XRP Price Data

The live XRP price today is $0.47923900 with a 24-hour trading volume of $741,330,489.

We update our XRP to USD price in real-time. The price of XRP has changed 1.98% in the last 24 hours.

Currently, XRP is the #8 largest cryptocurrency by market cap, with a live market cap of $26,665,778,306.00. It has a circulating supply of 55,688,327,582 XRP coins and a maximum supply of 100,000,000,000 coins.

See where to buy XRP or use our XRP Profit Calculator to calculate and track the performance of your investment.

Ripple at a glance

Ripple is an open-source payment protocol first conceptualized in 2004. It aims to revolutionize cross-border transactions and serve as a bridge between currencies. Due to the nature and popularity of the project, the Ripple cryptocurrency, XRP, has earned the moniker ‘the cryptocurrency of banks’.

What is Ripple?

Ripple is an open-source payment protocol that was initially designed in 2004. At the heart of the Ripple ecosystem is XRP, a digital cryptocurrency closely associated with the protocol.

Due to its extensive adoption by financial institutions, XRP has earned the moniker “the cryptocurrency of banks.”

An open-source protocol is a system where every transaction is transparently visible to all participants, and any developer can contribute to the underlying code. The open-source nature of the Ripple protocol means that even in the event of Ripple Labs closure, the network would persevere and remain operational.

The Ripple Cryptocurrency, XRP, fulfills a specific role as a digital asset designed to streamline transactions between disparate currencies.

It operates as an intermediary, facilitating swifter transfers by acting as a bridge between two distinct currencies.

To illustrate:

To illustrate, consider a scenario where a bank intends to transfer Euros to Japan. In this case, the bank would first convert the Euros to XRP and then further convert the XRP to Japanese Yen (JPN). This two-step process is made possible through XRP’s bridging capability.

XRP’s inherent functionality as a bridge currency contributes to expediting cross-border transactions, reducing costs, and enhancing the efficiency of international money transfers within the Ripple ecosystem.

The Ripple technology is a valuable addition to the existing banking payment systems. Its primary role is facilitating the seamless exchange of currencies during international banking transactions.

A snapshot of Ripple

- Ripple is an open-source payment protocol initially conceptualized in 2004. At the heart of the protocol is XRP, its native cryptocurrency.

- XRP is dubbed “the cryptocurrency of banks” due to its adoption by financial institutions.

- Ripple enhances existing banking payment systems by facilitating seamless currency exchange in international transactions conducted by banks.

- The protocol addresses challenges in cross-border transactions, offering an efficient solution.

- Ripple’s open-source nature ensures transparency, allowing any developer to contribute to the code.

- XRP, the Ripple cryptocurrency, is among the top 10 cryptocurrencies by market capitalization.

- XRP’s bridging capability expedites cross-border transactions, reducing costs, and enhancing efficiency.

What Determines Ripple Price?

The price of Ripple (XRP) is influenced by a combination of factors:

- Market Demand and Supply: Like any other tradable asset, XRP’s price is influenced by the joint forces of supply and demand. Increased demand for Ripple, driven by factors such as adoption by financial institutions or positive market sentiment, can lead to price appreciation.

- Utility and Adoption: The extent to which Ripple is utilized for its intended purpose – facilitating cross-border transactions and bridging currencies – plays a role in its price. Higher adoption by banks and financial entities can drive demand for XRP and potentially impact its value.

- Market Sentiment: Cryptocurrency markets are sensitive to investor sentiment and news. Positive news, partnerships, regulatory developments, and technological advancements can instill confidence in the market, potentially leading to upward price movements.

- Overall Cryptocurrency Market Trends: XRP’s price is influenced by broader trends in the cryptocurrency market. If major cryptocurrencies experience price surges or declines, it can indirectly affect XRP’s price due to market interconnectedness.

- Regulatory Environment: Regulatory developments and legal challenges can impact the price of XRP. Clarity or uncertainty surrounding XRP’s classification and legal status can influence investor confidence and market behavior.

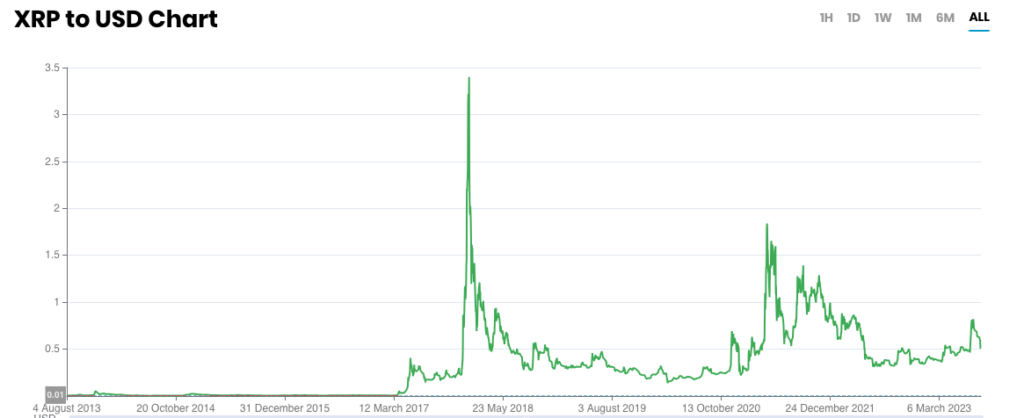

Ripple Price History

Ripple’s price history is marked by significant milestones and notable fluctuations, showcasing the volatility and evolution of the cryptocurrency:

- 2013-2017: Ripple’s price remained relatively modest during this period. However, it gained attention due to partnerships with major financial institutions. By mid-2017, XRP experienced a significant price surge alongside the broader cryptocurrency market.

- 2017-2018: In late 2017, Ripple’s price experienced an unprecedented rally, reaching an all-time high of over $3.50 in early 2018. This surge was attributed to increased interest in cryptocurrencies and the broader market sentiment at the time.

- 2018-2020: Following the peak in 2018, Ripple’s price underwent a significant correction, mirroring the broader market downturn.

- 2020-2021: Ripple’s price saw various fluctuations, responding to both positive news (such as partnerships) and negative news (such as legal challenges).

- 2021-2023: The ongoing legal proceedings and regulatory developments have influenced price movements, impacting investor sentiment. On July 13 2023, XRP experienced a significant spike when the court ruled in favor of Ripple Labs.

How Ripple works

At its core, Ripple aims to revolutionize the traditional landscape of cross-border transactions. Ripple’s architecture hinges on efficient consensus mechanisms, strategic transaction routing, and real-time settlement capabilities.

Here are key aspects of Ripple’s architecture:

- How Ripple Transactions Are Validated: Transactions conducted on the Ripple network undergo validation through a consensus mechanism known as the Ripple Protocol Consensus Algorithm (RPCA).

Before a trade is approved, consensus must be reached among all validators. This consensus process involves verifying the accuracy of transaction information. - Validation of Ripple Transactions: Validation of Ripple transactions is a privilege reserved for entities within the Ripple payment network, including banks and participating companies. This validation process is notably swift, often concluding within a mere 4-second timeframe.

Referred to as the “Unique Node List” (UNL), this committee of trusted nodes, which currently comprises 35 companies, with 2 being affiliated with Ripple (down from 6 in October 2022), assumes the responsibility of validating transactions. - Ripple Transaction Validation Speed: Ripple’s transaction validation speed is notably impressive, averaging about 4 seconds (with a range of 3 to 5 seconds). This rapidity allows for the approval of approximately 1,500 operations per second on the Ripple network.

What is Ripple used for?

Ripple was conceived with a clear mission: to enhance digital payment systems by facilitating more efficient and seamless cross-border transactions across diverse nations.

Ripple aims to streamline this landscape by providing a practical solution that bridges the gaps between disparate financial systems.

Ripple’s primary utility centers around its ability to revolutionize cross-border transactions. These transactions, which involve the transfer of funds between different countries, have historically been fraught with delays, fees, and intricate processes.

The Ripple project aims to minimize costs, accelerate transaction speeds, and eliminate the complexities that often accompany international transactions.

Who are the Founders of Ripple?

Ripple’s origins trace back to 2004, preceding the emergence of Bitcoin by four years. It was conceived by Canadian developer Ryan Fugger, who envisioned a revolutionary approach to expediting and cost-effectively conducting banking transactions.

Fugger, along with a group of dedicated developers, including programmer Jed McCaleb and angel investor Chris Larsen, introduced an enhanced iteration of Ripple in 2011.

The duo’s visionary efforts culminated in the establishment of a private company named OpenCoin in California. The company eventually underwent a rebranding journey, evolving from OpenCoin to Ripple Labs.

McCaleb left the company in July 2013.

What makes Ripple unique?

Ripple’s uniqueness emanates from its laser focus on enhancing cross-border transaction efficiency, its innovative consensus mechanism, its role as a bridge currency, and its strategic partnerships with financial institutions.

Here are key features that highlight Ripple’s uniqueness:

- Focus on Financial Institutions: Ripple’s primary target audience comprises financial institutions, a demographic that necessitates swift and secure cross-border transactions. By catering to this sector, Ripple aims to transform traditional banking operations, enabling banks to offer improved services to their customers, thereby enhancing their competitive edge.

- Efficiency in Cross-Border Transactions: Ripple’s standout feature lies in its exceptional ability to expedite cross-border transactions. Unlike traditional banking systems that often involve multiple intermediaries and lengthy settlement times, Ripple’s technology enables near-instantaneous transactions. This efficiency not only reduces transaction times but also minimizes exposure to currency fluctuations.

- Bridging Currencies: Ripple’s XRP serves as a bridge currency, seamlessly connecting different fiat currencies during transactions. This eliminates the need for a series of currency conversions, making the process more streamlined and cost-effective. Banks can employ XRP as an intermediary, enhancing the overall efficiency of international transactions.

- Consensus Mechanism: Ripple’s consensus protocol, the Ripple Protocol Consensus Algorithm (RPCA), distinguishes it from proof-of-work-based cryptocurrencies like Bitcoin. The RPCA eliminates resource-intensive mining activities and leverages independent servers owned predominantly by financial institutions for transaction validation. This mechanism significantly reduces energy consumption while maintaining transaction security.

- Real-World Partnerships: Ripple has successfully forged partnerships with numerous financial institutions and payment service providers worldwide. These collaborations underscore Ripple’s practicality and readiness for real-world integration. Such partnerships not only validate Ripple’s utility but also enhance its potential for global adoption.

How is Ripple secured?

Ripple’s security measures encompass cryptographic techniques, distributed ledger technology, a robust consensus protocol, continuous monitoring, and advanced network security infrastructure.

- Cryptographic Techniques: Ripple harnesses cryptographic techniques to secure transactions and data. These techniques involve complex algorithms that encode sensitive information, rendering it virtually impossible for unauthorized entities to decipher. This cryptographic layer safeguards the privacy and authenticity of transactions.

- Distributed Ledger Technology: Ripple’s use of Distributed Ledger Technology (DLT) further contributes to its security framework. A distributed ledger is inherently resistant to tampering or unauthorized alterations, as changes require consensus from a network of nodes. This decentralized nature fortifies the security of Ripple’s transaction history.

- Consensus Protocol: Ripple’s consensus protocol, the Ripple Protocol Consensus Algorithm (RPCA), ensures the validation of transactions by a network of independent servers. These servers are primarily operated by financial institutions, enhancing security by reducing the likelihood of malicious actors infiltrating the network.

- Continuous Monitoring and Auditing: Ripple’s security posture is reinforced through continuous monitoring and auditing of its systems. Regular assessments identify vulnerabilities and potential weaknesses, allowing Ripple to promptly address and mitigate any potential security risks.

- Multisignature Wallets: Ripple employs multi-signature wallets, which require multiple authorized parties to sign off on transactions. This mechanism adds an extra layer of security, as it prevents unauthorized individuals from initiating transactions without the necessary approvals.

Further Reading:

The Ultimate Beginner’s Guide to Bitcoin

The Ultimate Beginner’s Guide to Ethereum

FAQs

Can Ripple be mined?

No, XRP cannot be mined. The tokens have already been issued by the issuing company Ripple.

Is Ripple Labs a private company?

Yes, Ripple is a private company.

If I buy XRP, will I be buying Ripple company shares?

No, the Ripple company is not publicly traded. If you buy XRP you are not buying shares of the Ripple company, but you are buying the cryptocurrency issued by the company.

What is Ripple used for?

Ripple’s primary utility centers around its ability to revolutionize cross-border transactions. These transactions, which involve the transfer of funds between different countries, have historically been fraught with delays, fees, and intricate processes.

Good

Good  Bad

Bad