, Litecoin gained listing on Coinbase – a significant catalyst that led to a spike in the price of LTC.

While the Litecoin network forged various collaborations, its price remained subject to volatility until 2020. The broader cryptocurrency market rally in that year also contributed to Litecoin’s price increase.

Currently, the price of Litecoin is a fraction of its all-time high price, mirroring the downturn in the overall crypto market. Nevertheless, analysts are optimistic about its future prospects.

How Litecoin Works

Litecoin operates on a blockchain, which is a decentralized and distributed ledger technology. Transactions on the Litecoin network are verified by a decentralized network of miners using a consensus mechanism known as proof-of-work (PoW).

This process involves solving complex mathematical puzzles to secure the network and validate transactions. Litecoin’s block generation time is approximately 2.5 minutes, allowing for faster confirmations compared to Bitcoin’s 10-minute block time.

Litecoin stands out not only for its pioneering use of the Lightning Network but also for its unique hashing algorithm. Unlike Bitcoin’s SHA-256 algorithm, Litecoin employs Scrypt as its hashing algorithm.

This distinctive hashing algorithm has been a key factor in Litecoin’s ability to maintain network security and differentiate itself from other cryptocurrencies.

What is Litecoin Used For?

Litecoin serves as both a digital store of value and a medium of exchange. While it shares similarities with Bitcoin, its faster transaction times and lower fees make it a more practical choice for everyday transactions.

Litecoin is used for various purposes, including online purchases, remittances, and as an investment.

More specifically, Litecoin can be used for the following purposes:

- Buy products and services – Hundreds of service providers accept Litecoin as a payment method, including Twitch.

- Buy Gift Cards – Amazon, Uber, Xbox, Google Play, and Sony PlayStation all accept Litecoins to buy gift cards.

- Send Litecoins to others – You can also send Litecoins to friends or family, or pay for a service (to merchants that accept Litecoin).

- Earn money from investment income – One of the common ways to use Litecoin is for investing and trading. Crypto exchanges allow users to trade Litecoin and other cryptocurrencies and profit from price swings.

Who Are the Founders of Litecoin?

Litecoin was created by Charlie Lee, a former Google engineer and Coinbase employee.

His vision was to create a “lite” version of Bitcoin, with faster transaction times and lower fees, to facilitate its everyday use.

Charlie Lee’s prior involvement in the crypto space was instrumental to Litecoin’s development and adoption.

What Makes Litecoin Unique?

What sets Litecoin apart from other cryptocurrencies is its focus on faster transaction confirmations and lower fees.

Unique features of Litecoin’s architecture and ecosystem include:

- Its technology, based on the Scrypt hashing algorithm, differentiates it from Bitcoin’s SHA-256.

- In the Litecoin network, new blocks are created every 2.5 minutes (4x faster than Bitcoin).

- The maximum limit for Litecoins is higher (84 million).

- Litecoin has maintained a strong community and development team, ensuring ongoing updates and improvements to the network.

How is Litecoin Secured?

Litecoin’s security is maintained through the decentralized network of miners who validate transactions and secure the blockchain.

Its PoW algorithm, Scrypt, is designed to be ASIC-resistant, which means it’s less susceptible to centralization by large mining pools.

The combination of decentralized mining and robust network security measures helps protect Litecoin from attacks.

Good

Good  Bad

Bad