Highlights

- Platinum Savings offers 3.75% APY on balances of $5,000 or more

- No monthly fees on any deposit accounts

- No-Penalty 11-month CD at 3.75% APY with early withdrawal flexibility

- ATM fee reimbursements up to $30 per month

- Full integration with First Citizens Bank provides access to 550+ branches

Who Are CIT Bank?

CIT Bank is now a fully integrated division of First Citizens Bank, operating as one of America's leading direct banks with over $100 billion in assets. Following the completion of their merger in January 2022, CIT Bank customers benefit from both competitive online banking rates and access to First Citizens' extensive network of 550+ branches across 21 states.

The bank specializes in high-yield savings accounts, certificates of deposit, and fee-free banking services designed for customers who prefer digital-first banking. CIT Bank maintains its direct banking model while offering the security and resources of a top-20 U.S. financial institution.

This review focuses on CIT Bank's personal banking services, though the bank also provides business and commercial banking solutions for small businesses.

Who is CIT Bank For?

High-Interest Seekers: People who want to earn much more interest than a standard bank offers (CIT's rates are often 9x to 10x higher than the national average).

"Digital-First" Bankers: Anyone who is comfortable using an app or website to deposit checks and move money, since there are no physical CIT branches to visit.

Fee-Haters: People who want to avoid monthly "maintenance" fees or overdraft fees that can eat away at their savings.

Goal-Oriented Savers: Students or young adults saving for a specific goal - like a first car or a college fund - who want a safe, FDIC-insured place to keep their money.

Big Savers (for Platinum accounts): Those who can keep a balance of at least $5,000 to unlock the very highest interest rates available.

Consistent Savers: People who can commit to depositing at least $100 a month, which allows them to earn better rates on the "Savings Builder" account.

Products Offered

CIT Bank offers a focused range of deposit products designed for online banking customers. All accounts come with free debit cards featuring EMV chip technology and comprehensive fraud protection through the CIT Bank Shield program.

Platinum Savings

CIT Bank's flagship Platinum Savings account offers 3.75% APY on balances of $5,000 or more, with 0.25% APY on smaller balances. You can open an account with just $100, making it accessible for most savers.

The account has no monthly maintenance fees and your deposits are FDIC insured up to $250,000. The tiered structure encourages saving by rewarding larger balances with significantly higher returns.

No monthly fees or account opening costs

$100 minimum to open

3.75% APY on balances of $5,000 or more

0.25% APY on balances under $5,000

Savings Builder

The Savings Builder account offers 1.00% APY when you meet specific requirements designed to encourage regular saving habits:

Maintain a minimum balance of $25,000, OR

Make at least one monthly deposit of $100 or more

This account works well for people who can't maintain the $5,000 minimum for Platinum Savings but can commit to regular monthly deposits. The $100 opening deposit requirement keeps it accessible, while the monthly deposit option makes earning the higher rate achievable for consistent savers.

Savings Builder accounts have no opening or maintenance fees, making them suitable for building emergency funds or working toward specific savings goals.

Savings Connect

Savings Connect provides a linked checking and savings account combination, though APY rates vary and are updated regularly based on market conditions. The current rate as of January 2026 is AYP at 3.65% with a 9x2 multipler.

The linked structure allows easy transfers between checking and savings, helping you manage daily expenses while maximizing interest earnings on funds you don't need immediately.

$100 minimum account opening

Member FDIC

No monthly service fees

No account opening fees

Money Market Account

CIT Bank's Money Market Account currently offers competitive rates with no minimum balance requirements to earn interest. The account requires just a $10 minimum opening deposit and charges no monthly service fees.

Money Market accounts include Bill Pay functionality, allowing you to pay bills directly from the account. However, like all money market accounts, you're limited to six withdrawals per statement cycle, with a $20 fee for additional transactions.

Certificates of Deposit (CDs)

CIT Bank offers several CD options with varying terms and features to match different savings strategies.

Term CDs

Standard term CDs require a $1,000 minimum opening deposit and offer terms from 6 months to 5 years. Current rates as of January 2026 include:

- 6-month CD: 3.75% APY

- 13-month CD: 3.25% APY

- 18-month CD: 2.75% APY

- 5-year CD: 2.50% APY

Term CDs lock in your rate for the entire period, providing predictable returns regardless of market changes.

No-Penalty CDs

The 11-month No-Penalty CD offers 3.75% APY with the flexibility to withdraw your entire balance and earned interest without penalties. You can access your funds starting seven days after deposit, making this ideal for savers who want CD rates without the commitment anxiety.

This product requires a $1,000 minimum opening deposit and has no monthly maintenance fees. It's particularly valuable in uncertain interest rate environments where you might want to move money to take advantage of better opportunities.

Important Note

CD rates change frequently based on Federal Reserve policy and market conditions. The rates listed reflect December 2025 offerings and may have changed since publication. Always verify current rates on CIT Bank's website before making deposit decisions.

Jumbo CDs

Jumbo CDs are available for large deposits, though specific minimum requirements and current rates should be verified directly with CIT Bank as these products often have customized terms based on deposit amounts and market conditions.

Mortgages

CIT Bank offers fixed-rate mortgages with terms ranging from 10 to 30 years. Savings Builder account holders may qualify for relationship pricing benefits, though specific details about rate reductions and cashback offers should be confirmed directly with the bank as these programs change based on market conditions.

CIT Bank reimburses ATM fees up to $30 per month since it doesn't operate its own ATM network. This means you can use virtually any ATM without worrying about fees eating into your savings.

How to Bank with CIT

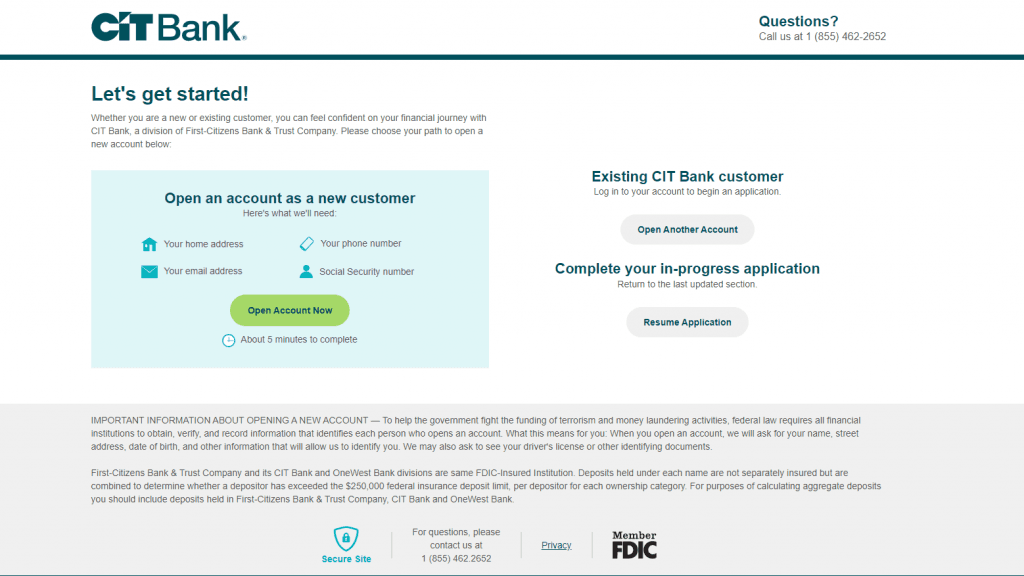

Opening a CIT Bank account is entirely online-based since the bank operates without physical branches. You can complete the application process through the CIT Bank website or mobile app in minutes.

The account opening process requires standard personal information, including your Social Security number, government-issued ID, and initial deposit method. Most accounts can be funded through electronic transfers from existing bank accounts, with funds typically available within 1-2 business days.

For customers who need in-person assistance, the integration with First Citizens Bank means you can visit any of their 550+ branch locations across 21 states for account support, though the primary banking relationship remains digital.

Banking Experience

CIT Bank operates as a digital-first bank with 24/7 online access through its website and mobile applications. The bank's technology infrastructure provides comprehensive account management capabilities from anywhere with internet access.

The CIT Bank mobile app supports essential banking functions including balance checking, transaction history, mobile check deposits, bill payments, and money transfers. The app integrates with Zelle for person-to-person payments and supports Apple Pay and Samsung Pay for convenient transactions.

However, recent user reviews indicate some technical challenges with the mobile app. Users report occasional login difficulties, biometric authentication failures, and mobile deposit recognition issues requiring multiple attempts. While CIT Bank responds to customer

Important platform change: Customers who enrolled in CIT Bank online banking before September 2, 2022, were automatically converted to First Citizens online banking on November 14, 2022. These customers now access their accounts through FirstCitizens.com and the First Citizens Mobile Banking app rather than CIT Bank-specific platforms.

Customer Service

CIT Bank provides customer support through multiple channels, with phone support available Monday through Friday from 9 a.m. to 9 p.m. ET and Saturday from 10 a.m. to 6 p.m. ET. The bank is closed Sundays and holidays.

Current customer service phone number: 855-462-2652

Customers can access their accounts 24/7 through online banking and mobile applications. The bank also offers automated telephone banking for basic account information and transactions.

For customers requiring in-person assistance, the First Citizens Bank branch network provides additional support options, though most routine banking can be handled through digital channels.

The CIT mobile application supports comprehensive account management including:

Real-time balance and transaction monitoring

Mobile check deposits with photo capture

Bill pay services and payment scheduling

Internal and external money transfers

Zelle integration for person-to-person payments

Mobile wallet integration for Apple Pay and Samsung Pay

CIT Bank: Pros & Cons

Let's do a quick glance over the advantages and disadvantages CIT Bank brings to the table.

Advantages of Choosing CIT Bank

3.75% APY on Platinum Savings beats national average by nearly 10x

No monthly fees on any deposit accounts

ATM fee reimbursements up to $30 monthly

FDIC insured with First Citizens Bank backing

Access to 550+ First Citizens branches when needed

No-penalty CD option provides rate and flexibility

Disadvantages of Choosing CIT Bank

Rates no longer market-leading compared to some online competitors

Mobile app has reported technical issues

No IRAs or retirement account options

No credit cards or auto loans

Platform transitions may confuse existing customers

CIT Bank remains a solid choice for online banking, particularly for customers who value fee-free operations and reliable service over absolute rate maximization. The integration with First Citizens Bank adds stability and branch access while maintaining the digital-first approach that makes online banking convenient.

If you prioritize the highest possible interest rates above all else, several competitors now offer superior APYs. However, if you want a balanced approach combining competitive rates, no fees, ATM reimbursements, and the security of a large banking institution, CIT Bank delivers solid value.

The bank works best for customers comfortable with digital banking who occasionally need in-person support. The First Citizens branch network provides that safety net while keeping the primary banking experience streamlined and fee-free.

FDIC Insurance Details: CIT Bank maintains FDIC insurance under certificate number 35575. As a division of First Citizens Bank & Trust Company, deposits held under both names are combined for insurance calculation purposes, not separately insured. This means your total deposits across both institutions count toward the $250,000 federal insurance limit per depositor for each ownership category.

CIT Bank: Is it Right For You?

If you’re ready to ditch the low interest rates of your local neighborhood bank and want to see your savings actually grow, CIT Bank is a fantastic teammate to have. It’s safe, it’s big, and it’s perfect for anyone who loves doing everything from their phone. While the app can have issues sometimes, the trade-off is a fee-free experience that puts more money back in your pocket.

So, if you’re comfortable with digital banking and want a secure place to park your cash, CIT Bank is definitely worth a look. It’s all about making your money work as hard as you do.

FAQs

Is CIT Bank safe?

Is CIT Bank safe?

Yes. CIT Bank prioritizes security through SSL encryption, comprehensive fraud monitoring, and the CIT Bank Shield protection program. As a division of First Citizens Bank, it benefits from enterprise-level security infrastructure and maintains FDIC insurance protection.

Is CIT Bank FDIC insured?

Is CIT Bank FDIC insured?

Yes. CIT Bank is FDIC insured under certificate number 35575. Customer deposits are protected up to $250,000 per depositor for each account ownership category. As part of First Citizens Bank, deposits across both institutions are combined for insurance calculation purposes.

Is CIT Bank legit?

Is CIT Bank legit?

CIT Bank is a 100% legitimate financial institution and operates as a division of First Citizens Bank, which is one of the top 20 largest banks in the United States. Your money is safe and protected by the government because all deposits are FDIC-insured up to $250,000 per person. Today, the bank manages over $200 billion in assets and uses high-level security to keep your digital account and personal information secure.

How does the First Citizens merger affect CIT Bank customers?

How does the First Citizens merger affect CIT Bank customers?

CIT Bank operates as a division of First Citizens Bank, maintaining its direct banking model while providing access to First Citizens' 550+ branch network. Existing customers who enrolled before September 2022 were transitioned to First Citizens' online banking platform, while new customers can still open accounts through CIT Bank's direct channels.

What are CIT Bank's current interest rates?

What are CIT Bank's current interest rates?

As of January 2026, CIT Bank's Platinum Savings offers 3.75% APY on balances of $5,000 or more and 0.25% APY on smaller balances. The No-Penalty 11-month CD offers 3.75% APY. Rates are variable and subject to change based on market conditions.