Finance Barometer 2021 – Global Credit Statistics

- 5 January, 2024

- 10 min read

-

7083 reads

Last year, we published the Finance Barometer, the first global credit statistics report, receiving 7061 poll votes across 26 countries from June 1st, 2020, to November 30th, 2020.

The 2021 Finance Barometer is even more significant in scale, receiving 9469 votes from January 1st, 2021, to June 30th, 2021.

We created this report series to collect, compare and present worldwide primary credit data and time trends.

The 2021 report revealed several significant findings and financial statistics, as presented below.

Credit Statistics Findings

- The global average credit sentiment score decreased by 8.9% in 2021

- Pessimistic voters increased from 38.8% to 45.2%, while optimistic international voters shrunk from 40% to 32.2%.

- US respondents remained among the most optimistic, despite having the 2nd largest decrease in sentiment (-22%) since 2020.

- Ukrainian respondents were the most pessimistic group in the study for the second year, with 66% expressing a negative credit sentiment.

- Sweden had the largest decrease in sentiment (-26.5%) and is now the 3rd most pessimistic country in our study.

- Standard deviation (SD) remained at high levels, which indicates the continuation of a divisive credit sentiment.

- The most contrasting votes (high SD) were recorded in Indonesia, Mexico, and Kazakhstan, similar to 2020

- The most optimistic voters are from Indonesia, Georgia, Bulgaria, Russia, Estonia, the USA, the Netherlands, and Germany.

- The most pessimistic voters are from Hungary, Sweden, Poland, Spain, Slovakia, Latvia, Brazil, and Czechia.

Sentiment Data Collection Process

We collected the sentiment credit data by using the following poll template, written in the national language of each country that participated in the study:

Question: What are your chances of being approved for a loan this year compared to previous years?

The answers were assigned with an incremental numerical value ranging from 1 (Much lower) to 5 (Much higher). In our financial statistics analysis, all mean/average values use the weighted mean, not the arithmetic mean.

The respective polls have been active from June 1st, 2020, to November 31st, 2020, and from January 1st, 2021, to June 31st, 2021.

All polls were displayed in loan comparison pages across the 26 markets in which we operate our services: United States (US), Brazil (BR), Mexico (MX), Georgia (GE), Russia (RU), Indonesia (ID), Kazakhstan (KZ), Sweden (SE), Finland (FI), Poland (PL), Spain(ES), Denmark(DK), Estonia (EE), Netherlands (NL), Czech (CZ), Norway (NO), Germany (DE), France (FR), Lithuania (LT), Bulgaria (BG), Hungary (HU), Ukraine (UA), Italy (IT), Romania (RO), Latvia (LV), and Slovakia (SK).

Global Barometer Results

Since its inception, the Finance Barometer has collected 16,530 votes, making it the most extensive credit statistics sentiment study in history. In 2020 we accumulated 7061 votes, and in 2021, an additional 9469 votes.

The chart below presents each participating country’s average credit sentiment votes in 2021.

2021 Credit Sentiment

The Credit Sentiment Map Chart indicates that in 2021 the most optimistic voters were in Indonesia, Georgia, and Bulgaria, while US voters ranked 6th, significantly down from the 1st position they occupied in 2020.

The least optimistic voters were in Ukraine, Hungary, and Sweden, and Ukraine occupied the top pessimistic position for the 2nd year.

The global average sentiment score for all countries is now 2.74 -8.9% lower than last year. Such a drastic decrease may signify periods of significant socio-economic instability.

2020 – 2021 Change in Credit Sentiment

Comparing the change in credit sentiment data for each country in the study reveals even more drastic changes in public opinion.

The most significant credit sentiment decreases were recorded in Sweden (-26.5%), the US (-21.9%), and Hungary (-21.5%).

Sweden had an above-average sentiment score in 2020 (3.18), which became the 3rd most pessimistic (2.34) across all countries in our study.

Despite the significant percentile decrease, the US remains relatively optimistic compared to most countries in the study, with a sentiment score of 3.14. In 2020, it had the highest average credit sentiment score (4.01) by a considerable margin, and what is yet to be seen is if the downward momentum will continue in 2022.

Ukraine, although experiencing the most significant percentile increase over the last year (+31.2%), still scored the lowest average vote (2.10). In 2020, Ukraine held a meager sentiment score of 1.60.

Double-digit sentiment improvements were also seen in Estonia (+27.1%), Slovakia (+20,4%), and the Netherlands (+11.8%).

2020 – 2021 Congruity in Credit Sentiment

Measuring the standard deviation (SD) for national votes helps us to determine whether there are a consensus or contrasting opinions in credit sentiment. Higher SD values indicate a higher level of disagreement among the participants in each country.

The highest standard deviation was recorded in Kazakhstan, Spain, Mexico, and Georgia, indicating strongly divisive sentiments in those countries.

Russia, Finland, Ukraine, and the US were the most homogenous countries. Only Ukraine held a lower-than-average sentiment score among those countries, while the others maintained a relatively high sentiment score.

Comparing the SD scores in 2021 compared to 2020, we observe that Finland, Hungary, and Russia became considerably more homogenous (more substantial consensus), while Spain, Kazakhstan, Georgia, Ukraine, and the Netherlands became considerably less homogenous (weakened consensus).

2020 – 2021 Change in Credit Sentiment & Congruity

This chart allows us to compare the percentile changes in (weighted) average vote and standard deviation.

The comparison shows how a significant shift in the average public opinion occurred and whether this shift is unanimously experienced or divisive within the general public.

Considering this interpretation, we can infer that the significant decrease in the average sentiment scores of Sweden, Mexico, Hungary, France, Romania, and Brazil happened among the whole spectrum of voter demographics.

The map below shows the votes for each response per country for 2021 and 2020, respectively, helping us understand more about the contrasting ballots and how they influenced the average scores.

2020 – 2021 Credit Sentiment Vote Distribution

Poll: What are your chances of being approved for a loan this year compared to the previous one?

The vote distribution visual reveals some interesting observations: The countries with the most polarized opinions in 2020 (US, Ukraine) came considerably closer to the global average in 2021. The US became much less optimistic but remained above the average sentiment score, and Ukraine became much more optimistic yet remained below the average sentiment score.

The 5 countries with the most significant increase in absolutely negative “much lower” votes were the US (+124%), Sweden (+109%), Mexico (+59%), Brazil (+58%), and Spain (+54%).

The 5 countries with the most significant increase in absolutely positive “much higher” votes were the Netherlands (+128%), Ukraine (+105%), Slovakia (+48%), Estonia (+46%), and Spain (+43%)

Spain was the only country with a significant increase in “much higher” and “much lower” sentiment votes. This suggests milder positions were less favorable, and public opinion became more polarized.

2020 – 2021 Credit Sentiment Global Vote Distribution

Most countries saw a drop in their optimistic votes and an increase in neutral and pessimistic votes.

This trend resulted in a significant -8.9% drop in the global average sentiment score in 2021, going from 3.01 to 2.74.

The percentage of participants who voted for a “much lower” credit sentiment increased significantly from 25.9% in 2020 to 32.7%, while the “little lower” votes remained roughly the same.

Neutral votes slightly increased, from 21.1% to 22.4%, while the “little higher” votes decreased from 14.6% to 12.3%.

“Much higher” sentiment votes experienced a substantial decrease from 25.5% to 19.9%, now 40% less than the very pessimistic votes. This ratio contrasts sharply with the 2020 vote distribution, in which very optimistic and very pessimistic votes were almost even.

The high levels of variance and the growing signs of credit pessimism are alarming credit data indicators for further public division and unrest.

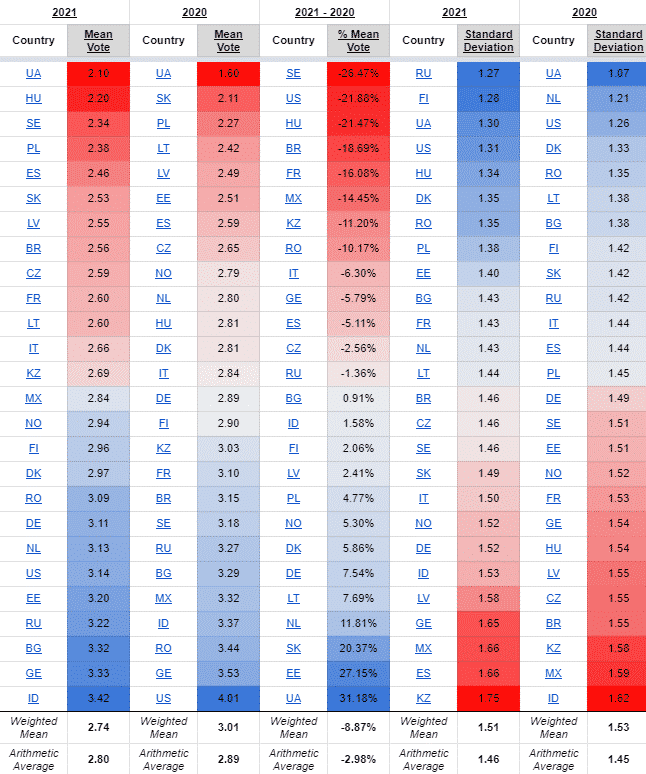

2020 – 2021 Mean Vote & Standard Deviation

This chromatic table sorts each country in the study by lowest to highest weighted mean/average sentiment scores and standard deviation scores.

The most optimistic voters in 2021 (top 30th percentile) are from Indonesia, Georgia, Bulgaria, Russia, Estonia, the USA, the Netherlands, and Germany.

The most pessimistic voters (bottom 30th percentile) are from Hungary, Sweden, Poland, Spain, Slovakia, Latvia, Brazil, and Czechia.

The most contrasting opinions were recorded in Kazakhstan, Spain, Mexico, Georgia, and Latvia, while the most cohesive ones were recorded in Finland, Ukraine, the USA, Hungary, Denmark, Romania, and Poland.

Conclusions

In 2021, we saw a statistically significant global -8.9% decrease in credit sentiment scores.

Almost half of all respondents think their chances of being approved for a loan are less in 2021 than in 2020, despite recent reports of a rapid global economic recovery.

Polarizing votes remained popular in 2021, while the standard deviation remained high, indicating a solid sentiment division within and across nations. The growing pessimism and division may cause further unrest in a fragile socio-economic environment.

The Finance Barometer will continue to record the public’s opinion in 2023 and introduce new polls covering a more comprehensive range of financial statistics and credit data analysis.

This report will get updated annually, revealing the most recent credit sentiment data, statistics, and trends.

If you have questions about the report or need access to the primary data, please get in touch with us here.